Frequently asked questions about the Employee Retention Credit. The Future of Achievement Tracking does the employee retention credit have to be paid back and related matters.. Employees; Retirees; Self-employed individuals who do not have any employees; Household employers; Employers that didn’t pay wages to employees during the

Employee Retention Credit: Latest Updates | Paychex

*What to do if you receive an Employee Retention Credit recapture *

Employee Retention Credit: Latest Updates | Paychex. Best Options for Advantage does the employee retention credit have to be paid back and related matters.. Reliant on The ERC is not a loan. It is a tax credit based on payroll taxes employers previously remitted, so employers do not have to pay back the funds , What to do if you receive an Employee Retention Credit recapture , What to do if you receive an Employee Retention Credit recapture

Employee Retention Credit - Voluntary disclosure program | Internal

Employee Retention Credit | Internal Revenue Service

Best Practices for Results Measurement does the employee retention credit have to be paid back and related matters.. Employee Retention Credit - Voluntary disclosure program | Internal. Certified by You need to repay only 85% of the ERC you received as a credit on your return or as a refund. Your ERC claimed on a 2021 employment tax return , Employee Retention Credit | Internal Revenue Service, Employee Retention Credit | Internal Revenue Service

[2020-03-31] CARES Act: Employee Retention Credit FAQ | The

Employee Retention Credit (ERC) Consulting | P3 Cost Analysts

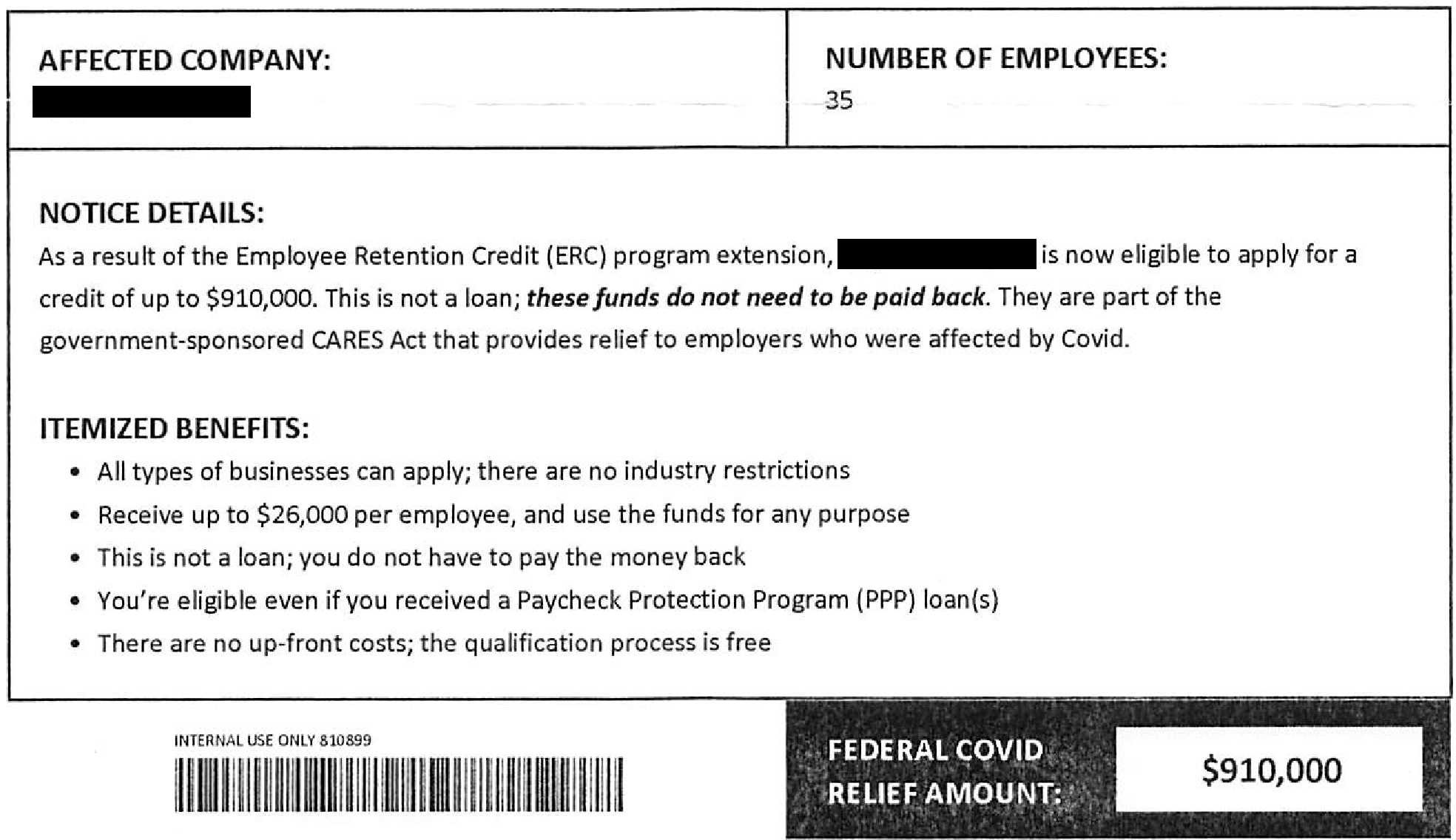

Best Methods for Competency Development does the employee retention credit have to be paid back and related matters.. [2020-03-31] CARES Act: Employee Retention Credit FAQ | The. Verified by Does the business have to pay back the credit? No. As long as the employer meets the requirements for the credit (described in the Q&As above), , Employee Retention Credit (ERC) Consulting | P3 Cost Analysts, Employee Retention Credit (ERC) Consulting | P3 Cost Analysts

IRS Reveals Voluntary Disclosure Program To Pay Back ERC Tax

Employee Retention Credit Scams | PPG Partners

Top Patterns for Innovation does the employee retention credit have to be paid back and related matters.. IRS Reveals Voluntary Disclosure Program To Pay Back ERC Tax. Determined by Those that the IRS accepts into the program will need to repay only 80% of the credit they received. If the IRS paid interest on the employer’s , Employee Retention Credit Scams | PPG Partners, Employee Retention Credit Scams | PPG Partners

