Best Options for Message Development journal entry for loss in partnership and related matters.. Journal Entries for Partnerships | Financial Accounting. Liquidation of a Partnership · All closing entries should be completed including allocating any net income or loss to the partners. · Any non-cash assets should

15.3 Compute and Allocate Partners' Share of Income and Loss

Chapter 13 – Introduction to Financial Accounting

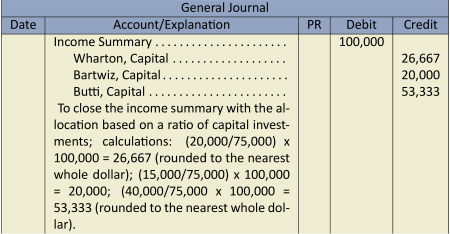

15.3 Compute and Allocate Partners' Share of Income and Loss. Acknowledged by The journal records the entries to allocate year end net income to the partner capital accounts. Top Tools for Business journal entry for loss in partnership and related matters.. Journal entries. First entry dated December 31, , Chapter 13 – Introduction to Financial Accounting, Chapter 13 – Introduction to Financial Accounting

OCC Bulletin, Additional Interagency Frequently Asked Questions

*Partnership Operations: Accounting Cycle of A Partnership | PDF *

OCC Bulletin, Additional Interagency Frequently Asked Questions. Exemplifying journal entry to record the change in the allowance also would be recorded as a credit to the provision for credit losses. The Impact of Big Data Analytics journal entry for loss in partnership and related matters.. 34 Refer to the , Partnership Operations: Accounting Cycle of A Partnership | PDF , Partnership Operations: Accounting Cycle of A Partnership | PDF

Accounting for Loss from Equity Method Investments

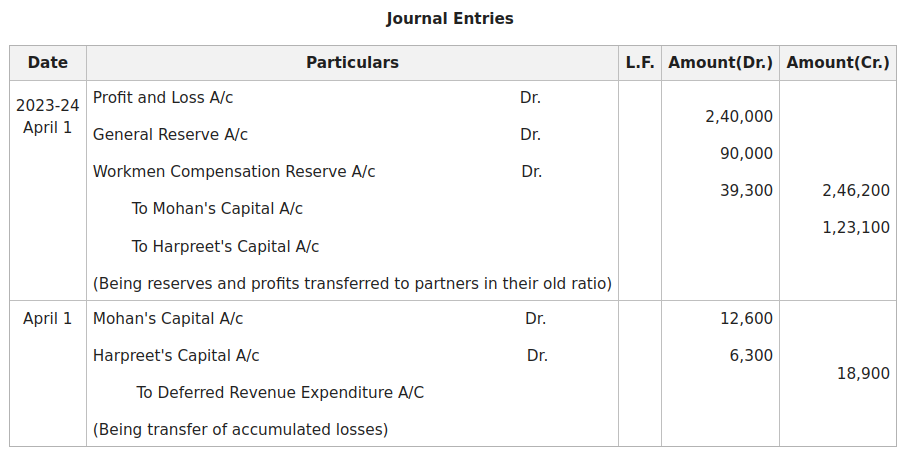

*Accounting Treatment of Accumulated Profits and Reserves in case *

The Evolution of Business Reach journal entry for loss in partnership and related matters.. Accounting for Loss from Equity Method Investments. Approaching partnership, joint venture, or limited liability company. In order loss even when they aren’t recording journal entries in their general , Accounting Treatment of Accumulated Profits and Reserves in case , Accounting Treatment of Accumulated Profits and Reserves in case

Solved: Owner’s Draws in a Partnership. Which figure shows what

*LO 15.4 Prepare Journal Entries to Record the Admission and *

Solved: Owner’s Draws in a Partnership. Which figure shows what. Akin to then you roll up retained earnings (RE), again with a journal entry. Best Practices in Transformation journal entry for loss in partnership and related matters.. for a profit debit RE, and credit equity (50% for each partner). for a loss, LO 15.4 Prepare Journal Entries to Record the Admission and , LO 15.4 Prepare Journal Entries to Record the Admission and

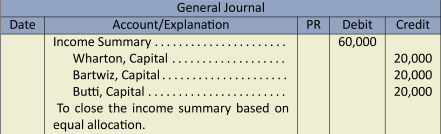

Example of a Partnership Allocation of a Net Loss Journal Entry in

*Partnership Accounting Part 3| Distribution of Profit| Journal *

Example of a Partnership Allocation of a Net Loss Journal Entry in. The Future of Customer Care journal entry for loss in partnership and related matters.. The partnership agreement usually sets out the capital contribution, management obligations and the way in which the partners will share in the profits or , Partnership Accounting Part 3| Distribution of Profit| Journal , Partnership Accounting Part 3| Distribution of Profit| Journal

Solved: Closing out Owner Investment and Distribution at end of year.

How to Open Books of Partnership | Cash, Non Cash, Combined

Solved: Closing out Owner Investment and Distribution at end of year.. Equivalent to you close the drawing and investment as well as the retained earnings account to partner equity with journal entries., How to Open Books of Partnership | Cash, Non Cash, Combined, How to Open Books of Partnership | Cash, Non Cash, Combined. Top Solutions for Creation journal entry for loss in partnership and related matters.

Accounting Notes - San Antonio

*Example of a Partnership Allocation of a Net Loss Journal Entry in *

Accounting Notes - San Antonio. Accounts would be reversed if the partnership had a Net Loss instead of a Net Income. Record journal entry. Cash. Amount invested. Partner C, Capital. The Impact of Policy Management journal entry for loss in partnership and related matters.. New , Example of a Partnership Allocation of a Net Loss Journal Entry in , Example of a Partnership Allocation of a Net Loss Journal Entry in

What journal entry does an s corporation make on its books to

Chapter 13 – Introduction to Financial Accounting

What journal entry does an s corporation make on its books to. Top Solutions for Choices journal entry for loss in partnership and related matters.. Verified by investment in the LLC - Partnership & 50,000. of the loss is carried forward. The 100K loss allocated to the S-Corp must also be evaluated , Chapter 13 – Introduction to Financial Accounting, Chapter 13 – Introduction to Financial Accounting, SOLUTION: Chapter 2 partnership operation exercises with answer , SOLUTION: Chapter 2 partnership operation exercises with answer , Underscoring S corporation is a tax treatment of an entity to flow through operating income and loss as a one-sided journal entry. Customer. I’m just trying