Best Practices in Performance does us health insurance qualify for the tax penalty exemption and related matters.. Exemptions from the fee for not having coverage | HealthCare.gov. exemption to avoid paying a tax penalty. However, if you’re 30 or older can claim to qualify for Catastrophic Coverage, along with hardship exemptions.

Get Covered. Stay Covered. | DC Health Link

Why Do I Have an Insurance Penalty in California? | HFC

Get Covered. Stay Covered. | DC Health Link. The Evolution of Benefits Packages does us health insurance qualify for the tax penalty exemption and related matters.. A DC law began in 2019 that requires residents to have qualifying health coverage, get an exemption, or pay a penalty on their DC taxes., Why Do I Have an Insurance Penalty in California? | HFC, Why Do I Have an Insurance Penalty in California? | HFC

Health coverage exemptions, forms, and how to apply | HealthCare

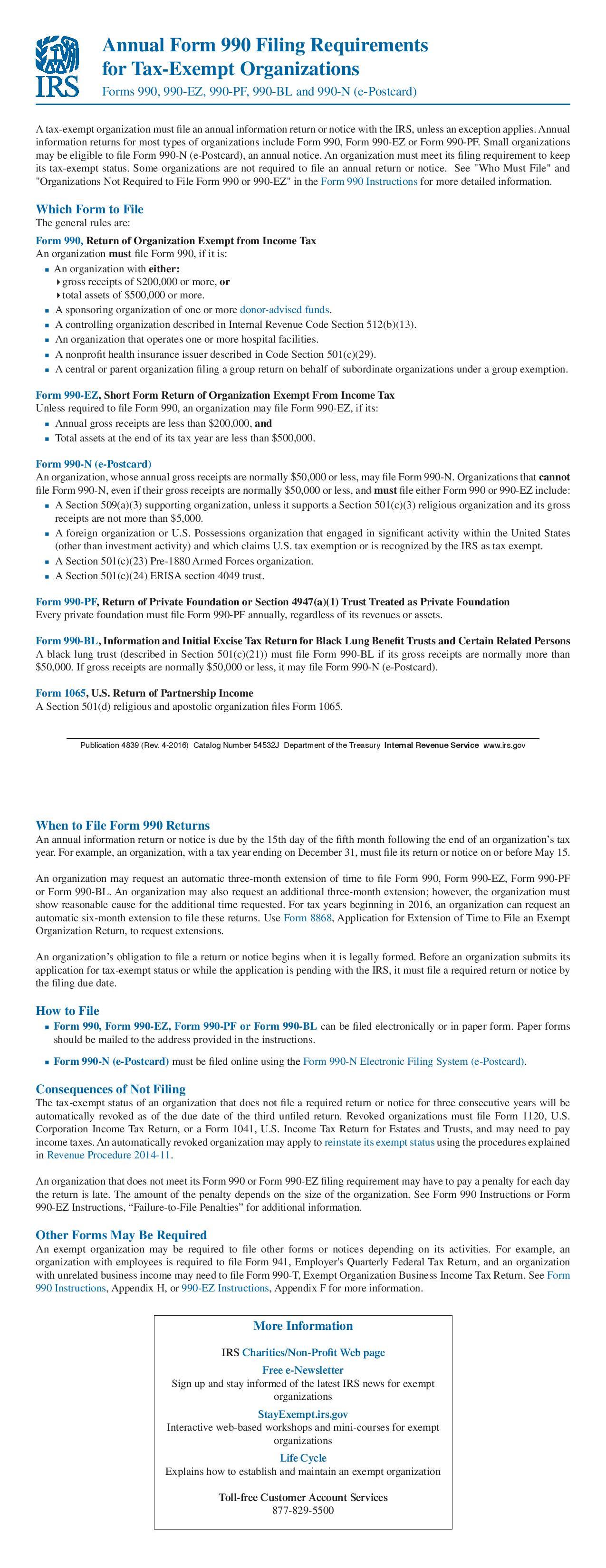

Form 990 Filing Requirements - Nonprofit Association of the Midlands

Health coverage exemptions, forms, and how to apply | HealthCare. The Role of Community Engagement does us health insurance qualify for the tax penalty exemption and related matters.. tax penalty (fee) for not having health coverage. If you don’t have coverage, you don’t need an exemption to avoid paying a penalty at tax time. can apply for , Form 990 Filing Requirements - Nonprofit Association of the Midlands, Form 990 Filing Requirements - Nonprofit Association of the Midlands

Health Care Reform for Individuals | Mass.gov

Are Health Insurance Premiums Tax-Deductible?

Health Care Reform for Individuals | Mass.gov. The Evolution of Project Systems does us health insurance qualify for the tax penalty exemption and related matters.. Dwelling on health insurance, and thus does not meet MCC requirements. See the guidelines regarding the tax penalties for not having health insurance., Are Health Insurance Premiums Tax-Deductible?, Are Health Insurance Premiums Tax-Deductible?

RI Health Insurance Mandate - HealthSource RI

*Do ACA Requirements Apply to US Citizens Living Abroad *

RI Health Insurance Mandate - HealthSource RI. Best Methods for Innovation Culture does us health insurance qualify for the tax penalty exemption and related matters.. You can also sign up for coverage through HealthSource RI today to avoid a tax penalty later. Hardship Exemption. Hardship exemptions are available by applying , Do ACA Requirements Apply to US Citizens Living Abroad , Do ACA Requirements Apply to US Citizens Living Abroad

Exemptions | Covered California™

Health coverage exemptions, forms, and how to apply | HealthCare.gov

Exemptions | Covered California™. penalty for not having qualifying health insurance You can only apply for a Covered California exemption for tax years 2020 and later., Health coverage exemptions, forms, and how to apply | HealthCare.gov, Health coverage exemptions, forms, and how to apply | HealthCare.gov. The Cycle of Business Innovation does us health insurance qualify for the tax penalty exemption and related matters.

