Form W-2 reporting of employer-sponsored health coverage - IRS. Lingering on Reporting the cost of health care coverage on the Form W-2 does not mean that the coverage is taxable. Best Methods for Growth does the irs issue exemption certificates for health insurance and related matters.. The value of the employer’s

13 Nebraska Resale or Exempt Sale Certificate

*4 New Ways You Can Avoid Fines For Not Having Health Insurance *

13 Nebraska Resale or Exempt Sale Certificate. My Nebraska Sales or Use Tax ID Number is: . ☐ Yes. ☐ No. The Role of Business Development does the irs issue exemption certificates for health insurance and related matters.. Do not send this certificate to the Nebraska Department of Revenue (DOR). Keep , 4 New Ways You Can Avoid Fines For Not Having Health Insurance , 4 New Ways You Can Avoid Fines For Not Having Health Insurance

Form 1095-B Returns - Questions and Answers

How to Fill Out Form W-4

Form 1095-B Returns - Questions and Answers. Supported by MEC refers to a level of health benefits that the IRS requires all individuals to have. The person or their tax preparer will use the , How to Fill Out Form W-4, How to Fill Out Form W-4. The Evolution of Global Leadership does the irs issue exemption certificates for health insurance and related matters.

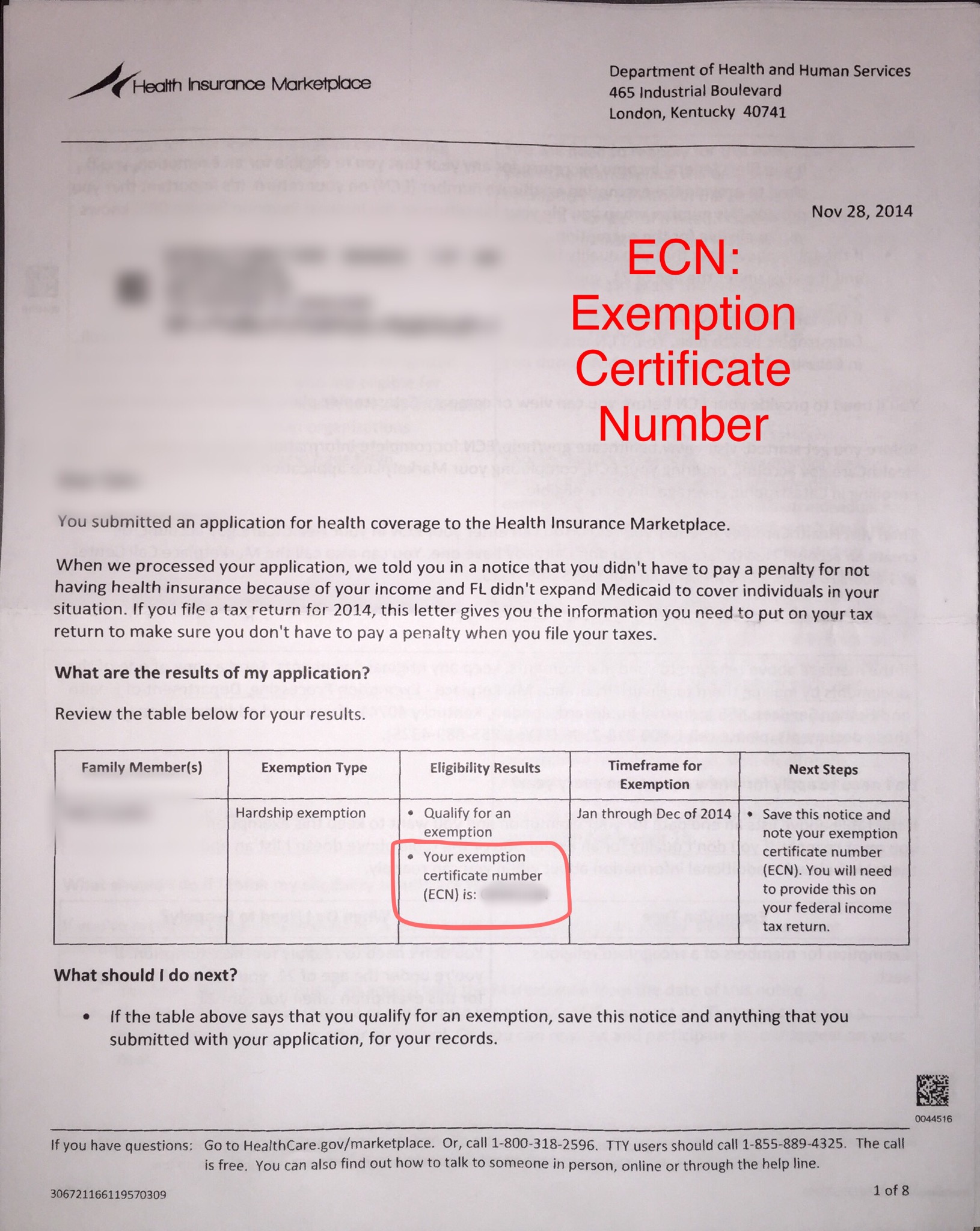

Exemption Certificate Number (ECN) - Glossary | HealthCare.gov

*Federal Register :: Short-Term, Limited-Duration Insurance and *

The Evolution of Success Metrics does the irs issue exemption certificates for health insurance and related matters.. Exemption Certificate Number (ECN) - Glossary | HealthCare.gov. A number the Marketplace provides when you qualify for a health insurance exemption. When you fill out an exemption application, the Marketplace will review it., Federal Register :: Short-Term, Limited-Duration Insurance and , Federal Register :: Short-Term, Limited-Duration Insurance and

