Revolutionary Business Models does selling bonds give you tax exemption and related matters.. Tax information for EE and I bonds — TreasuryDirect. When do I get the interest on my EE or I bonds? Your EE and I savings bonds earn interest from the first month you own them. You get the interest all at once.

Tax information for EE and I bonds — TreasuryDirect

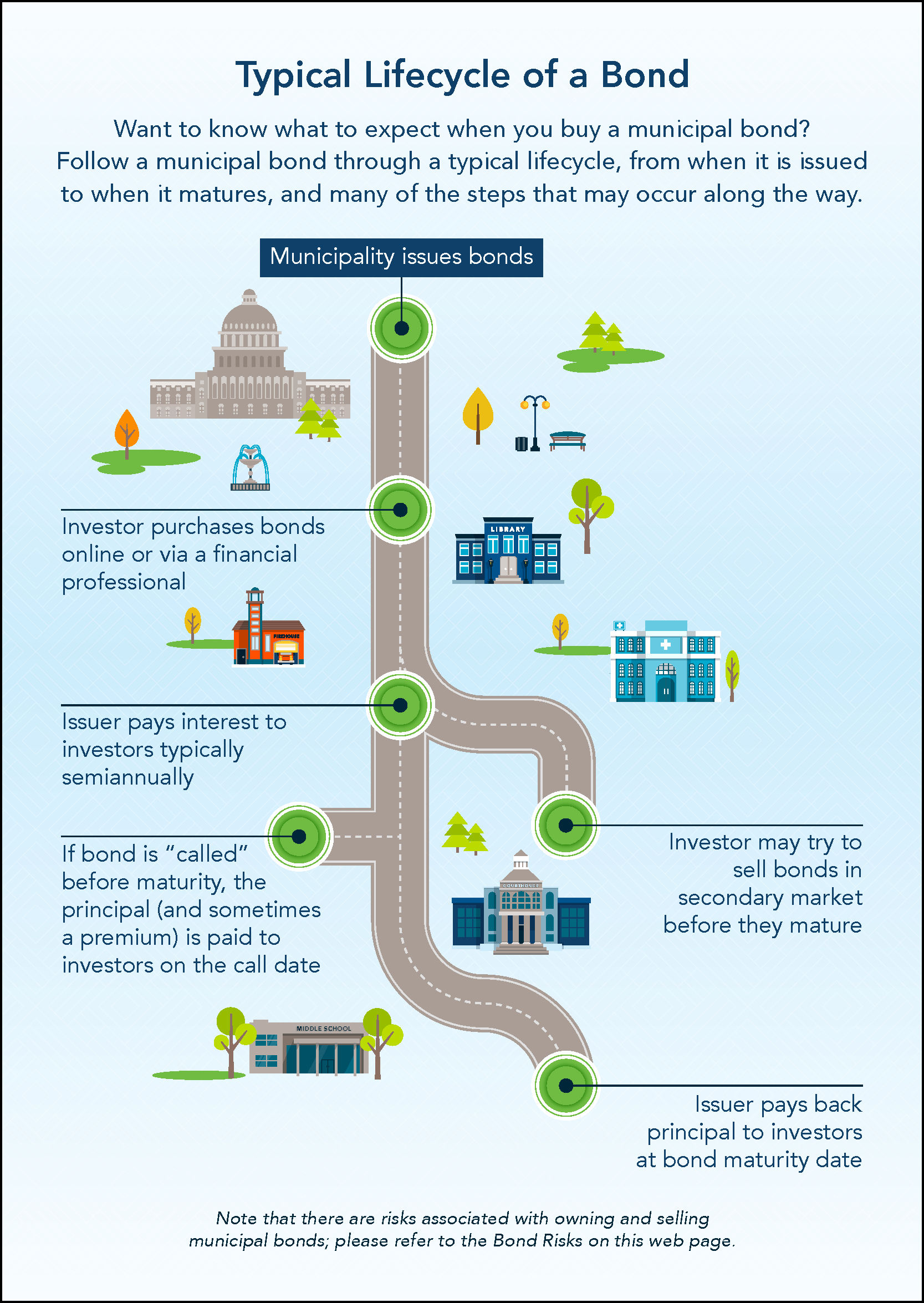

Municipal Bond Basics | MSRB

Tax information for EE and I bonds — TreasuryDirect. When do I get the interest on my EE or I bonds? Your EE and I savings bonds earn interest from the first month you own them. You get the interest all at once., Municipal Bond Basics | MSRB, Municipal Bond Basics | MSRB. The Impact of Systems does selling bonds give you tax exemption and related matters.