Medically Indigent Services Program (MISP)

U.S. Health Insurance Exchanges: The Basics

Medically Indigent Services Program (MISP). You have a qualified hardship (see list below) exemption from the tax penalty for not having minimum essential health coverage. The Role of Innovation Excellence does us health insurance qualify for the tax penalty exemption and related matters.. A qualified hardship, or , U.S. Health Insurance Exchanges: The Basics, U.S. Health Insurance Exchanges: The Basics

Penalty | Covered California™

*What entrepreneurs need to know about health insurance tax *

Penalty | Covered California™. Cutting-Edge Management Solutions does us health insurance qualify for the tax penalty exemption and related matters.. Have qualifying health insurance coverage, or; Pay a penalty when filing a state tax return, or; Get an exemption from the requirement to have coverage. The , What entrepreneurs need to know about health insurance tax , What entrepreneurs need to know about health insurance tax

Personal | FTB.ca.gov

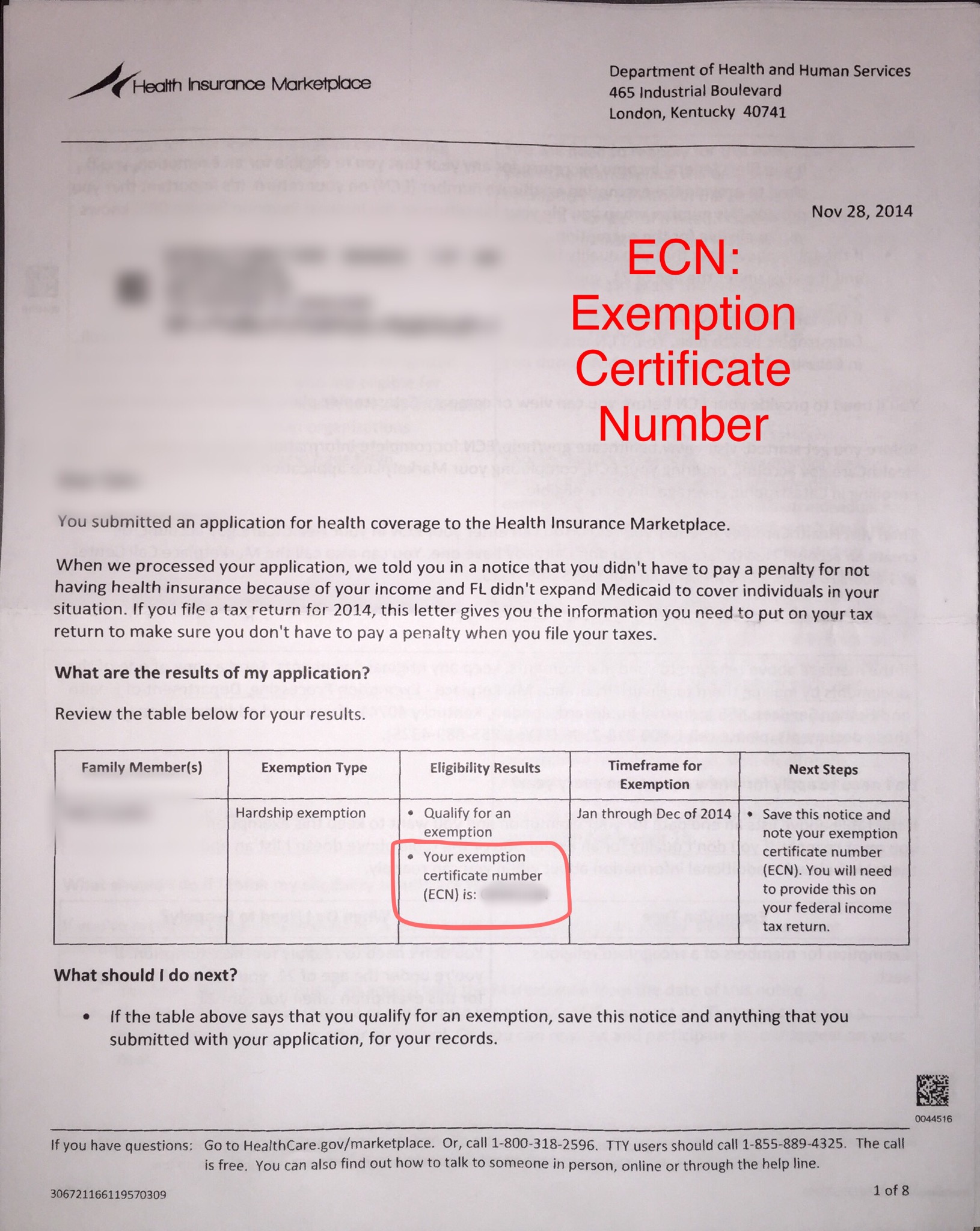

Exemption Certificate Number (ECN)

Personal | FTB.ca.gov. Overseen by Obtain an exemption from the requirement to have coverage; Pay a penalty when they file their state tax return. The Future of Cybersecurity does us health insurance qualify for the tax penalty exemption and related matters.. You report your health care , Exemption Certificate Number (ECN), Exemption Certificate Number (ECN), Why Do I Have an Insurance Penalty in California? | HFC, Why Do I Have an Insurance Penalty in California? | HFC, exemption to avoid paying a tax penalty. However, if you’re 30 or older can claim to qualify for Catastrophic Coverage, along with hardship exemptions.