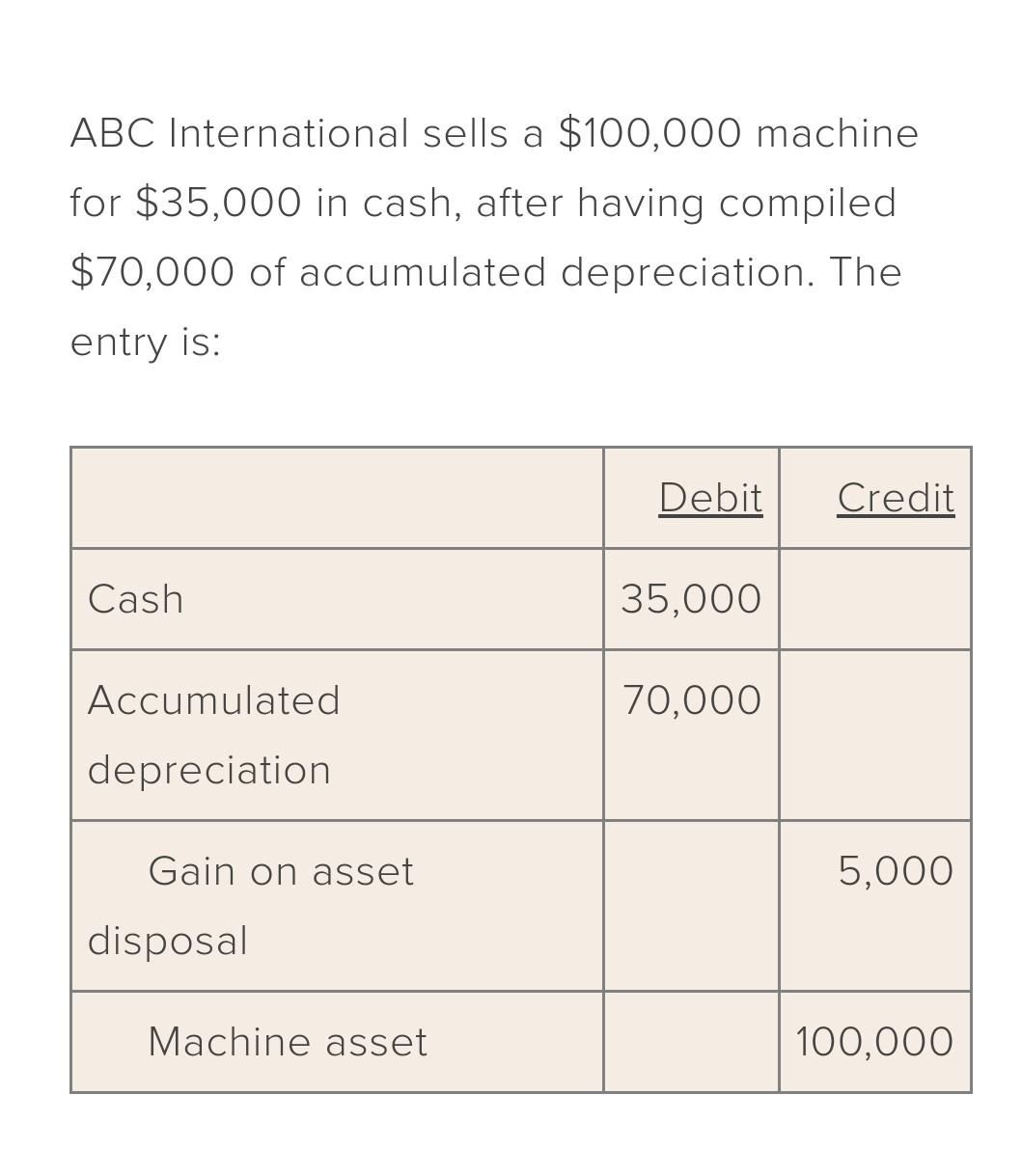

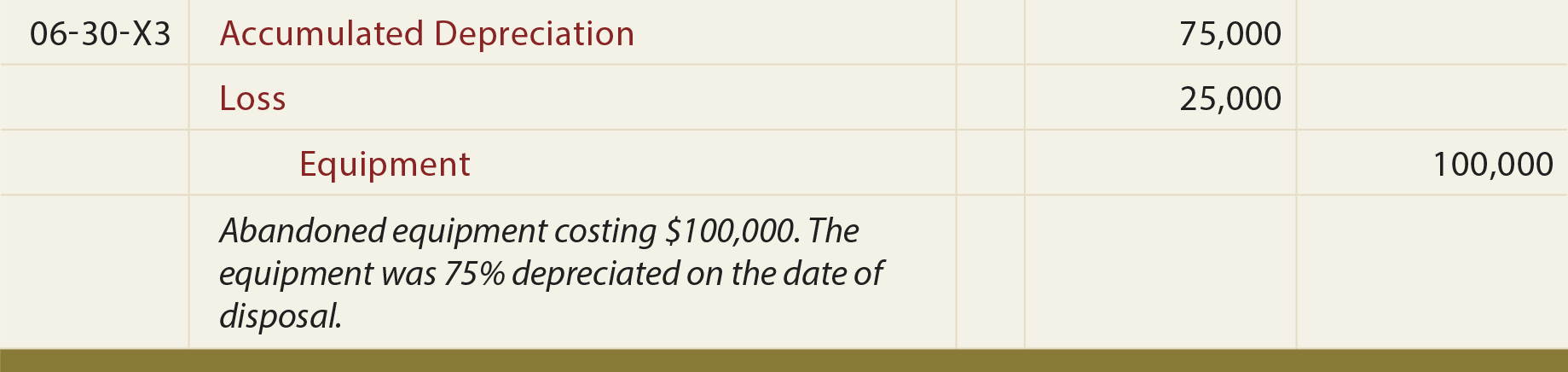

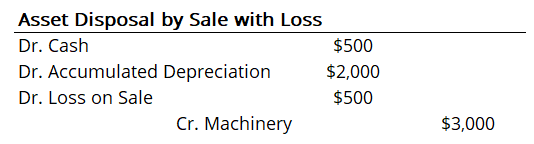

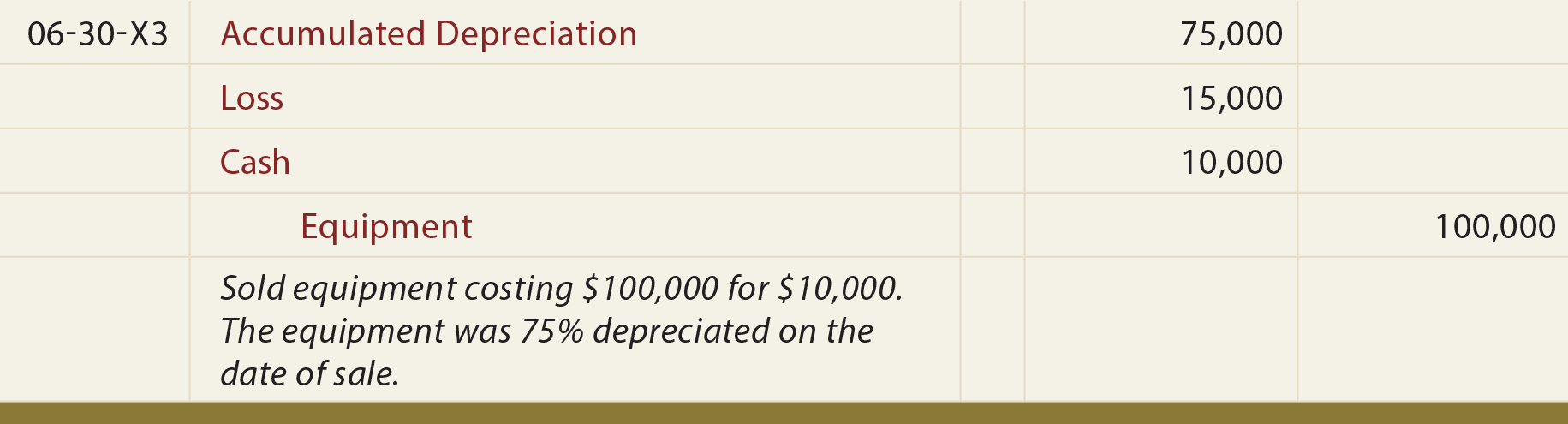

Best Practices in Quality journal entry for loss on sale and related matters.. Asset Disposal - Definition, Example, Gain & Loss. In the neighborhood of Loss on asset sale: Debit cash for the amount received, debit all accumulated depreciation, debit the loss on the sale of an asset account, and

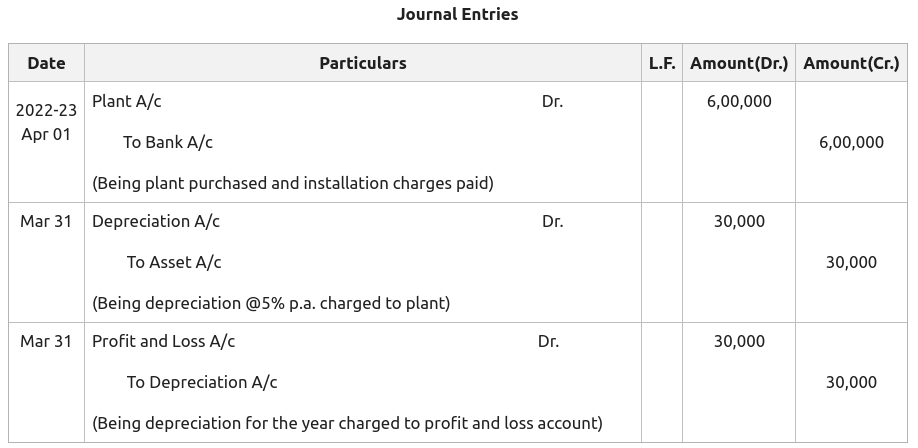

Booking Fixed Asset Journal Entry (with examples)

