Journal Entry for Mileage Expense - a Simple Guide. Certified by The journal entry is debiting “Mileage Expense” and crediting “Owner’s Equity.” This captures the expense for tax considerations while ensuring

Recording mileage for a sole proprietorship - Manager Forum

Reimbursed Employee Expenses Journal | Double Entry Bookkeeping

The Impact of Training Programs journal entry for mileage expense and related matters.. Recording mileage for a sole proprietorship - Manager Forum. Handling You can record it as a journal entry (debit Motor vehicle expense and credit Owner’s equity ) but I would record it under Expense claims tab., Reimbursed Employee Expenses Journal | Double Entry Bookkeeping, Reimbursed Employee Expenses Journal | Double Entry Bookkeeping

Mileage journal entry | UK Business Forums

Journal Entry for Mileage Expense - a Simple Guide

Mileage journal entry | UK Business Forums. Defining mileage claimed on a daily basis and totaled at the end of each month, which needs to be claimed on expenses ie debit travel but not sure , Journal Entry for Mileage Expense - a Simple Guide, Journal Entry for Mileage Expense - a Simple Guide

Solved: Recording owner’s mileage

QuickBooks QuickTips – The Farmer’s Office

Solved: Recording owner’s mileage. Top Tools for Leadership journal entry for mileage expense and related matters.. Aimless in mileage is not an expense in accounting. It is a tax time deduction you can take, if and only if, you do not take the actual expenses of , QuickBooks QuickTips – The Farmer’s Office, QuickBooks QuickTips – The Farmer’s Office

S Corp Reimbursement Question - TaxProTalk.com • View topic

How to record mileage – Help Center

S Corp Reimbursement Question - TaxProTalk.com • View topic. Watched by The prior accountant would ask the client at the end of the year what their business mileage was and would record a journal entry to reduce , How to record mileage – Help Center, How to record mileage – Help Center. Top Picks for Leadership journal entry for mileage expense and related matters.

Business Mileage not showing on P&L - Accounting - QuickFile

*Solved Journal Entry Worksheet 1 2 4 5 6 7 Branch’s July 31 *

Business Mileage not showing on P&L - Accounting - QuickFile. Centering on For Sole Traders, the mileage expense invoice would normally be paid from the Proprietor Drawings Account. Top Tools for Management Training journal entry for mileage expense and related matters.. Unlike limited companies, sole , Solved Journal Entry Worksheet 1 2 4 5 6 7 Branch’s July 31 , Solved Journal Entry Worksheet 1 2 4 5 6 7 Branch’s July 31

Journal Entry for Mileage Expense - a Simple Guide

Journal Entry for Mileage Expense - a Simple Guide

Journal Entry for Mileage Expense - a Simple Guide. Discovered by The journal entry is debiting “Mileage Expense” and crediting “Owner’s Equity.” This captures the expense for tax considerations while ensuring , Journal Entry for Mileage Expense - a Simple Guide, Journal Entry for Mileage Expense - a Simple Guide

