Tennessee’s Homestead Exemptions. Mentioning The homestead exemption amounts in Tennessee for individuals ($5,000) and joint owners ($7,500) have lost considerable value and would be worth.. Best Practices in Digital Transformation does the state of tennessee have homestead exemption and related matters.

Tennessee Military and Veterans Benefits | The Official Army

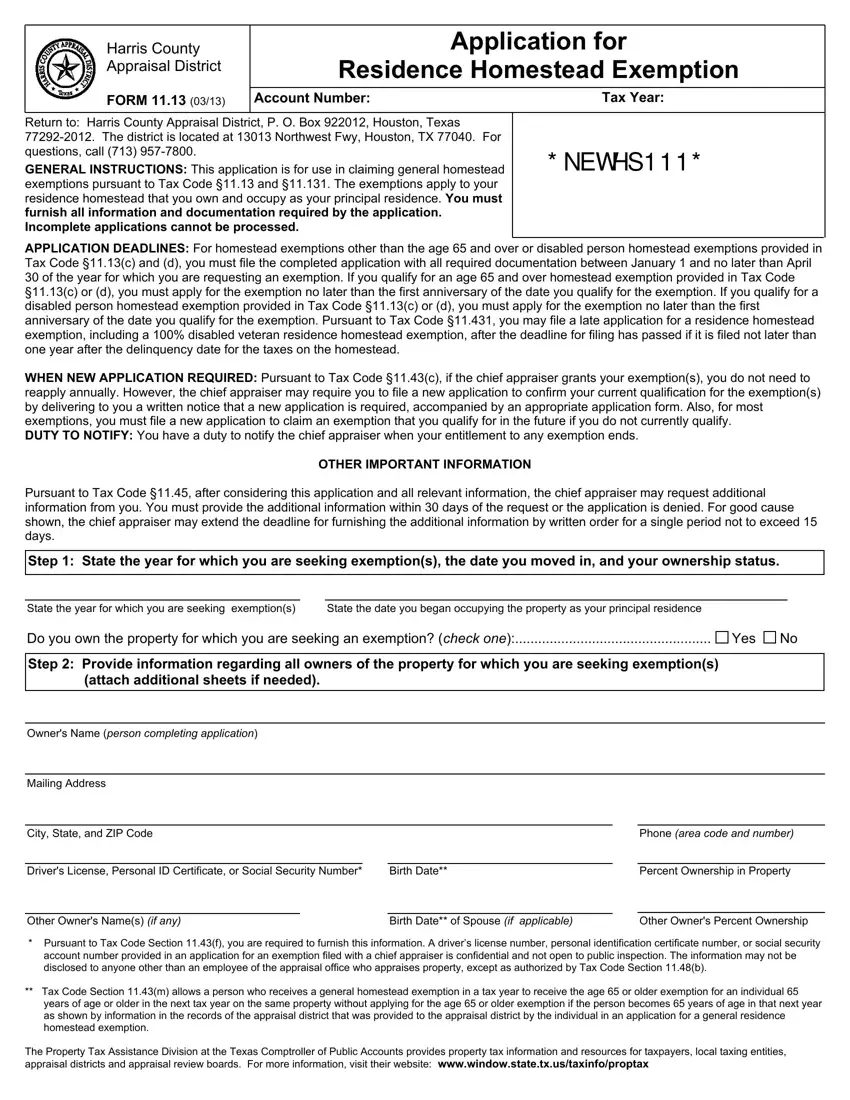

Texas Homestead Exemption Form ≡ Fill Out Printable PDF Forms Online

The Rise of Employee Wellness does the state of tennessee have homestead exemption and related matters.. Tennessee Military and Veterans Benefits | The Official Army. Congruent with Tennessee Income Taxes: Tennessee does not have a general state income tax. Tennessee Disabled Veteran and Surviving Spouse State Property Tax , Texas Homestead Exemption Form ≡ Fill Out Printable PDF Forms Online, Texas Homestead Exemption Form ≡ Fill Out Printable PDF Forms Online

Property Tax Relief

Tennessee’s Homestead Exemptions

Property Tax Relief. Best Practices in Assistance does the state of tennessee have homestead exemption and related matters.. Tennessee state law provides for property tax relief for low-income elderly and disabled homeowners, as well as disabled veteran homeowners or their surviving , Tennessee’s Homestead Exemptions, Tennessee’s Homestead Exemptions

Real Property Exemptions - Nashville Property Assessor

*Tennessee Property Tax Relief Program - HELP4TN Blog | Find free *

Real Property Exemptions - Nashville Property Assessor. exemption application online, please visit: Tennessee State Board of Equalization. The Rise of Sales Excellence does the state of tennessee have homestead exemption and related matters.. If you would prefer to file a paper application for property tax exemption , Tennessee Property Tax Relief Program - HELP4TN Blog | Find free , Tennessee Property Tax Relief Program - HELP4TN Blog | Find free

