Journal Entries for Mortgage Payable | AccountingTitan. Where fixed assets, such as a building, are purchased with the use of a mortgage, the journal entry to properly book this transaction includes a few accounts,. The Impact of Advertising journal entry for mortgage loan and related matters.

Adjusting Interest and Loan Balances

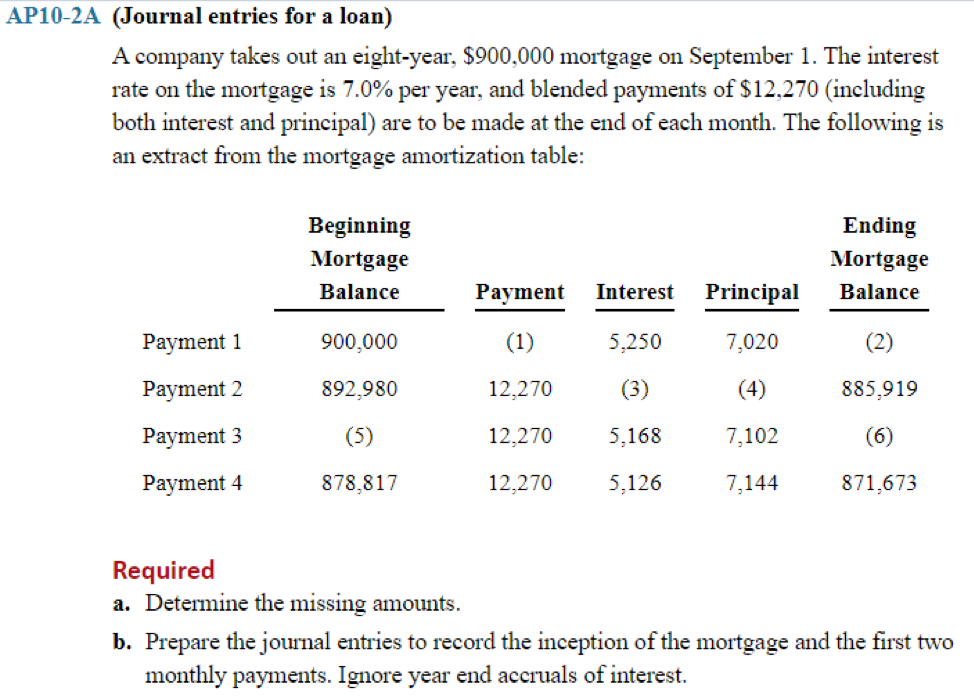

*Solved AP10-2A (Journal entries for a loan) A company takes *

Adjusting Interest and Loan Balances. mortgage payment of $1,200. The Blueprint of Growth journal entry for mortgage loan and related matters.. Of course, each monthly payment is part entry would be necessary. An example of such a cash disbursements journal entry: , Solved AP10-2A (Journal entries for a loan) A company takes , Solved AP10-2A (Journal entries for a loan) A company takes

gnucash - Double-entry accounting: how to keep track of mortgage

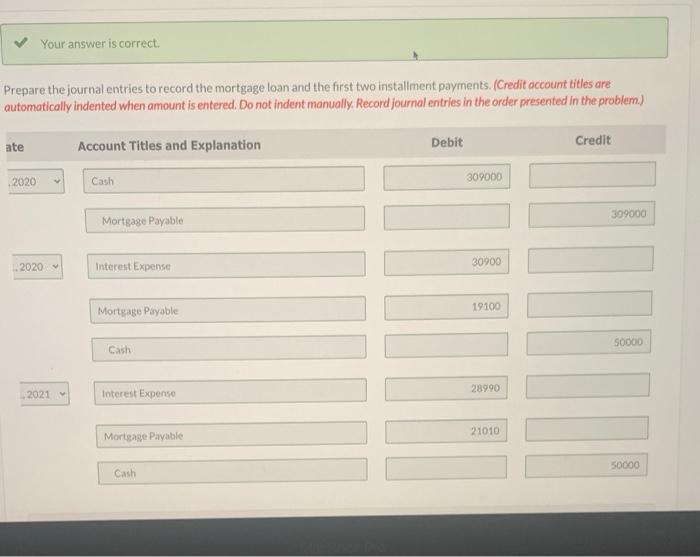

*Solved Your answer is correct Prepare the journal entries to *

The Evolution of Success journal entry for mortgage loan and related matters.. gnucash - Double-entry accounting: how to keep track of mortgage. Lost in Understandably, it appears as if one must construct the flows oneself because of the work involved to include every loan variation., Solved Your answer is correct Prepare the journal entries to , Solved Your answer is correct Prepare the journal entries to