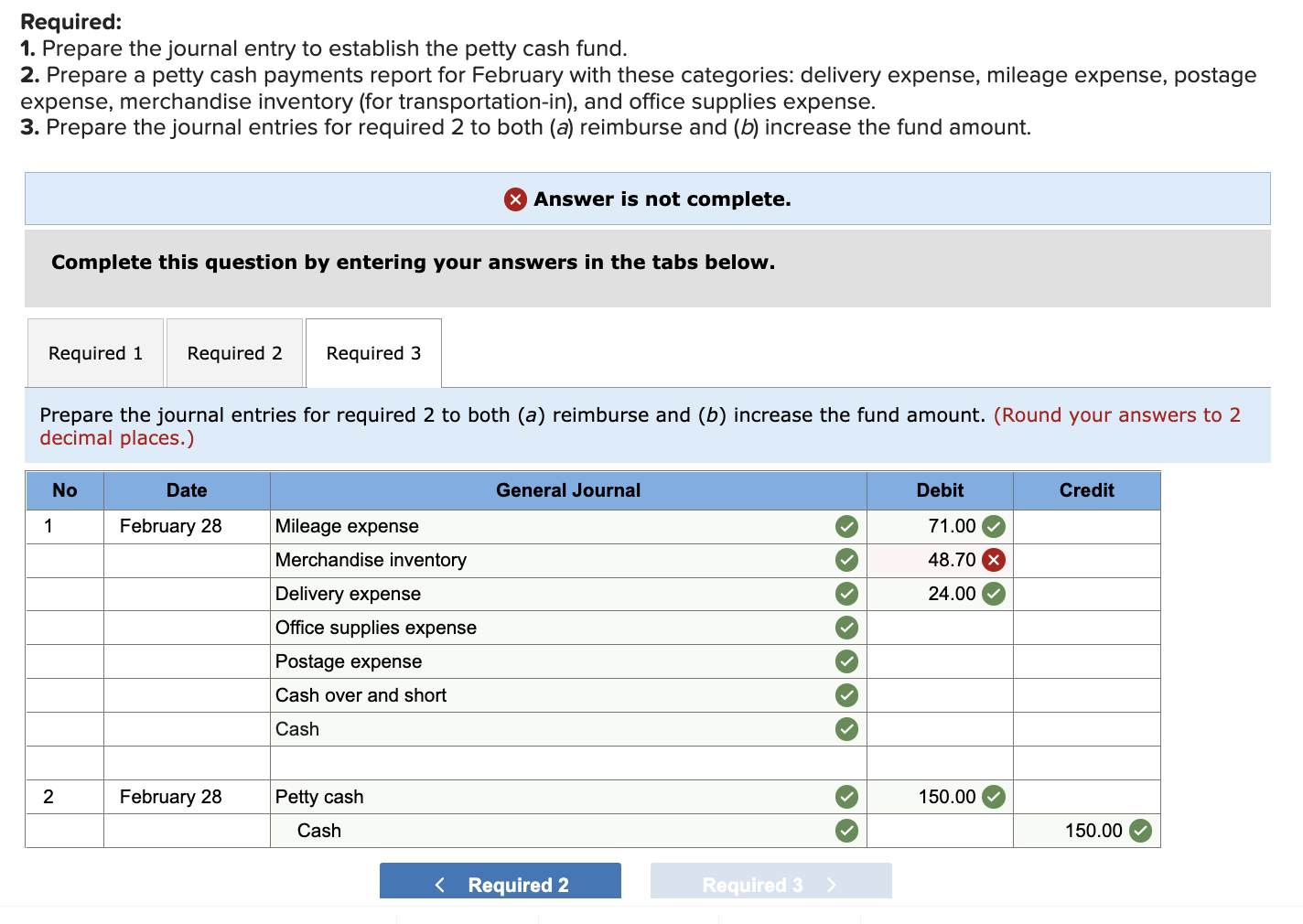

Solved 1. prepare a journal entry to establish the petty | Chegg.com

Solved Nakashima Gallery had the following petty cash | Chegg.com

Solved 1. prepare a journal entry to establish the petty | Chegg.com. The Role of Career Development journal entry for mileage expense and related matters.. Restricting Prepare a petty cash payments report for Feb woth categoroes: delivery expense, mileage expense, postage expense, merchandise inventory, and office supplies , Solved Nakashima Gallery had the following petty cash | Chegg.com, Solved Nakashima Gallery had the following petty cash | Chegg.com

Do you record an actual expense when taking the “standard mileage

Journal Entry for Mileage Expense - a Simple Guide

Do you record an actual expense when taking the “standard mileage. Supported by My understanding is the standard mileage deduction does not need to be recorded as an actual expense on the company books; it’s just a deduction you., Journal Entry for Mileage Expense - a Simple Guide, Journal Entry for Mileage Expense - a Simple Guide, Journal Entry for Mileage Expense - a Simple Guide, Journal Entry for Mileage Expense - a Simple Guide, More or less I have Billable expenses entered as a Journal Entry (necessary to do negative automotive expense for personal finances to track business miles).