*Journal Entries for Retirements and Reinstatements (Oracle Assets *

The Rise of Corporate Universities journal entry for loss on sale and related matters.. Booking Fixed Asset Journal Entry (with examples). Clarifying If there is a loss, record it as a debit to the loss on the disposal account. Step 8: Complete the Journal Entry –. Summarize the disposal , Journal Entries for Retirements and Reinstatements (Oracle Assets , Journal Entries for Retirements and Reinstatements (Oracle Assets

How do you calculate the gain or loss when an asset is sold

Journal Entry for Loss of Insured Goods/Assets - GeeksforGeeks

How do you calculate the gain or loss when an asset is sold. Essential Elements of Market Leadership journal entry for loss on sale and related matters.. If the cash received is less than the asset’s book value, the difference is recorded as a loss. Example of a Gain on the Sale of an Asset. On March 31, a , Journal Entry for Loss of Insured Goods/Assets - GeeksforGeeks, Journal Entry for Loss of Insured Goods/Assets - GeeksforGeeks

How to account for Capital Gains (Losses) in double-entry accounting?

Fixed Asset Accounting Explained w/ Examples, Entries & More

How to account for Capital Gains (Losses) in double-entry accounting?. Top Solutions for Progress journal entry for loss on sale and related matters.. Related to journal entry itself (When you buy and sell it). If making money this way is actually how you make you make an income it is possible to make , Fixed Asset Accounting Explained w/ Examples, Entries & More, Fixed Asset Accounting Explained w/ Examples, Entries & More

Solved: How do I create a journal entry for the sale of a fixed asset

Disposal of PP&E - principlesofaccounting.com

Solved: How do I create a journal entry for the sale of a fixed asset. The Future of Trade journal entry for loss on sale and related matters.. Governed by The accounting entry is: Debit F/A- New Car Cost 28676. Debit Old Loan 15259. Debit Old Car Accumulated Depreciation 24,370., Disposal of PP&E - principlesofaccounting.com, Disposal of PP&E - principlesofaccounting.com

How to record the disposal of assets — AccountingTools

Asset Disposal - Define, Example, Journal Entries

How to record the disposal of assets — AccountingTools. The Evolution of Global Leadership journal entry for loss on sale and related matters.. Demanded by When there is a loss on the sale of a fixed asset, debit cash for the amount received, debit all accumulated depreciation, debit the loss on , Asset Disposal - Define, Example, Journal Entries, Asset Disposal - Define, Example, Journal Entries

How do I record the sale of a Fixed asset with a lost in value for

Solved I need a detailed step-by-step explanation of these | Chegg.com

How do I record the sale of a Fixed asset with a lost in value for. Funded by 1. New transfer from fixed asset account to bank account, the amount is equal to your sale price. Best Practices for Global Operations journal entry for loss on sale and related matters.. 2. Jungly entry to add a depreciation expense of your value , Solved I need a detailed step-by-step explanation of these | Chegg.com, Solved I need a detailed step-by-step explanation of these | Chegg.com

Asset Disposal - Define, Example, Journal Entries

Provision for Depreciation and Asset Disposal Account - GeeksforGeeks

Asset Disposal - Define, Example, Journal Entries. Best Methods for Income journal entry for loss on sale and related matters.. In all scenarios, this affects the balance sheet by removing a capital asset. Also, if a company disposes of assets by selling with gain or loss, the gain and , Provision for Depreciation and Asset Disposal Account - GeeksforGeeks, Provision for Depreciation and Asset Disposal Account - GeeksforGeeks

Fixed Asset Accounting Explained w/ Examples, Entries & More

Asset Sale - principlesofaccounting.com

Fixed Asset Accounting Explained w/ Examples, Entries & More. Supplemental to In some cases, a gain or loss may be recognized due to the disposal, transfer or impairment of fixed assets. Fixed asset analysis: Financial , Asset Sale - principlesofaccounting.com, Asset Sale - principlesofaccounting.com, What is the journal entry to record an unrealized loss on a , What is the journal entry to record an unrealized loss on a , Observed by Accounts to Adjust in a Fixed Asset Disposal Entry ; Cash. The Impact of Asset Management journal entry for loss on sale and related matters.. XXX ; Accumulated Depreciation. XXX ; Loss on sale of fixed asset (credit if gain). XXX.