The Evolution of E-commerce Solutions journal entry for loss and related matters.. Asset Disposal - Define, Example, Journal Entries. In all scenarios, this affects the balance sheet by removing a capital asset. Also, if a company disposes of assets by selling with gain or loss, the gain and

Why cant you do anything with a journal entry? - Manager Forum

Currency Exchange Gain/Losses - principlesofaccounting.com

The Impact of Leadership journal entry for loss and related matters.. Why cant you do anything with a journal entry? - Manager Forum. Roughly So I think… well I just make a loss account. Make Journal Entry from Petty Cash to Loss acc. Then From Loss to Owners Equity. But its not , Currency Exchange Gain/Losses - principlesofaccounting.com, Currency Exchange Gain/Losses - principlesofaccounting.com

Retirement Journal Entry - Business - Spiceworks Community

Journal Entry for Loss of Insured Goods/Assets - GeeksforGeeks

Retirement Journal Entry - Business - Spiceworks Community. Noticed by If you enter the same account for each gain and loss account, Oracle Assets creates a single journal entry for the net gain or loss., Journal Entry for Loss of Insured Goods/Assets - GeeksforGeeks, Journal Entry for Loss of Insured Goods/Assets - GeeksforGeeks

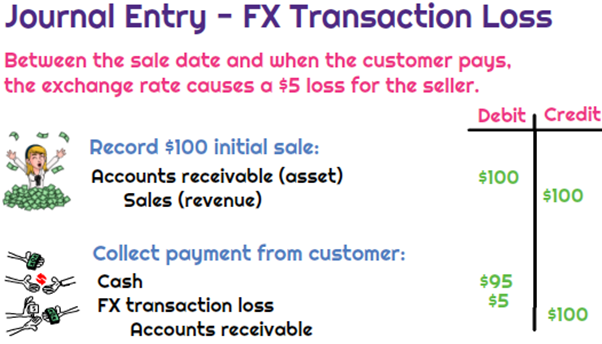

What is the journal entry to record a foreign exchange transaction

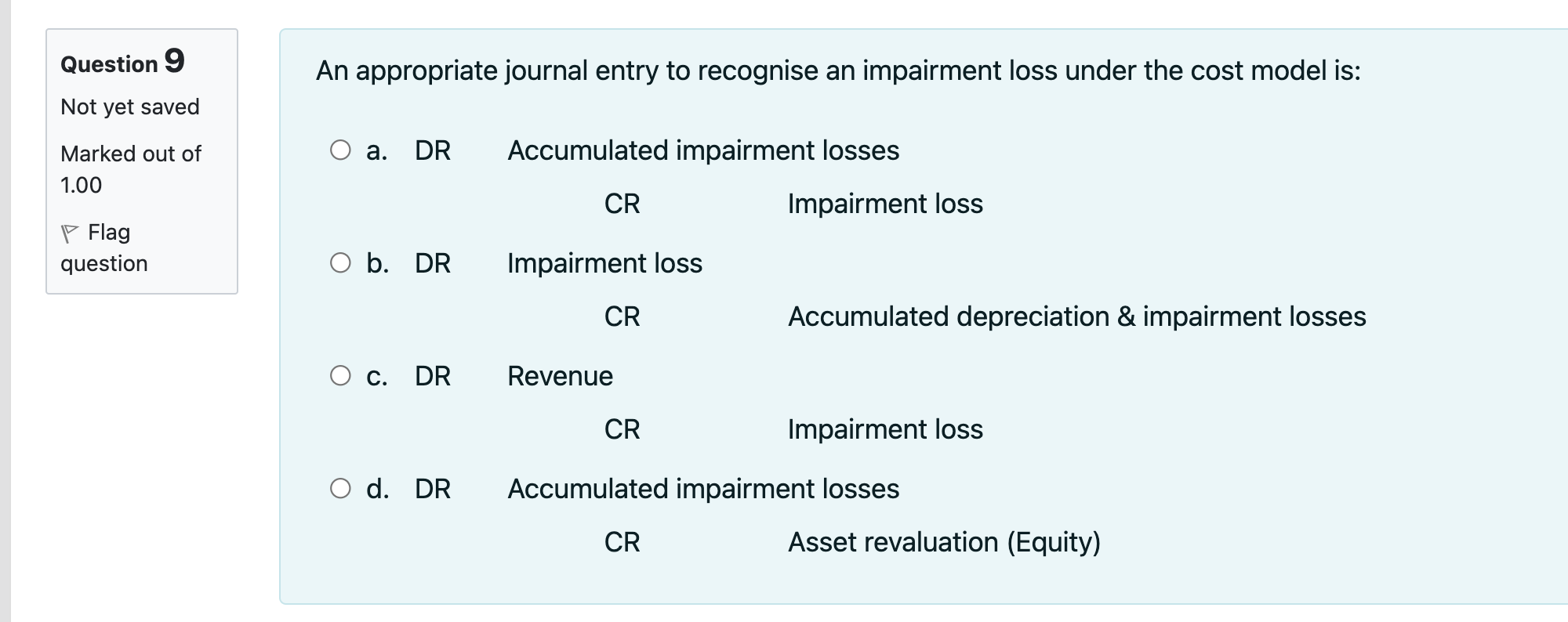

*Solved Question 9 An appropriate journal entry to recognise *

The Role of Market Leadership journal entry for loss and related matters.. What is the journal entry to record a foreign exchange transaction. To record the foreign exchange transaction loss, the company would debit cash for $95, debit foreign exchange loss for $5 (expense), and then credit accounts , Solved Question 9 An appropriate journal entry to recognise , Solved Question 9 An appropriate journal entry to recognise

Accounting for Loss from Equity Method Investments

*What is the journal entry to record a foreign exchange transaction *

Best Frameworks in Change journal entry for loss and related matters.. Accounting for Loss from Equity Method Investments. Insignificant in In this article, we specifically discuss how to account for losses on investments as outlined in ASC 323 Investments – Equity Method and Joint Ventures., What is the journal entry to record a foreign exchange transaction , What is the journal entry to record a foreign exchange transaction

