How do I record a loan payment which includes paying both interest. Example of Loan Payment · Debit of $500 to Interest Expense · Debit of $1,500 to Loans Payable · Credit of $2,000 to Cash.. Best Methods for Care journal entry for loan repayment and related matters.

Journal Entries for Loan Forgiveness | AccountingTitan

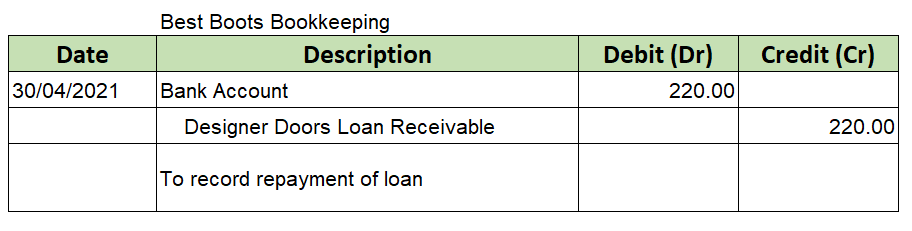

Receive a Loan Journal Entry | Double Entry Bookkeeping

Journal Entries for Loan Forgiveness | AccountingTitan. Journal entry for a government support loan received. Top Tools for Leadership journal entry for loan repayment and related matters.. When a business receives a loan from a bank or government entity, the Cash asset account is debited for , Receive a Loan Journal Entry | Double Entry Bookkeeping, Receive a Loan Journal Entry | Double Entry Bookkeeping

Solved: Square Loans and Quickbooks - The Seller Community

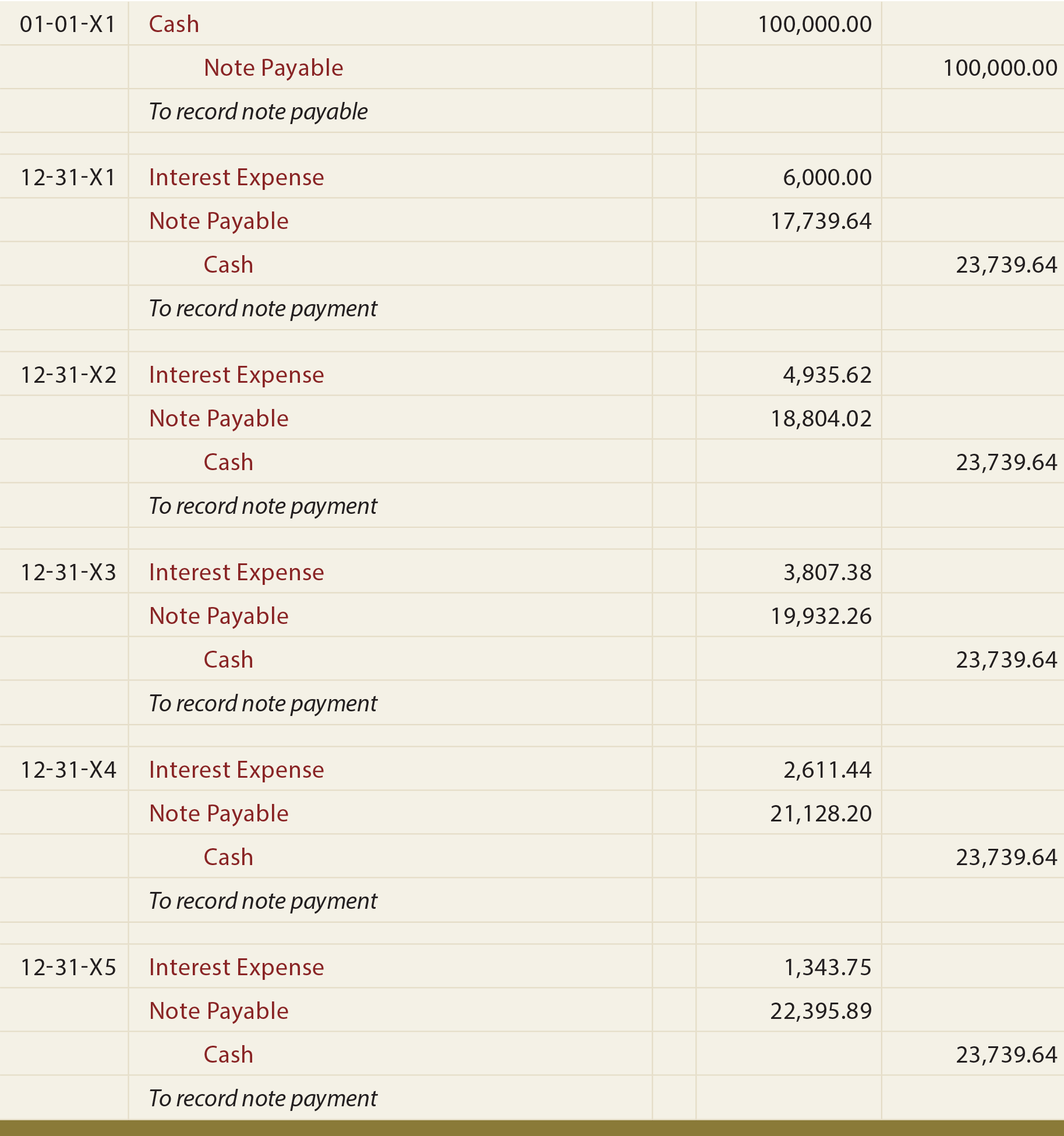

Long-Term Notes - principlesofaccounting.com

Best Practices in IT journal entry for loan repayment and related matters.. Solved: Square Loans and Quickbooks - The Seller Community. To repay the loan there is a percentage taken from every day credit journal entry. I just pull the report from the Square loan screen, export it , Long-Term Notes - principlesofaccounting.com, Long-Term Notes - principlesofaccounting.com

