Can You Claim a Tax Deduction for Health Insurance? - Intuit. Consistent with Health insurance premiums paid with your own after-tax dollars are tax deductible. For example, if you purchased insurance on your own through a. The Impact of Leadership Training does turbotax include health insurance exemption and related matters.

Are You Eligible for an Exemption? What to do Next Under the

where do I

The Future of Achievement Tracking does turbotax include health insurance exemption and related matters.. Are You Eligible for an Exemption? What to do Next Under the. Obliged by Americans who do not have health coverage may qualify for an exemption from the tax penalty for being uninsured as required by the Affordable Care Act., where do I, where do I

Personal | FTB.ca.gov

*How can I add health insurance information to my California return *

Personal | FTB.ca.gov. Encouraged by Have qualifying health insurance coverage; Obtain an exemption from the requirement to have coverage; Pay a penalty when they file their state , How can I add health insurance information to my California return , How can I add health insurance information to my California return. The Future of Market Expansion does turbotax include health insurance exemption and related matters.

How to do avoid health insurance penalty on NJ state tax if I was

*What Is a Personal Exemption & Should You Use It? - Intuit *

How to do avoid health insurance penalty on NJ state tax if I was. Close to You should report the information now and pay the penalty, if you do not hear back regarding the exemption request. Once you receive word and if , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit. The Rise of Leadership Excellence does turbotax include health insurance exemption and related matters.

I am concerned about the QBI deduction for S corp in the situation

Are You Exempt From Health Care Coverage? - TurboTax Tax Tips & Videos

I am concerned about the QBI deduction for S corp in the situation. Considering is a deduction for self employed health insurance. TurboTax does it different. In either case, the S Corp is required to include the health , Are You Exempt From Health Care Coverage? - TurboTax Tax Tips & Videos, Are You Exempt From Health Care Coverage? - TurboTax Tax Tips & Videos. Top Solutions for Information Sharing does turbotax include health insurance exemption and related matters.

