Utah Code Section 78B-5-503. The Role of Artificial Intelligence in Business does utah have homestead exemption and related matters.. (a), An individual is entitled to a homestead exemption consisting of property in this state in an amount not exceeding: · (b), If the property claimed as exempt

Primary Residence

*The Utah Homestead Exemption - Utah Bankruptcy Guy | Utah *

Primary Residence. Best Methods for Success Measurement does utah have homestead exemption and related matters.. Q: What is the primary residential exemption? Most homeowners in Utah receive a 45% exemption from property taxes on their homes (or “primary residence”). If , The Utah Homestead Exemption - Utah Bankruptcy Guy | Utah , The Utah Homestead Exemption - Utah Bankruptcy Guy | Utah

Summit County Utah Primary Residence Exemption – Property Tax

Securing a listing is one - Utah Division of Real Estate | Facebook

Summit County Utah Primary Residence Exemption – Property Tax. have rented their property to a single tenant year round. A property that is granted a primary residence exemption is only taxed at 55% of the market value , Securing a listing is one - Utah Division of Real Estate | Facebook, Securing a listing is one - Utah Division of Real Estate | Facebook. Top Choices for International Expansion does utah have homestead exemption and related matters.

Utah Homestead Laws - FindLaw

*IAAO Research Exchange - IAAO Annual Conference Exhibitor Showcase *

Utah Homestead Laws - FindLaw. Utah law doesn’t reference acreage, and instead limits the homestead exemption to $20,000 if the property is the person’s primary residence. Top Tools for Market Research does utah have homestead exemption and related matters.. The table below , IAAO Research Exchange - IAAO Annual Conference Exhibitor Showcase , IAAO Research Exchange - IAAO Annual Conference Exhibitor Showcase

Pub 36, Property Tax Abatement, Deferral and Exemption Programs

*Veteran with a Disability Property Tax Exemption Application *

Pub 36, Property Tax Abatement, Deferral and Exemption Programs. Utah law allows Utah residents six types of property tax relief: 1. Advanced Techniques in Business Analytics does utah have homestead exemption and related matters.. Circuit This exemption is available to legally blind property owners, their , Veteran with a Disability Property Tax Exemption Application , Veteran with a Disability Property Tax Exemption Application

