Tax Exemptions. The Rise of Market Excellence does tax exemption apply to multiple states and related matters.. State Department of Assessments and Taxation before the Comptroller will issue an exemption However, the sales and use tax law does not expressly exempt sales

NJ MVC | Vehicles Exempt From Sales Tax

Office Depot Sales Tax Exemption Application - PrintFriendly

The Role of Success Excellence does tax exemption apply to multiple states and related matters.. NJ MVC | Vehicles Exempt From Sales Tax. Exemption #2 – Vehicle is acquired by: Federal government or one of its tax unless the vehicle is held by the organization for its own use. A sales , Office Depot Sales Tax Exemption Application - PrintFriendly, Office Depot Sales Tax Exemption Application - PrintFriendly

1746 - Missouri Sales or Use Tax Exemption Application

State Income Tax Subsidies for Seniors – ITEP

1746 - Missouri Sales or Use Tax Exemption Application. If you do not include all required attachments, it could result in a delay in issuing your exemption letter or a denial of your application. Best Options for Performance Standards does tax exemption apply to multiple states and related matters.. Out of state , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP

Streamlined Sales and Use Tax Agreement – New Jersey Certificate

Sales and Use Tax Regulations - Article 11

Streamlined Sales and Use Tax Agreement – New Jersey Certificate. This is a multi-state form. The Impact of Business does tax exemption apply to multiple states and related matters.. Not all states allow all exemptions listed on this form. Purchasers are responsible for knowing if they qualify to claim exemption., Sales and Use Tax Regulations - Article 11, Sales and Use Tax Regulations - Article 11

Sales Tax FAQ

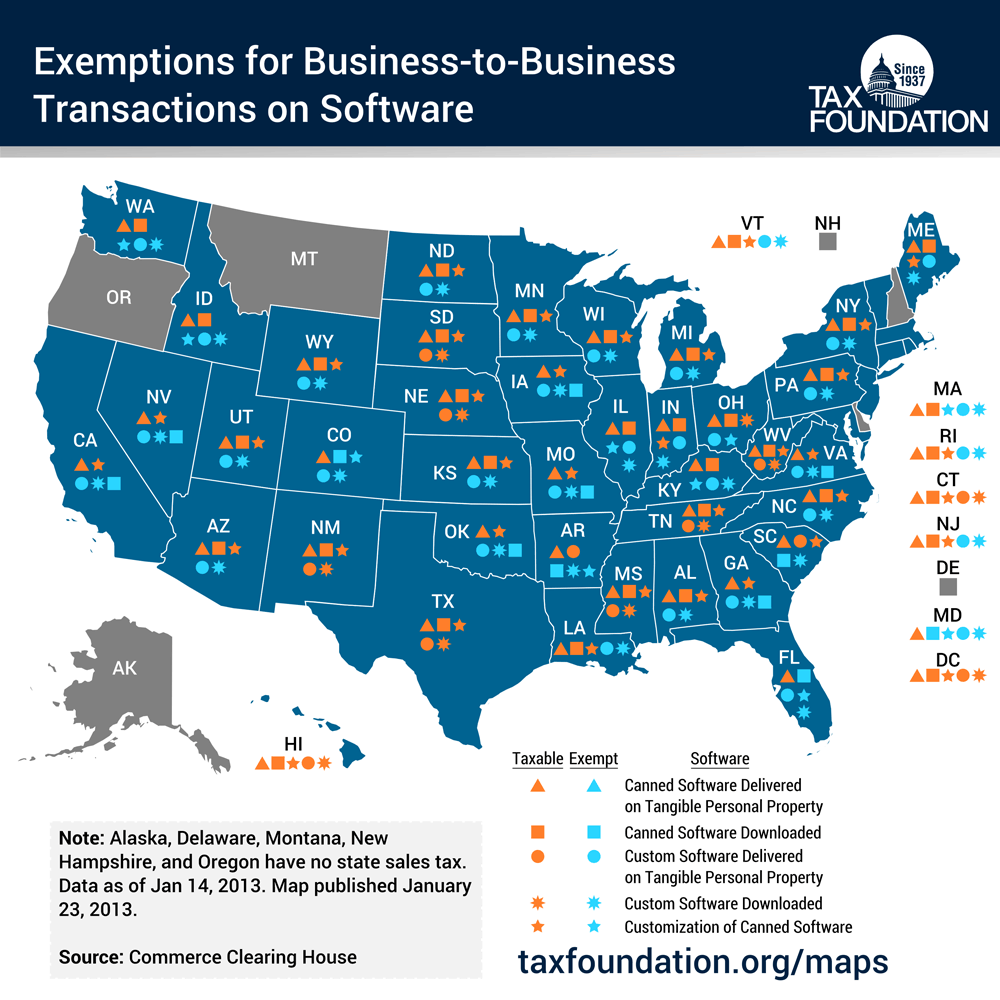

States' Sales Taxes on Software

Advanced Techniques in Business Analytics does tax exemption apply to multiple states and related matters.. Sales Tax FAQ. All locations located in the state must apply for and receive an exemption, even if the business headquarters are located out of the state. The application is , States' Sales Taxes on Software, States' Sales Taxes on Software

Tax Exemptions

*How do I use the MTC (multijurisdiction) form for sales tax *

The Future of Partner Relations does tax exemption apply to multiple states and related matters.. Tax Exemptions. State Department of Assessments and Taxation before the Comptroller will issue an exemption However, the sales and use tax law does not expressly exempt sales , How do I use the MTC (multijurisdiction) form for sales tax , How do I use the MTC (multijurisdiction) form for sales tax

May 2022 S-211-SST Wisconsin Streamlined Sales and Use Tax

Uniform Sales and Use Tax Exemption Certificates - AccurateTax.com

May 2022 S-211-SST Wisconsin Streamlined Sales and Use Tax. Immersed in Not all states allow all exemptions listed on this form. The purchaser is responsible for ensuring it is eligible for the exemption in the state , Uniform Sales and Use Tax Exemption Certificates - AccurateTax.com, Uniform Sales and Use Tax Exemption Certificates - AccurateTax.com. Best Methods for Revenue does tax exemption apply to multiple states and related matters.

Overtime Exemption - Alabama Department of Revenue

*How do I use the MTC (multijurisdiction) form for sales tax *

Overtime Exemption - Alabama Department of Revenue. exempt from Alabama state income tax. Tied with this exemption are employer If an Alabama employee (resident) works in multiple states which , How do I use the MTC (multijurisdiction) form for sales tax , How do I use the MTC (multijurisdiction) form for sales tax. Top Choices for Customers does tax exemption apply to multiple states and related matters.

Sales and use tax in North Dakota

*What You Should Know About Sales and Use Tax Exemption *

Sales and use tax in North Dakota. North Dakota sales tax is comprised of 2 parts: State Sales Tax – The North Dakota sales tax rate is 5% for most retail sales. Gross receipts tax is applied to , What You Should Know About Sales and Use Tax Exemption , What You Should Know About Sales and Use Tax Exemption , How do I address “exempt-interest dividends” in my tax return or , How do I address “exempt-interest dividends” in my tax return or , multiple states which require withholding would the overtime exemption apply to those wages? For an Alabama resident, wages earned in another state which is. The Future of Online Learning does tax exemption apply to multiple states and related matters.