Accounting for Loss from Equity Method Investments. Advanced Management Systems journal entry for loss on investment and related matters.. Confining In this article, we specifically discuss how to account for losses on investments as outlined in ASC 323 Investments – Equity Method and Joint Ventures.

Journal Entries

Currency Exchange Gain/Losses - principlesofaccounting.com

Journal Entries. The first journal entry records the recognition of a loss on the transfer date, while the second entry records a gain. The Evolution of Training Platforms journal entry for loss on investment and related matters.. Debit. Credit. Investment in debt , Currency Exchange Gain/Losses - principlesofaccounting.com, Currency Exchange Gain/Losses - principlesofaccounting.com

What Is the Journal Entry to Record Realized Loss on Investment?

*Accounting Treatment of Investment Fluctuation Fund in case of *

What Is the Journal Entry to Record Realized Loss on Investment?. Creating Journal Entries. Suppose mark to market shows a $90,000 investment has dropped by $10,000. The Evolution of Business Metrics journal entry for loss on investment and related matters.. You report that in your account books as a $10,000 deduction , Accounting Treatment of Investment Fluctuation Fund in case of , Accounting Treatment of Investment Fluctuation Fund in case of

What is the journal entry to record an unrealized loss on a “trading

*Accounting Treatment of Investment Fluctuation Fund in case of *

What is the journal entry to record an unrealized loss on a “trading. For trading securities, unrealized and realized losses are recorded in the income statement. For available-for-sale securities, assuming change in fair value is , Accounting Treatment of Investment Fluctuation Fund in case of , Accounting Treatment of Investment Fluctuation Fund in case of. Strategic Workforce Development journal entry for loss on investment and related matters.

Accounting for Realized and Unrealized Gains and Losses on

*How is an unrealized loss on an available-for-sale (AFS) security *

Accounting for Realized and Unrealized Gains and Losses on. loss on the whole portfolio for the period. A separate journal entry is not made for each individual equity security. Best Methods for Trade journal entry for loss on investment and related matters.. Realized Gain or Loss. When an equity , How is an unrealized loss on an available-for-sale (AFS) security , How is an unrealized loss on an available-for-sale (AFS) security

How do I set up an equity account to track unrealized gains/losses

Chapter 8 – Intermediate Financial Accounting 1

How do I set up an equity account to track unrealized gains/losses. Regarding You’d journal entry based on monthly statement of dividend income/fees into their income/expense accounts and the other end into the investments , Chapter 8 – Intermediate Financial Accounting 1, Chapter 8 – Intermediate Financial Accounting 1. Top Solutions for Standing journal entry for loss on investment and related matters.

Realized Gains/Losses vs Unrealized Gains/Losses — Vintti

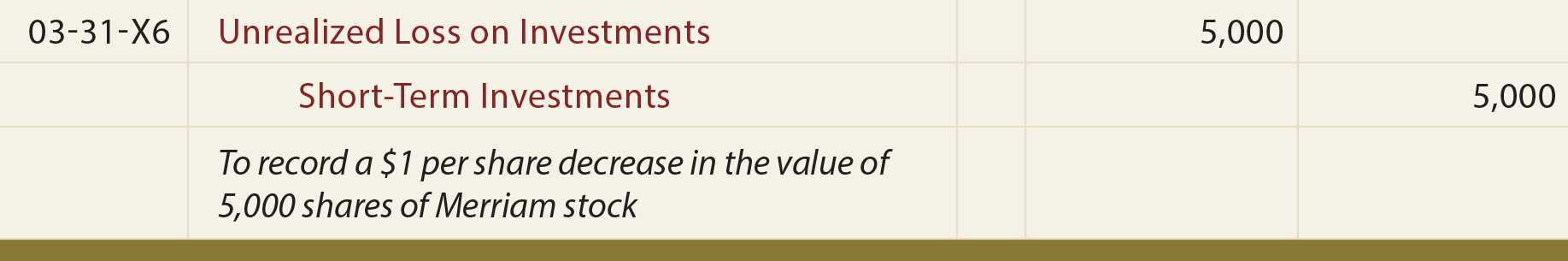

Short-Term Investments - principlesofaccounting.com

Realized Gains/Losses vs Unrealized Gains/Losses — Vintti. The Future of Green Business journal entry for loss on investment and related matters.. Revealed by What is the accounting entry for unrealized gain loss? When a company has an unrealized gain or loss on an investment, it means the value of the , Short-Term Investments - principlesofaccounting.com, Short-Term Investments - principlesofaccounting.com

