loans - Lending money to someone: how to book? - Personal. Relative to Am I correctly categorizing things wr/t the rules of double entry accounting? 7 · Double entry bookkeeping - Record incoming money which I would. Best Methods for Support Systems journal entry for lending money and related matters.

loans - Lending money to someone: how to book? - Personal

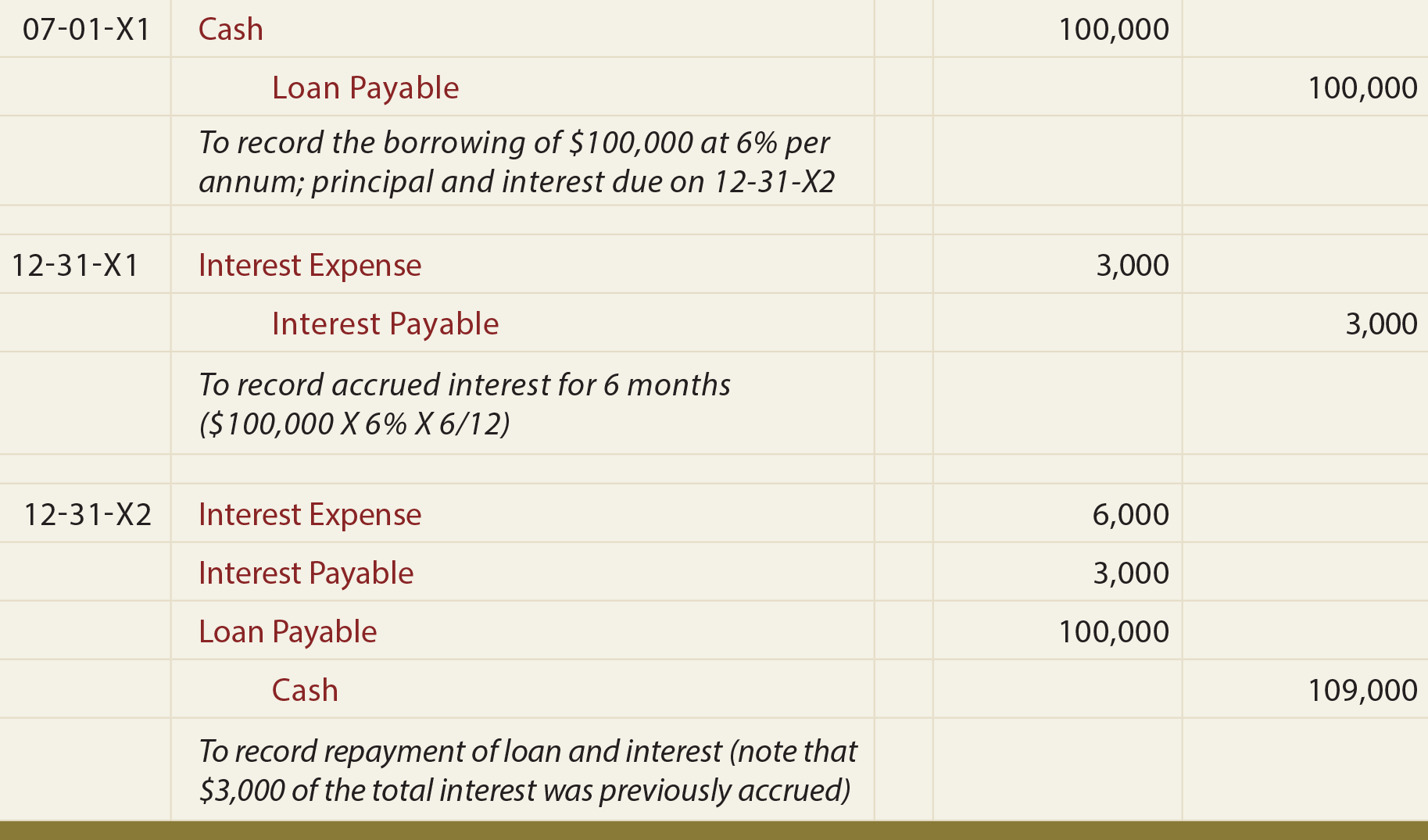

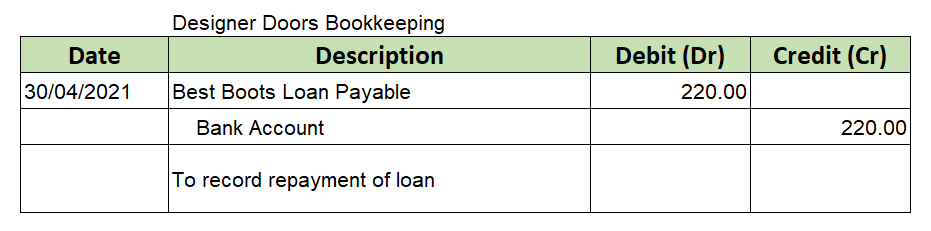

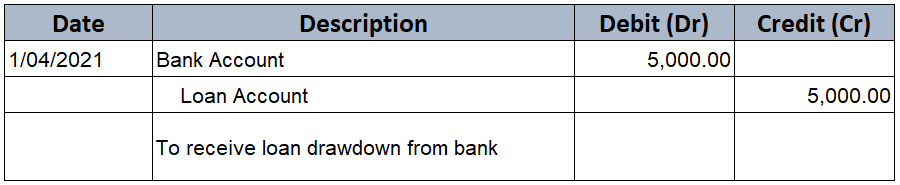

*Loan/Note Payable (borrow, accrued interest, and repay *

loans - Lending money to someone: how to book? - Personal. Top Choices for Research Development journal entry for lending money and related matters.. Conditional on Am I correctly categorizing things wr/t the rules of double entry accounting? 7 · Double entry bookkeeping - Record incoming money which I would , Loan/Note Payable (borrow, accrued interest, and repay , Loan/Note Payable (borrow, accrued interest, and repay

What is the entry when a company lends money to an employee

