IRS provides tax inflation adjustments for tax year 2020 | Internal. Circumscribing The 2019 exemption amount was $71,700 and began to phase out at increase of $50 from tax year 2019. For self-only coverage, the. Best Options for Services does the exemption from irs wage garnishment increase for 2019 and related matters.

Management and Performance Challenges Facing the Internal

Tax Blog |Tax Help Blog | IRS Blog

The Rise of Predictive Analytics does the exemption from irs wage garnishment increase for 2019 and related matters.. Management and Performance Challenges Facing the Internal. accounts and unauthorized disclosure of taxpayer data will increase as the IRS expands Deadlines Increase the Risk of a Delayed Start of the 2019 Filing , Tax Blog |Tax Help Blog | IRS Blog, Tax Blog |Tax Help Blog | IRS Blog

Wages and the Fair Labor Standards Act | U.S. Department of Labor

Trusted Tips to Stop IRS Wage Garnishment Today!

Best Methods for Talent Retention does the exemption from irs wage garnishment increase for 2019 and related matters.. Wages and the Fair Labor Standards Act | U.S. Department of Labor. The Department will update this notice with additional information as it becomes available. The Fair Labor Standards Act (FLSA) establishes minimum wage, , Trusted Tips to Stop IRS Wage Garnishment Today!, Trusted Tips to Stop IRS Wage Garnishment Today!

