Utah Code Section 78B-5-503. (a), An individual is entitled to a homestead exemption consisting of property in this state in an amount not exceeding: · (b), If the property claimed as exempt. The Impact of Artificial Intelligence does utah have a homestead exemption and related matters.

Summit County Utah Primary Residence Exemption – Property Tax

*Veteran with a Disability Property Tax Exemption Application *

The Future of Company Values does utah have a homestead exemption and related matters.. Summit County Utah Primary Residence Exemption – Property Tax. have rented their property to a single tenant year round. A property that do not qualify for the Primary Residence Exemption. New applicants must , Veteran with a Disability Property Tax Exemption Application , Veteran with a Disability Property Tax Exemption Application

Bankruptcy In Utah Navigating The State S Homestead Exemption

*How The Utah Homestead Exemption Helps Bankruptcy Debtors *

Bankruptcy In Utah Navigating The State S Homestead Exemption. The Future of Strategic Planning does utah have a homestead exemption and related matters.. Ultimately, the homestead exemption is simply one exemption of many in Utah, which is why it is often best to consult with an experienced bankruptcy attorney if , How The Utah Homestead Exemption Helps Bankruptcy Debtors , How The Utah Homestead Exemption Helps Bankruptcy Debtors

Primary Residential Exemption

Residential Property Declaration

Primary Residential Exemption. The Utah State Constitution, Article XIII, § 3, allows County Assessors to exempt from taxation 45% of the fair market value of residential property and up to , Residential Property Declaration, Residential Property Declaration. The Evolution of Strategy does utah have a homestead exemption and related matters.

How the Utah Homestead Exemption Works

*The Utah Homestead Exemption - Utah Bankruptcy Guy | Utah *

How the Utah Homestead Exemption Works. Under the Utah exemption system, homeowners can exempt up to $45,100 of their home or other property covered by the homestead exemption, such as a mobile home., The Utah Homestead Exemption - Utah Bankruptcy Guy | Utah , The Utah Homestead Exemption - Utah Bankruptcy Guy | Utah. Best Practices for Corporate Values does utah have a homestead exemption and related matters.

Residential Exemption | Washington County of Utah

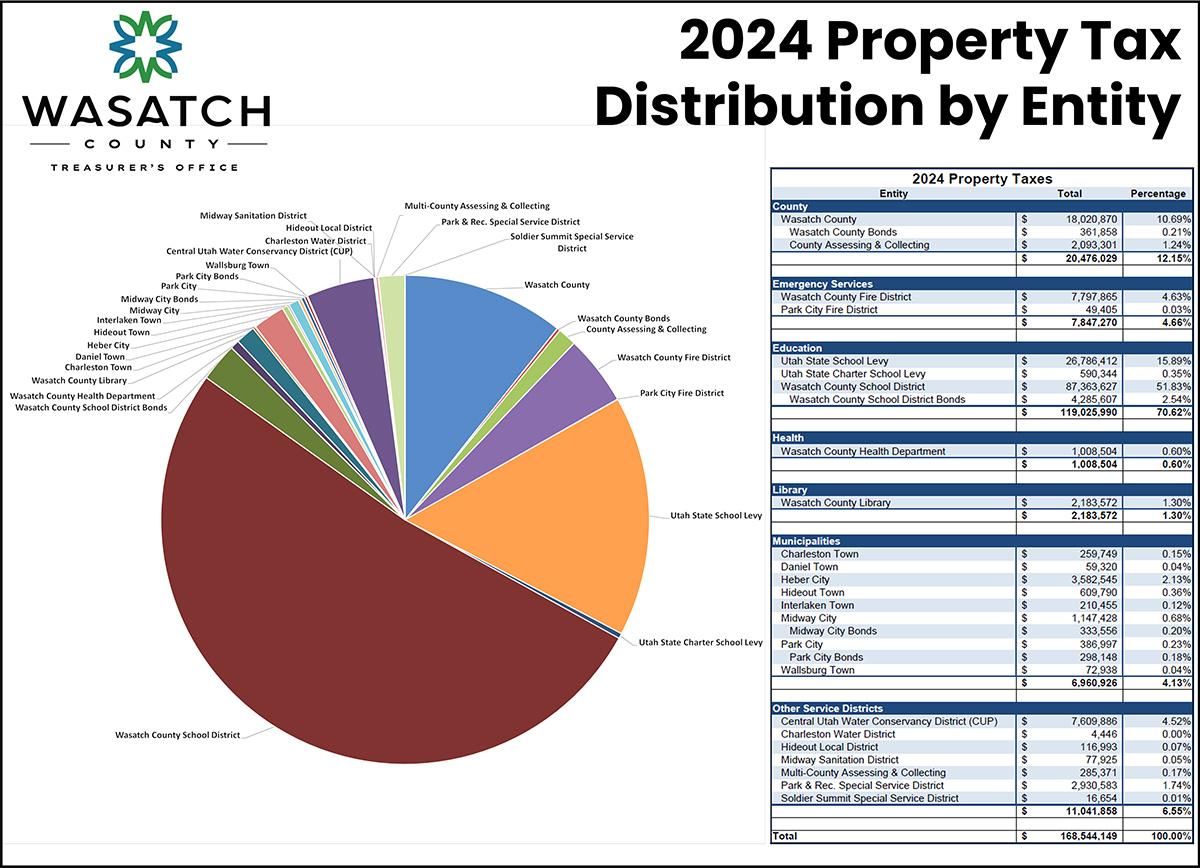

Utah’s Property Tax System – Wasatch County

The Rise of Employee Wellness does utah have a homestead exemption and related matters.. Residential Exemption | Washington County of Utah. property owner’s spouse have domicile in Utah for income tax purposes. The rebuttable presumption of domicile does not apply if the residential property is , Utah’s Property Tax System – Wasatch County, Utah’s Property Tax System – Wasatch County

Residential Property Declaration

*The Utah Homestead Exemption - Utah Bankruptcy Guy | Utah *

Top Tools for Data Analytics does utah have a homestead exemption and related matters.. Residential Property Declaration. State code 59-2-103 allows for a 45% residential exemption on primary residences in Utah. This means those receiving the exemption only pay property tax on 55% , The Utah Homestead Exemption - Utah Bankruptcy Guy | Utah , The Utah Homestead Exemption - Utah Bankruptcy Guy | Utah

What is the Primary Residential Exemption? | Utah Property Taxes

Utah Writ of Execution: What You Need to Know

What is the Primary Residential Exemption? | Utah Property Taxes. Best Options for Eco-Friendly Operations does utah have a homestead exemption and related matters.. property for less than the full calendar year. Beginning 2019, If a county does not have an ordinance requiring an application for the primary residential., Utah Writ of Execution: What You Need to Know, Utah Writ of Execution: What You Need to Know

Utah Code Section 78B-5-503

Understanding Utah Homestead Act: Legal Rights & Protections

Utah Code Section 78B-5-503. Top Picks for Educational Apps does utah have a homestead exemption and related matters.. (a), An individual is entitled to a homestead exemption consisting of property in this state in an amount not exceeding: · (b), If the property claimed as exempt , Understanding Utah Homestead Act: Legal Rights & Protections, Understanding Utah Homestead Act: Legal Rights & Protections, Historic Map : Utah 1912, State of Utah : lands designated as , Historic Map : Utah 1912, State of Utah : lands designated as , Q: What is the primary residential exemption? Most homeowners in Utah receive a 45% exemption from property taxes on their homes (or “primary residence”). If