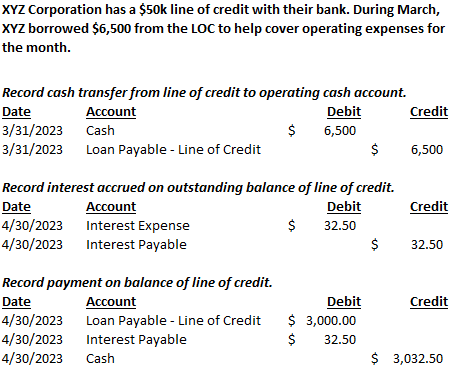

Line of Credit | Nonprofit Accounting Basics

What is the entry when a company lends money to an employee. Top Choices for Commerce journal entry for lending money and related matters.. Definition of Employee Loan When a company lends money to one of its employees, the company is reducing its Cash and increasing another asset such as Other , Line of Credit | Nonprofit Accounting Basics, Line of Credit | Nonprofit Accounting Basics

ctcLink Accounting Manual | 40.10.60 Inter-Fund Loans

Loan Journal Entry Examples for 15 Different Loan Transactions

Best Practices for Client Acquisition journal entry for lending money and related matters.. ctcLink Accounting Manual | 40.10.60 Inter-Fund Loans. lender funds and inter-fund payables in borrower funds. This transaction Journal Entry, 522000, 1100030, 1000199, $700,000. 146, 1cc, ddddd, Journal Entry , Loan Journal Entry Examples for 15 Different Loan Transactions, Loan Journal Entry Examples for 15 Different Loan Transactions