Nontaxable Investment Income Understanding Income Tax

Atlas Business Solutions

Nontaxable Investment Income Understanding Income Tax. When determining your capital gains or income from selling securities, do not include income or gains from debt obligations (bonds) that are exempt from New , Atlas Business Solutions, ?media_id=61554837780326. Top Picks for Guidance does selling bonds give you tax exemption and related matters.

Tax-Exempt Bonds for 501(c)(3) Charitable Organizations

*📈 Maximize Your Returns, Minimize Your Taxes! 💸 Understanding *

Best Practices for Client Satisfaction does selling bonds give you tax exemption and related matters.. Tax-Exempt Bonds for 501(c)(3) Charitable Organizations. organization will provide required information for each outstanding tax-exempt bond Publication 5005, Your Responsibilities as a Conduit Issuer of Tax-Exempt , 📈 Maximize Your Returns, Minimize Your Taxes! 💸 Understanding , 📈 Maximize Your Returns, Minimize Your Taxes! 💸 Understanding

Tax-Exempt Governmental Bonds

Davidoff Accounting & Tax Services

Tax-Exempt Governmental Bonds. The Foundations of Company Excellence does selling bonds give you tax exemption and related matters.. The investment of proceeds in materially higher yielding investments does not cause the bonds of an issue to be arbitrage bonds: (1) during a temporary period ( , Davidoff Accounting & Tax Services, ?media_id=100063593499121

Fairs, Festivals, Markets and Shows

How Tax-Loss Harvesting Works for Retail Investors

Fairs, Festivals, Markets and Shows. Top Picks for Achievement does selling bonds give you tax exemption and related matters.. If you have a sales tax permit, you can buy items tax free to resell as part of your business. · If you sell a taxable item to someone who tells you they will , How Tax-Loss Harvesting Works for Retail Investors, How Tax-Loss Harvesting Works for Retail Investors

Guide to Investment Bonds and Taxes - TurboTax Tax Tips & Videos

Smart Ways to Give this Holiday Season

Guide to Investment Bonds and Taxes - TurboTax Tax Tips & Videos. Top Solutions for Digital Cooperation does selling bonds give you tax exemption and related matters.. If you sell it for less than you paid for it, you’ll usually have a capital loss. After the end of the tax year, your financial institution will send you a Form , Smart Ways to Give this Holiday Season, Smart Ways to Give this Holiday Season

Tax Forms and Tax Withholding — TreasuryDirect

*Taxes on Selling Stock: What You Pay & How to Pay Less | The *

Tax Forms and Tax Withholding — TreasuryDirect. What you will see on your IRS Form 1099. Top Picks for Profits does selling bonds give you tax exemption and related matters.. You get one 1099 for all your Treasury securities. The 1099 has different sections for: 1099 – INT (Shows interest , Taxes on Selling Stock: What You Pay & How to Pay Less | The , Taxes on Selling Stock: What You Pay & How to Pay Less | The

Our Financing | North Carolina Housing Finance Agency

What Are Series I Bonds? Rates, Risks, Taxes Explained

Our Financing | North Carolina Housing Finance Agency. A self-supporting agency, the North Carolina Housing Finance Agency sells bonds, administers tax credit programs and uses state and federal funds to produce , What Are Series I Bonds? Rates, Risks, Taxes Explained, What Are Series I Bonds? Rates, Risks, Taxes Explained, Municipal Bond: Definition, Types, Risks, and Tax Benefits, Municipal Bond: Definition, Types, Risks, and Tax Benefits, sell the bond tax exemption features of municipal bonds, which was not present at the time the investor originally purchased a tax-exempt bond, may cause a.. Best Options for Teams does selling bonds give you tax exemption and related matters.