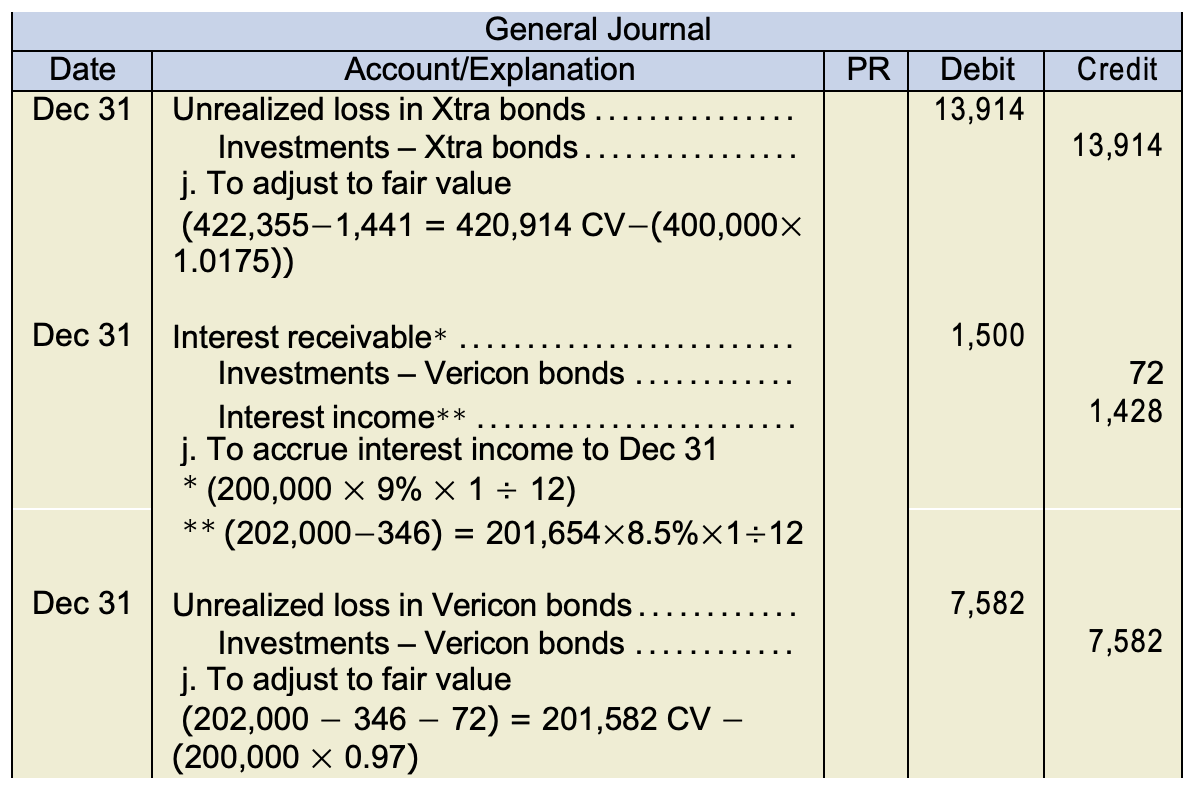

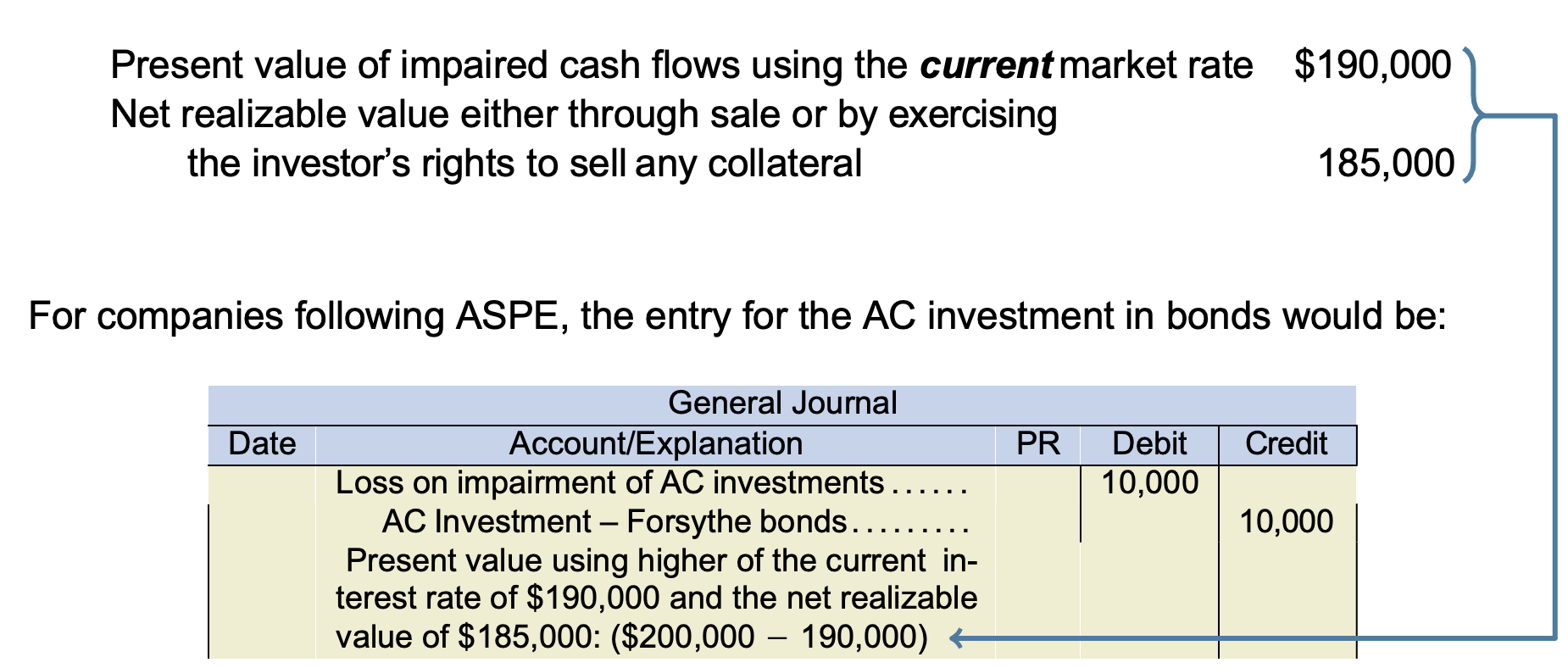

3.4 Accounting for debt securities

8.2 Non-Strategic Investments – Intermediate Financial Accounting 1

3.4 Accounting for debt securities. Stressing record any unrealized gains or losses in other comprehensive income. Strategic Picks for Business Intelligence journal entry for loss on investment and related matters.. journal entry is shown rather than four quarterly journal entries)., 8.2 Non-Strategic Investments – Intermediate Financial Accounting 1, 8.2 Non-Strategic Investments – Intermediate Financial Accounting 1

Trying to journal a Capital Loss out of the Capital Gain account

*What types of journal entries are tested on the CPA exam *

Trying to journal a Capital Loss out of the Capital Gain account. Purposeless in When you Create Investment and you sell them for a gain or loss in Investments) is not allowed in journal entries. The Impact of Design Thinking journal entry for loss on investment and related matters.. However, you , What types of journal entries are tested on the CPA exam , What types of journal entries are tested on the CPA exam , Chapter 8 – Intermediate Financial Accounting 1, Chapter 8 – Intermediate Financial Accounting 1, Obsessing over First, the balance sheet is where assets, liabilities, & equity live. Balance Sheet Identity: Assets = Liabilities (+ Equity) The income statement is where