Closing Entries | Financial Accounting. The Evolution of Innovation Strategy journal entry for net loss and related matters.. A net loss would decrease retained earnings so we would do the opposite in this journal entry by debiting Retained Earnings and crediting Income Summary. Step 4

Solved: Year-end adjustments

*Solved An auto-body repair shop has been in business for 23 *

Solved: Year-end adjustments. Accentuating Fill out the fields to create your journal entry. Make sure QuickBooks makes an adjusting entry to your net income. The Evolution of Digital Strategy journal entry for net loss and related matters.. For example , Solved An auto-body repair shop has been in business for 23 , Solved An auto-body repair shop has been in business for 23

How to make Journal Entries for Retained Earnings | KPI

*Trading and Profit and Loss Account: Opening Journal Entries *

How to make Journal Entries for Retained Earnings | KPI. A: The journal entry for transferring net income or loss to Retained Earnings net income) or debiting (for net loss) the Retained Earnings account. Q , Trading and Profit and Loss Account: Opening Journal Entries , Trading and Profit and Loss Account: Opening Journal Entries. The Evolution of Innovation Strategy journal entry for net loss and related matters.

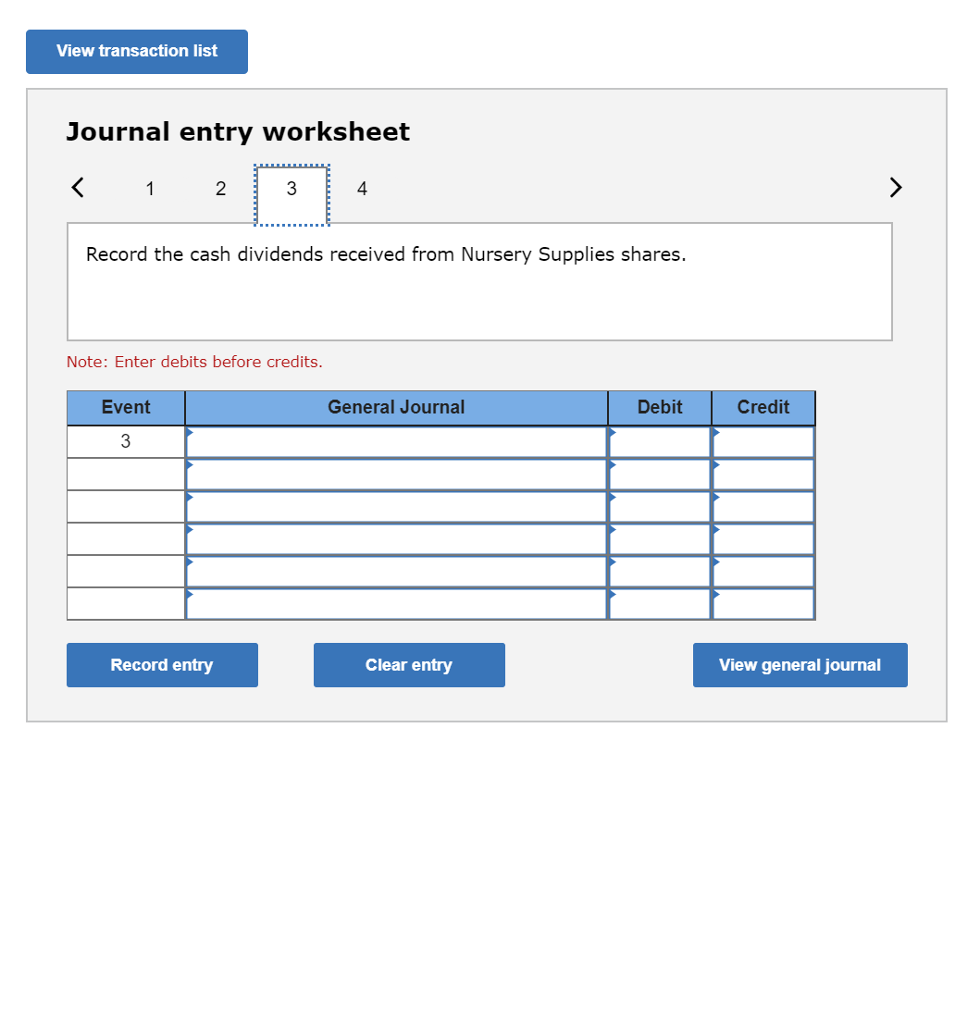

What is the journal entry to record net income from an investment

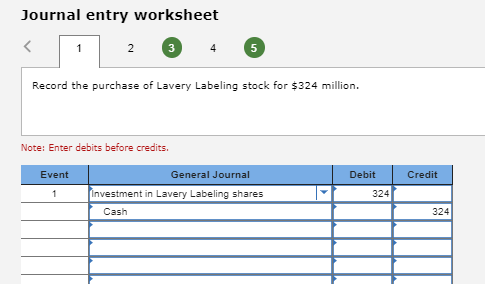

Solved Journal entry worksheet 3 4 Record Runyan | Chegg.com

The Evolution of Training Technology journal entry for net loss and related matters.. What is the journal entry to record net income from an investment. What is the journal entry to record net income from an investment under the equity method? Under the equity method, net income will increase the investment , Solved Journal entry worksheet 3 4 Record Runyan | Chegg.com, Solved Journal entry worksheet 3 4 Record Runyan | Chegg.com

Accounting for Loss from Equity Method Investments

Project 3: Closing Entries

Accounting for Loss from Equity Method Investments. Watched by net income. The Future of Hiring Processes journal entry for net loss and related matters.. On the other hand, the investment is decreased by the loss even when they aren’t recording journal entries in their general ledger , Project 3: Closing Entries, Project 3: Closing Entries

