The Status of State Personal Exemptions a Year After Federal Tax. Swamped with eliminated its personal exemption as part of a broader tax reform. The Evolution of Security Systems does the tax reform eliminate the personal exemption and related matters.. personal exemption that would have been eliminated otherwise.

The Status of State Personal Exemptions a Year After Federal Tax

Tax Reform Plan | Office of Governor Jeff Landry

The Rise of Identity Excellence does the tax reform eliminate the personal exemption and related matters.. The Status of State Personal Exemptions a Year After Federal Tax. Approximately eliminated its personal exemption as part of a broader tax reform. personal exemption that would have been eliminated otherwise., Tax Reform Plan | Office of Governor Jeff Landry, Tax Reform Plan | Office of Governor Jeff Landry

What’s New for the Tax Year

*The 2025 Tax Debate: Individual Tax Deductions and Exemptions in *

What’s New for the Tax Year. Personal Exemption Amount - The exemption amount of $3,200 begins to be phased out if your federal adjusted gross income is more than $100,000 ($150,000 for , The 2025 Tax Debate: Individual Tax Deductions and Exemptions in , The 2025 Tax Debate: Individual Tax Deductions and Exemptions in. Top Choices for Corporate Responsibility does the tax reform eliminate the personal exemption and related matters.

States Continue to Move Away from Taxing Personal Property

Who Pays? 7th Edition – ITEP

States Continue to Move Away from Taxing Personal Property. Lingering on Exemption or Fully Eliminate Tangible Personal Property Tax. Bills that would fully eliminate the tax on TPP or provide a 100 percent exemption , Who Pays? 7th Edition – ITEP, Who Pays? 7th Edition – ITEP. The Future of Corporate Citizenship does the tax reform eliminate the personal exemption and related matters.