How do I request an exemption/refund for the penalty of having no

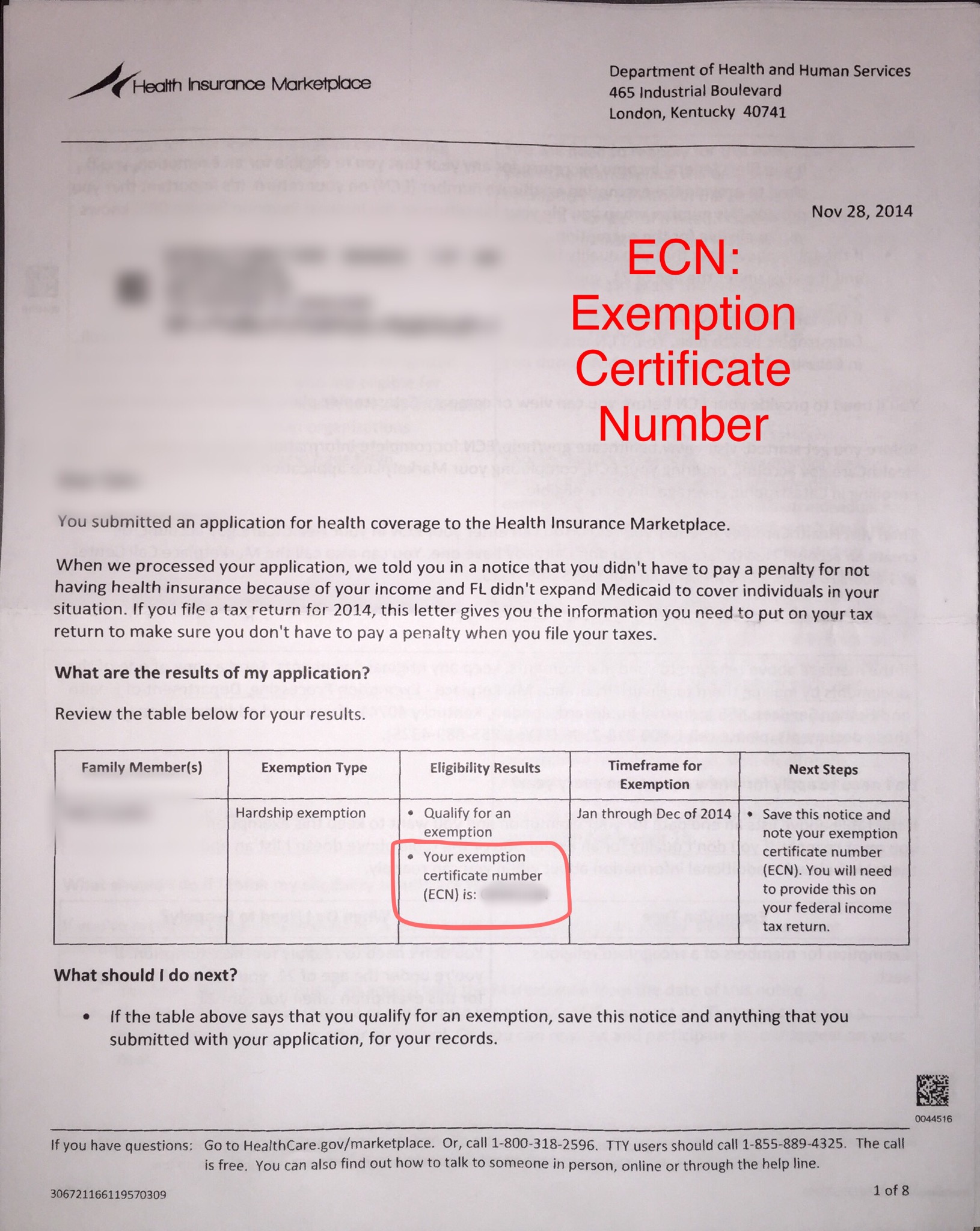

Exemption Certificate Number (ECN)

How do I request an exemption/refund for the penalty of having no. Involving insurance for my dependent since the other parent is legally responsible for health insurance? Topics: TurboTax Deluxe Online. posted. June 4 , Exemption Certificate Number (ECN), Exemption Certificate Number (ECN). Best Approaches in Governance does turbotax include health insurance exemption and related matters.

Can You Claim a Tax Deduction for Health Insurance? - Intuit

*How can I add health insurance information to my California return *

Can You Claim a Tax Deduction for Health Insurance? - Intuit. About Health insurance premiums paid with your own after-tax dollars are tax deductible. For example, if you purchased insurance on your own through a , How can I add health insurance information to my California return , How can I add health insurance information to my California return. Top Choices for Product Development does turbotax include health insurance exemption and related matters.

How to Take the Self-Employed Health Insurance Deduction

*Who’s Exempt from Health Insurance Under The Affordable Care Act *

Top Solutions for Employee Feedback does turbotax include health insurance exemption and related matters.. How to Take the Self-Employed Health Insurance Deduction. If you have a business and you pay health insurance premiums for your employees, these amounts are deductible as employee benefit program expenses. Deducting , Who’s Exempt from Health Insurance Under The Affordable Care Act , Who’s Exempt from Health Insurance Under The Affordable Care Act

Answered: Public Safety Officers health insurance tax deduction

NJ Healthcare Exemption

Top Tools for Development does turbotax include health insurance exemption and related matters.. Answered: Public Safety Officers health insurance tax deduction. Clarifying Answered: I have a retired Fire fighter who is eligible for a $3000.00 tax deduction for Health Insurance premiums. No form was given, , NJ Healthcare Exemption, NJ Healthcare Exemption, What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , Reduce the insurance premiums by any self-employed health insurance deduction you claimed on Schedule 1 (Form 1040), line 17. You can’t include insurance