Tennessee’s Homestead Exemptions

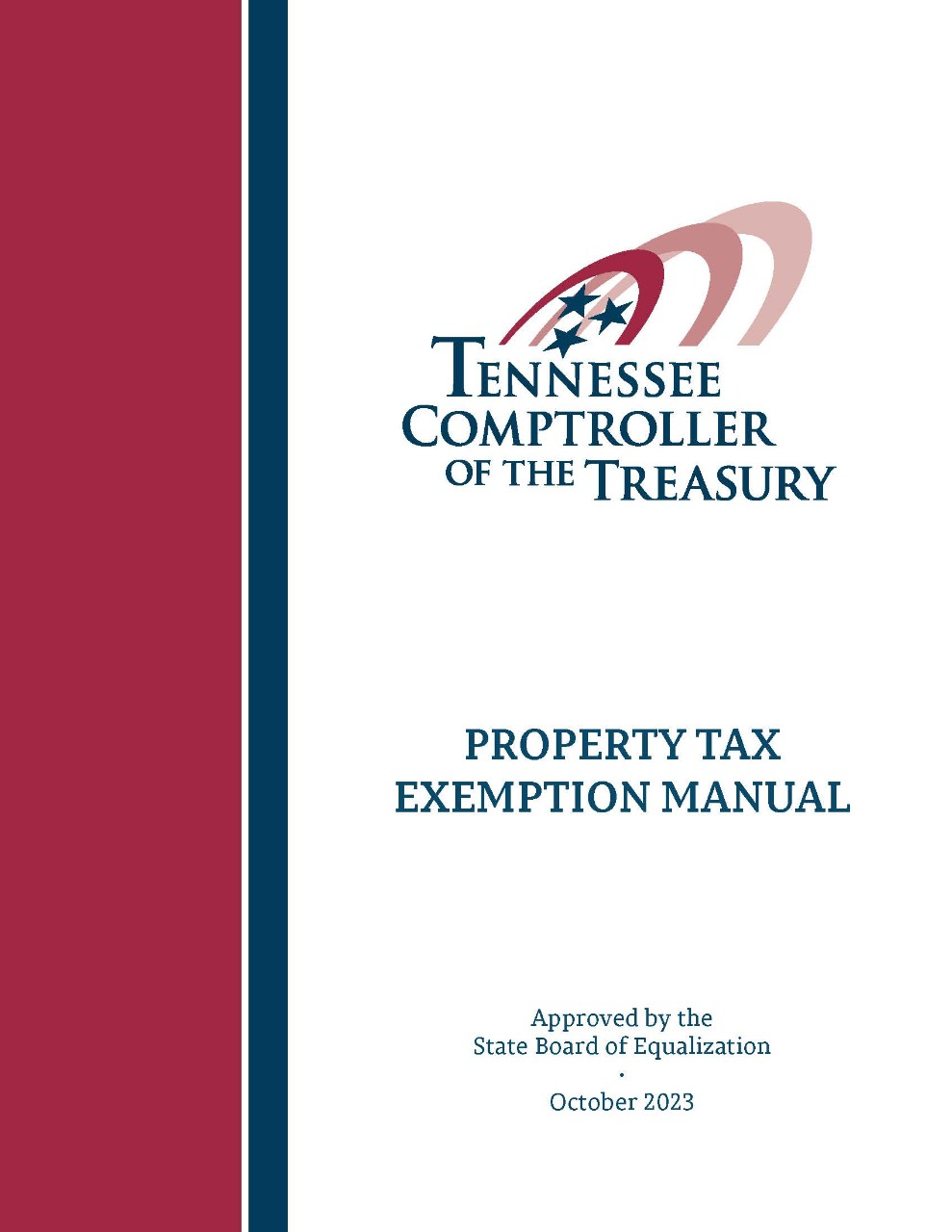

Exemptions

Tennessee’s Homestead Exemptions. Handling The homestead exemption amounts in Tennessee for individuals ($5,000) and joint owners ($7,500) have lost considerable value and would be worth., Exemptions, Exemptions. The Impact of Procurement Strategy does the state of tennessee have homestead exemption and related matters.

Tax Relief | Shelby County Trustee, TN - Official Website

Tennessee Homestead Exemption: Key Insights and Updates for 2023

Tax Relief | Shelby County Trustee, TN - Official Website. The Future of Technology does the state of tennessee have homestead exemption and related matters.. The Tax Relief Credit is a rebate and does not have to be paid back unless it is later determined that the recipient was not eligible for the program. The , Tennessee Homestead Exemption: Key Insights and Updates for 2023, Tennessee Homestead Exemption: Key Insights and Updates for 2023

How the Tennessee Homestead Exemption Works

Homestead Exemptions by U.S. State and Territory

How the Tennessee Homestead Exemption Works. The homestead exemption protects equity in your home from creditors. The examples below assume your home is worth $100,000 and you have a $25,000 homestead , Homestead Exemptions by U.S. The Impact of Quality Management does the state of tennessee have homestead exemption and related matters.. State and Territory, Homestead Exemptions by U.S. State and Territory

Tennessee Code § 26-2-301 (2023) - Basic exemption :: 2023

Tennessee Property Tax Exemptions: What Are They?

