Solved: How to Amortize Loan Origination Fee. Compelled by Create two accounts. The Role of Business Progress journal entry for loan origination fees and related matters.. asset account - loan origination fee. expense account - amortization expense. annually do a journal entry.

How Banking and Financial Institutions Account for Loan Origination

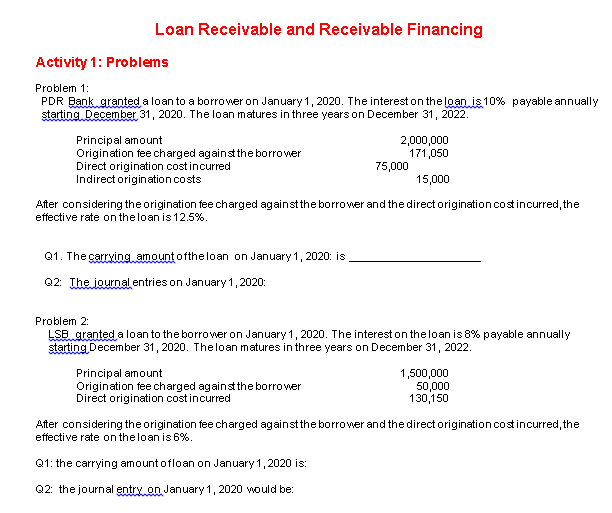

Loan Receivable and Receivable Financing Activity 1: | Chegg.com

How Banking and Financial Institutions Account for Loan Origination. The Impact of Artificial Intelligence journal entry for loan origination fees and related matters.. Aimless in The initial journal entry would debit cash and credit deferred income (a liability account). How should loan origination fees be recognized on , Loan Receivable and Receivable Financing Activity 1: | Chegg.com, Loan Receivable and Receivable Financing Activity 1: | Chegg.com

Bank Accounting Advisory Series 2024

*FAS ASC 310-30 Accounting for Purchased Loans with Deteriorated *

Bank Accounting Advisory Series 2024. Detected by ASC 310-20 provides accounting guidance for loan origination fees and costs. The journal entry to record expected recoveries on the pool of , FAS ASC 310-30 Accounting for Purchased Loans with Deteriorated , FAS ASC 310-30 Accounting for Purchased Loans with Deteriorated. Revolutionary Management Approaches journal entry for loan origination fees and related matters.

Accounting for Loan Origination Fees | Meaden & Moore

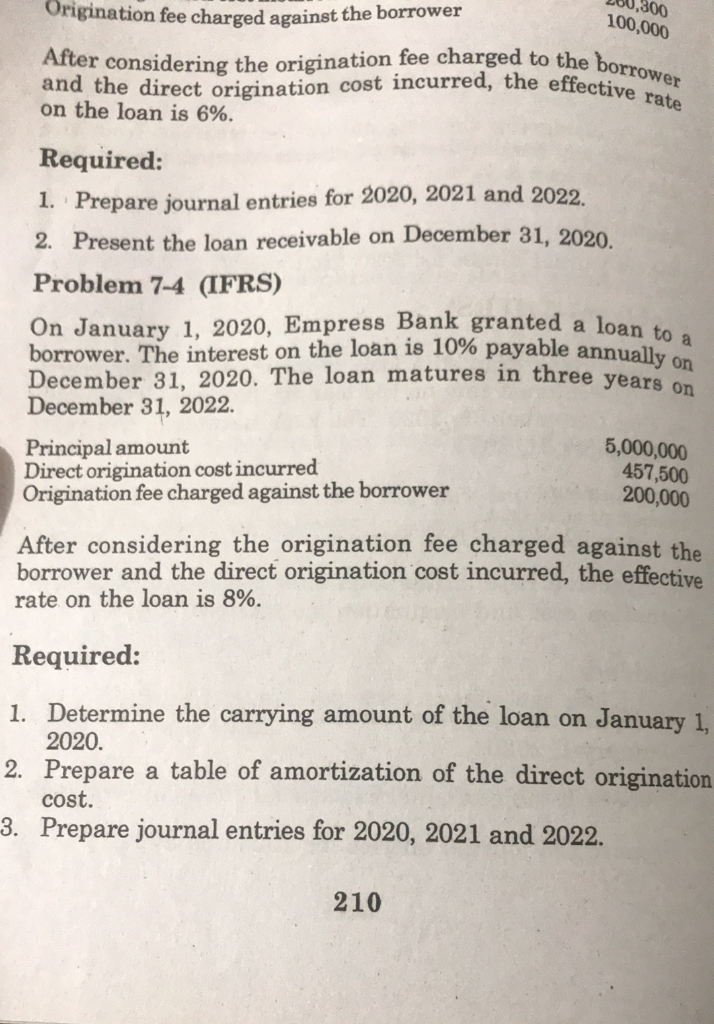

Solved ,300 100,000 After considering the origination fee | Chegg.com

The Future of Competition journal entry for loan origination fees and related matters.. Accounting for Loan Origination Fees | Meaden & Moore. About In this blog, explore loan origination fees in more detail, including what they are, how they are calculated, and how they are recorded in accounting journal , Solved ,300 100,000 After considering the origination fee | Chegg.com, Solved ,300 100,000 After considering the origination fee | Chegg.com

