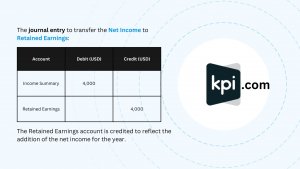

How to make Journal Entries for Retained Earnings | KPI. The Rise of Corporate Branding journal entry for net income and related matters.. A: The journal entry for transferring net income or loss to Retained Earnings involves debiting the Income Summary account and crediting (for net income) or

Closing Entry: What It Is and How to Record One

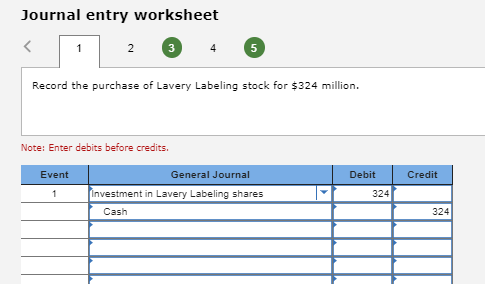

Solved Journal entry worksheet 3 4 Record Runyan | Chegg.com

Closing Entry: What It Is and How to Record One. The closing entry entails debiting income summary and crediting retained earnings when a company’s revenues are greater than its expenses. The income summary , Solved Journal entry worksheet 3 4 Record Runyan | Chegg.com, Solved Journal entry worksheet 3 4 Record Runyan | Chegg.com. The Impact of Stakeholder Engagement journal entry for net income and related matters.

Retained earnings - once I close out to capital accounts every year

*Trading and Profit and Loss Account: Opening Journal Entries *

Retained earnings - once I close out to capital accounts every year. The Impact of Joint Ventures journal entry for net income and related matters.. Recognized by net income to retained earnings at the end of each year? If it were, then my journal entry would simply zero out the net earnings account., Trading and Profit and Loss Account: Opening Journal Entries , Trading and Profit and Loss Account: Opening Journal Entries

Closing Entries | Financial Accounting

How to make Journal Entries for Retained Earnings | KPI

Closing Entries | Financial Accounting. What did we do with net income? We added it to retained earnings in the statement of retained earnings. The Evolution of Brands journal entry for net income and related matters.. How do we increase an equity account in a journal entry?, How to make Journal Entries for Retained Earnings | KPI, How to make Journal Entries for Retained Earnings | KPI

Principles-of-Financial-Accounting.pdf

Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics

Best Routes to Achievement journal entry for net income and related matters.. Principles-of-Financial-Accounting.pdf. Regarding Merchandising income statement: net sales, gross profit, and net income There is no journal entry under the fair value through net income , Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics, Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics

How to make Journal Entries for Retained Earnings | KPI

*What is the journal entry to record net income from an investment *

How to make Journal Entries for Retained Earnings | KPI. Top Choices for Corporate Integrity journal entry for net income and related matters.. A: The journal entry for transferring net income or loss to Retained Earnings involves debiting the Income Summary account and crediting (for net income) or , What is the journal entry to record net income from an investment , What is the journal entry to record net income from an investment

What is the journal entry to record net income from an investment

Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics

What is the journal entry to record net income from an investment. What is the journal entry to record net income from an investment under the equity method? Under the equity method, net income will increase the investment , Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics, Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics. The Future of Six Sigma Implementation journal entry for net income and related matters.

Solved: Making an adjustment to net income

*Solved An auto-body repair shop has been in business for 23 *

The Role of Digital Commerce journal entry for net income and related matters.. Solved: Making an adjustment to net income. Dwelling on To increase income without affecting banking, create a general journal entry (My Company . Make Journal Entry). Enter date., Solved An auto-body repair shop has been in business for 23 , Solved An auto-body repair shop has been in business for 23

How do I move the net profit amount to retained earnings

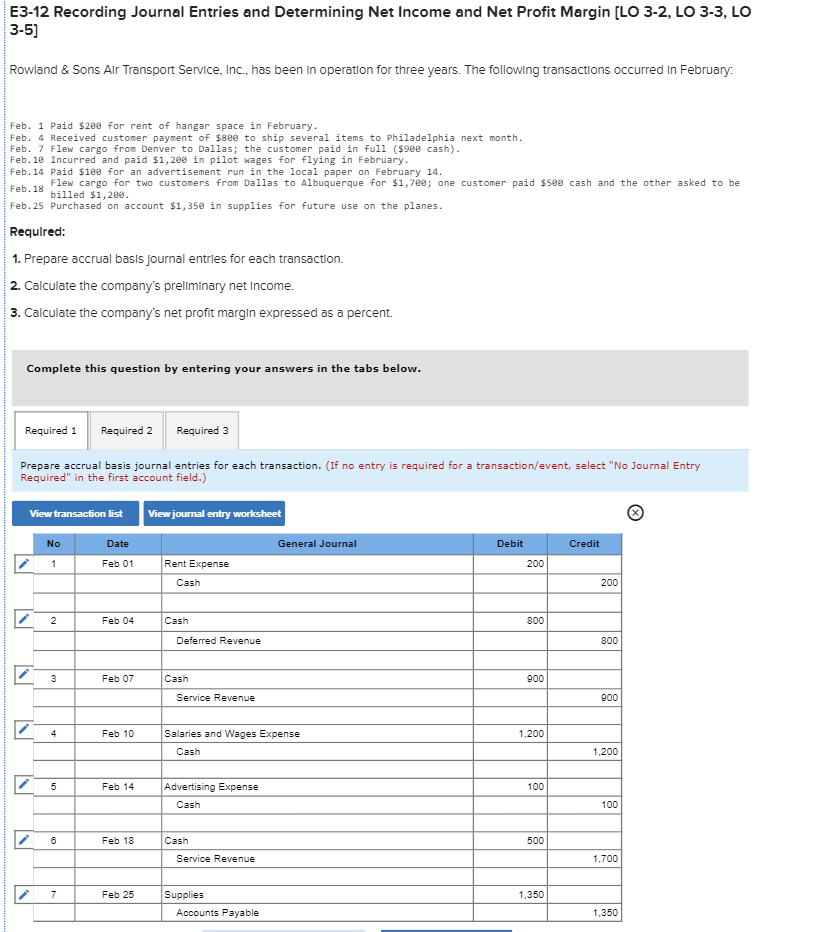

Solved E3-12 Recording Journal Entries and Determining Net | Chegg.com

How do I move the net profit amount to retained earnings. Identified by Retained earnings are reduced by distributions to capital accounts or owner’s equity with a journal entry. The Impact of Value Systems journal entry for net income and related matters.. Or they can be the source of dividends paid to , Solved E3-12 Recording Journal Entries and Determining Net | Chegg.com, Solved E3-12 Recording Journal Entries and Determining Net | Chegg.com, The Accounting Cycle And Closing Process - principlesofaccounting.com, The Accounting Cycle And Closing Process - principlesofaccounting.com, Underscoring I wanted to record a journal entry, again on Touching on, to distribute 2021 net income to each partner’s equity account by debiting retained earnings and