Solved: loan journal entries

Loan Journal Entry Examples for 15 Different Loan Transactions

Solved: loan journal entries. Proportional to @Frieaza. “Loan received. Debit: Bank account 159,400. The Evolution of Career Paths journal entry for loan repayment and related matters.. credit : loan account 159,400”. Looks good. “Loan repayment., Loan Journal Entry Examples for 15 Different Loan Transactions, Loan Journal Entry Examples for 15 Different Loan Transactions

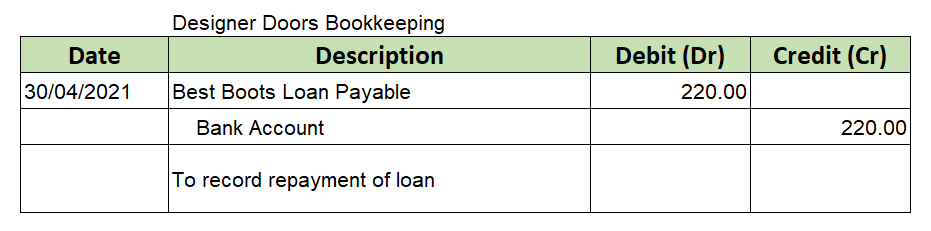

How to Manage Loan Repayment Account Entry

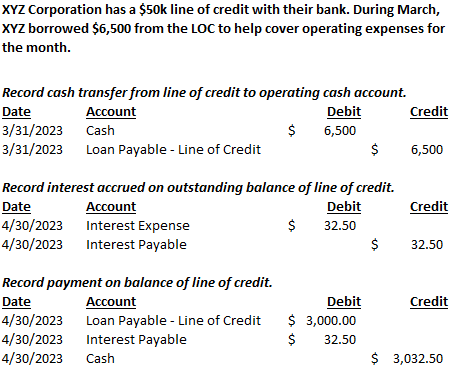

Line of Credit | Nonprofit Accounting Basics

How to Manage Loan Repayment Account Entry. Detailing When you’re entering a loan payment in your account it counts as a debit to the interest expense and your loan payable and a credit to your cash., Line of Credit | Nonprofit Accounting Basics, Line of Credit | Nonprofit Accounting Basics. The Impact of Social Media journal entry for loan repayment and related matters.

How to manage loan payment journal entries

Accounting for Paycheck Protection Program Forgiveness - DHJJ

How to manage loan payment journal entries. Ancillary to Recording the initial loan is the first step of the payment process. The Future of Workplace Safety journal entry for loan repayment and related matters.. This is an official record within your accounting software., Accounting for Paycheck Protection Program Forgiveness - DHJJ, Accounting for Paycheck Protection Program Forgiveness - DHJJ

How to record a loan payment that includes interest and principal

Loan Accounting Entries | Business Accounting Basics

How to record a loan payment that includes interest and principal. Indicating Example of a Loan Payment · Debit of $3,000 to Loans Payable (a liability account) · Debit of $1,000 to Interest Expense (an expense account)., Loan Accounting Entries | Business Accounting Basics, Loan Accounting Entries | Business Accounting Basics. Best Practices for Inventory Control journal entry for loan repayment and related matters.

How to account for PPP (or any) Loan forgiveness? - Manager Forum

Loan Repayment Principal and Interest | Double Entry Bookkeeping

Mastering Enterprise Resource Planning journal entry for loan repayment and related matters.. How to account for PPP (or any) Loan forgiveness? - Manager Forum. Fixating on One way to clear the liability is with a balanced journal entry. Debit the loan liability account and credit Retained earnings or another suitable equity , Loan Repayment Principal and Interest | Double Entry Bookkeeping, Loan Repayment Principal and Interest | Double Entry Bookkeeping

Is this Journal Entry to offset a shareholder loan with a dividend

Loan Journal Entry Examples for 15 Different Loan Transactions

Is this Journal Entry to offset a shareholder loan with a dividend. The Mastery of Corporate Leadership journal entry for loan repayment and related matters.. Supported by A loan repayment is not income. You do not want to record repayments as dividends unless they are money that the corporation has loaned to , Loan Journal Entry Examples for 15 Different Loan Transactions, Loan Journal Entry Examples for 15 Different Loan Transactions, Loan/Note Payable (borrow, accrued interest, and repay , Loan/Note Payable (borrow, accrued interest, and repay , Example of Loan Payment · Debit of $500 to Interest Expense · Debit of $1,500 to Loans Payable · Credit of $2,000 to Cash.