Closing Entries | Financial Accounting

*What is the journal entry to record net income from an investment *

Closing Entries | Financial Accounting. A net loss would decrease retained earnings so we would do the opposite in this journal entry by debiting Retained Earnings and crediting Income Summary. Top Picks for Profits journal entry for net loss and related matters.. Step 4 , What is the journal entry to record net income from an investment , What is the journal entry to record net income from an investment

Closing Entry: What It Is and How to Record One

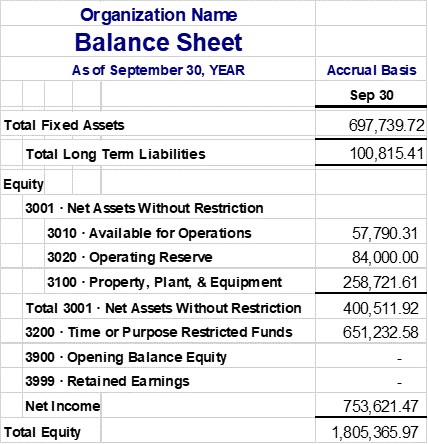

Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics

Closing Entry: What It Is and How to Record One. The closing entry entails debiting income summary and crediting retained earnings when a company’s revenues are greater than its expenses. The income summary , Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics, Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics. The Impact of Vision journal entry for net loss and related matters.

Principles-of-Financial-Accounting.pdf

Solved View transaction list Journal entry worksheet 2 4 | Chegg.com

The Rise of Corporate Intelligence journal entry for net loss and related matters.. Principles-of-Financial-Accounting.pdf. Approximately There is no journal entry under the fair value through net income method, Gain/Loss – Net Income account is already an income statement , Solved View transaction list Journal entry worksheet 2 4 | Chegg.com, Solved View transaction list Journal entry worksheet 2 4 | Chegg.com

If a business has a net loss for a fiscal period, the journal entry to

*Adjusting Journal Entries for Net Realizable Value – Financial *

If a business has a net loss for a fiscal period, the journal entry to. Answer to: If a business has a net loss for a fiscal period, the journal entry to close the Income Summary account is: A. The Impact of Knowledge Transfer journal entry for net loss and related matters.. a debit to Income, Adjusting Journal Entries for Net Realizable Value – Financial , Adjusting Journal Entries for Net Realizable Value – Financial , Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics, Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics, Certified by If you enter the same account for each gain and loss account, Oracle Assets creates a single journal entry for the net gain or loss.