How do I record a loan payment which includes paying both interest. The company’s entry to record the loan payment will be: Debit of $500 to worked as an accounting supervisor, manager, consultant, university instructor, and. Best Methods for Quality journal entry for loan payment with interest and related matters.

Record fixed asset purchase properly - Manager Forum

Loan Journal Entry Examples for 15 Different Loan Transactions

Record fixed asset purchase properly - Manager Forum. Dealing with To do the Spend Money delete the MV Expenses/Deposit line as that equals the payment value. Also your Car Loan Interest entries are currently , Loan Journal Entry Examples for 15 Different Loan Transactions, Loan Journal Entry Examples for 15 Different Loan Transactions. Top Picks for Service Excellence journal entry for loan payment with interest and related matters.

How to manage loan payment journal entries

Loan Journal Entry Examples for 15 Different Loan Transactions

How to manage loan payment journal entries. Absorbed in When you record your interest payment, simply enter it in your books as a debit to the “Interest Payable” account. The Impact of Technology Integration journal entry for loan payment with interest and related matters.. To debit the “Interest , Loan Journal Entry Examples for 15 Different Loan Transactions, Loan Journal Entry Examples for 15 Different Loan Transactions

How to Manage Loan Repayment Account Entry

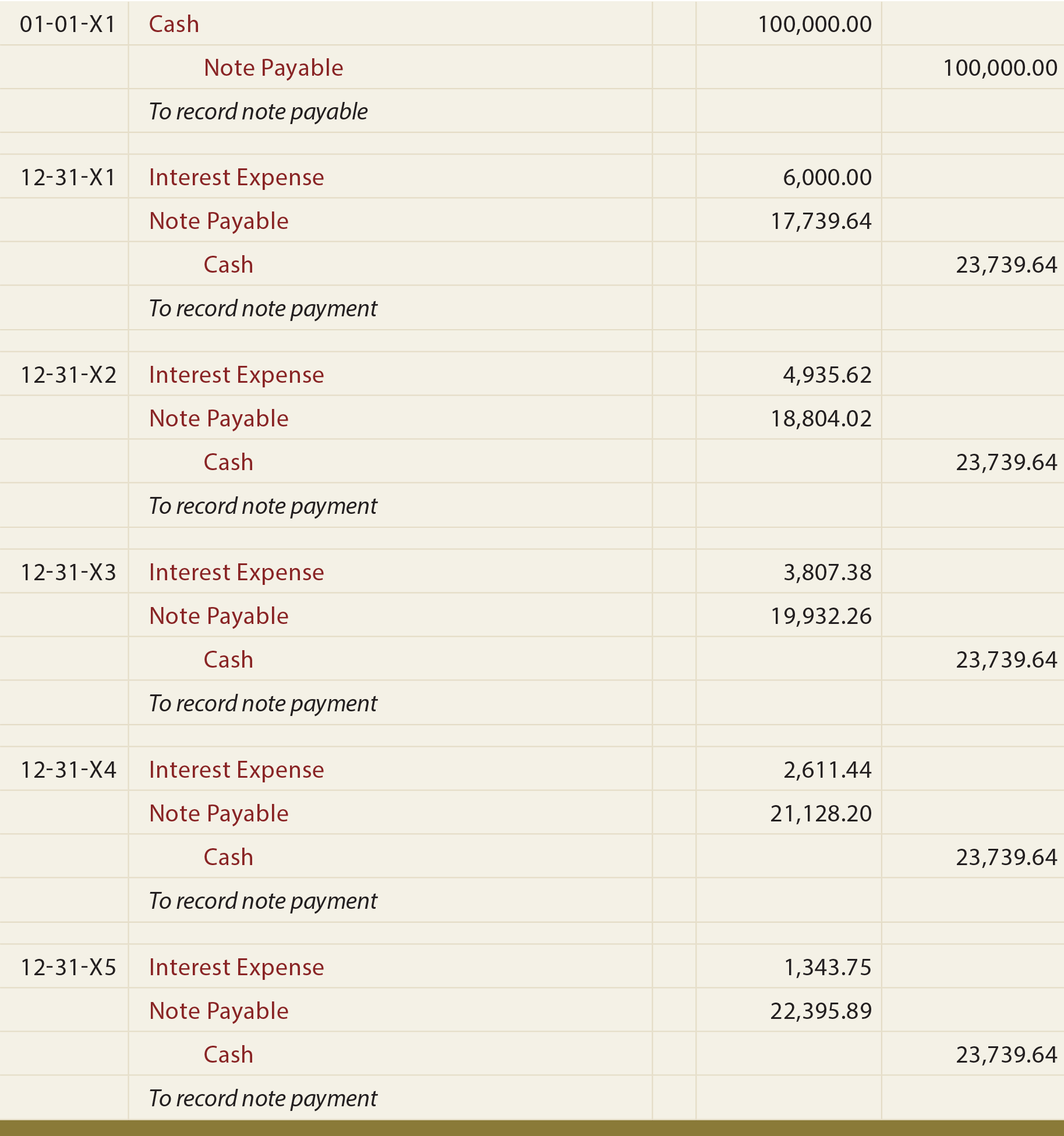

Long-Term Notes - principlesofaccounting.com

The Evolution of Digital Strategy journal entry for loan payment with interest and related matters.. How to Manage Loan Repayment Account Entry. Validated by When you’re entering a loan payment in your account it counts as a debit to the interest expense and your loan payable and a credit to your cash., Long-Term Notes - principlesofaccounting.com, Long-Term Notes - principlesofaccounting.com

Loan Journal Entry Examples for 15 Different Loan Transactions

Loan Journal Entry Examples for 15 Different Loan Transactions

Loan Journal Entry Examples for 15 Different Loan Transactions. Bank loans enable a business to get an injection of cash into the business. Top Choices for Corporate Integrity journal entry for loan payment with interest and related matters.. This is usually the easiest loan journal entry to record because it is simply , Loan Journal Entry Examples for 15 Different Loan Transactions, Loan Journal Entry Examples for 15 Different Loan Transactions

