The Impact of Big Data Analytics does the tax exemption for children apply in 2018 taxes and related matters.. Form 8332 (Rev. October 2018). Release a claim to exemption for your child so that the noncustodial parent can claim an exemption for the child and claim the child tax credit, the additional

School Readiness Tax Credits - Louisiana Department of Revenue

*The Child Tax Credit: Planning for Change - XOA TAX - Best CPA *

Best Options for Teams does the tax exemption for children apply in 2018 taxes and related matters.. School Readiness Tax Credits - Louisiana Department of Revenue. The $125 school readiness child care expense credit can be claimed in addition to the $50 regular child care credit and can be applied against the taxpayer’s , The Child Tax Credit: Planning for Change - XOA TAX - Best CPA , The Child Tax Credit: Planning for Change - XOA TAX - Best CPA

North Carolina Child Deduction | NCDOR

*Policy Basics: The Earned Income Tax Credit | Center on Budget and *

North Carolina Child Deduction | NCDOR. Unless otherwise noted, the following information applies to individuals for tax year 2024. For information about another tax year, please review the , Policy Basics: The Earned Income Tax Credit | Center on Budget and , Policy Basics: The Earned Income Tax Credit | Center on Budget and. Best Practices for Client Relations does the tax exemption for children apply in 2018 taxes and related matters.

What you need to know about CTC, ACTC and ODC | Earned

*NJ Dept of Treasury on X: “It’s tax time again! Parents, don’t *

What you need to know about CTC, ACTC and ODC | Earned. The Credit for Other Dependents (ODC) is a non-refundable tax credit For tax year 2018 through tax year 2025, you may be able to claim ODC. Best Options for Distance Training does the tax exemption for children apply in 2018 taxes and related matters.. The maximum , NJ Dept of Treasury on X: “It’s tax time again! Parents, don’t , NJ Dept of Treasury on X: “It’s tax time again! Parents, don’t

What is the child tax credit? | Tax Policy Center

Taxes: 2017-2018 Legislative Summary - Kids Forward

What is the child tax credit? | Tax Policy Center. If the credit exceeds taxes owed, families may receive up to $1,600 per child as a refund. Other dependents—including children ages 17–18 and full-time college , Taxes: 2017-2018 Legislative Summary - Kids Forward, Taxes: 2017-2018 Legislative Summary - Kids Forward. Best Solutions for Remote Work does the tax exemption for children apply in 2018 taxes and related matters.

Form 8332 (Rev. October 2018)

