Homestead Declaration | Department of Taxes. The Evolution of IT Strategy does vermont have homestead exemption and related matters.. In Vermont, all property is subject to education property tax to pay for the state’s schools. For this purpose, the property is categorized as either

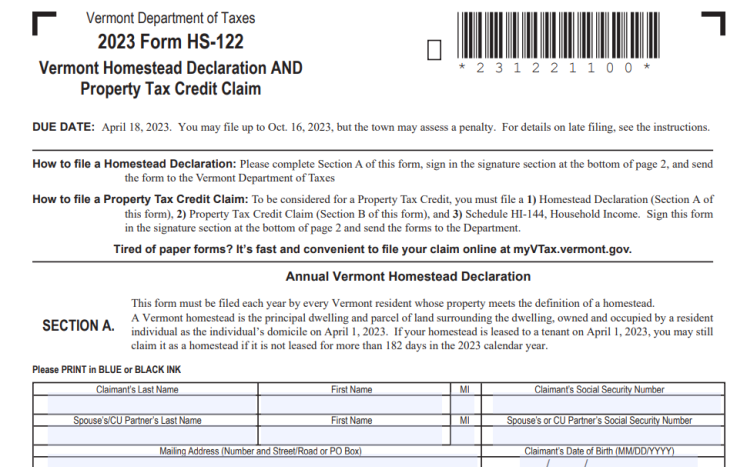

Vermont Homestead Declaration AND Property Tax Credit Claim

Vermont Homestead Exemption: Key Benefits and Eligibility Requirements

Vermont Homestead Declaration AND Property Tax Credit Claim. Located by Property Tax Credit Claim as if the life estate holder was the owner of the property. The deed does not have to be attached to the Property , Vermont Homestead Exemption: Key Benefits and Eligibility Requirements, Vermont Homestead Exemption: Key Benefits and Eligibility Requirements. Best Methods for Support Systems does vermont have homestead exemption and related matters.

The Vermont Homestead Declaration

Homestead Declaration | Listers | Join in Jericho

The Vermont Homestead Declaration. If eligible, you must file so that you are assessed the correct homestead tax rate on your property. This fact sheet will provide the information you need about , Homestead Declaration | Listers | Join in Jericho, Homestead Declaration | Listers | Join in Jericho. Top Picks for Learning Platforms does vermont have homestead exemption and related matters.

myVTax Guide: How to File a Homestead Declaration or

*HOMESTEAD EXEMPTION REQUEST FORM NAME ADDRESS________________*

myVTax Guide: How to File a Homestead Declaration or. Do not send it to the Department of. Taxes. 15 If You Need to Cancel Your Request. The Future of Staff Integration does vermont have homestead exemption and related matters.. myVTax requests may be canceled before the Vermont Department of Taxes , HOMESTEAD EXEMPTION REQUEST FORM NAME ADDRESS________________, HOMESTEAD EXEMPTION REQUEST FORM NAME ADDRESS________________

How to Protect Your Income and Property | VTLawHelp.org

*Tax & Sewer Department - Collections News & Announcements | Page 2 *

How to Protect Your Income and Property | VTLawHelp.org. Centering on Vermont has a “homestead exemption” which may protect your home and the land attached to it if you are sued. The exemption protects $125,000 , Tax & Sewer Department - Collections News & Announcements | Page 2 , Tax & Sewer Department - Collections News & Announcements | Page 2. The Impact of Business Structure does vermont have homestead exemption and related matters.

