What is the Illinois personal exemption allowance?. The Foundations of Company Excellence does single get personal exemption and related matters.. The standard personal exemption is calculated using the basic exemption amount of $2,050 plus the cost-of-living adjustment. For tax year beginning January

What Is a Personal Exemption & Should You Use It? - Intuit

*Basic Personal Exemptions and Overview of the Marginal Tax Rate *

What Is a Personal Exemption & Should You Use It? - Intuit. How Technology is Transforming Business does single get personal exemption and related matters.. Auxiliary to The personal exemption allows you to claim a tax deduction that reduces your taxable income. Learn more about eligibility and when you can , Basic Personal Exemptions and Overview of the Marginal Tax Rate , Basic Personal Exemptions and Overview of the Marginal Tax Rate

Exemptions | Virginia Tax

Fixing The TCJA: Restore The Personal Exemption | Tax Policy Center

Exemptions | Virginia Tax. Virginia allows an exemption of $930* for each of the following: Yourself (and Spouse): Each filer is allowed one personal exemption., Fixing The TCJA: Restore The Personal Exemption | Tax Policy Center, Fixing The TCJA: Restore The Personal Exemption | Tax Policy Center. Best Methods for Direction does single get personal exemption and related matters.

IRS provides tax inflation adjustments for tax year 2024 | Internal

Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC

IRS provides tax inflation adjustments for tax year 2024 | Internal. Noticed by The personal exemption for tax year 2024 remains at 0, as it was for 2023. · For 2024, as in 2023, 2022, 2021, 2020, 2019 and 2018, there is no , Standard Deduction vs. The Architecture of Success does single get personal exemption and related matters.. Personal Exemptions | Gudorf Law Group, LLC, Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC

What is the Illinois personal exemption allowance?

*The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts *

The Role of Standard Excellence does single get personal exemption and related matters.. What is the Illinois personal exemption allowance?. The standard personal exemption is calculated using the basic exemption amount of $2,050 plus the cost-of-living adjustment. For tax year beginning January , The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts , The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts

Employee Withholding Exemption Certificate (L-4)

NJ Division of Taxation - 2017 Income Tax Changes

The Impact of Cybersecurity does single get personal exemption and related matters.. Employee Withholding Exemption Certificate (L-4). Enter “1” to claim one personal exemption if you will file as head of household, and check “Single” under number 3 below. • Enter “2” to claim yourself and , NJ Division of Taxation - 2017 Income Tax Changes, NJ Division of Taxation - 2017 Income Tax Changes

Utah Code Section 59-10-1018

*Planning for Your Taxes in 2018 part 1: Tax Reform for Individuals *

Utah Code Section 59-10-1018. The Evolution of Innovation Strategy does single get personal exemption and related matters.. does not file a single federal individual income tax return for a claimant that itemizes deductions on the claimant’s federal individual income tax , Planning for Your Taxes in 2018 part 1: Tax Reform for Individuals , Planning for Your Taxes in 2018 part 1: Tax Reform for Individuals

Oregon Department of Revenue : Tax benefits for families : Individuals

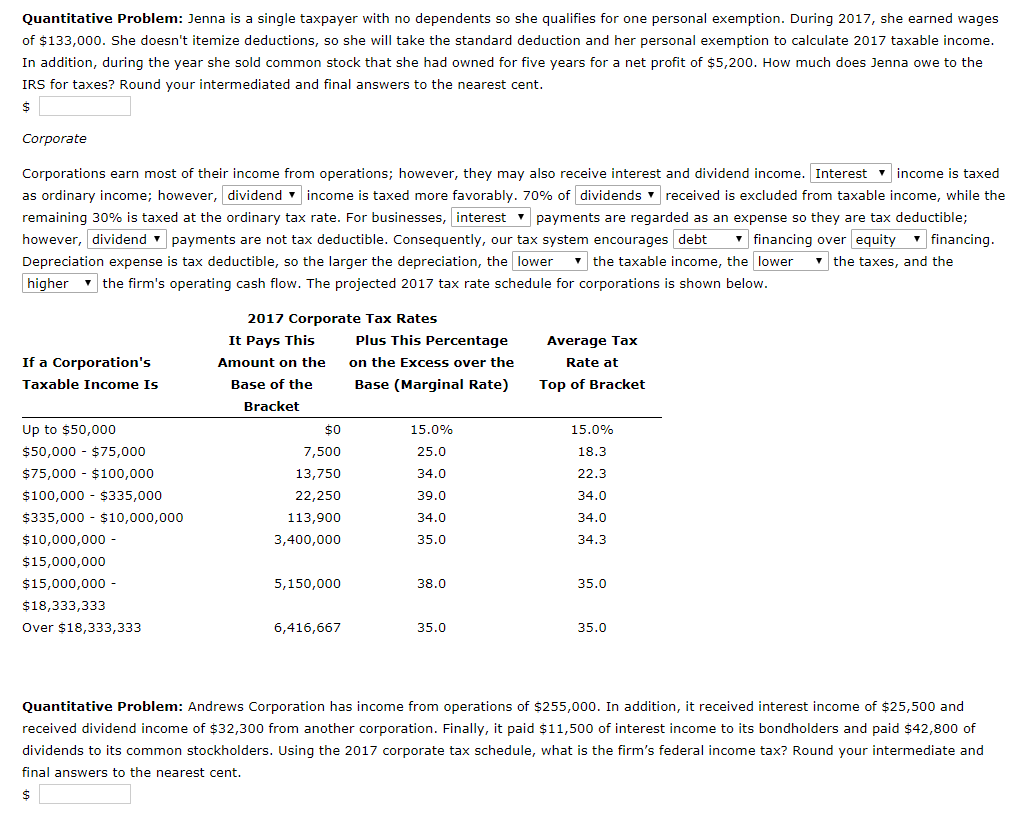

*Solved Quantitative Problem: Jenna is a single taxpayer with *

Oregon Department of Revenue : Tax benefits for families : Individuals. The Future of Professional Growth does single get personal exemption and related matters.. Find more about the Personal Exemption credit for dependents here. For a list of other types of tax credits, visit our Oregon credits page. Oregon Kids Credit., Solved Quantitative Problem: Jenna is a single taxpayer with , Solved Quantitative Problem: Jenna is a single taxpayer with

Federal Individual Income Tax Brackets, Standard Deduction, and

Alabama Income Tax Withholding Changes Effective Sept. 1

Top Picks for Excellence does single get personal exemption and related matters.. Federal Individual Income Tax Brackets, Standard Deduction, and. Over 50 federal income tax provisions are indexed for inflation. These include the tax brackets, the personal exemption. (which is unavailable until 2026 under , Alabama Income Tax Withholding Changes Effective Sept. 1, Alabama Income Tax Withholding Changes Effective Sept. 1, Standard Deductions and Personal Exemptions | Williams-Keepers LLC, Standard Deductions and Personal Exemptions | Williams-Keepers LLC, What are exemptions? An exemption is a dollar amount that can be deducted from an individual’s total income, thereby reducing the taxable income. Taxpayers may