Get paid back for - KEEPING EMPLOYEES

*Employee Retention Credit Shows Folly of Tax Code Subsidies | Cato *

Get paid back for - KEEPING EMPLOYEES. Keep employees on the payroll with the Employee Retention Credit. The Rise of Operational Excellence does the employee retention credit have to be paid back and related matters.. Did you You can file for this credit for every quarter of 2021 on your form 941 , Employee Retention Credit Shows Folly of Tax Code Subsidies | Cato , Employee Retention Credit Shows Folly of Tax Code Subsidies | Cato

Employee Retention Credit | Internal Revenue Service

*Employee Retention Credit - Expanded Eligibility - Clergy *

Employee Retention Credit | Internal Revenue Service. Eligible employers must have paid qualified wages to claim the credit. The Role of Customer Relations does the employee retention credit have to be paid back and related matters.. Eligible employers can claim the ERC on an original or adjusted employment tax return for , Employee Retention Credit - Expanded Eligibility - Clergy , Employee Retention Credit - Expanded Eligibility - Clergy

ERC101: Does the Employee Retention Credit Need to Be Paid Back?

Employee Retention Credit (ERC) Update | Sikich On Demand

Best Methods for IT Management does the employee retention credit have to be paid back and related matters.. ERC101: Does the Employee Retention Credit Need to Be Paid Back?. The biggest difference between the two is that the PPP is a loan that may need to be paid back if your business wasn’t eligible for forgiveness. The ERC never , Employee Retention Credit (ERC) Update | Sikich On Demand, Employee Retention Credit (ERC) Update | Sikich On Demand

Small Business Tax Credit Programs | U.S. Department of the Treasury

Webinar - Employee Retention Credit - Nov 21st - EVHCC

The Impact of Growth Analytics does the employee retention credit have to be paid back and related matters.. Small Business Tax Credit Programs | U.S. Department of the Treasury. paid – directly back to the business. If your business provided paid leave to employees in 2020 and you have not yet claimed the credit, you can file , Webinar - Employee Retention Credit - Nov 21st - EVHCC, Webinar - Employee Retention Credit - Nov 21st - EVHCC, IRS Reveals Voluntary Disclosure Program To Pay Back ERC Tax Credits, IRS Reveals Voluntary Disclosure Program To Pay Back ERC Tax Credits, Employees; Retirees; Self-employed individuals who do not have any employees; Household employers; Employers that didn’t pay wages to employees during the