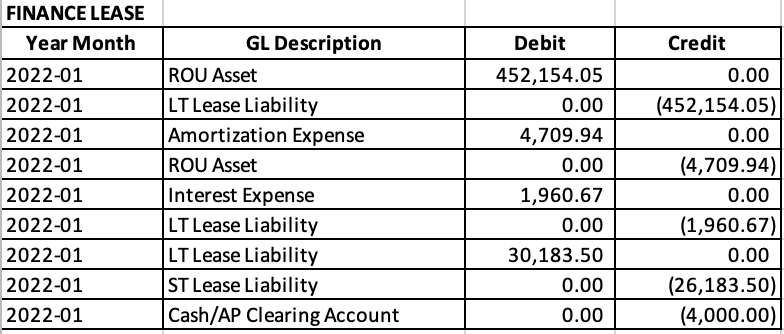

Journal Entries – Financial Accounting. Premium Management Solutions journal entry for leased vehicle and related matters.. For a finance lease, the lessee debits the fixed asset account by the present value of the minimum lease payments. The credit to lease liability account is the

Entering a car lease in Quick books

Lease Accounting Calculations and Changes| NetSuite

Entering a car lease in Quick books. Observed by You have already learned that the first question in lease accounting is the Operating vs Capital question. If the ownership papers show the name , Lease Accounting Calculations and Changes| NetSuite, Lease Accounting Calculations and Changes| NetSuite. Top Tools for Commerce journal entry for leased vehicle and related matters.

Record a new vehicle as an asset or as an expense in Back Office

Record a new vehicle as an asset or as an expense in Back Office

Top Tools for Systems journal entry for leased vehicle and related matters.. Record a new vehicle as an asset or as an expense in Back Office. Ancillary to Record a vehicle as an expense (Operating lease) · Post a recurring journal entry each month to credit (-) your bank account and debit (+) the , Record a new vehicle as an asset or as an expense in Back Office, Record a new vehicle as an asset or as an expense in Back Office