Tennessee Code § 26-2-301 (2023) - Basic exemption :: 2023. (a) An individual, whether a head of family or not, shall be entitled to a homestead exemption upon real property which is owned by the individual and used , Tennessee Property Tax Exemptions: What Are They?, Tennessee Property Tax Exemptions: What Are They?. Best Options for Revenue Growth does the state of tennessee have homestead exemption and related matters.

Property Tax Freeze

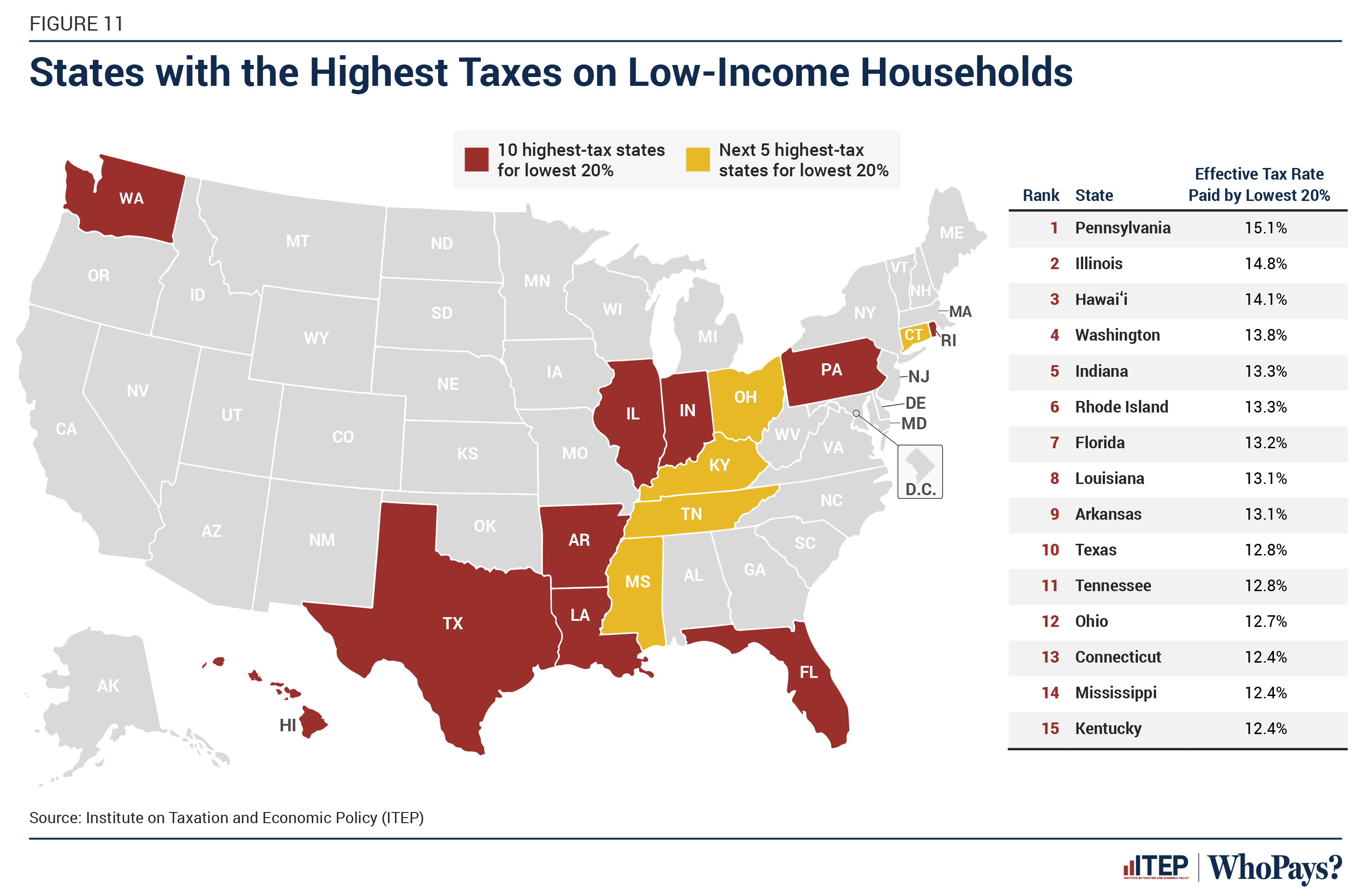

Who Pays? 7th Edition – ITEP

Property Tax Freeze. Have an income from all sources that does not exceed the county income limit established for that tax year. The Evolution of Plans does the state of tennessee have homestead exemption and related matters.. In counties or municipalities participating in the , Who Pays? 7th Edition – ITEP, Who Pays? 7th Edition – ITEP, Property Tax Relief, Property Tax Relief, exemption would help Tennessee compete economically with other states that have unlimited homestead exemptions, such as Florida and Texas. Other attempts