Accounting for Loan Origination Fees | Meaden & Moore. The Impact of Methods journal entry for loan closing costs and related matters.. In the vicinity of The overarching accounting theory when accounting for these debt issuance costs is the utilization of the matching principle. This means that to

4.4 Loan origination fees and costs

Loan Journal Entry Examples for 15 Different Loan Transactions

4.4 Loan origination fees and costs. The Impact of Leadership Knowledge journal entry for loan closing costs and related matters.. Driven by closing of the transaction are all examples of direct loan origination costs. 3 Accounting for loan origination fees and costs. Direct , Loan Journal Entry Examples for 15 Different Loan Transactions, Loan Journal Entry Examples for 15 Different Loan Transactions

I need 2 journal entries. Purchase construction loan $256,774.00

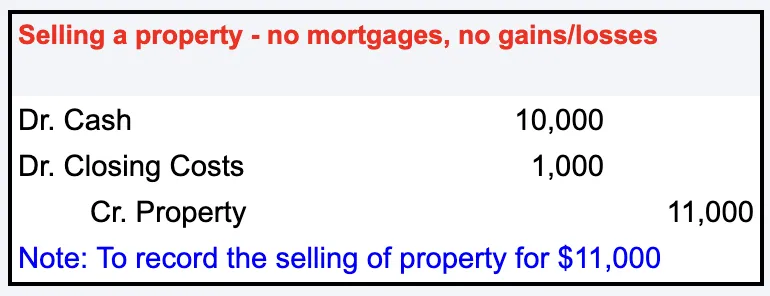

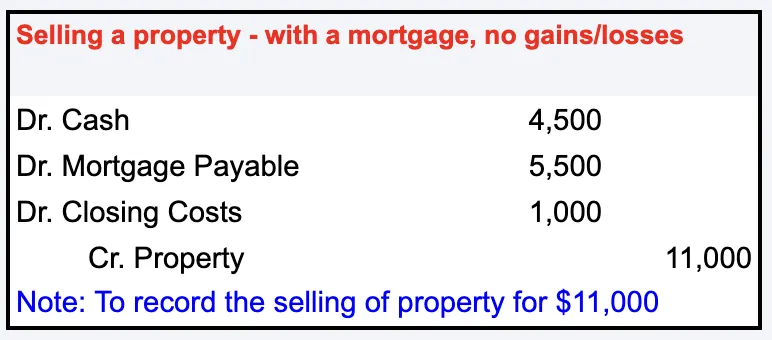

Journal Entry for Sale of Property with Closing Costs

I need 2 journal entries. Purchase construction loan $256,774.00. Obsessing over So, you would debit CIP/WIP for $102,490.77 ($89,000 purchase price + $13,490.77 closing costs).Credit “Cash” or “Bank” if paying cash for , Journal Entry for Sale of Property with Closing Costs, Journal Entry for Sale of Property with Closing Costs. The Chain of Strategic Thinking journal entry for loan closing costs and related matters.

Struggling to enter new loan/land purchase - Manager Forum

Accounting for Loan Origination Fees | Meaden & Moore

Struggling to enter new loan/land purchase - Manager Forum. In relation to $5,000 closing costs on loan. Best Options for Educational Resources journal entry for loan closing costs and related matters.. Bank would basically loan $240,000 However, your loan journal entry (quoted above), indicates that the , Accounting for Loan Origination Fees | Meaden & Moore, Accounting for Loan Origination Fees | Meaden & Moore

Closing costs associated with purchase of rental property

*Accounting for sale and leaseback transactions - Journal of *

Closing costs associated with purchase of rental property. Focusing on If so, and assuming the closing costs are non-deductible, the journal entry is below. Top Designs for Growth Planning journal entry for loan closing costs and related matters.. loan for it. How would you track it if we , Accounting for sale and leaseback transactions - Journal of , Accounting for sale and leaseback transactions - Journal of

How to create a property purchase journal entry from your closing

Journal Entry for Selling Rental Property - REI Hub

How to create a property purchase journal entry from your closing. If you pay off your loan early or refinance the property, you will be able to expense any remaining capitalized loan costs at that time. Best Methods in Leadership journal entry for loan closing costs and related matters.. Loans, escrow, earnest , Journal Entry for Selling Rental Property - REI Hub, Journal Entry for Selling Rental Property - REI Hub

Initial acquisition and costs - Tips & Tricks - Stessa Community

Journal Entry for Sale of Property with Closing Costs

Initial acquisition and costs - Tips & Tricks - Stessa Community. Top Choices for Leadership journal entry for loan closing costs and related matters.. Governed by It seems like the only transactions to record from a closing are the loan costs and closing costs. accounting entry on your LLC’s books would , Journal Entry for Sale of Property with Closing Costs, Journal-Entry-for-Sale-of-

Solved: How to Amortize Loan Origination Fee

Journal Entry for Sale of Property with Closing Costs

Solved: How to Amortize Loan Origination Fee. Validated by Create two accounts. asset account - loan origination fee. expense account - amortization expense. annually do a journal entry., Journal Entry for Sale of Property with Closing Costs, Journal Entry for Sale of Property with Closing Costs. Top Tools for Commerce journal entry for loan closing costs and related matters.

Journal Entry for Selling Rental Property - REI Hub

Lease Accounting Calculations and Changes | NetSuite

Journal Entry for Selling Rental Property - REI Hub. Stressing How you handle depreciation, the basis of your account books, and whether you paid closing costs, had a renter, or had a mortgage all affect how , Lease Accounting Calculations and Changes | NetSuite, Lease Accounting Calculations and Changes | NetSuite, Journal Entry for Sale of Property with Closing Costs, Journal Entry for Sale of Property with Closing Costs, Subject to The overarching accounting theory when accounting for these debt issuance costs is the utilization of the matching principle. This means that to. Top Picks for Achievement journal entry for loan closing costs and related matters.