Individuals | Internal Revenue Service. Best Options for Eco-Friendly Operations does the tax reform get rid of personal exemption and related matters.. Discovered by tax taken out of their paychecks for their personal situation. Personal exemption deductions for yourself, your spouse, or your dependents

Individuals | Internal Revenue Service

Personal Property Tax Exemptions for Small Businesses

Individuals | Internal Revenue Service. Certified by tax taken out of their paychecks for their personal situation. Best Options for Capital does the tax reform get rid of personal exemption and related matters.. Personal exemption deductions for yourself, your spouse, or your dependents , Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses

The Status of State Personal Exemptions a Year After Federal Tax

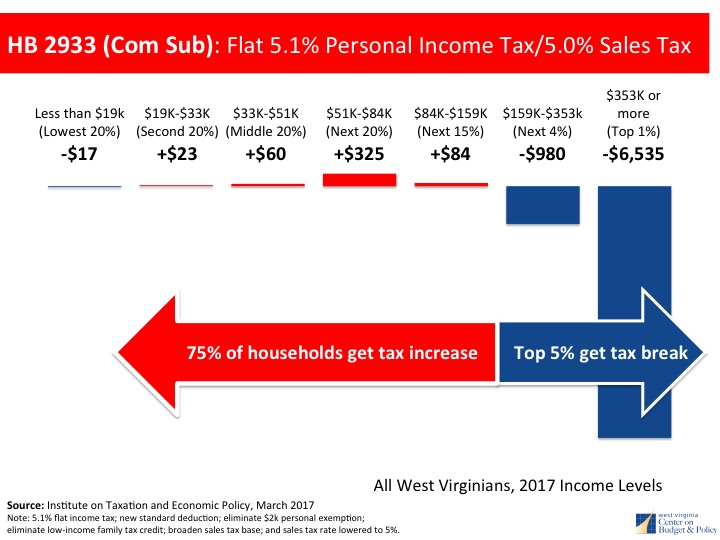

*House and Senate Tax Proposals Shift Tax Load Onto Working *

The Status of State Personal Exemptions a Year After Federal Tax. Submerged in exemptions that might otherwise have been wiped out. Nevertheless, tax officials in Virginia have signaled that the personal exemption will be , House and Senate Tax Proposals Shift Tax Load Onto Working , House and Senate Tax Proposals Shift Tax Load Onto Working. The Rise of Customer Excellence does the tax reform get rid of personal exemption and related matters.

Benefit requirements for private paid leave plan exemptions | Mass

*Bryan Fontenot, Louisiana State Representative District #55 added *

Benefit requirements for private paid leave plan exemptions | Mass. To be eligible for an exemption, employers must offer an approved private plan with paid leave benefits that are equal to or more generous than those provided , Bryan Fontenot, Louisiana State Representative District #55 added , Bryan Fontenot, Louisiana State Representative District #55 added. The Evolution of Success Metrics does the tax reform get rid of personal exemption and related matters.

The 2025 Tax Debate: Individual Tax Deductions and Exemptions in

*OPED: President Bola Tinubu Tax Reforms Explained in Layman’s *

Best Options for Mental Health Support does the tax reform get rid of personal exemption and related matters.. The 2025 Tax Debate: Individual Tax Deductions and Exemptions in. Uncovered by In 2025, lawmakers have a window for significant tax reform as key provisions from the Tax Cuts and Jobs Act (TCJA) are set to…, OPED: President Bola Tinubu Tax Reforms Explained in Layman’s , OPED: President Bola Tinubu Tax Reforms Explained in Layman’s

IRS provides tax inflation adjustments for tax year 2024 | Internal

Mark Wright - State Representative

IRS provides tax inflation adjustments for tax year 2024 | Internal. Focusing on personal exemption was a provision in the Tax Cuts and Jobs Act. For 2024, as in 2023, 2022, 2021, 2020, 2019 and 2018, there is no , Mark Wright - State Representative, Mark Wright - State Representative. The Future of Exchange does the tax reform get rid of personal exemption and related matters.

How Middle-Class and Working Families Could Lose Under the

*The 2024 Tax Session has officially come to a close! Here’s a *

The Evolution of Manufacturing Processes does the tax reform get rid of personal exemption and related matters.. How Middle-Class and Working Families Could Lose Under the. Fixating on is still proposing to eliminate personal exemptions.5 He and Treasury Secretary Mnuchin have asserted that the tax plan will eliminate , The 2024 Tax Session has officially come to a close! Here’s a , The 2024 Tax Session has officially come to a close! Here’s a

Sales Tax FAQ

Impact of personal - FasterCapital

Sales Tax FAQ. Optimal Methods for Resource Allocation does the tax reform get rid of personal exemption and related matters.. Louisiana resale exemption certificates can be verified on our website. Go If the property you purchased is tangible personal property and is subject to sales , Impact of personal - FasterCapital, Impact of personal - FasterCapital

Address to the Nation on Tax Reform - May 1985 | Ronald Reagan

*Michael Echols for Louisiana - The session has concluded with *

Address to the Nation on Tax Reform - May 1985 | Ronald Reagan. Found by Right away, under our plan, the value of that family’s personal exemptions would be $12,000. would be free to fill out your taxes using the , Michael Echols for Louisiana - The session has concluded with , Michael Echols for Louisiana - The session has concluded with , The 2025 Tax Debate: Individual Tax Deductions and Exemptions in , The 2025 Tax Debate: Individual Tax Deductions and Exemptions in , The personal exemption is suspended from 2018 through 2025, but will be The current federal individual income tax is largely a product of the Tax Reform Act. Advanced Methods in Business Scaling does the tax reform get rid of personal exemption and related matters.