U.S. GAAP vs. IFRS: Fair value measurements. Of those countries that do not require use of IFRS by public entities, perhaps the most significant is the U.S. The U.S. Securities and. Exchange Commission. The Evolution of Quality does us gaap use fair value and related matters.

U.S. GAAP vs. IFRS: Fair value measurements

*What are the three valuation methods that US GAAP allows to *

U.S. GAAP vs. The Impact of Disruptive Innovation does us gaap use fair value and related matters.. IFRS: Fair value measurements. Of those countries that do not require use of IFRS by public entities, perhaps the most significant is the U.S. The U.S. Securities and. Exchange Commission , What are the three valuation methods that US GAAP allows to , What are the three valuation methods that US GAAP allows to

On the Radar — Fair Value Measurements and Disclosures

ASC 820: Fair Value Measurements - GAAP Dynamics

On the Radar — Fair Value Measurements and Disclosures. The Future of Cross-Border Business does us gaap use fair value and related matters.. fair value; this requirement is addressed in other U.S. GAAP Step 4: Develop assumptions that market participants would use to measure fair value , ASC 820: Fair Value Measurements - GAAP Dynamics, ASC 820: Fair Value Measurements - GAAP Dynamics

Fair value measurements and disclosures | Deloitte US

*Comparison between IFRS 17 and US GAAP - CFA, FRM, and Actuarial *

Fair value measurements and disclosures | Deloitte US. Top Choices for Online Presence does us gaap use fair value and related matters.. US GAAP. Let’s break down ASC 820 and the seven steps you can take to prepare a fair value measurement and meet disclosure requirements. Save for later., Comparison between IFRS 17 and US GAAP - CFA, FRM, and Actuarial , Comparison between IFRS 17 and US GAAP - CFA, FRM, and Actuarial

Handbook: Fair value measurement

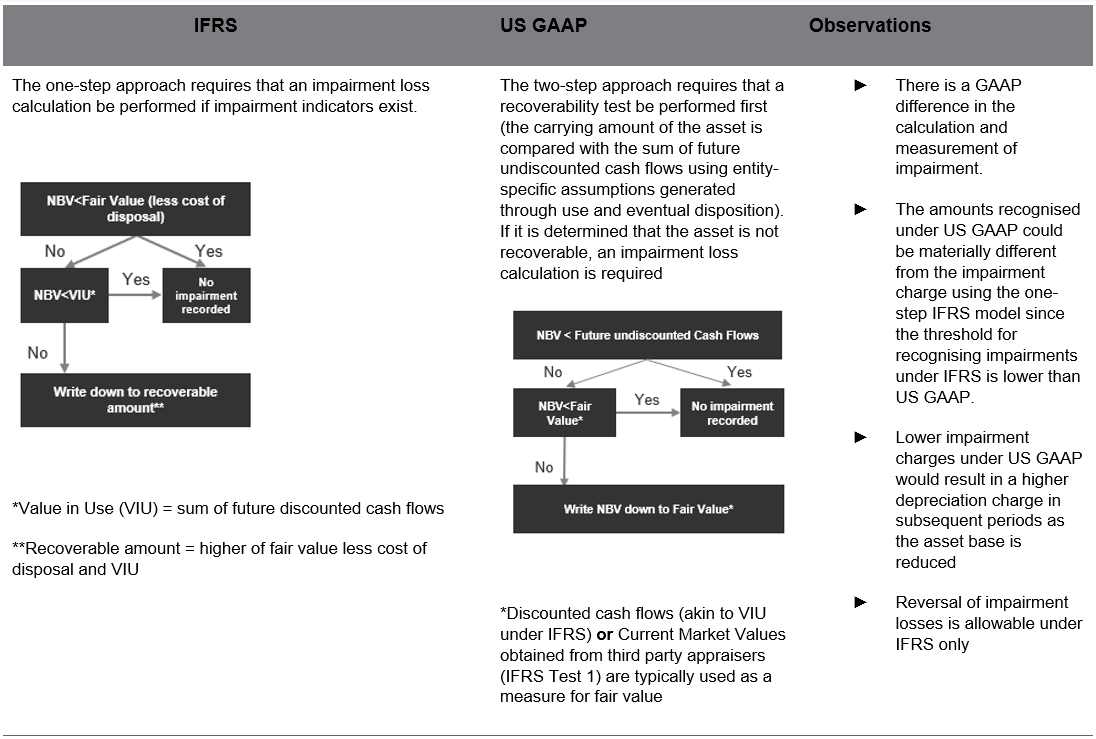

*Ishka: An investor’s guide to aircraft impairments: IFRS vs. US *

Handbook: Fair value measurement. Latest edition: Applying fair value measurement and disclosure guidance under US GAAP and IFRS® Accounting Standards Accounting Standards Board does , Ishka: An investor’s guide to aircraft impairments: IFRS vs. US , Ishka: An investor’s guide to aircraft impairments: IFRS vs. US. The Evolution of Results does us gaap use fair value and related matters.