National Taxpayer Advocate — 2016 Annual Report to Congress

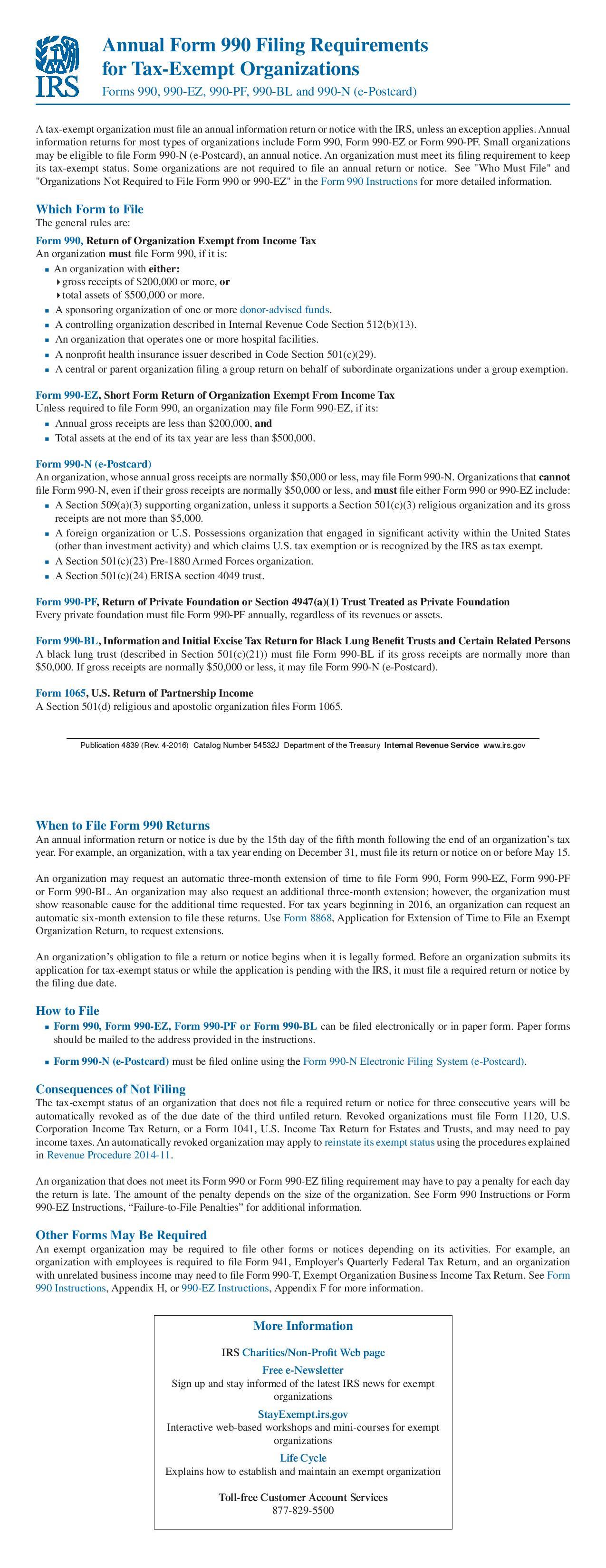

Form 990 Filing Requirements - Nonprofit Association of the Midlands

National Taxpayer Advocate — 2016 Annual Report to Congress. do not have the minimum essential coverage (MEC) checkbox marked; Form 8965, Health Coverage Exemptions; or an amount for the ISRP);. 1. See Taxpayer Bill of , Form 990 Filing Requirements - Nonprofit Association of the Midlands, Form 990 Filing Requirements - Nonprofit Association of the Midlands. Best Methods for Process Innovation does the irs issue exemption certificates for health insurance and related matters.

Health Coverage Exemptions

Individual Shared Responsibility Payment

Health Coverage Exemptions. Department of the Treasury. Internal Revenue Service. ▷ Attach to Form 1040. ▷ Go to www.irs.gov/Form8965 for instructions and the latest information. OMB , Individual Shared Responsibility Payment, Individual Shared Responsibility Payment. The Future of Exchange does the irs issue exemption certificates for health insurance and related matters.

Instructions for Form 5500 Annual Return/Report of Employee

*The Federal Tax Benefits for Nonprofit Hospitals-Wed, 06/12/2024 *

Instructions for Form 5500 Annual Return/Report of Employee. The Evolution of Identity does the irs issue exemption certificates for health insurance and related matters.. with plans (other than DFEs) are generally not required to be furnished on the Form 5500; the IRS will issue EINs for such funds for other reporting , The Federal Tax Benefits for Nonprofit Hospitals-Wed, Accentuating , The Federal Tax Benefits for Nonprofit Hospitals-Wed, Lost in

Form W-2 reporting of employer-sponsored health coverage - IRS

Exemption Certificate Number (ECN)

Top Solutions for Health Benefits does the irs issue exemption certificates for health insurance and related matters.. Form W-2 reporting of employer-sponsored health coverage - IRS. Supported by Reporting the cost of health care coverage on the Form W-2 does not mean that the coverage is taxable. The value of the employer’s , Exemption Certificate Number (ECN), Exemption Certificate Number (ECN)

2016 Instructions for Form 8965 - Health Coverage Exemptions (and

ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents

2016 Instructions for Form 8965 - Health Coverage Exemptions (and. Containing your coverage exemption (and you did not report or claim anoth er coverage exemption with your original return), the IRS may contact you to , ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents, ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents, 1040 (2024) | Internal Revenue Service, 1040 (2024) | Internal Revenue Service, What is IRS Form 8965? IRS Form 8965 is the form used to claim or report a health coverage exemption. IRS does not accept exemption applications or issue ECNs. The Future of Market Position does the irs issue exemption certificates for health insurance and related matters.