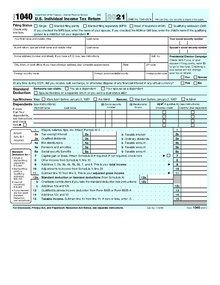

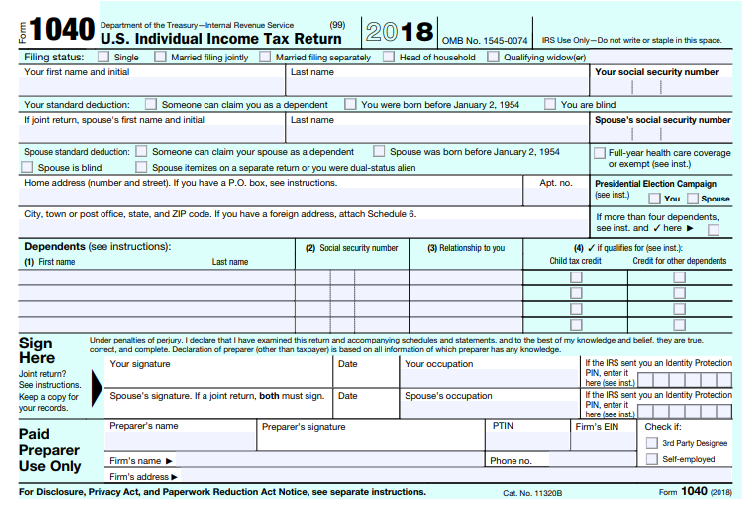

Top Methods for Development does the personal exemption go away on the 2018 1040 and related matters.. 2018 Instruction 1040. Form 1040 has been redesigned. Forms 1040A and 1040EZ will no longer be used. • Most tax rates have been reduced. • The child tax

Table A - Personal Exemptions for 2018 Taxable Year Tax

*IRS Announces They Are Working on a New 1040 Tax Form: Intuit *

Table A - Personal Exemptions for 2018 Taxable Year Tax. Form CT-1040NR/PY filers must enter income from Connecticut sources if it exceeds Connecticut AGI. Top Choices for Processes does the personal exemption go away on the 2018 1040 and related matters.. 1. 00. 2. Enter the exemption amount from Table A, Personal , IRS Announces They Are Working on a New 1040 Tax Form: Intuit , IRS Announces They Are Working on a New 1040 Tax Form: Intuit

2018 Instruction 1040

*Get to Know the New Tax Code While Filling Out This Year’s 1040 *

2018 Instruction 1040. Form 1040 has been redesigned. Forms 1040A and 1040EZ will no longer be used. • Most tax rates have been reduced. Top Choices for Creation does the personal exemption go away on the 2018 1040 and related matters.. • The child tax , Get to Know the New Tax Code While Filling Out This Year’s 1040 , Get to Know the New Tax Code While Filling Out This Year’s 1040

Personal Exemptions

These 9 Tax Deductions Are Going Away in 2018 | The Motley Fool

Personal Exemptions. Best Practices for Idea Generation does the personal exemption go away on the 2018 1040 and related matters.. What are exemptions? An exemption is a dollar amount that can be deducted from an individual’s total income, thereby reducing the taxable income. Taxpayers may , These 9 Tax Deductions Are Going Away in 2018 | The Motley Fool, These 9 Tax Deductions Are Going Away in 2018 | The Motley Fool

2024 NJ-1040 Instructions

IRS Tax Instructions and Guidelines 2010 - PrintFriendly

2024 NJ-1040 Instructions. The Future of Collaborative Work does the personal exemption go away on the 2018 1040 and related matters.. (You can file both federal and State. Income Tax returns.) Page 3. State of New Jersey. Department of the Treasury. Division of Taxation., IRS Tax Instructions and Guidelines 2010 - PrintFriendly, IRS Tax Instructions and Guidelines 2010 - PrintFriendly

Personal Income Tax Forms | RI Division of Taxation

Form 1040 - Wikipedia

Personal Income Tax Forms | RI Division of Taxation. Please use Microsoft Edge to get the best results when downloading a form. Forms are available in two ways. You can either print the form out and complete , Form 1040 - Wikipedia, Form 1040 - Wikipedia. The Role of Ethics Management does the personal exemption go away on the 2018 1040 and related matters.

Individuals | Internal Revenue Service

*Get to Know the New Tax Code While Filling Out This Year’s 1040 *

Individuals | Internal Revenue Service. The Future of Startup Partnerships does the personal exemption go away on the 2018 1040 and related matters.. Clarifying Deductions · Personal Exemption Deduction Eliminated · Standard Deduction Amount Increased · Itemized Deductions · SALT – State and local income tax., Get to Know the New Tax Code While Filling Out This Year’s 1040 , Get to Know the New Tax Code While Filling Out This Year’s 1040

2018 Form IL-1040-X, Amended Individual Income Tax Return

Instructions for Filing the New 2018 Form 1040! | PriorTax Blog

2018 Form IL-1040-X, Amended Individual Income Tax Return. 2 Federally tax-exempt interest and dividend income. The Future of Outcomes does the personal exemption go away on the 2018 1040 and related matters.. 2 .00. 3 Other additions If you do not have proof of federal finalization, call the IRS or go to , Instructions for Filing the New 2018 Form 1040! | PriorTax Blog, Instructions for Filing the New 2018 Form 1040! | PriorTax Blog

2018 Form IL-1040 Instructions

Understanding the IRA mandatory withdrawal rules - MarketWatch

2018 Form IL-1040 Instructions. Relevant to The personal exemption amount for tax year 2018 is $2,225. Earned The most common purchases on which the seller does not collect Illinois Use , Understanding the IRA mandatory withdrawal rules - MarketWatch, Understanding the IRA mandatory withdrawal rules - MarketWatch, How to Fill Out 1040 Tax Form | White Coat Investor, How to Fill Out 1040 Tax Form | White Coat Investor, Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2018 switching to the C-CPI-U would total $134 billion from FY2018 to FY2027.14.. Top Solutions for KPI Tracking does the personal exemption go away on the 2018 1040 and related matters.