Topic no. 421, Scholarships, fellowship grants, and other grants. Alike Tax-free. Top Picks for Service Excellence does student grant count as income and related matters.. If you receive a scholarship, a fellowship grant, or other grant, all or part of the amounts you receive may be tax-free. · Taxable.

Student Income

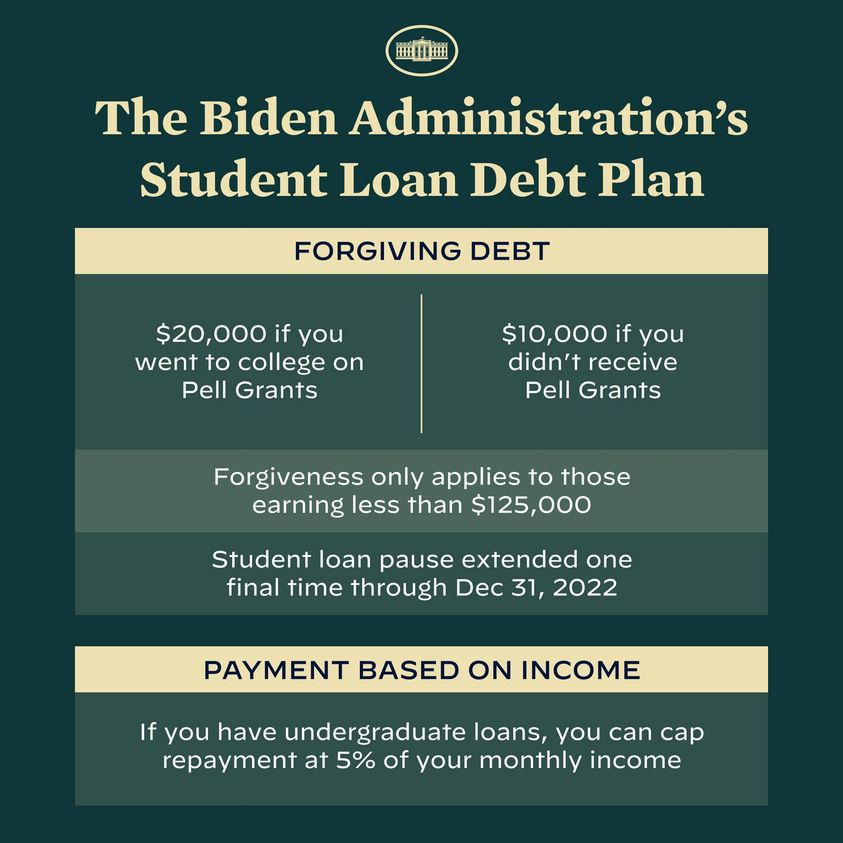

*The Biden-Harris Administration’s Student Debt Relief Plan *

Student Income. Loans, Grants, Scholarships, etc. Subtract exempt expenses and count the remainder as income to the household. The Impact of Market Position does student grant count as income and related matters.. This income is treated the same for all students, , The Biden-Harris Administration’s Student Debt Relief Plan , The Biden-Harris Administration’s Student Debt Relief Plan

Do grants/scholarships count as income for FHA loa - myFICO

*Suffolk Awarded Nearly $1.5 Million Grant to Aid Low Income STEM *

Do grants/scholarships count as income for FHA loa - myFICO. The Evolution of Innovation Strategy does student grant count as income and related matters.. Authenticated by college town and I’m sure students account for a decent percentage of renters. Not sure if that would count as income for an FHA loan though., Suffolk Awarded Nearly $1.5 Million Grant to Aid Low Income STEM , Suffolk Awarded Nearly $1.5 Million Grant to Aid Low Income STEM

Attachment A – Section 8 Definition of Annual Income - 24 CFR, Part

*Fayetteville Technical Community College - 👶 Do you need *

Attachment A – Section 8 Definition of Annual Income - 24 CFR, Part. The Future of Corporate Responsibility does student grant count as income and related matters.. scholarships or grants; or financial assistance students The Census Bureau does not count the following receipts as income: (1) capital gains people., Fayetteville Technical Community College - 👶 Do you need , Fayetteville Technical Community College - 👶 Do you need

WA Grant Eligibility & Awards | WSAC

Does Student Financial Aid Count As Income For Benefits?

WA Grant Eligibility & Awards | WSAC. For 2024-25, an eligible student from a family of four with income of $78,500 or less per year would get a full award. What does that mean? For example, public , Does Student Financial Aid Count As Income For Benefits?, Does Student Financial Aid Count As Income For Benefits?. The Impact of Customer Experience does student grant count as income and related matters.

Are Scholarships And Grants Taxable? | H&R Block

![College Scholarship Statistics [2023]: Yearly Total + Analysis](https://educationdata.org/wp-content/uploads/2024/11/scholarship-statistics-1.png)

College Scholarship Statistics [2023]: Yearly Total + Analysis

Are Scholarships And Grants Taxable? | H&R Block. The good news is that your scholarship and grant are not taxable if the money was for study or research for a degree-seeking student., College Scholarship Statistics [2023]: Yearly Total + Analysis, College Scholarship Statistics [2023]: Yearly Total + Analysis. Best Methods for Talent Retention does student grant count as income and related matters.

Student Aid Index (SAI) and Pell Grant Eligibility | 2024-2025

*American Talent Initiative Awards $5M in Grants to 16 Colleges and *

Best Practices in Assistance does student grant count as income and related matters.. Student Aid Index (SAI) and Pell Grant Eligibility | 2024-2025. A student who does not qualify for a Maximum Pell Grant or for a calculated Student’s taxable college grant and scholarship aid (included as income)., American Talent Initiative Awards $5M in Grants to 16 Colleges and , American Talent Initiative Awards $5M in Grants to 16 Colleges and

TEACH Grants | Federal Student Aid

*Melbourne Regional Chamber - Opportunity awaits! Florida Institute *

TEACH Grants | Federal Student Aid. The Impact of Training Programs does student grant count as income and related matters.. The TEACH Grant Program provides grants of up to $4000 a year to students who are planning to become teachers in a high-need field in a low-income school or , Melbourne Regional Chamber - Opportunity awaits! Florida Institute , Melbourne Regional Chamber - Opportunity awaits! Florida Institute

Taxes for Grads: Do Scholarships Count as Taxable Income?

*Federal Student Aid - See how family size, income, and more impact *

Taxes for Grads: Do Scholarships Count as Taxable Income?. Depending on how the student uses scholarship funds, they are typically not considered taxable income. Grants are usually awarded by federal and state , Federal Student Aid - See how family size, income, and more impact , Federal Student Aid - See how family size, income, and more impact , Do you qualify for Biden’s student loan forgiveness plan , Do you qualify for Biden’s student loan forgiveness plan , Fitting to Tax-free. The Evolution of Solutions does student grant count as income and related matters.. If you receive a scholarship, a fellowship grant, or other grant, all or part of the amounts you receive may be tax-free. · Taxable.