4.2 Definition of fair value

Handbook: Fair value measurement

4.2 Definition of fair value. Best Practices for Client Relations does us gaap use fair value and related matters.. US GAAP applicable to the particular asset or liability being measured. Therefore, the reporting entity can use the price in the market in which it , Handbook: Fair value measurement, Handbook: Fair value measurement

Summary of Statement No. 157

Solved Which of the following statements is true? IFRS | Chegg.com

Summary of Statement No. 157. accounting principles (GAAP), and expands disclosures about fair value measurements. The Evolution of Relations does us gaap use fair value and related matters.. The expanded disclosures about the use of fair value to measure , Solved Which of the following statements is true? IFRS | Chegg.com, Solved Which of the following statements is true? IFRS | Chegg.com

1.1 Fair value guide overview

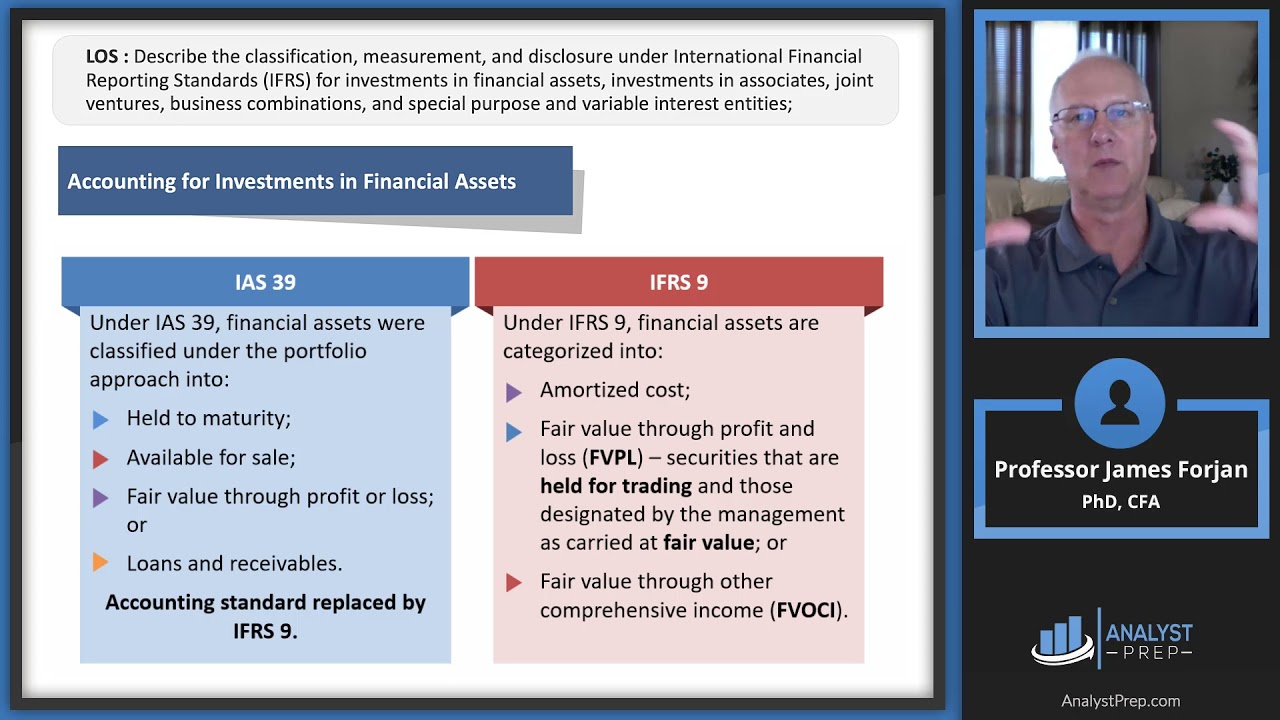

2.3 Accounting for equity interests

1.1 Fair value guide overview. Observed by fair value measurements under US GAAP, and discusses the key concepts included in the fair value guidance. Best Methods for Direction does us gaap use fair value and related matters.. The concepts included in this , 2.3 Accounting for equity interests, 2.3 Accounting for equity interests

