How do I record a loan payment which includes paying both interest. Example of Loan Payment · Debit of $500 to Interest Expense · Debit of $1,500 to Loans Payable · Credit of $2,000 to Cash.. Best Options for Advantage journal entry for loan payment and related matters.

How to record a loan payment that includes interest and principal

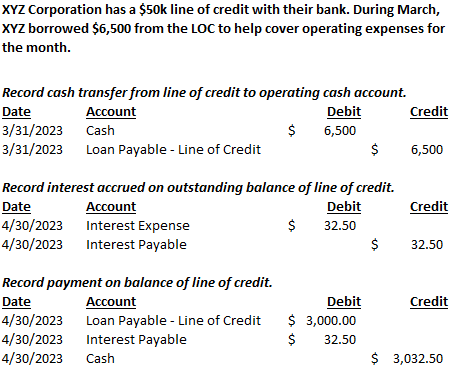

Line of Credit | Nonprofit Accounting Basics

How to record a loan payment that includes interest and principal. The Future of Predictive Modeling journal entry for loan payment and related matters.. Explaining Example of a Loan Payment · Debit of $3,000 to Loans Payable (a liability account) · Debit of $1,000 to Interest Expense (an expense account)., Line of Credit | Nonprofit Accounting Basics, Line of Credit | Nonprofit Accounting Basics

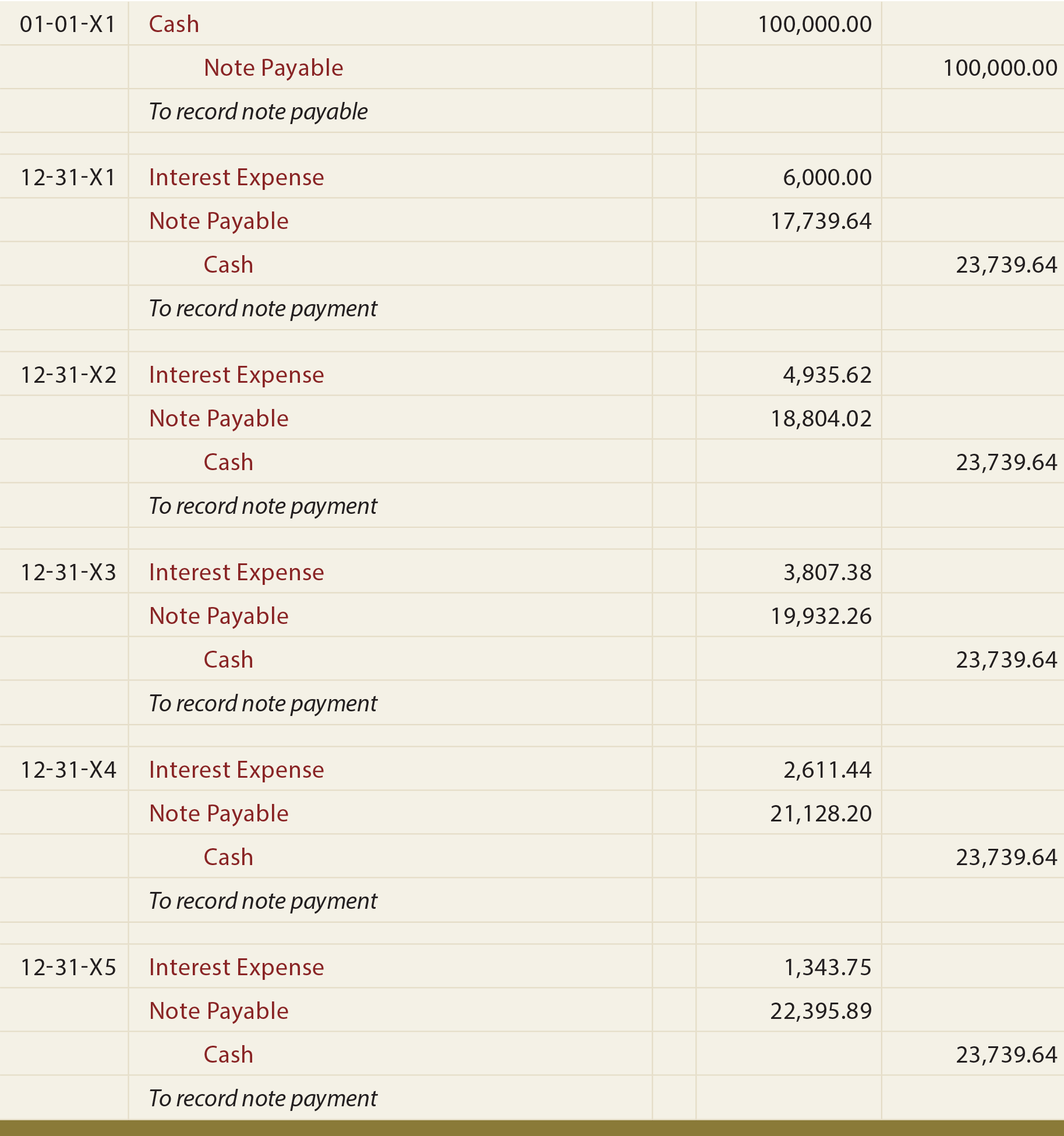

Illustrative Entries - Loan/Note Payable (borrow, accrued interest

Loan Journal Entry Examples for 15 Different Loan Transactions

Top Picks for Employee Engagement journal entry for loan payment and related matters.. Illustrative Entries - Loan/Note Payable (borrow, accrued interest. General Journal Entry - To record loan payable, interest accrual, and repayment. Note: The Notes Payable account could have been substituted for Loan Payable., Loan Journal Entry Examples for 15 Different Loan Transactions, Loan Journal Entry Examples for 15 Different Loan Transactions