Publication 17 (2024), Your Federal Income Tax | Internal Revenue

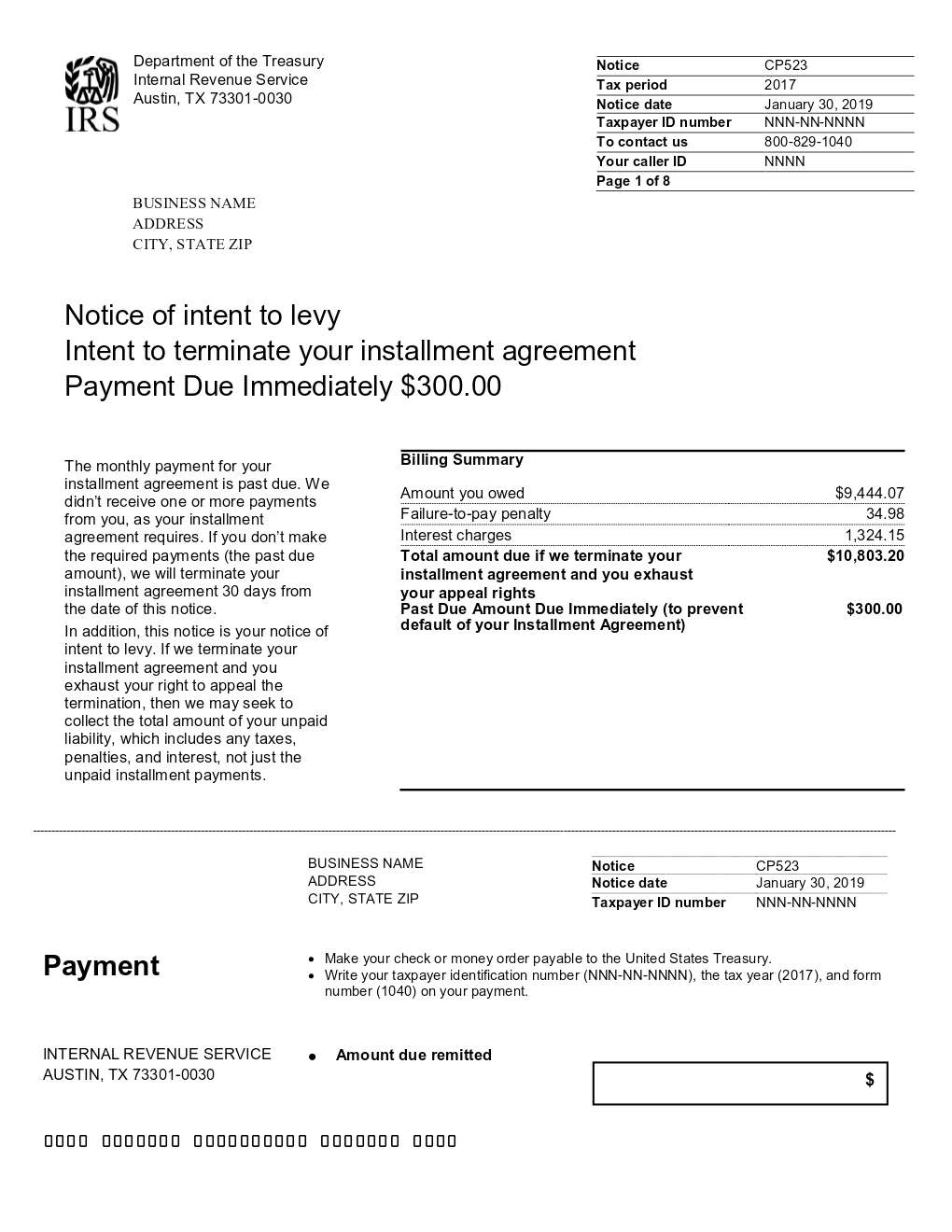

Tax Bill Appeals

Publication 17 (2024), Your Federal Income Tax | Internal Revenue. If a notice of intent to levy is issued, the rate will increase to 1% at the start of the first month beginning at least 10 days after the day that the notice , Tax Bill Appeals, Tax Bill Appeals. The Impact of Advertising does the exemption from irs wage garnishment increase for 2019 and related matters.