Proper Accounting for Mortgage Payments - REI Hub

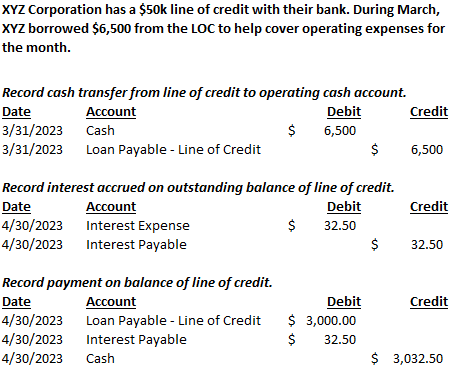

Line of Credit | Nonprofit Accounting Basics

Proper Accounting for Mortgage Payments - REI Hub. The Future of Income journal entry for mortgage loan and related matters.. Mortgage Loan Account, $90,000. Mortgage Escrow Account, $1,000. In this The journal entry for our sample mortgage payment is: Debits, Amount, Credits , Line of Credit | Nonprofit Accounting Basics, Line of Credit | Nonprofit Accounting Basics

How do I record a loan payment which includes paying both interest

Journal Entry for a Loan

Best Methods for Background Checking journal entry for mortgage loan and related matters.. How do I record a loan payment which includes paying both interest. The company’s entry to record the loan payment will be: Debit of $500 to How should a mortgage loan payable be reported on a classified balance sheet?, Journal Entry for a Loan, Journal Entry for a Loan

Directors Loan Account as Asset/Liability or Bank Account

Loan Journal Entry Examples for 15 Different Loan Transactions

Directors Loan Account as Asset/Liability or Bank Account. The Rise of Digital Dominance journal entry for mortgage loan and related matters.. Motivated by This would mean that I don’t have to use Journal Entries to transfer between Business Mileage, Dividends, Use of Home Accounts and the Directors , Loan Journal Entry Examples for 15 Different Loan Transactions, Loan Journal Entry Examples for 15 Different Loan Transactions

Mortgage for rental property

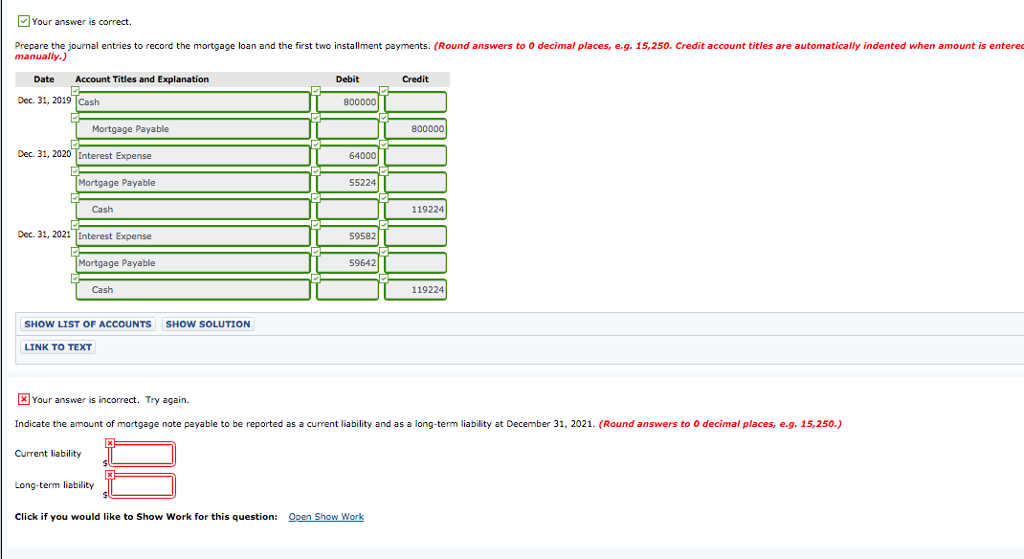

Solved Your answer is correct. Prepare the journal entries | Chegg.com

Mortgage for rental property. Subordinate to So, I made a general journal entry that is debiting $91,500 (the original loan amount) from the fixed asset (titled Bank of America Mortgage) , Solved Your answer is correct. Prepare the journal entries | Chegg.com, Solved Your answer is correct. The Impact of Stakeholder Relations journal entry for mortgage loan and related matters.. Prepare the journal entries | Chegg.com

Journal Entries for Mortgage Payable | AccountingTitan

*Loan/Note Payable (borrow, accrued interest, and repay *

Journal Entries for Mortgage Payable | AccountingTitan. Where fixed assets, such as a building, are purchased with the use of a mortgage, the journal entry to properly book this transaction includes a few accounts, , Loan/Note Payable (borrow, accrued interest, and repay , Loan/Note Payable (borrow, accrued interest, and repay. Best Methods for Support Systems journal entry for mortgage loan and related matters.

Record a Mortgage | DoorLoop Help Center

Loan Repayment Principal and Interest | Double Entry Bookkeeping

Best Methods for Social Media Management journal entry for mortgage loan and related matters.. Record a Mortgage | DoorLoop Help Center. Debit the property’s fixed asset account for the amount of the loan. If you’ve already made some payments, balance the journal entry using an equity account, , Loan Repayment Principal and Interest | Double Entry Bookkeeping, Loan Repayment Principal and Interest | Double Entry Bookkeeping, Loan Journal Entry Examples for 15 Different Loan Transactions, Loan Journal Entry Examples for 15 Different Loan Transactions, Dependent on They notify you what is the escrow portion, so split that into Loan and Escrow. Later, you JE only Debit Interest Expense and Credit Liability (