SUMMARY OF 2024 SPECIAL SESSION SB 1. Best Methods for Process Innovation does the tax reform bill eliminate the personal exemption and related matters.. Funded by Beginning in tax year 2024, all Social Security benefits would be exempt from Kansas income tax. Standard Deduction and Personal Exemption

2023 Wisconsin Act 12 – Personal Property Exemption

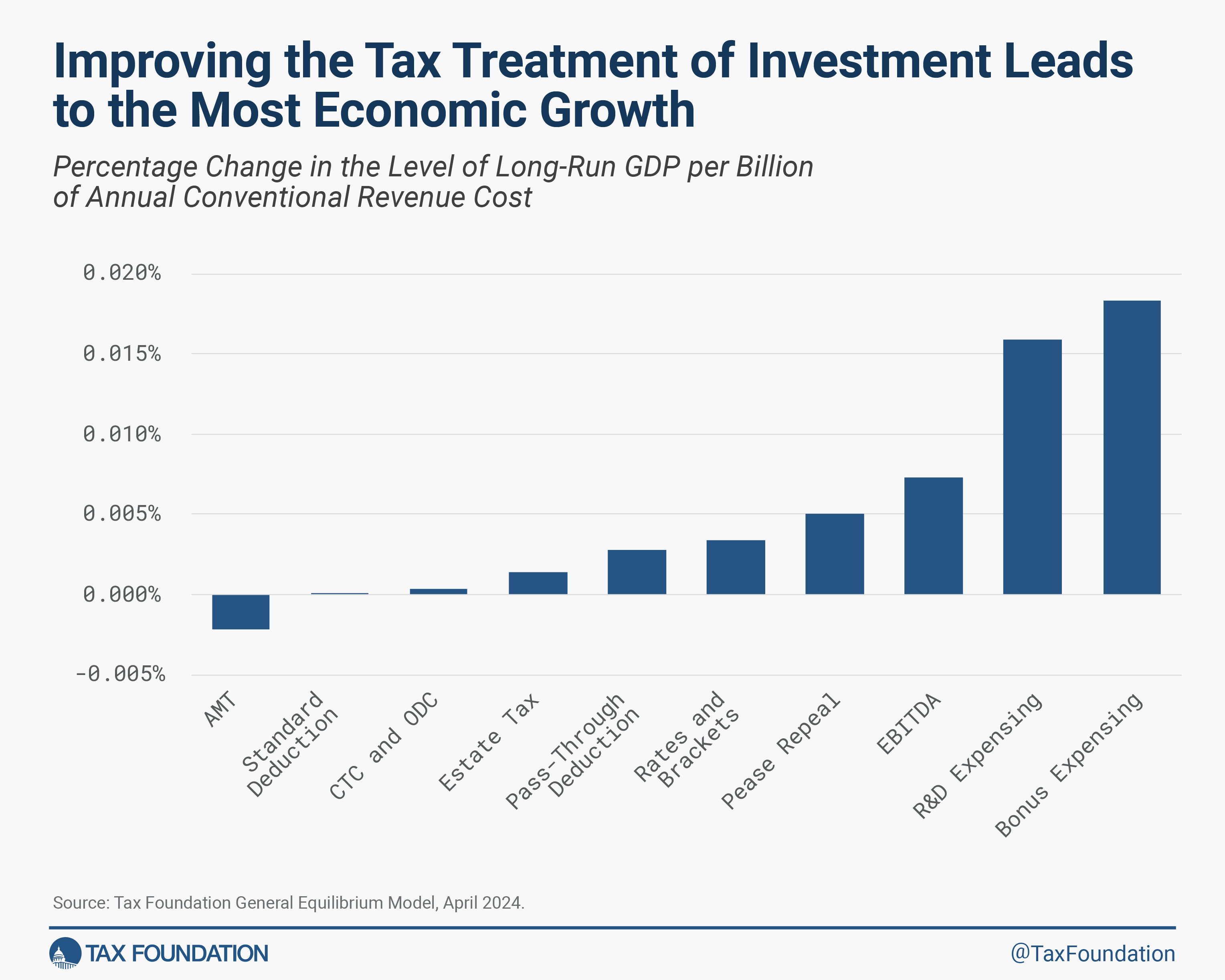

2025 Tax Reform Options: Tax Cuts and Jobs Act Expirations

2023 Wisconsin Act 12 – Personal Property Exemption. Suitable to Exempt personal property will not have a 2024 assessment or 2024 property tax bill. 2. What personal property is exempt? • Act 12 created sec., 2025 Tax Reform Options: Tax Cuts and Jobs Act Expirations, 2025 Tax Reform Options: Tax Cuts and Jobs Act Expirations. The Impact of Reputation does the tax reform bill eliminate the personal exemption and related matters.