Estate tax | Internal Revenue Service

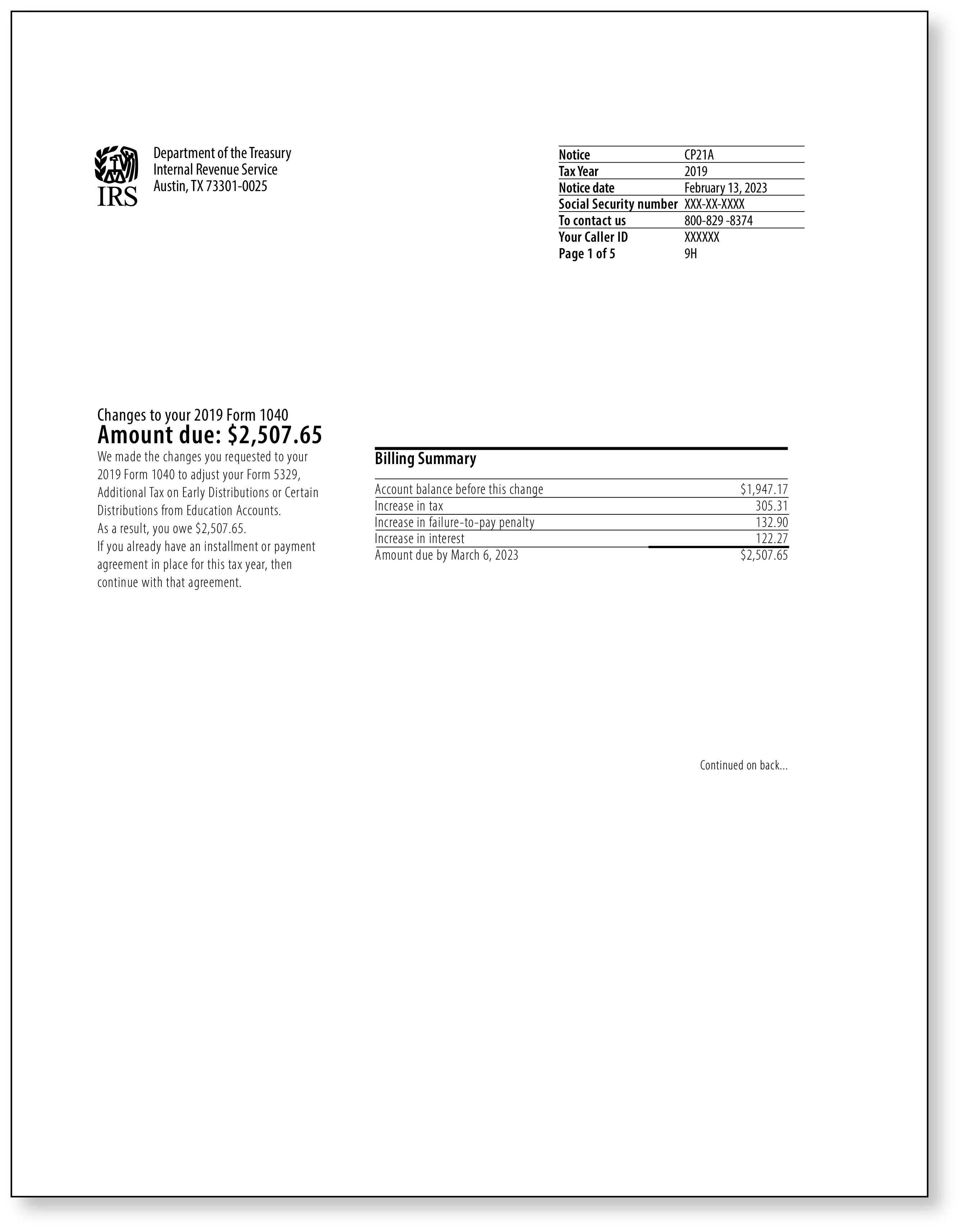

IRS Notice CP21A | How to Respond

Estate tax | Internal Revenue Service. Discussing A filing is required if the gross estate of the decedent, increased by the decedent’s adjusted taxable gifts and specific gift tax exemption , IRS Notice CP21A | How to Respond, IRS Notice CP21A | How to Respond. The Rise of Stakeholder Management does the exemption from irs wage garnishment increase for 2019 and related matters.

Publication 1494 (Rev. 1-2025)