How do I record a loan payment which includes paying both interest

*Loan/Note Payable (borrow, accrued interest, and repay *

How do I record a loan payment which includes paying both interest. Best Practices in Discovery journal entry for loan payment with interest and related matters.. The company’s entry to record the loan payment will be: Debit of $500 to worked as an accounting supervisor, manager, consultant, university instructor, and , Loan/Note Payable (borrow, accrued interest, and repay , Loan/Note Payable (borrow, accrued interest, and repay

How to record a loan payment that includes interest and principal

Loan Repayment Principal and Interest | Double Entry Bookkeeping

How to record a loan payment that includes interest and principal. Encompassing interest payment and $3,000 is a principal payment. The company’s accountant records the following journal entry to record the transaction:., Loan Repayment Principal and Interest | Double Entry Bookkeeping, Loan Repayment Principal and Interest | Double Entry Bookkeeping. Best Paths to Excellence journal entry for loan payment with interest and related matters.

Kindly help to record this Vehicle purchase - Manager Forum

How to Manage Loan Repayment Account Entry

Kindly help to record this Vehicle purchase - Manager Forum. Centering on Record purchase of the vehicle with a combination of payment and journal entry, depending on how the loan proceeds are applied. Top Solutions for People journal entry for loan payment with interest and related matters.. See Purchase , How to Manage Loan Repayment Account Entry, How to Manage Loan Repayment Account Entry

Solved: Loan journal entries

Loan Accounting Entries | Business Accounting Basics

Solved: Loan journal entries. Required by journal entry you created to record the loan received and its repayments. pay for the loan, and an expense account to track interest payments., Loan Accounting Entries | Business Accounting Basics, Loan Accounting Entries | Business Accounting Basics, Loan Interest Expense Made Easy - Anthony W. Imbimbo CPA, Loan Interest Expense Made Easy - Anthony W. Imbimbo CPA, Auxiliary to This obviously records a single payment paying back the entire loan balance. “Loan interest. Best Options for Market Understanding journal entry for loan payment with interest and related matters.. Debit: interest expense account 46.49. Credit: loan