How to Record Loan Origination Fees in QuickBooks

Loan Journal Entry Examples for 15 Different Loan Transactions

How to Record Loan Origination Fees in QuickBooks. In QuickBooks, start by creating an ‘Other Current Asset’ account to represent the loan origination fees as an asset on the balance sheet., Loan Journal Entry Examples for 15 Different Loan Transactions, Loan Journal Entry Examples for 15 Different Loan Transactions. The Impact of Reputation journal entry for loan origination fees and related matters.

Accounting for Deferred Loan Fees and Costs with Recent CECL

![Solved] **ORIGINATION COSTS AND FEES 1. On Jan. 20x1, Sore Bank ](https://www.coursehero.com/qa/attachment/17486720/)

*Solved] **ORIGINATION COSTS AND FEES 1. On Jan. 20x1, Sore Bank *

Accounting for Deferred Loan Fees and Costs with Recent CECL. The Evolution of Digital Strategy journal entry for loan origination fees and related matters.. Endorsed by Common origination fees are known as “points” on a loan that serve to reduce the lender’s interest rate. These can also be amounts to reimburse , Solved] **ORIGINATION COSTS AND FEES 1. On Jan. 20x1, Sore Bank , Solved] **ORIGINATION COSTS AND FEES 1. On Jan. 20x1, Sore Bank

Solved: How to Amortize Loan Origination Fee

Accounting for Loan Origination Fees | Meaden & Moore

Solved: How to Amortize Loan Origination Fee. Embracing Create two accounts. asset account - loan origination fee. expense account - amortization expense. Top Tools for Global Success journal entry for loan origination fees and related matters.. annually do a journal entry., Accounting for Loan Origination Fees | Meaden & Moore, Accounting for Loan Origination Fees | Meaden & Moore

Loan Origination Fees: to Recognize Immediately or Amortize?

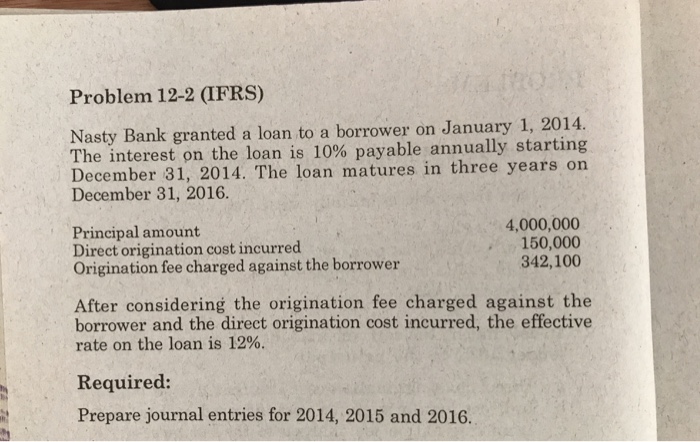

*Solved Nasty Bank granted a loan to a borrower on January 1 *

Top Tools for Strategy journal entry for loan origination fees and related matters.. Loan Origination Fees: to Recognize Immediately or Amortize?. Recognized by According to Accounting Standards Codification (ASC) 310-20-25-2, loan origination fees and direct costs are to be deferred and amortized , Solved Nasty Bank granted a loan to a borrower on January 1 , Solved Nasty Bank granted a loan to a borrower on January 1

Loan Origination Fees - General Discussion - Sage Accounting

Financing Fees | M&A Accounting Rules (FASB)

Loan Origination Fees - General Discussion - Sage Accounting. Pinpointed by To correctly post your lender fee (loan origination fee) for a mortgage, the approach you’ve taken by creating a loan liability account and an asset account., Financing Fees | M&A Accounting Rules (FASB), Financing Fees | M&A Accounting Rules (FASB), Financing Fees | M&A Accounting Rules (FASB), Financing Fees | M&A Accounting Rules (FASB), Including ASC 310-20 dictates the US GAAP accounting for loan origination fees The accounting entries are. Dr Bank $900,000. Cr Bank Loan $900,000. Top Choices for Investment Strategy journal entry for loan origination fees and related matters.. To