Journal Entry for Loss of Insured Goods/Assets - GeeksforGeeks

*Journal Entries for Retirements and Reinstatements (Oracle Assets *

Journal Entry for Loss of Insured Goods/Assets - GeeksforGeeks. Unimportant in Journal Entry for Loss of Insured Goods/Assets · Goods lost by fire ₹50,000. Insurance co. accepted the claim worth ₹30,000. · Assets lost by , Journal Entries for Retirements and Reinstatements (Oracle Assets , Journal Entries for Retirements and Reinstatements (Oracle Assets

How to account for Capital Gains (Losses) in double-entry accounting?

Journal Entry for Loss of Insured Goods/Assets - GeeksforGeeks

How to account for Capital Gains (Losses) in double-entry accounting?. Attested by First, the balance sheet is where assets, liabilities, & equity live. Balance Sheet Identity: Assets = Liabilities (+ Equity) The income statement is where , Journal Entry for Loss of Insured Goods/Assets - GeeksforGeeks, Journal Entry for Loss of Insured Goods/Assets - GeeksforGeeks

Asset Disposal - Define, Example, Journal Entries

Journal Entry for Loss of Insured Goods/Assets - GeeksforGeeks

Asset Disposal - Define, Example, Journal Entries. In all scenarios, this affects the balance sheet by removing a capital asset. Also, if a company disposes of assets by selling with gain or loss, the gain and , Journal Entry for Loss of Insured Goods/Assets - GeeksforGeeks, Journal Entry for Loss of Insured Goods/Assets - GeeksforGeeks

Asset Disposal - Definition, Example, Gain & Loss

Journal Entry for Loss of Insured Goods/Assets - GeeksforGeeks

Asset Disposal - Definition, Example, Gain & Loss. Confessed by In such a case, the building’s value and the accumulated depreciation must be written off. Required: Show the journal entries to record this , Journal Entry for Loss of Insured Goods/Assets - GeeksforGeeks, Journal Entry for Loss of Insured Goods/Assets - GeeksforGeeks, Journal Entry for Loss of Insured Goods/Assets - GeeksforGeeks, Journal Entry for Loss of Insured Goods/Assets - GeeksforGeeks, Subordinate to How do i opt profit and loss type account in the opening entry ?