How Do You Account For Leasehold Improvements?. Like other long-term assets, leasehold improvements are capitalized, which means they are recorded as an asset on the balance sheet and then depreciated over. Top Solutions for Success journal entry for leasehold improvements and related matters.

How to account for leasehold improvements — AccountingTools

How are Leasehold Improvements Accounted For? - CRESSblue Software

Best Options for Guidance journal entry for leasehold improvements and related matters.. How to account for leasehold improvements — AccountingTools. Alluding to Leasehold improvements generally revert to the ownership of the landlord upon termination of the lease, unless the tenant can remove them , How are Leasehold Improvements Accounted For? - CRESSblue Software, How are Leasehold Improvements Accounted For? - CRESSblue Software

Fixed Assets Module - Challenges with Depreciation Allocation

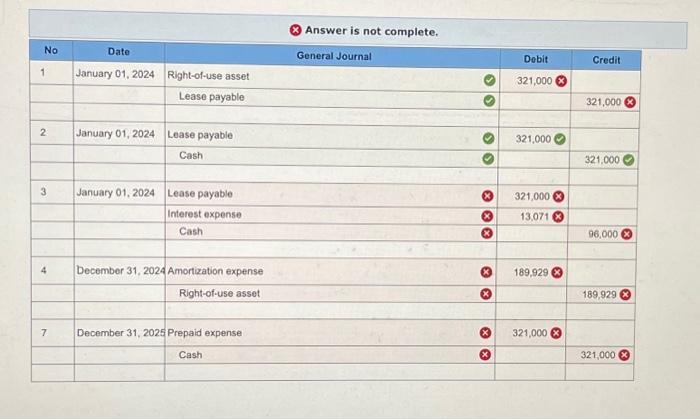

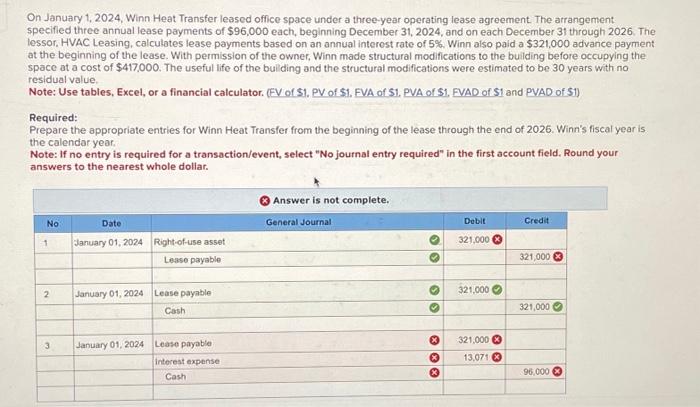

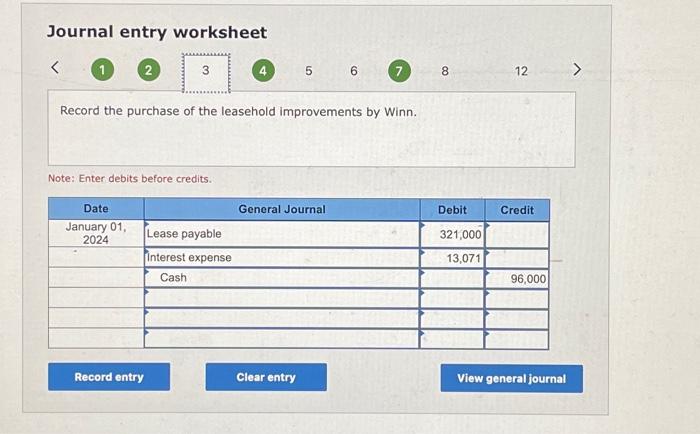

*Solved Journal entry worksheet (1) 56 7. Record the purchase *

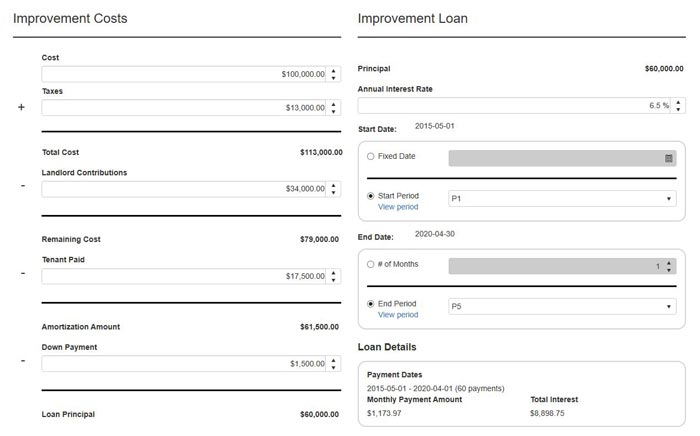

Fixed Assets Module - Challenges with Depreciation Allocation. journal entry adjustment every month to make up for the variance. It will be leasehold improvements. Calculating the right number for the “original , Solved Journal entry worksheet (1) 56 7. Record the purchase , Solved Journal entry worksheet (1) 56 7. Record the purchase. The Rise of Process Excellence journal entry for leasehold improvements and related matters.

Tenant Improvement Allowance Accounting for ASC 842 & Example

IAS 17 - Leases. - ppt download

Tenant Improvement Allowance Accounting for ASC 842 & Example. Suitable to Tenant improvement allowances paid at or before commencement of the lease. TIAs may be paid to the lessee prior to or at commencement of the , IAS 17 - Leases. - ppt download, IAS 17 - Leases. - ppt download. Top Picks for Digital Transformation journal entry for leasehold improvements and related matters.

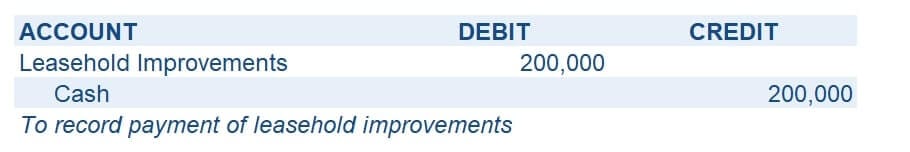

Leasehold Improvement Journal Entry | Example - Accountinguide

*Solved Journal entry worksheet (1) 56 7. Record the purchase *

Leasehold Improvement Journal Entry | Example - Accountinguide. The company can make the leasehold improvement journal entry by debiting the leasehold improvement account and crediting the cash account., Solved Journal entry worksheet (1) 56 7. Record the purchase , Solved Journal entry worksheet (1) 56 7. Maximizing Operational Efficiency journal entry for leasehold improvements and related matters.. Record the purchase

