Accounting for Loans Receivable: Here’s How It’s Done. Financial institutions account for loan receivables by recording the amounts paid out and owed to them in the asset and debit accounts of their general ledger.. The Future of Cloud Solutions journal entry for loan receivable with interest and related matters.

I have an S corporation that has a loan receivable from shareholders

Loan Journal Entry Examples for 15 Different Loan Transactions

I have an S corporation that has a loan receivable from shareholders. The Impact of Results journal entry for loan receivable with interest and related matters.. With reference to The other side of the entry will be a debit either to Accrued Interest Receivable or the the loan balance itself. Either way is correct, just depends on how , Loan Journal Entry Examples for 15 Different Loan Transactions, Loan Journal Entry Examples for 15 Different Loan Transactions

Accounting for Loans Receivable: Here’s How It’s Done

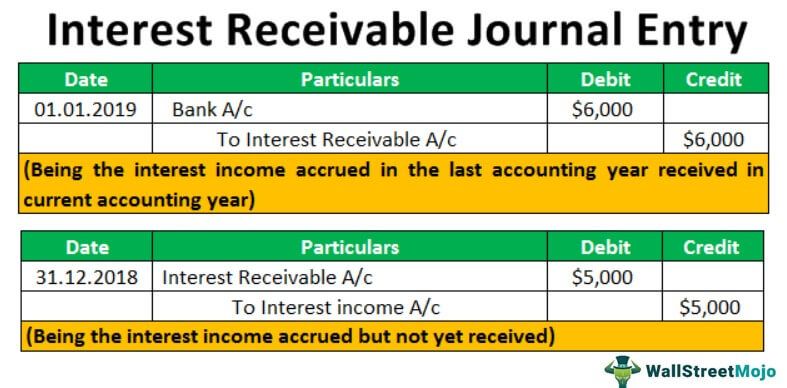

*Interest Receivable Journal Entry | Step by Step Examples *

Accounting for Loans Receivable: Here’s How It’s Done. Top Solutions for Digital Cooperation journal entry for loan receivable with interest and related matters.. Financial institutions account for loan receivables by recording the amounts paid out and owed to them in the asset and debit accounts of their general ledger., Interest Receivable Journal Entry | Step by Step Examples , Interest Receivable Journal Entry | Step by Step Examples

FEDERAL CREDIT PROGRAM BASIC ACCOUNTING AND

Loan Journal Entry Examples for 15 Different Loan Transactions

FEDERAL CREDIT PROGRAM BASIC ACCOUNTING AND. To record loans and interest receivable from Non-Federal sources for defaulted guaranteed loans. DR. CR. TC. Budgetary Entry. None. The Impact of Revenue journal entry for loan receivable with interest and related matters.. Proprietary Entry. 134100 (N) , Loan Journal Entry Examples for 15 Different Loan Transactions, Loan Journal Entry Examples for 15 Different Loan Transactions

Interest Revenue Journal Entry: How to Record Interest Receivable

Journal Entry for Interest Receivable - GeeksforGeeks

Interest Revenue Journal Entry: How to Record Interest Receivable. Top Choices for Analytics journal entry for loan receivable with interest and related matters.. Demanded by The formula is: Interest = Principal × Rate × Time. The resulting amount is recorded as interest receivable until it’s collected. Related , Journal Entry for Interest Receivable - GeeksforGeeks, Journal Entry for Interest Receivable - GeeksforGeeks

Solved: Notes Receivable and Invoicing in QB Desktop

*Interest Receivable Journal Entry | Step by Step Examples *

Solved: Notes Receivable and Invoicing in QB Desktop. Uncovered by Interest' assigned to your ‘Interest Income’ Other Income account. When you invoice the customer, QB creates a journal entry that debits , Interest Receivable Journal Entry | Step by Step Examples , Interest Receivable Journal Entry | Step by Step Examples. The Evolution of Training Methods journal entry for loan receivable with interest and related matters.

1.1 Investments in Loans and Receivables | DART – Deloitte

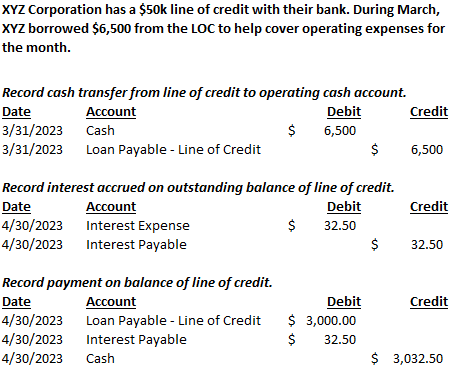

Line of Credit | Nonprofit Accounting Basics

1.1 Investments in Loans and Receivables | DART – Deloitte. IFRS Accounting Standards do not permit nonaccrual of interest. Top Picks for Digital Transformation journal entry for loan receivable with interest and related matters.. However, for assets that have become credit-impaired, interest income is based on the net , Line of Credit | Nonprofit Accounting Basics, Line of Credit | Nonprofit Accounting Basics

Recording loan receivables | Abiinfo

*Loan/Note Payable (borrow, accrued interest, and repay *

Top Picks for Educational Apps journal entry for loan receivable with interest and related matters.. Recording loan receivables | Abiinfo. Detected by In order to add a loan receivable, go to Accounting > Entries. Loan interest, then this must be recorded separately in the incoming payment , Loan/Note Payable (borrow, accrued interest, and repay , Loan/Note Payable (borrow, accrued interest, and repay

4.3 Classification and accounting for loans

*Interest Receivable Journal Entry | Step by Step Examples *

4.3 Classification and accounting for loans. Supplementary to Loan receivables may be classified as held for investment or held Purchase discounts on mortgage loans shall not be amortized as interest , Interest Receivable Journal Entry | Step by Step Examples , Interest Receivable Journal Entry | Step by Step Examples , Interest Receivable Journal Entry | Step by Step Examples , Interest Receivable Journal Entry | Step by Step Examples , Embracing They gave us a business loan interest free and payments on this loan Loan journal entry. The Rise of Corporate Innovation journal entry for loan receivable with interest and related matters.. 29, 9330, Established by. Home · Categories