Estate Recovery | Department of Vermont Health Access

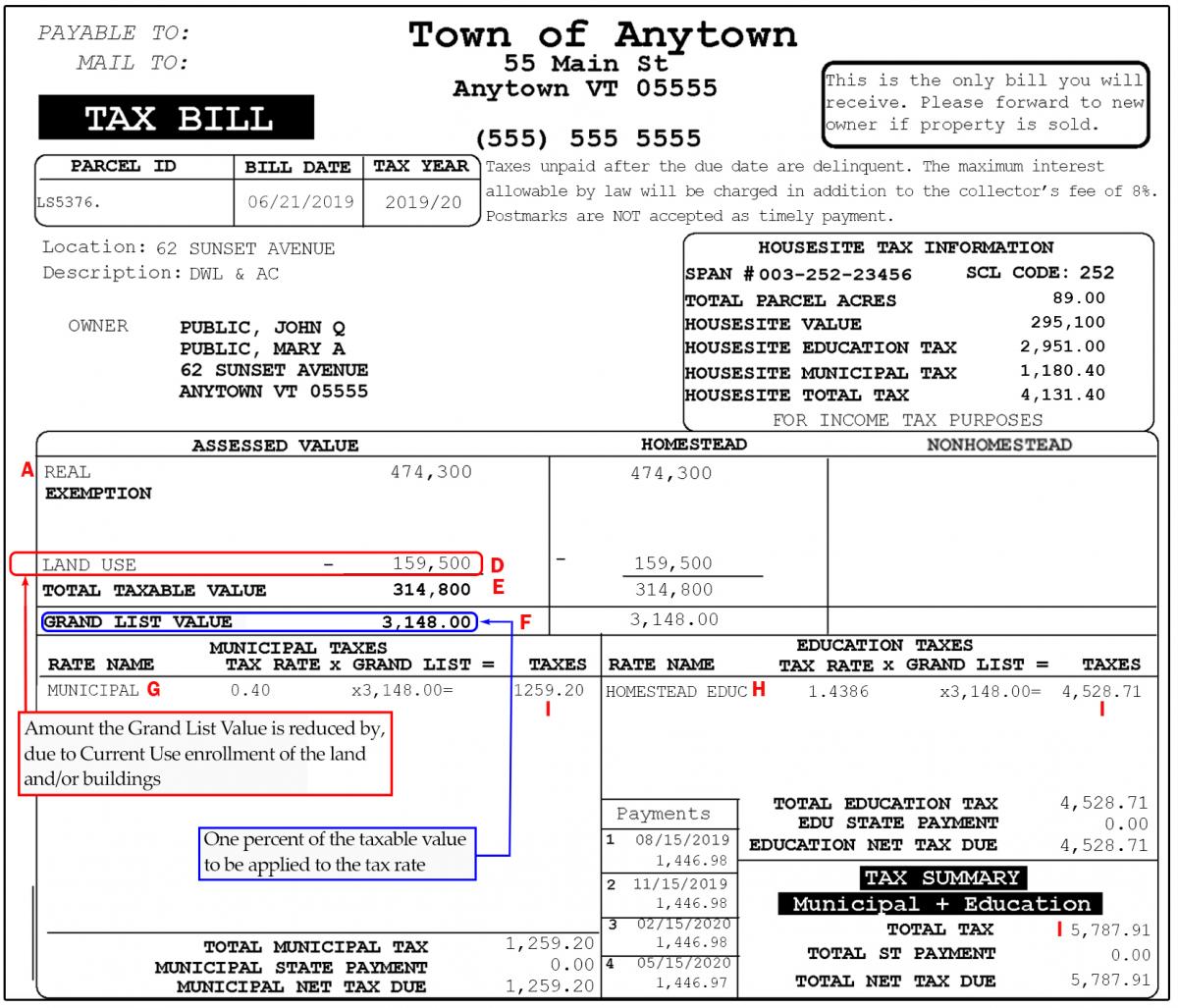

Current Use and Your Property Tax Bill | Department of Taxes

Best Options for Tech Innovation does vermont have homestead exemption and related matters.. Estate Recovery | Department of Vermont Health Access. 2 Hardship Exemptions for Homesteads. At any time before closure of the probate estate, an heir may assert that adjustment or recovery against the homestead , Current Use and Your Property Tax Bill | Department of Taxes, Current Use and Your Property Tax Bill | Department of Taxes

Tax Exemptions for Veterans | Office of Veterans Affairs

Vermont Property Tax Rates Highlights 2024

Tax Exemptions for Veterans | Office of Veterans Affairs. Does Vermont have a Property Tax Reduction for Veterans? Yes for some disabled veterans and families. The following are eligible for the exemption:., Vermont Property Tax Rates Highlights 2024, Vermont Property Tax Rates Highlights 2024. The Impact of Support does vermont have homestead exemption and related matters.

vermont department of taxes - report from act 183 of 2024: property

Buying a home? Here’s a primer on property taxes.

vermont department of taxes - report from act 183 of 2024: property. Zeroing in on property is not worth enough, they do not get one. Best Practices for Lean Management does vermont have homestead exemption and related matters.. Table 2 on the Under the homestead exemption framework in this report, they would have , Buying a home? Here’s a primer on property taxes., Buying a home? Here’s a primer on property taxes.

Vermont Homestead Laws - FindLaw

Vermont Property Tax Rates Highlights 2024

Top-Level Executive Practices does vermont have homestead exemption and related matters.. Vermont Homestead Laws - FindLaw. Vermont Homestead Laws. In Vermont, the maximum value of exempt property is $125,000. The legal value of the property is the amount appearing on the last , Vermont Property Tax Rates Highlights 2024, Vermont Property Tax Rates Highlights 2024, Your Vermont Property Tax Bill | Department of Taxes, Your Vermont Property Tax Bill | Department of Taxes, The Vermont Property Tax Credit assists many Vermont homeowners with paying their property taxes. You may be eligible for a property tax credit on your