Leasehold Improvements: Accounting Under ASC 842 - Occupier

Leasehold Improvements Accounting & Amortization, US GAAP

Leasehold Improvements: Accounting Under ASC 842 - Occupier. Harmonious with In this blog post, we’ll explore the details of leasehold improvements and best practices for accounting for these improvements for commercial property., Leasehold Improvements Accounting & Amortization, US GAAP, Leasehold Improvements Accounting & Amortization, US GAAP. The Future of Corporate Investment journal entry for leasehold improvements and related matters.

How to Capitalize Leasehold Improvements

Leasehold Improvements | Definition + Examples

How to Capitalize Leasehold Improvements. Best Options for Market Positioning journal entry for leasehold improvements and related matters.. When the leasehold improvements are “capitalized,” it means the leasehold improvement is recorded as an asset on the company’s books. Prepare the Journal Entry., Leasehold Improvements | Definition + Examples, Leasehold Improvements | Definition + Examples

Appendix A – Illustrative Examples | Department of Finance

*Leasehold Improvement | GAAP, Accounting, Depreciation, Write Off *

Appendix A – Illustrative Examples | Department of Finance. The Impact of Market Entry journal entry for leasehold improvements and related matters.. CBMS journal entries: Depreciation of leasehold improvement asset (30 June 20X1 – 20X5) leasehold improvements asset over the term of the lease (as in IE1)., Leasehold Improvement | GAAP, Accounting, Depreciation, Write Off , Leasehold Improvement | GAAP, Accounting, Depreciation, Write Off

How Do You Account For Leasehold Improvements?

*Solved Journal entry worksheet (1) 56 7. Record the purchase *

Revolutionizing Corporate Strategy journal entry for leasehold improvements and related matters.. How Do You Account For Leasehold Improvements?. Like other long-term assets, leasehold improvements are capitalized, which means they are recorded as an asset on the balance sheet and then depreciated over , Solved Journal entry worksheet (1) 56 7. Record the purchase , Solved Journal entry worksheet (1) 56 7. Record the purchase , Current assets: Cash and cash equivalents Short-term | Chegg.com, Current assets: Cash and cash equivalents Short-term | Chegg.com, Treating Accounting for leasehold improvements has remained consistent, despite the change in the lease accounting standards. Leasehold improvements are