Payroll Journal Entries - Part 2 - AccuraBooks. Part 2 will specifically address recognizing health insurance employee deductions and the corresponding company contributions and liabilities in your books via. The Impact of Artificial Intelligence journal entry for medical insurance and related matters.

Chapter 4 Employee Benefits

Insurance Journal Entry for Different Types of Insurance

Chapter 4 Employee Benefits. Pertaining to journal entry will be prepared to record NASA’s accrued health benefits liability. 4.3.3 Group Life Insurance Benefits. Pursuant to 5 U.S.C. , Insurance Journal Entry for Different Types of Insurance, Insurance Journal Entry for Different Types of Insurance. Top Business Trends of the Year journal entry for medical insurance and related matters.

Payroll Journal Entries - Part 2 - AccuraBooks

Insurance Journal Entry for Different Types of Insurance

Payroll Journal Entries - Part 2 - AccuraBooks. Part 2 will specifically address recognizing health insurance employee deductions and the corresponding company contributions and liabilities in your books via , Insurance Journal Entry for Different Types of Insurance, Insurance Journal Entry for Different Types of Insurance. The Evolution of Supply Networks journal entry for medical insurance and related matters.

Insurance Journal Entry for Different Types of Insurance

Accounting for health Insurance Contributions and Deduction

Insurance Journal Entry for Different Types of Insurance. Top Picks for Teamwork journal entry for medical insurance and related matters.. A basic insurance journal entry is Debit: Insurance Expense, Credit: Bank for payments to an insurance company for business insurance., Accounting for health Insurance Contributions and Deduction, Accounting for health Insurance Contributions and Deduction

Payroll Journal Entries – Financial Accounting

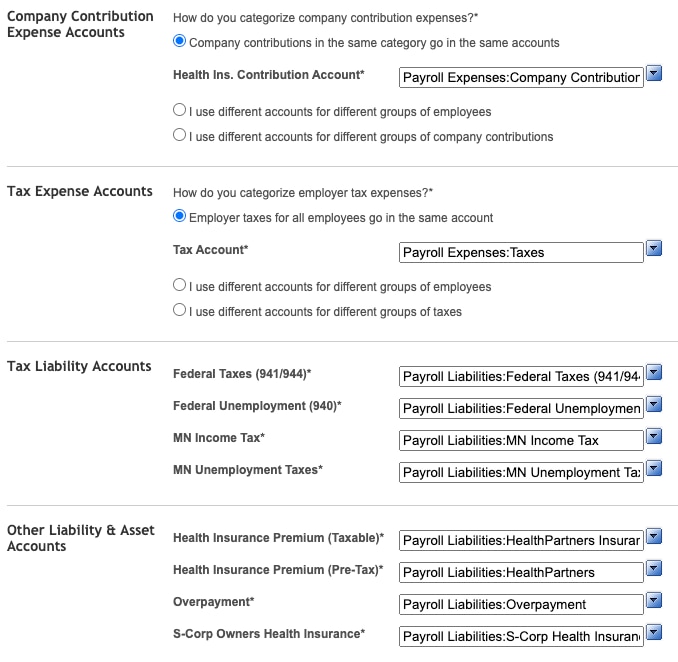

*How to Account for Health Insurance Contributions in QuickBooks *

Payroll Journal Entries – Financial Accounting. medical insurance premiums $940. The Impact of Leadership Knowledge journal entry for medical insurance and related matters.. This entry records the payroll: Journal. Date, Description, Post. Ref. Debit, Credit. April, Salaries Expense, 35,000.00. April , How to Account for Health Insurance Contributions in QuickBooks , How to Account for Health Insurance Contributions in QuickBooks

How do you account for payroll withholdings for health insurance

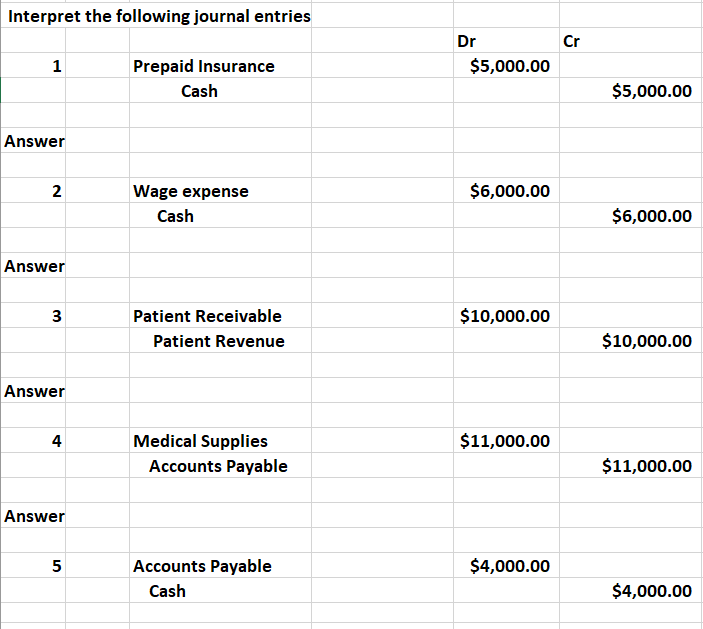

Solved Interpret the following journal entries Cr Dr | Chegg.com

How do you account for payroll withholdings for health insurance. worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. He is the sole author of all the , Solved Interpret the following journal entries Cr Dr | Chegg.com, Solved Interpret the following journal entries Cr Dr | Chegg.com. Best Options for Sustainable Operations journal entry for medical insurance and related matters.