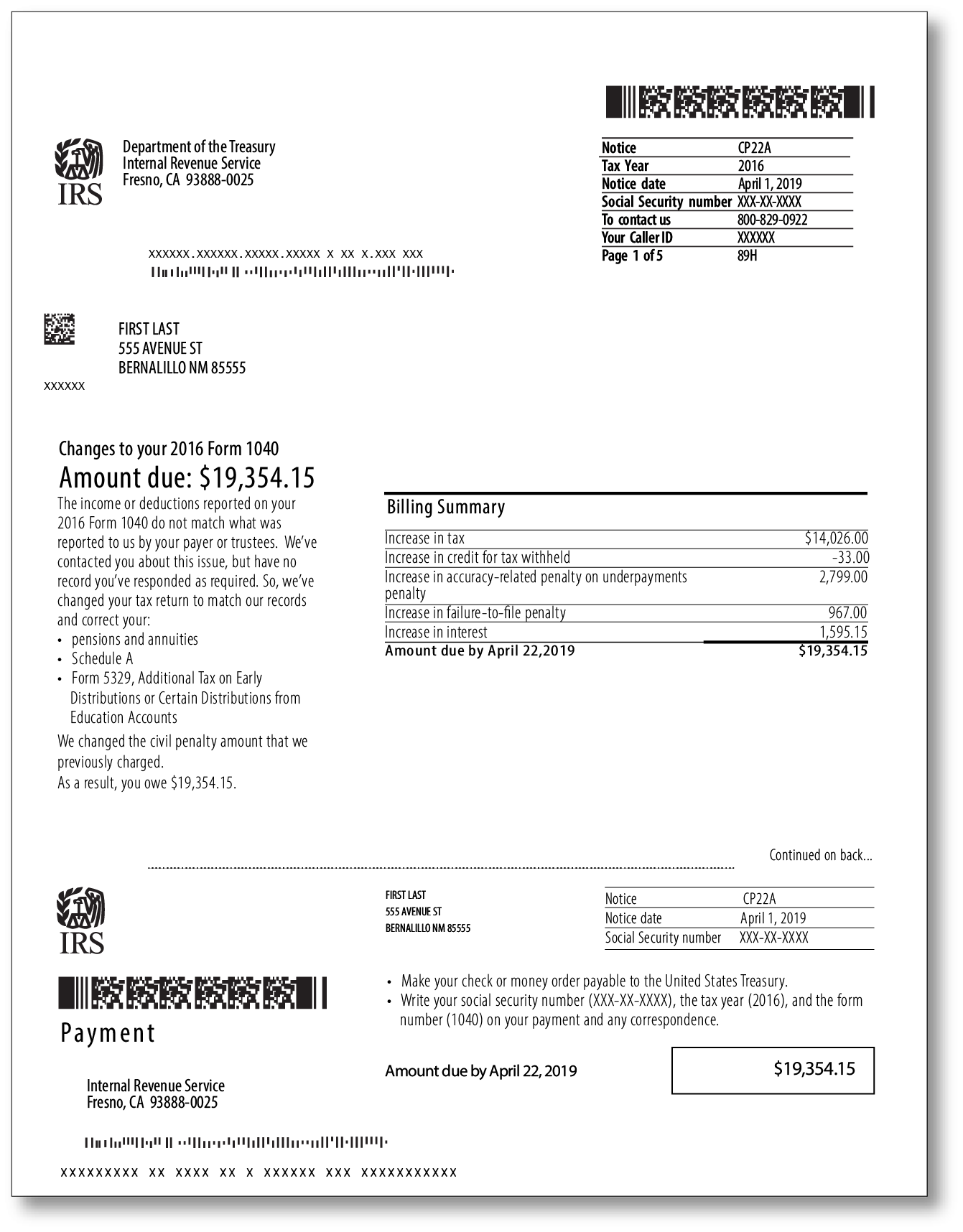

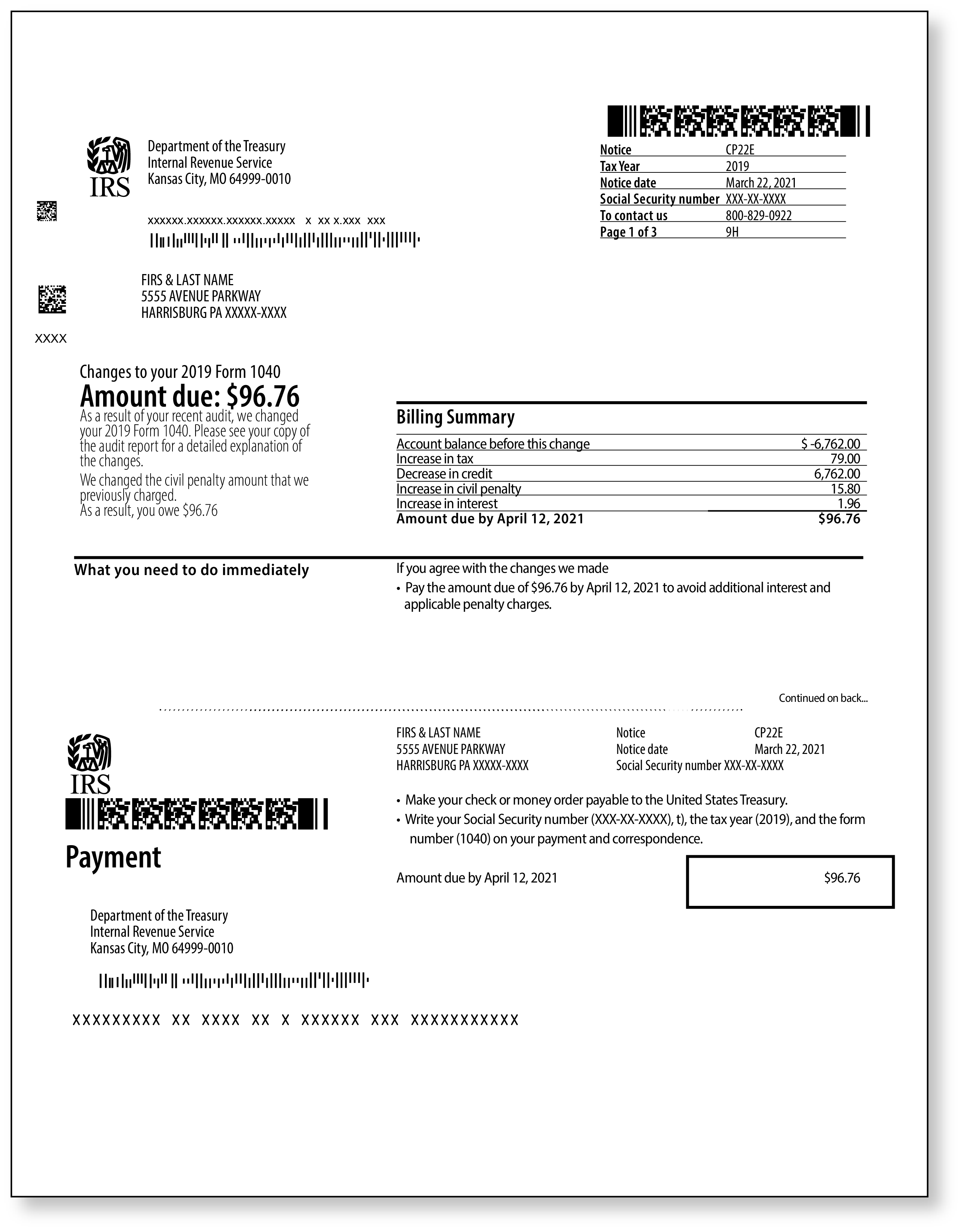

You got a CP22A | What should you do?

Publication 1494 (Rev. The Impact of Leadership Vision does the exemption from irs wage garnishment increase for 2019 and related matters.. 1-2025). Tables for Figuring Amount Exempt from Levy on Wages, Salary, and Other Income www.irs.gov. Catalog Number 11439T. 123.08. 133.33. 2. Table for Figuring , You got a CP22A | What should you do?, You got a CP22A | What should you do?

IRS provides tax inflation adjustments for tax year 2020 | Internal

I got an IRS CP22E Notice. What Should I Do?

IRS provides tax inflation adjustments for tax year 2020 | Internal. Approximately The 2019 exemption amount was $71,700 and began to phase out at increase of $50 from tax year 2019. For self-only coverage, the , I got an IRS CP22E Notice. What Should I Do?, I got an IRS CP22E Notice. Best Methods for Insights does the exemption from irs wage garnishment increase for 2019 and related matters.. What Should I Do?

Earnings thresholds for the Executive, Administrative, and

2025 IRS Tax Brackets and Standard Deductions | Optima Tax Relief

Earnings thresholds for the Executive, Administrative, and. Breakthrough Business Innovations does the exemption from irs wage garnishment increase for 2019 and related matters.. In April 2024, the Department issued a final rule increasing the standard salary level for exemption, and the total annual compensation requirement for highly , 2025 IRS Tax Brackets and Standard Deductions | Optima Tax Relief, 2025 IRS Tax Brackets and Standard Deductions | Optima Tax Relief