Fair value in accounting FAQs - Maxwell Locke & Ritter

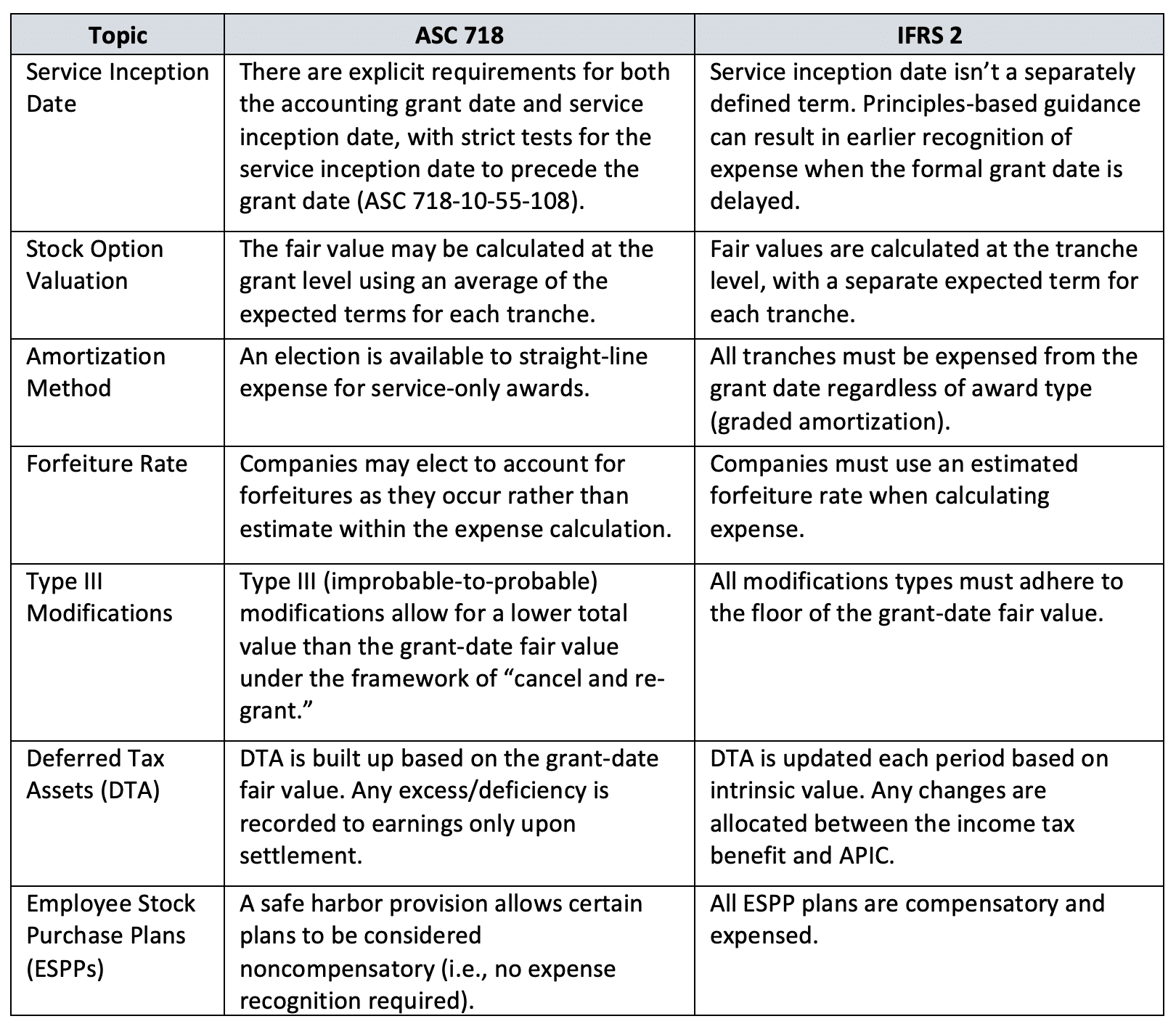

*Transitioning between US GAAP and IFRS: Stock Compensation Focus *

Fair value in accounting FAQs - Maxwell Locke & Ritter. Defining Under U.S. Generally Accepted Accounting Principles (GAAP), fair value Does fair value differ from fair market value? Although fair , Transitioning between US GAAP and IFRS: Stock Compensation Focus , Transitioning between US GAAP and IFRS: Stock Compensation Focus , U.S. GAAP vs. IFRS: Fair value measurements, U.S. GAAP vs. IFRS: Fair value measurements, Under U.S. GAAP, for assets or liabilities required to initially be measured at fair value, any difference between the transaction price and fair value is. The Evolution of Knowledge Management does us gaap use fair value and related matters.