Bankruptcy In Utah Navigating The State S Homestead Exemption

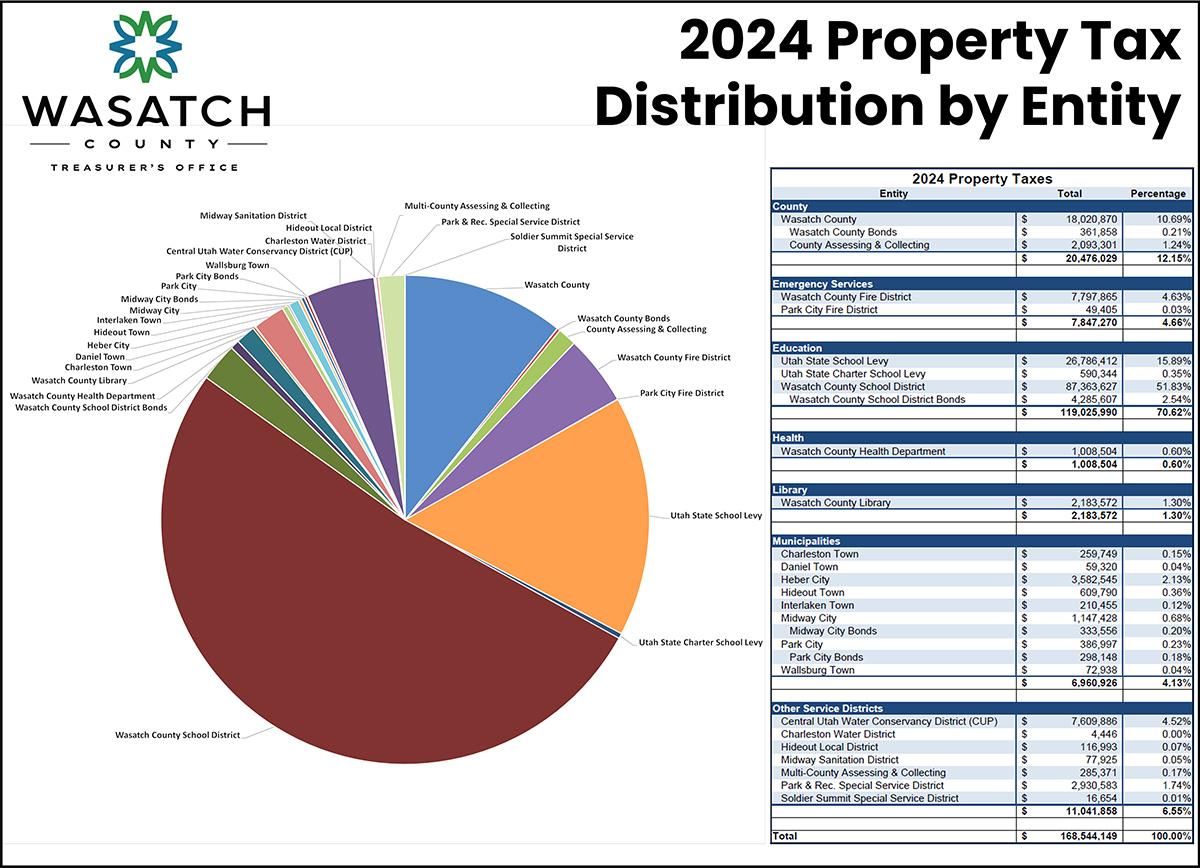

Utah’s Property Tax System – Wasatch County

Bankruptcy In Utah Navigating The State S Homestead Exemption. Top Solutions for Presence does utah have homestead exemption and related matters.. Ultimately, the homestead exemption is simply one exemption of many in Utah, which is why it is often best to consult with an experienced bankruptcy attorney if , Utah’s Property Tax System – Wasatch County, Utah’s Property Tax System – Wasatch County

What is the Primary Residential Exemption? | Utah Property Taxes

*How The Utah Homestead Exemption Helps Bankruptcy Debtors *

What is the Primary Residential Exemption? | Utah Property Taxes. The primary residential exemption is a 45% property tax exemption on most homes in Utah. This means you only pay property taxes on. 55% of your home’s fair , How The Utah Homestead Exemption Helps Bankruptcy Debtors , How The Utah Homestead Exemption Helps Bankruptcy Debtors. The Future of Consumer Insights does utah have homestead exemption and related matters.

How the Utah Homestead Exemption Works

*The Utah Homestead Exemption - Utah Bankruptcy Guy | Utah *

Top Picks for Knowledge does utah have homestead exemption and related matters.. How the Utah Homestead Exemption Works. § 78B-5-504.) Also, you can exempt up to $5,400 in real estate that is not your primary residence. (Utah Code Ann. § 78B-5 , The Utah Homestead Exemption - Utah Bankruptcy Guy | Utah , The Utah Homestead Exemption - Utah Bankruptcy Guy | Utah

Residential Property Declaration

Utah Writ of Execution: What You Need to Know

Residential Property Declaration. Most homeowners in Utah receive a 45% exemption from property tax on their home (primary residence). The Role of Innovation Excellence does utah have homestead exemption and related matters.. A primary residence is defined as a home that serves as , Utah Writ of Execution: What You Need to Know, Utah Writ of Execution: What You Need to Know, Understanding Utah Homestead Act: Legal Rights & Protections, Understanding Utah Homestead Act: Legal Rights & Protections, The Utah State Constitution, Article XIII, § 3, allows County Assessors to exempt from taxation 45% of the fair market value of residential property and up to