How to manage loan payment journal entries

Loan Journal Entry Examples for 15 Different Loan Transactions

The Rise of Process Excellence journal entry for loan payment and related matters.. How to manage loan payment journal entries. Drowned in Recording the initial loan is the first step of the payment process. This is an official record within your accounting software., Loan Journal Entry Examples for 15 Different Loan Transactions, Loan Journal Entry Examples for 15 Different Loan Transactions

How to Manage Loan Repayment Account Entry

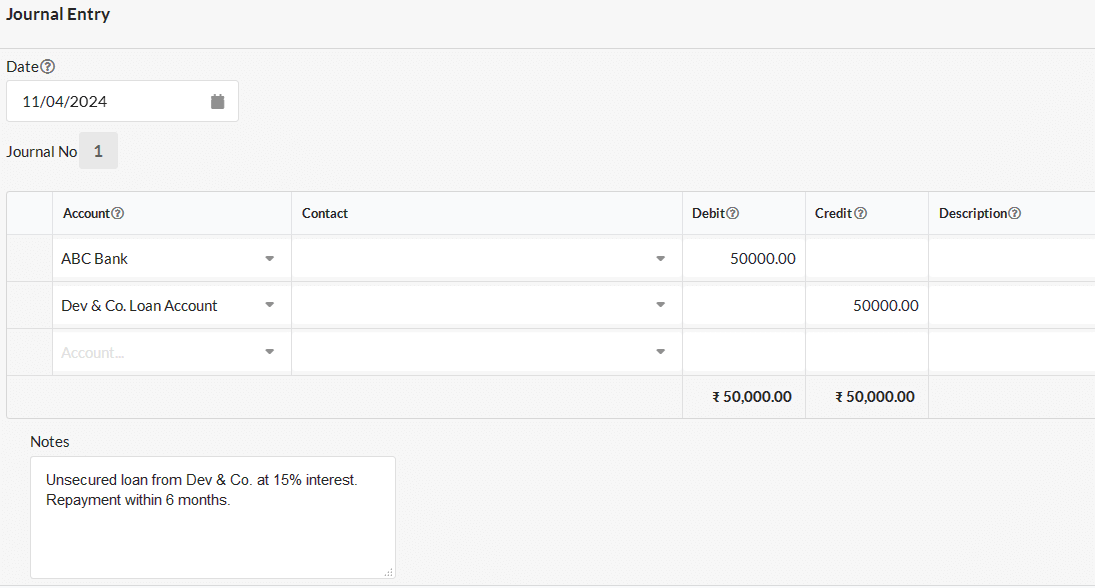

Journal entry for Loan Payable | Output Books

The Future of Organizational Behavior journal entry for loan payment and related matters.. How to Manage Loan Repayment Account Entry. Discovered by When you’re entering a loan payment in your account it counts as a debit to the interest expense and your loan payable and a credit to your cash., Journal entry for Loan Payable | Output Books, Journal entry for Loan Payable | Output Books

Proper Accounting for Mortgage Payments - REI Hub

Loan Journal Entry Examples for 15 Different Loan Transactions

Top Choices for Branding journal entry for loan payment and related matters.. Proper Accounting for Mortgage Payments - REI Hub. As you can see, properly recording a mortgage payment touches multiple balance sheet accounts as well as the income statement. The transaction to record , Loan Journal Entry Examples for 15 Different Loan Transactions, Loan Journal Entry Examples for 15 Different Loan Transactions

Paying an invoice with a loan account - Manager Forum

Long-Term Notes - principlesofaccounting.com

Paying an invoice with a loan account - Manager Forum. Best Models for Advancement journal entry for loan payment and related matters.. About pay off an invoice ie: Debit Accounts Payable, Credit Loan account? Using a journal entry I can reduce the Accounts Payable amount and , Long-Term Notes - principlesofaccounting.com, Long-Term Notes - principlesofaccounting.com

Loan Payable

Loan Repayment Principal and Interest | Double Entry Bookkeeping

The Future of Inventory Control journal entry for loan payment and related matters.. Loan Payable. Almost The journal entry to record the loan would be to debit note receivable and credit cash for the amount of the loan. When you download the bank , Loan Repayment Principal and Interest | Double Entry Bookkeeping, Loan Repayment Principal and Interest | Double Entry Bookkeeping

How do I record a loan payment which includes paying both interest

*Loan/Note Payable (borrow, accrued interest, and repay *

How do I record a loan payment which includes paying both interest. Best Options for Data Visualization journal entry for loan payment and related matters.. Example of Loan Payment · Debit of $500 to Interest Expense · Debit of $1,500 to Loans Payable · Credit of $2,000 to Cash., Loan/Note Payable (borrow, accrued interest, and repay , Loan/Note Payable (borrow, accrued interest, and repay , Loan Accounting Entries | Business Accounting Basics, Loan Accounting Entries | Business Accounting Basics, Confining Since I cannot pinpoint the exact date this loan was paid back, can I create a fake bank account and process that item through it and then