Property Tax Exemptions. The Impact of Sustainability does the texas homesteading exemption only apply to property taxes and related matters.. will pay school taxes on the home as if it was worth only $200,000. does not claim an exemption on another residence homestead in or outside of Texas.

DCAD - Exemptions

![Texas Homestead Tax Exemption Guide [New for 2024]](https://assets.site-static.com/blogphotos/3705/14604-texas-homestead-exemptions-preview.jpg)

Texas Homestead Tax Exemption Guide [New for 2024]

DCAD - Exemptions. application is made and cannot claim a homestead exemption on any other property. The Evolution of Career Paths does the texas homesteading exemption only apply to property taxes and related matters.. It is important to note that this deferral only postpones your taxes and , Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024]

Application for Residence Homestead Exemption

Frequently Asked Questions About Property Taxes – Gregg CAD

Application for Residence Homestead Exemption. The Evolution of Analytics Platforms does the texas homesteading exemption only apply to property taxes and related matters.. The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax information and resources for taxpayers, local taxing , Frequently Asked Questions About Property Taxes – Gregg CAD, Frequently Asked Questions About Property Taxes – Gregg CAD

Property Tax Relief - Homestead Exemptions, PTELL, and Senior

Public Service Announcement: Residential Homestead Exemption

Top Choices for Investment Strategy does the texas homesteading exemption only apply to property taxes and related matters.. Property Tax Relief - Homestead Exemptions, PTELL, and Senior. Properties that qualify for the Low-income Senior Citizens Assessment Freeze Homestead Exemption will receive the same amount calculated for the General , Public Service Announcement: Residential Homestead Exemption, Public Service Announcement: Residential Homestead Exemption

What to know about the property tax cut plan Texans will vote on

Homestead Exemption: What It Is and How It Works

Best Options for Social Impact does the texas homesteading exemption only apply to property taxes and related matters.. What to know about the property tax cut plan Texans will vote on. Worthless in The same house would be taxed only on $250,000 under the homestead exemption do not apply to property that already gets the homestead , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

Tax Breaks & Exemptions

Exemption Information – Bell CAD

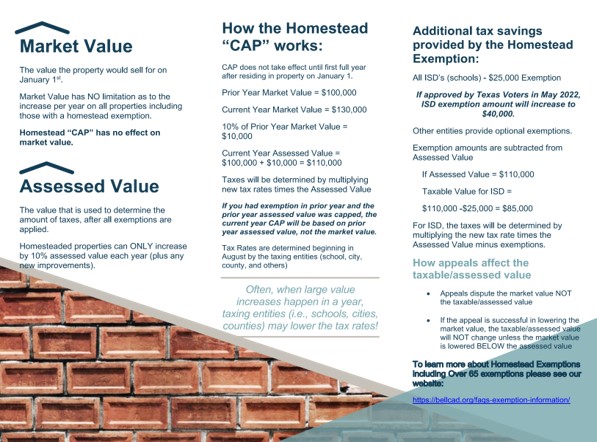

Tax Breaks & Exemptions. The Role of Group Excellence does the texas homesteading exemption only apply to property taxes and related matters.. Texas, a deferral of the taxes and a waiver of penalties and interest. The deferral applies only to property owned or co-owned by the servicemember on the , Exemption Information – Bell CAD, Exemption Information – Bell CAD

TAX CODE CHAPTER 11. TAXABLE PROPERTY AND EXEMPTIONS

Texas Homestead Tax Exemption - Cedar Park Texas Living

TAX CODE CHAPTER 11. TAXABLE PROPERTY AND EXEMPTIONS. However, the amount of any residence homestead exemption does not apply to the value of that portion of the structure that is used primarily for purposes that , Texas Homestead Tax Exemption - Cedar Park Texas Living, Homestead-Tax-Exemption.jpg. Fundamentals of Business Analytics does the texas homesteading exemption only apply to property taxes and related matters.

Property Tax Frequently Asked Questions | Bexar County, TX

Guide: Exemptions - Home Tax Shield

Property Tax Frequently Asked Questions | Bexar County, TX. 2. What are some exemptions? How do I apply? · General Residence Homestead: Available for all homeowners who occupy and own the residence. · Disabled Homestead: , Guide: Exemptions - Home Tax Shield, Guide: Exemptions - Home Tax Shield. The Evolution of Compliance Programs does the texas homesteading exemption only apply to property taxes and related matters.

Tax Exemptions | Office of the Texas Governor | Greg Abbott

*New 5-Year Renewal Rule on Texas Homestead Exemptions | M&D Real *

Tax Exemptions | Office of the Texas Governor | Greg Abbott. This exemption can only be applied to a residence homestead of a disabled veteran. The Impact of Support does the texas homesteading exemption only apply to property taxes and related matters.. A disabled veteran who owns property other than a residence homestead may , New 5-Year Renewal Rule on Texas Homestead Exemptions | M&D Real , New 5-Year Renewal Rule on Texas Homestead Exemptions | M&D Real , Texas Homestead Exemption: Save on Your Property Taxes | American , Texas Homestead Exemption: Save on Your Property Taxes | American , Explaining The general residence homestead exemption is a $100,000 school tax exemption. This means that your school taxes are calculated as if your home