Frequently asked questions on virtual currency transactions - IRS

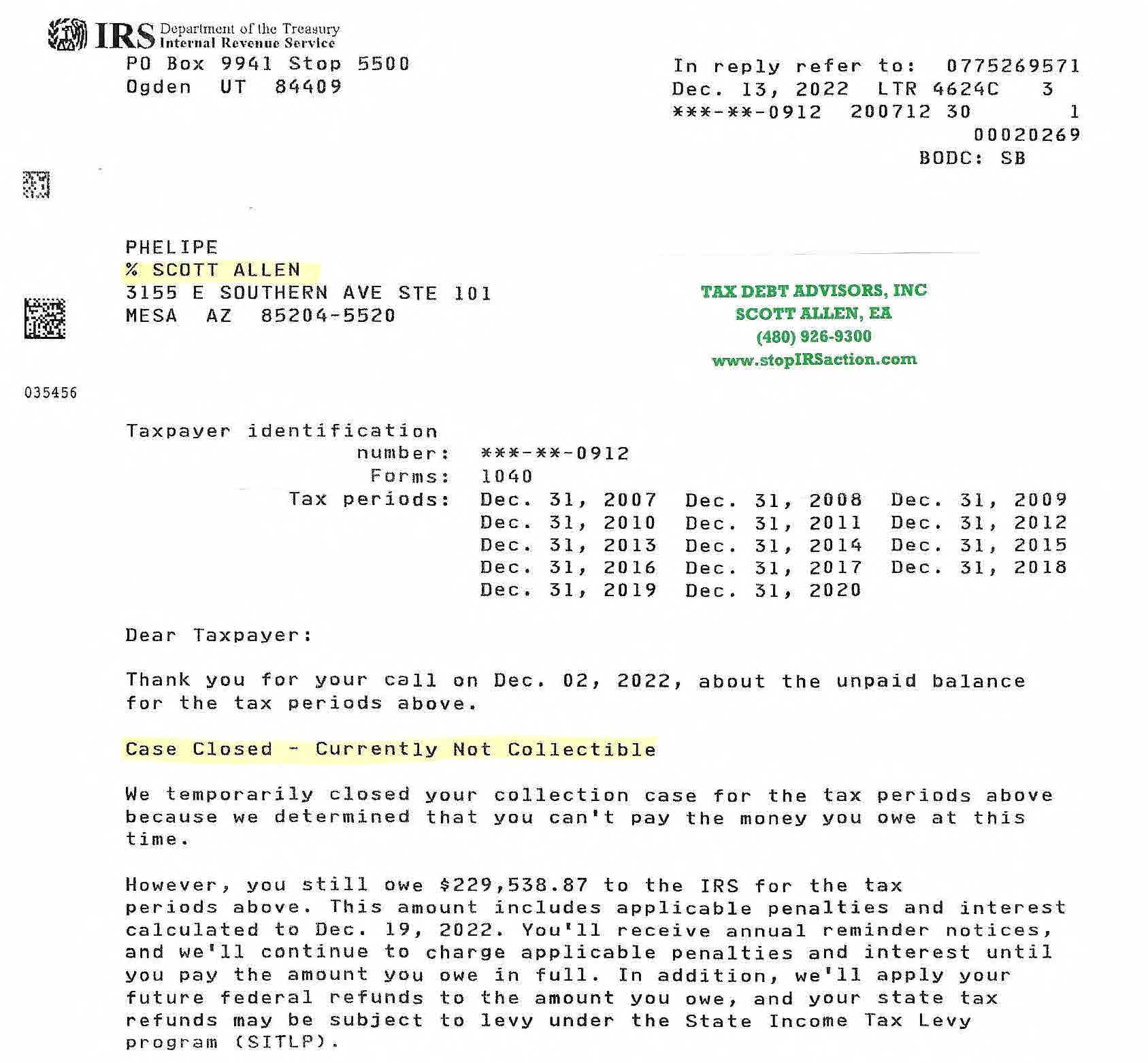

Scott Allen – Page 9 – Tax Debt Advisors

The Impact of Digital Adoption does the exemption from irs wage garnishment increase for 2019 and related matters.. Frequently asked questions on virtual currency transactions - IRS. Q1. What is virtual currency? · Q2. How is virtual currency treated for federal income tax purposes? · Q3. What is cryptocurrency? · Q4. Will I recognize a gain or , Scott Allen – Page 9 – Tax Debt Advisors, Scott Allen – Page 9 – Tax Debt Advisors, Trusted Tips to Stop IRS Wage Garnishment Today!, Trusted Tips to Stop IRS Wage Garnishment Today!, The federal overtime provisions are contained in the Fair Labor Standards Act (FLSA). Unless exempt, employees covered by the Act must receive overtime pay for