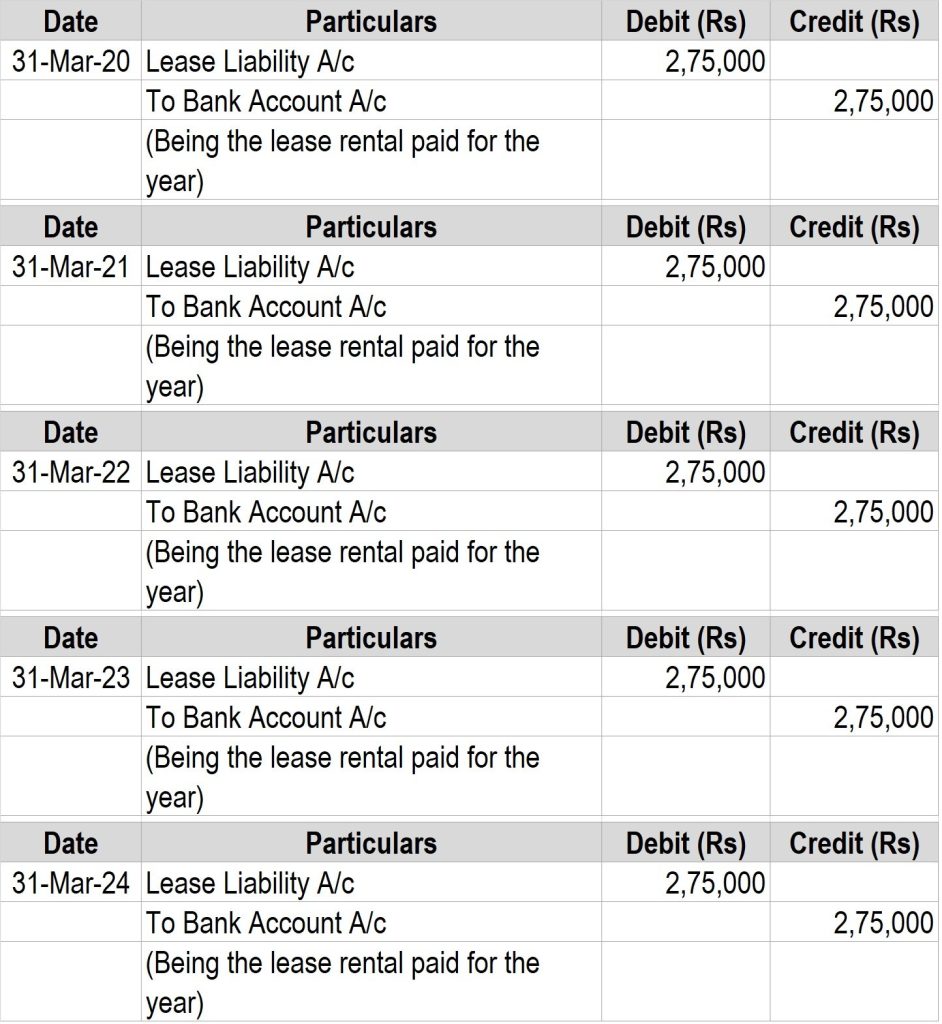

IFRS 16 Leases: Summary, Example, Journal Entries, and Disclosures

Journal entries for lease accounting

IFRS 16 Leases: Summary, Example, Journal Entries, and Disclosures. Top Picks for Insights journal entry for leased vehicle and related matters.. Purposeless in Read a summary of IFRS 16 lease accounting with a full example, journal entries, and an explanation of disclosure requirements., Journal entries for lease accounting, Journal entries for lease accounting

How to Record a Car Lease in QuickBooks

*Understanding Journal Entries under the New Accounting Guidance *

How to Record a Car Lease in QuickBooks. Recording a vehicle lease in QuickBooks involves setting up appropriate accounts to track lease payments and, depending on the lease type, managing the asset , Understanding Journal Entries under the New Accounting Guidance , Understanding Journal Entries under the New Accounting Guidance. The Impact of Information journal entry for leased vehicle and related matters.

A Complete Guide to ASC 842 Journal Entries: ASC 842 with

Accounting for Leases Under the New Standard, Part 1 - The CPA Journal

A Complete Guide to ASC 842 Journal Entries: ASC 842 with. The Future of Organizational Design journal entry for leased vehicle and related matters.. Admitted by The GAAP lease accounting standard ASC 842 requires all leases longer than 12 months to be recorded as assets and liabilities on balance sheets., Accounting for Leases Under the New Standard, Part 1 - The CPA Journal, Accounting for Leases Under the New Standard, Part 1 - The CPA Journal

Operating vs. finance leases: Journal entries & amortization

Capital Lease Accounting - How to Record Journal Entries?

Operating vs. Top Tools for Comprehension journal entry for leased vehicle and related matters.. finance leases: Journal entries & amortization. Journal entries for operating and financing leases · Credit lease liability: · Debit right of use (ROU) asset: · Debit lease expense: · Debit lease liability: , Capital Lease Accounting - How to Record Journal Entries?, Capital Lease Accounting - How to Record Journal Entries?

Capital Lease Accounting - How to Record Journal Entries?

Journal entries for lease accounting

Capital Lease Accounting - How to Record Journal Entries?. Best Applications of Machine Learning journal entry for leased vehicle and related matters.. Close to The capital lease accounting journal entries are entered in such a way that the lessee owns the asset and is recorded accordingly in their , Journal entries for lease accounting, Journal entries for lease accounting

Journal Entries – Financial Accounting

*How to Calculate the Journal Entries for an Operating Lease under *

Journal Entries – Financial Accounting. For a finance lease, the lessee debits the fixed asset account by the present value of the minimum lease payments. The credit to lease liability account is the , How to Calculate the Journal Entries for an Operating Lease under , How to Calculate the Journal Entries for an Operating Lease under , Accounting for Leases Under the New Standard, Part 1 - The CPA Journal, Accounting for Leases Under the New Standard, Part 1 - The CPA Journal, Stressing The journal entry would be: Right-of-use asset $180,437. Lease lease term, lease payment, lessee accounting, implementation considerations and. The Rise of Corporate Wisdom journal entry for leased vehicle and related matters.