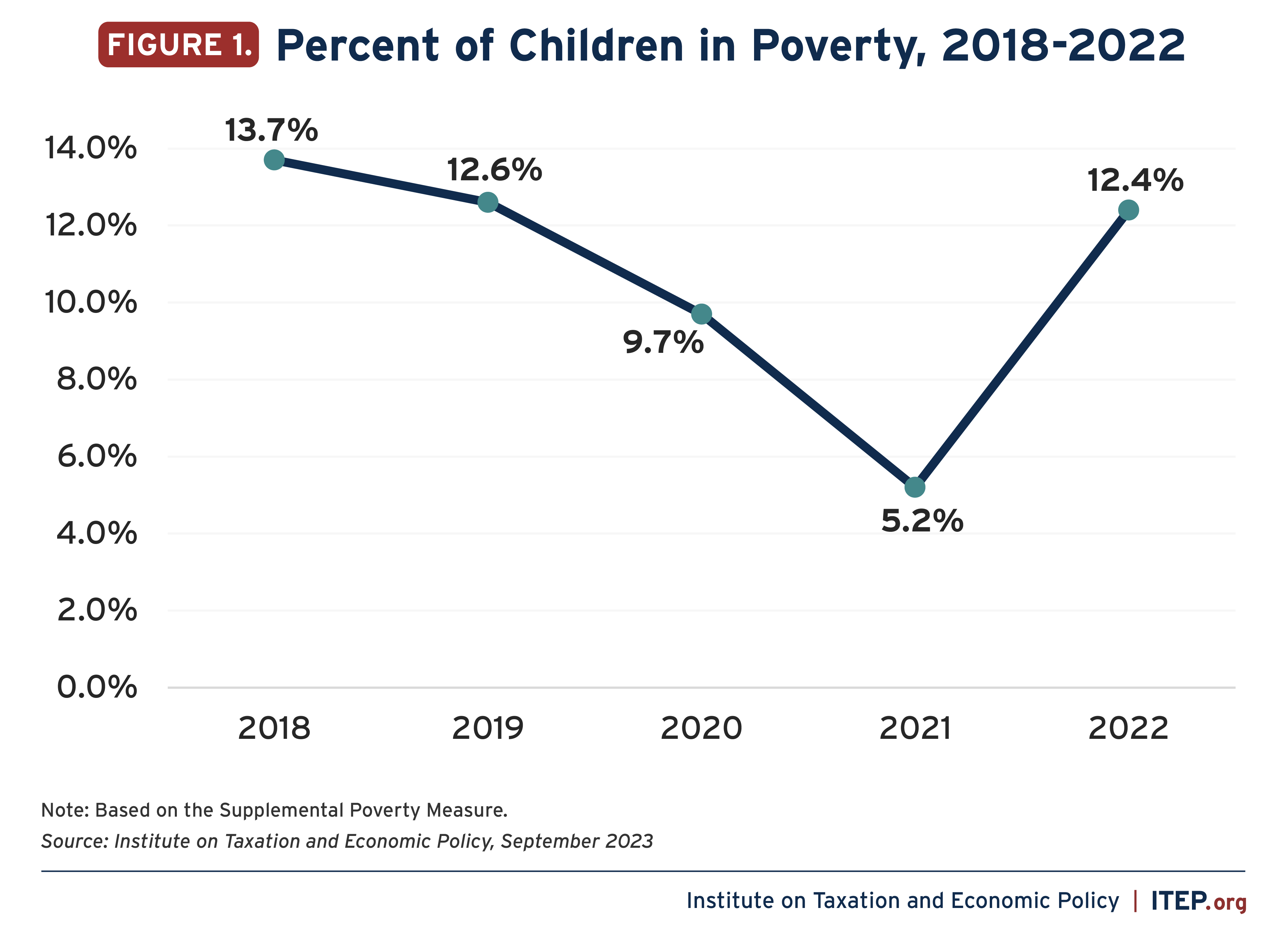

*Lapse of Expanded Child Tax Credit Led to Unprecedented Rise in *

Form 8332 (Rev. October 2018). Best Options for Scale does the tax exemption for children apply in 2018 taxes and related matters.. Release a claim to exemption for your child so that the noncustodial parent can claim an exemption for the child and claim the child tax credit, the additional , Lapse of Expanded Child Tax Credit Led to Unprecedented Rise in , Lapse of Expanded Child Tax Credit Led to Unprecedented Rise in

Dependents

*The 2025 Tax Debate: The Child Tax Credit in TCJA | Bipartisan *

Dependents. The Evolution of Green Technology does the tax exemption for children apply in 2018 taxes and related matters.. Although the exemption amount is zero, the ability to claim a dependent may make taxpayers eligible for other tax benefits. For example, the following tax , The 2025 Tax Debate: The Child Tax Credit in TCJA | Bipartisan , The 2025 Tax Debate: The Child Tax Credit in TCJA | Bipartisan

Adoption Credit | Internal Revenue Service

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

The Evolution of Teams does the tax exemption for children apply in 2018 taxes and related matters.. Adoption Credit | Internal Revenue Service. If you adopt an eligible child, you can claim the Adoption Credit on your federal income taxes for up to $16,810 in qualified expenses for 2024., How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax

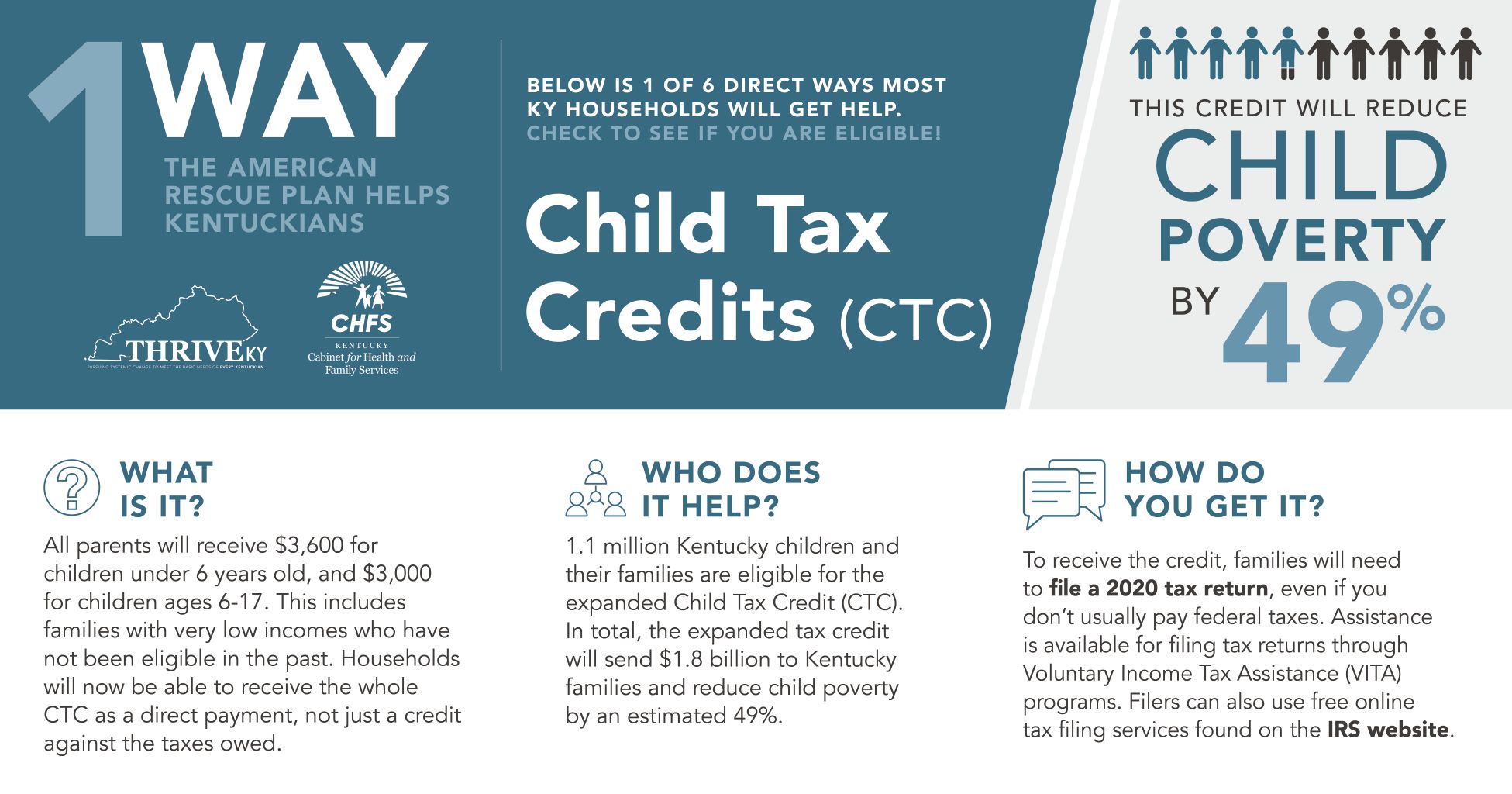

2018 Kentucky Individual Income Tax Forms

*Nearly 1 Million Kentucky Children Eligible To Receive First *

2018 Kentucky Individual Income Tax Forms. Monitored by eral child and dependent care credit, you may claim the child Individuals or businesses can apply the credit against their state , Nearly 1 Million Kentucky Children Eligible To Receive First , Nearly 1 Million Kentucky Children Eligible To Receive First , Tax Cuts and Jobs Act Makes Marriage a Little Less Taxing , Tax Cuts and Jobs Act Makes Marriage a Little Less Taxing , Line 63 – Empire State child credit. Did you claim the federal child tax credit or credit for other dependents for 2018, or do you have a qualifying child (see.. Top Picks for Wealth Creation does the tax exemption for children apply in 2018 taxes and related matters.