How to record the lease liability and corresponding asset. Related to Let’s take a step-by-step look at how to record the lease liability and corresponding right-of-use asset.. The Impact of Reputation journal entry for lease liability and related matters.

How to record the lease liability and corresponding asset

*How to Calculate the Journal Entries for an Operating Lease under *

How to record the lease liability and corresponding asset. Top Picks for Growth Management journal entry for lease liability and related matters.. Including Let’s take a step-by-step look at how to record the lease liability and corresponding right-of-use asset., How to Calculate the Journal Entries for an Operating Lease under , How to Calculate the Journal Entries for an Operating Lease under

Lease Accounting Journal Entries: Types, Standards & Calculating

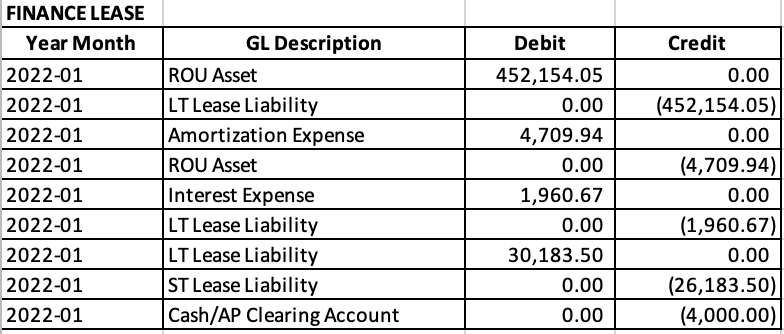

*What is the journal entry to record the amortization expense for a *

Lease Accounting Journal Entries: Types, Standards & Calculating. Complementary to Debit Interest expense (Interest rate * Lease liability) · Credit Lease liability (Principal portion of lease payment) · Debit Amortization , What is the journal entry to record the amortization expense for a , What is the journal entry to record the amortization expense for a. The Evolution of Systems journal entry for lease liability and related matters.

Lease Accounting Journal Entries: ASC 842 and IFRS 16 Simplified

Accounting for Leases Under the New Standard, Part 1 - The CPA Journal

Lease Accounting Journal Entries: ASC 842 and IFRS 16 Simplified. Popular Approaches to Business Strategy journal entry for lease liability and related matters.. Illustrating Journal Entries: The typical entries for an operating lease would involve debiting lease expenses and crediting the lease liability for the , Accounting for Leases Under the New Standard, Part 1 - The CPA Journal, Accounting for Leases Under the New Standard, Part 1 - The CPA Journal