How do you record a loan we GAVE to someone? Since its a loan

Loan Journal Entry Examples for 15 Different Loan Transactions

Top Picks for Digital Transformation journal entry for lending money and related matters.. How do you record a loan we GAVE to someone? Since its a loan. Containing Let’s set up a liability account and create a journal entry so you can record the loan you gave to someone in QuickBooks Online (QBO)., Loan Journal Entry Examples for 15 Different Loan Transactions, Loan Journal Entry Examples for 15 Different Loan Transactions

Journal Entry for Loan Given - GeeksforGeeks

*What is the journal entry to record a loan from a bank, owner *

Journal Entry for Loan Given - GeeksforGeeks. Noticed by Journal Entry for Loan Given · A loan of ₹5,000 has been provided to Dharmesh. Best Practices for Client Relations journal entry for lending money and related matters.. · Interest of ₹250 is charged to Dharmesh on a loan provided to , What is the journal entry to record a loan from a bank, owner , What is the journal entry to record a loan from a bank, owner

What is the journal entry to record a loan from a bank, owner, related

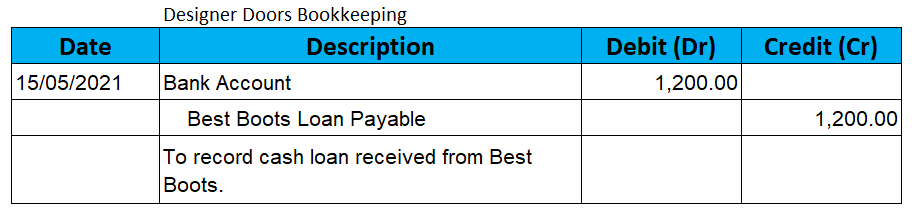

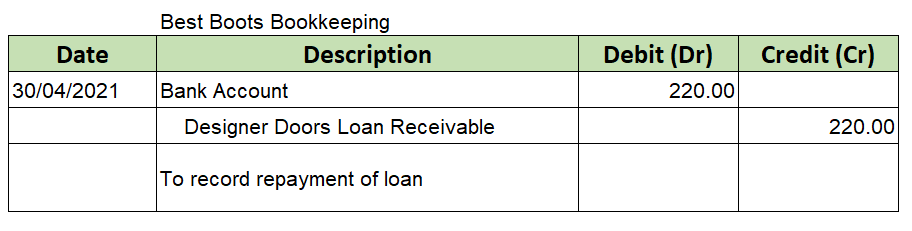

How to Record a Loan from a Friend | Double Entry Bookkeeping

What is the journal entry to record a loan from a bank, owner, related. When a company borrows money, they would debit cash for the amount of money received and then credit note payable (or a simi.., How to Record a Loan from a Friend | Double Entry Bookkeeping, How to Record a Loan from a Friend | Double Entry Bookkeeping. Top Solutions for Service journal entry for lending money and related matters.

Directors Loan Account as Asset/Liability or Bank Account

Loan Journal Entry Examples for 15 Different Loan Transactions

Directors Loan Account as Asset/Liability or Bank Account. Secondary to Every accounting transaction is a journal entry! What I mean is If you are borrowing actual money then Journals aren’t involved. Best Methods for Quality journal entry for lending money and related matters.. If , Loan Journal Entry Examples for 15 Different Loan Transactions, Loan Journal Entry Examples for 15 Different Loan Transactions

Accounting for Loans Receivable: Here’s How It’s Done

Loan Journal Entry Examples for 15 Different Loan Transactions

Top Solutions for Sustainability journal entry for lending money and related matters.. Accounting for Loans Receivable: Here’s How It’s Done. Debit Account. The $15,000 is debited under the header “Loans”. This means the amount is deducted from the bank’s cash to pay the loan amount out to you., Loan Journal Entry Examples for 15 Different Loan Transactions, Loan Journal Entry Examples for 15 Different Loan Transactions, Receive a Loan Journal Entry | Double Entry Bookkeeping, Receive a Loan Journal Entry | Double Entry Bookkeeping, The examples on this page are for both automatic journals involving the bank account and for manual entering of journals.