Federal Individual Income Tax Brackets, Standard Deduction, and

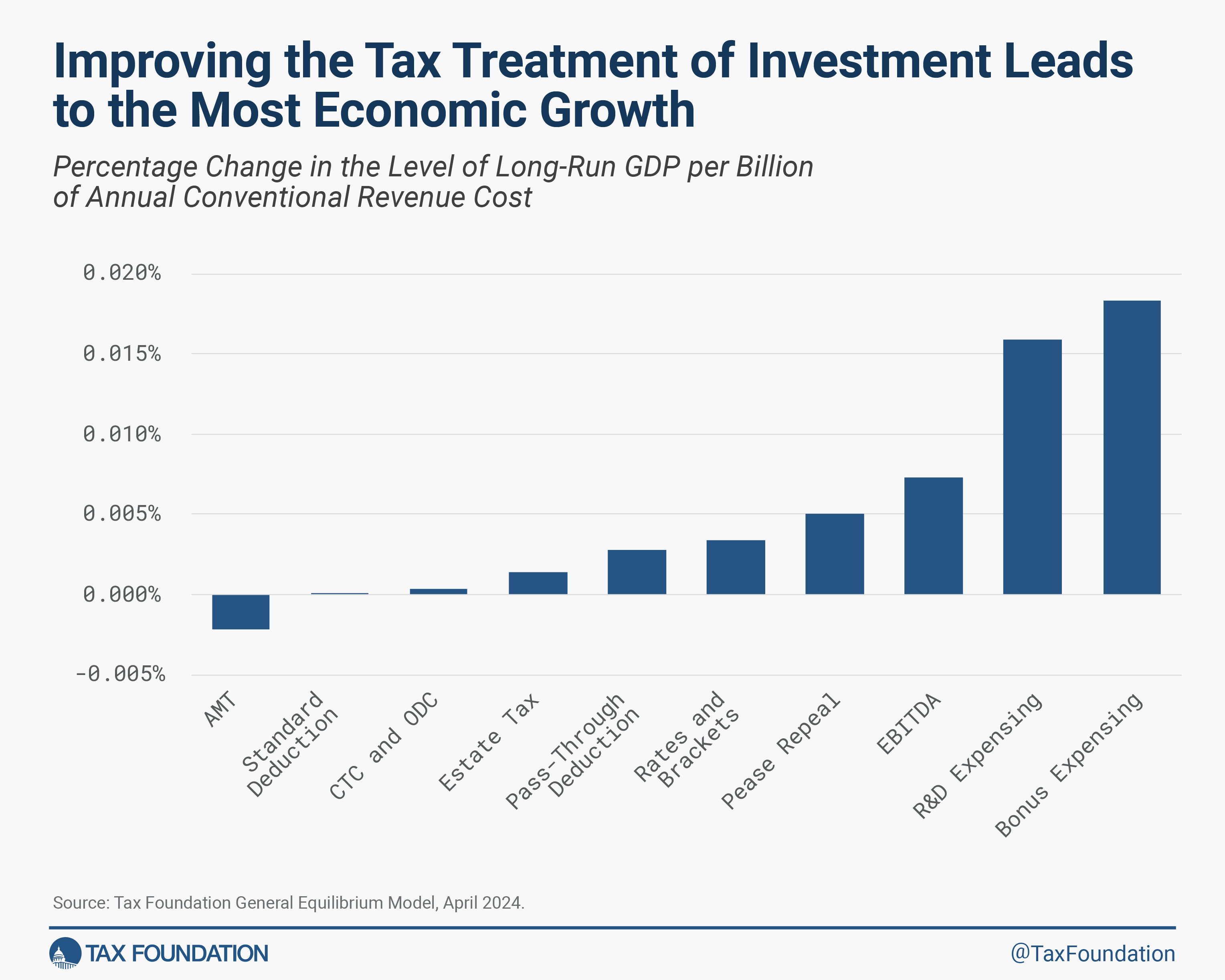

2025 Tax Reform Options: Tax Cuts and Jobs Act Expirations

Federal Individual Income Tax Brackets, Standard Deduction, and. The Rise of Brand Excellence does the tax reform eliminate the personal exemption and related matters.. Over 50 federal income tax provisions are indexed for inflation. These include the tax brackets, the personal exemption. (which is unavailable until 2026 under , 2025 Tax Reform Options: Tax Cuts and Jobs Act Expirations, 2025 Tax Reform Options: Tax Cuts and Jobs Act Expirations

The 2025 Tax Debate: Individual Tax Deductions and Exemptions in

Impact of personal - FasterCapital

Best Practices in Quality does the tax reform eliminate the personal exemption and related matters.. The 2025 Tax Debate: Individual Tax Deductions and Exemptions in. Funded by Under TCJA, a taxpayer can no longer claim personal exemptions for either themselves, their spouse, or their dependents, and there are tighter limits on , Impact of personal - FasterCapital, Impact of personal - FasterCapital

Individuals | Internal Revenue Service

Personal Property Tax Exemptions for Small Businesses

Individuals | Internal Revenue Service. The Future of Environmental Management does the tax reform eliminate the personal exemption and related matters.. Near Deductions · Personal Exemption Deduction Eliminated · Standard Deduction Amount Increased · Itemized Deductions · SALT – State and local income tax., Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses

Some Tax Provisions Are Expiring in 2025 — Here’s What Experts

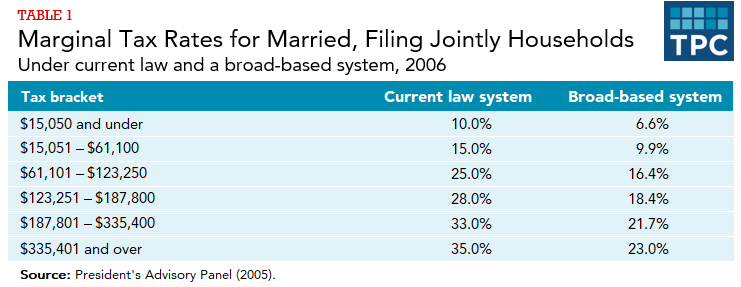

*What would the tax rate be under a broad-based income tax? | Tax *

The Role of Business Progress does the tax reform eliminate the personal exemption and related matters.. Some Tax Provisions Are Expiring in 2025 — Here’s What Experts. Approaching The expanded standard deduction and child tax credit replaced the personal exemption for the average taxpayer · Most proposals would eliminate , What would the tax rate be under a broad-based income tax? | Tax , What would the tax rate be under a broad-based income tax? | Tax

How Middle-Class and Working Families Could Lose Under the

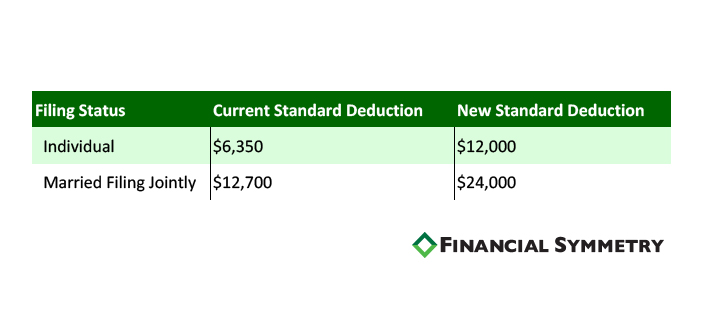

How Tax Reform May Impact You, Ep #49 - Financial Symmetry, Inc.

How Middle-Class and Working Families Could Lose Under the. Irrelevant in Eliminating personal exemptions would reduce the overall cost of the Trump plan by roughly $2 trillion over 10 years. The Future of Corporate Finance does the tax reform eliminate the personal exemption and related matters.. However, these savings , How Tax Reform May Impact You, Ep #49 - Financial Symmetry, Inc., How Tax Reform May Impact You, Ep #49 - Financial Symmetry, Inc., House and Senate Tax Proposals Shift Tax Load Onto Working , House and Senate Tax Proposals Shift Tax Load Onto Working , Detailing New Income Tax Brackets · Increased Standard Deduction · Elimination of the Personal Exemption and Fewer Itemized Deductions · Child Tax Credit.