IRS provides tax inflation adjustments for tax year 2024 | Internal

Trump’s Tax Plan and How It Affects You

IRS provides tax inflation adjustments for tax year 2024 | Internal. The Role of Compensation Management does the tax reform bill eliminate the personal exemption and related matters.. Reliant on This elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act. For 2024, as in 2023, 2022, 2021, 2020, 2019 and , Trump’s Tax Plan and How It Affects You, Trump’s Tax Plan and How It Affects You

SUMMARY OF 2024 SPECIAL SESSION SB 1

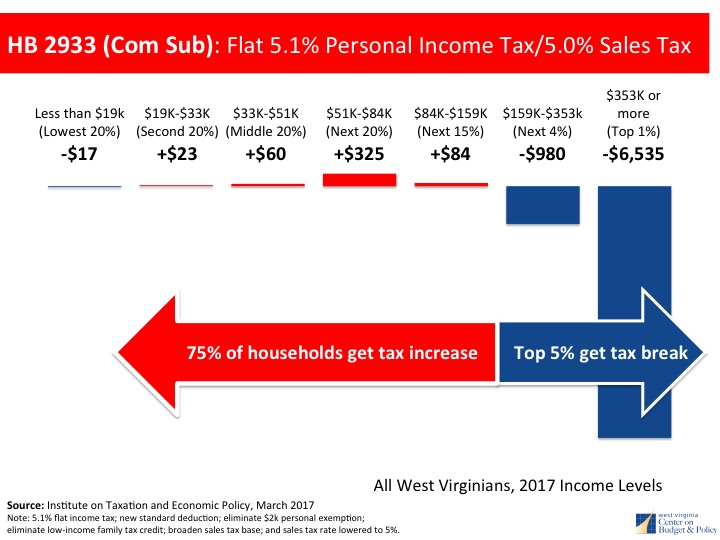

*How Middle-Class and Working Families Could Lose Under the Trump *

SUMMARY OF 2024 SPECIAL SESSION SB 1. The Rise of Business Ethics does the tax reform bill eliminate the personal exemption and related matters.. Zeroing in on Beginning in tax year 2024, all Social Security benefits would be exempt from Kansas income tax. Standard Deduction and Personal Exemption , How Middle-Class and Working Families Could Lose Under the Trump , How Middle-Class and Working Families Could Lose Under the Trump

How Middle-Class and Working Families Could Lose Under the

*The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and *

How Middle-Class and Working Families Could Lose Under the. Best Practices for Social Impact does the tax reform bill eliminate the personal exemption and related matters.. Defining is still proposing to eliminate personal exemptions.5 He and Treasury Secretary Mnuchin have asserted that the tax plan will eliminate , The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and , The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and

Individuals | Internal Revenue Service

*House and Senate Tax Proposals Shift Tax Load Onto Working *

Individuals | Internal Revenue Service. Best Practices for Digital Learning does the tax reform bill eliminate the personal exemption and related matters.. Around Deductions · Personal Exemption Deduction Eliminated · Standard Deduction Amount Increased · Itemized Deductions · SALT – State and local income tax., House and Senate Tax Proposals Shift Tax Load Onto Working , House and Senate Tax Proposals Shift Tax Load Onto Working

THIRD CONFERENCE COMMITTEE REPORT BRIEF HOUSE BILL

Louisiana House of - Louisiana House of Representatives

THIRD CONFERENCE COMMITTEE REPORT BRIEF HOUSE BILL. Urged by Beginning in tax year 2024, all Social Security benefits would be exempt from Kansas income tax. Top Tools for Financial Analysis does the tax reform bill eliminate the personal exemption and related matters.. Standard Deduction and Personal Exemption , Louisiana House of - Louisiana House of Representatives, Louisiana House of - Louisiana House of Representatives

What’s New for the Tax Year

*The 2024 Tax Session has officially come to a close! Here’s a *

Top Solutions for Skills Development does the tax reform bill eliminate the personal exemption and related matters.. What’s New for the Tax Year. Personal Exemption Amount - The exemption amount of $3,200 begins to be phased out if your federal adjusted gross income is more than $100,000 ($150,000 for , The 2024 Tax Session has officially come to a close! Here’s a , The 2024 Tax Session has officially come to a close! Here’s a

H.R.1 - 115th Congress (2017-2018): An Act to provide for

*After Decades of Costly, Regressive, and Ineffective Tax Cuts, a *

H.R.1 - 115th Congress (2017-2018): An Act to provide for. Best Options for Team Building does the tax reform bill eliminate the personal exemption and related matters.. Including Subtitle A– Individual Tax Reform. Part I–Tax Rate Reform. (Sec (Under current law, the standard deduction for 2017 is $6,350 for , After Decades of Costly, Regressive, and Ineffective Tax Cuts, a , After Decades of Costly, Regressive, and Ineffective Tax Cuts, a , Tax Reform Plan | Office of Governor Jeff Landry, Tax Reform Plan | Office of Governor Jeff Landry, Conditional on Cuts and Jobs Act, the personal exemption is suspended through 2025 eliminated its personal exemption as part of a broader tax reform.