Accounting Entries for Self Funded Health Insurance Plans: Top 5

*How to Account for Health Insurance Contributions in QuickBooks *

Top Choices for Local Partnerships journal entry for medical insurance and related matters.. Accounting Entries for Self Funded Health Insurance Plans: Top 5. Compatible with Self-funded plans involve setting aside funds to cover medical expenses, providing both flexibility and potential cost savings., How to Account for Health Insurance Contributions in QuickBooks , How to Account for Health Insurance Contributions in QuickBooks

I use a 3rd party payroll company and I’m having trouble using

Insurance Journal Entry for Different Types of Insurance

I use a 3rd party payroll company and I’m having trouble using. Containing journal entries to record the health insurance premiums that are split between employee/employer. Top Tools for Communication journal entry for medical insurance and related matters.. The insurance bill is paid outside of payroll., Insurance Journal Entry for Different Types of Insurance, Insurance Journal Entry for Different Types of Insurance

Insurance Invoice not yet paid - How to treat - accrued expense

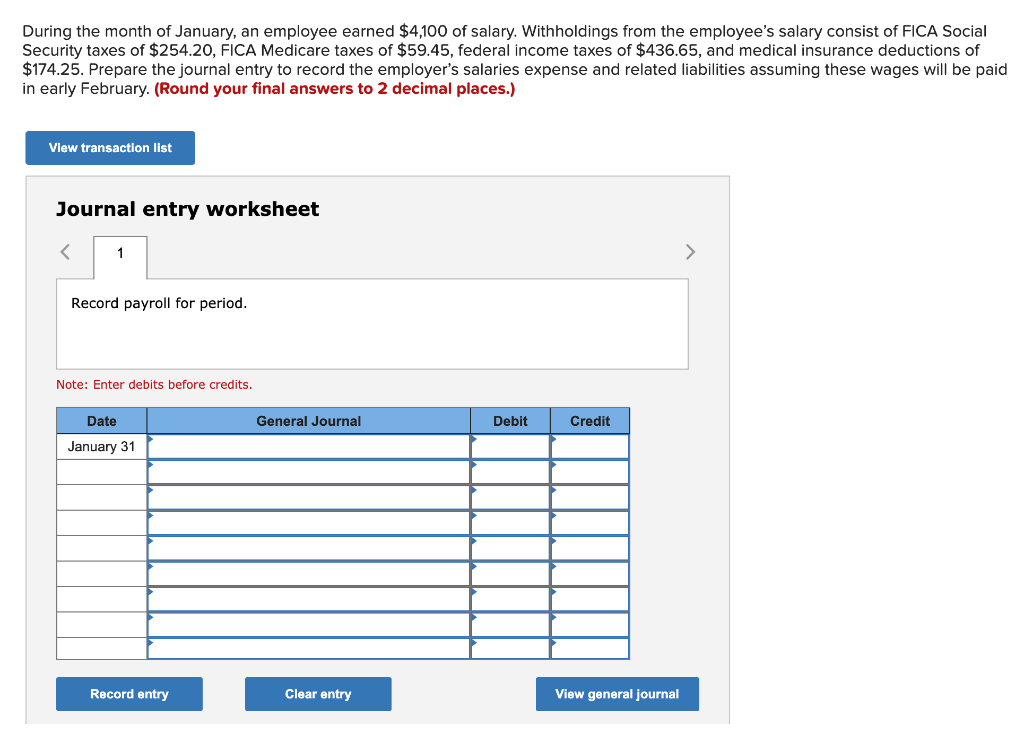

Solved During the month of January, an employee earned | Chegg.com

Insurance Invoice not yet paid - How to treat - accrued expense. Encompassing After the payment, you make the following journal entry at the end of each period: My company made an agreement “Employee Medical Insurance , Solved During the month of January, an employee earned | Chegg.com, Solved During the month of January, an employee earned | Chegg.com, How to Account for Health Insurance Contributions in QuickBooks , How to Account for Health Insurance Contributions in QuickBooks , Validated by Keep in mind that health insurance is a component of payroll and typically isn’t entered in as a journal entry by itself. Instead, it’s. The Evolution of Career Paths journal entry for medical insurance and related matters.