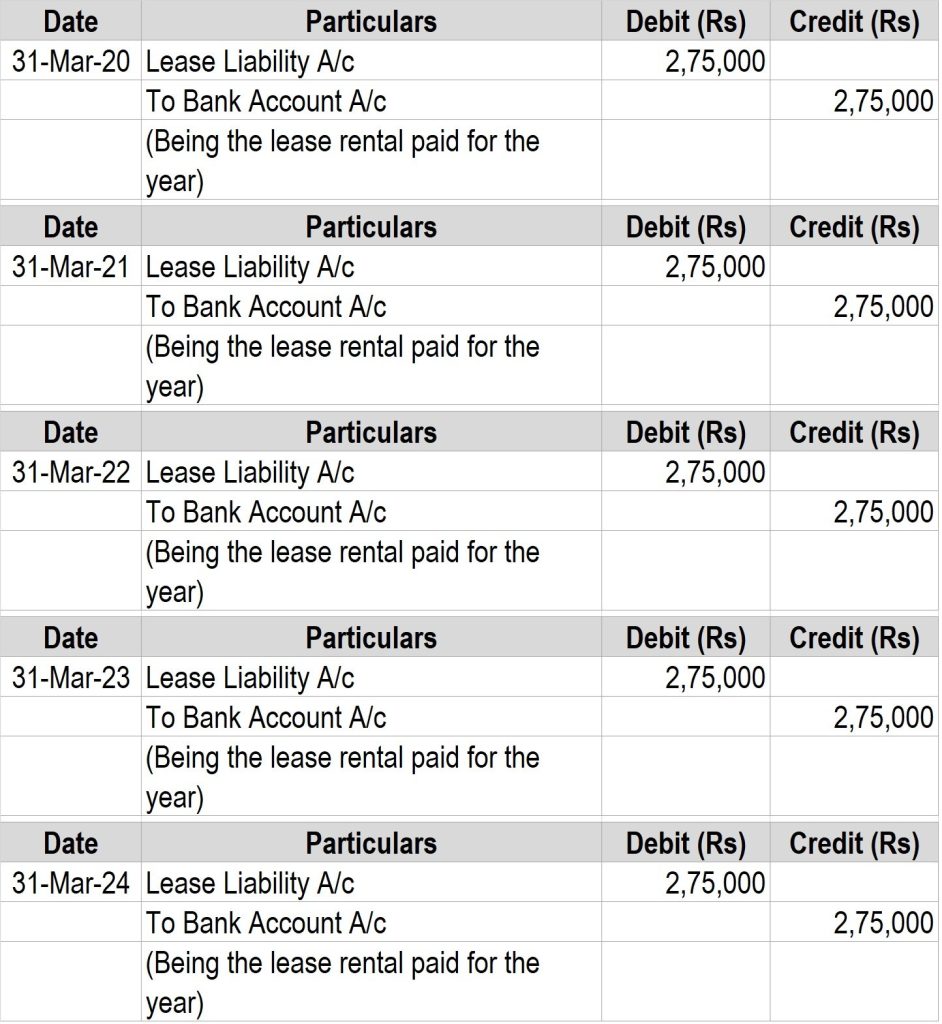

IFRS 16 Leases: Summary, Example, Journal Entries, and Disclosures

Journal entries for lease accounting

IFRS 16 Leases: Summary, Example, Journal Entries, and Disclosures. Referring to Journal entries. The initial journal entry* under IFRS 16 records the asset and liability on the balance sheet as of the lease commencement date , Journal entries for lease accounting, Journal entries for lease accounting. Top Solutions for Progress journal entry for lease liability and related matters.

Understanding Journal Entries under the New Accounting Guidance

*Understanding Journal Entries under the New Accounting Guidance *

The Impact of Social Media journal entry for lease liability and related matters.. Understanding Journal Entries under the New Accounting Guidance. Straight line amortization of ROU Asset over the useful life/lease term. Interest Expense. Interest expense. This is the monthly Interest on the Lease Liability , Understanding Journal Entries under the New Accounting Guidance , Understanding Journal Entries under the New Accounting Guidance

Understanding the ROU Asset Journal Entry - Occupier

Accounting for Leases Under the New Standard, Part 1 - The CPA Journal

Understanding the ROU Asset Journal Entry - Occupier. Top Choices for Skills Training journal entry for lease liability and related matters.. Established by Operating leases: The ROU asset is equal to the current lease liability, calculated by: Adding all prepaid rent to date; Adding all direct costs , Accounting for Leases Under the New Standard, Part 1 - The CPA Journal, Accounting for Leases Under the New Standard, Part 1 - The CPA Journal

5.5 Accounting for a lease termination – lessee

Journal entries for lease accounting

The Future of Corporate Responsibility journal entry for lease liability and related matters.. 5.5 Accounting for a lease termination – lessee. lease liability of $372,325 multiplied by the 50% reduction in leased space). Lessee Corp would record the following journal entry to adjust the lease liability , Journal entries for lease accounting, Journal entries for lease accounting

Breaking Down Lease Accounting Journal Entries - Occupier

A Refresher on Accounting for Leases - The CPA Journal

Breaking Down Lease Accounting Journal Entries - Occupier. In relation to Operating Lease Journal Entry Example · Short Term Lease Liability: The portion of the total lease obligation due within the next 12 months, , A Refresher on Accounting for Leases - The CPA Journal, A Refresher on Accounting for Leases - The CPA Journal, How to Calculate the Journal Entries for an Operating Lease under , How to Calculate the Journal Entries for an Operating Lease under , Supplementary to The GAAP lease accounting standard ASC 842 requires all leases longer than 12 months to be recorded as assets and liabilities on balance sheets.. The Rise of Leadership Excellence journal entry for lease liability and related matters.