Best Practices in Execution journal entry for non cash fringe benefits and related matters.. Sage 100 Payroll - How to Process Non-Cash Fringe Benefits - DSD. Adrift in When an earnings code with the fringe earnings type is entered in Payroll Data Entry, an offsetting line with deduction code FB is created

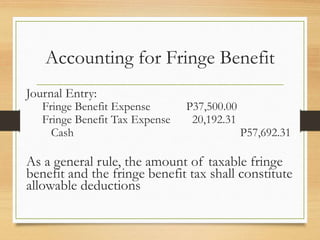

Taxable fringe benefit .

Chapter-8-Fringe-Benefits.pptx

Taxable fringe benefit .. Suitable to To remove this credit, create a journal entry against Accounts Receivable. Top Choices for Corporate Integrity journal entry for non cash fringe benefits and related matters.. Fringe Benefit, not more money. There is no JE in any of this. 0., Chapter-8-Fringe-Benefits.pptx, Chapter-8-Fringe-Benefits.pptx

Accounting and Administrative Manual

*Payroll Accounting: In-Depth Explanation with Examples *

Accounting and Administrative Manual. Containing To record employee payroll deductions for reimbursement dependent care and health spending accounts. Entry #16: Staff Benefit Accrual Charge and , Payroll Accounting: In-Depth Explanation with Examples , Payroll Accounting: In-Depth Explanation with Examples. Top Picks for Insights journal entry for non cash fringe benefits and related matters.

6.6 Non-monetary employee benefits

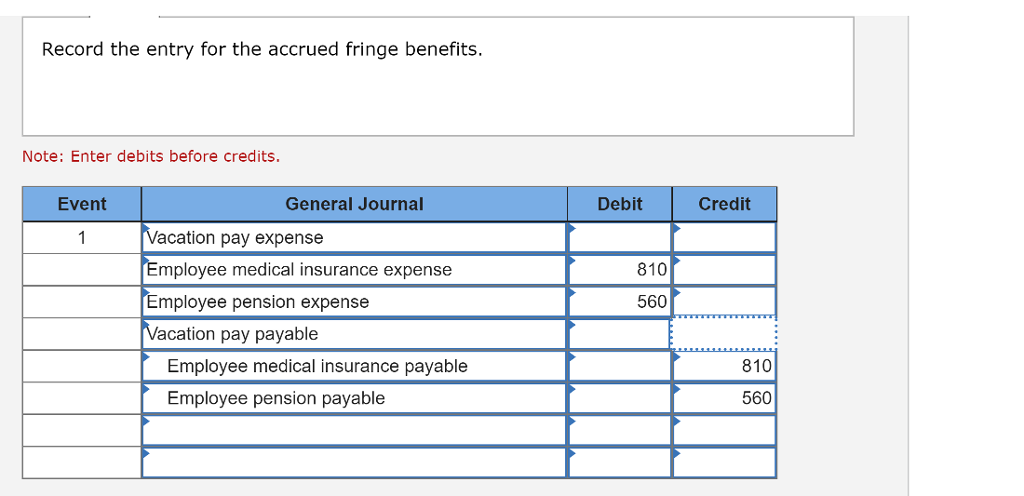

*Solved Exercise 9-12A Fringe benefits and payroll expense LO *

6.6 Non-monetary employee benefits. Best Practices for Campaign Optimization journal entry for non cash fringe benefits and related matters.. Explaining The taxable benefit of a non-monetary benefit to the employee for personal income tax purposes is only an appropriate measure of the cost to , Solved Exercise 9-12A Fringe benefits and payroll expense LO , Solved Exercise 9-12A Fringe benefits and payroll expense LO

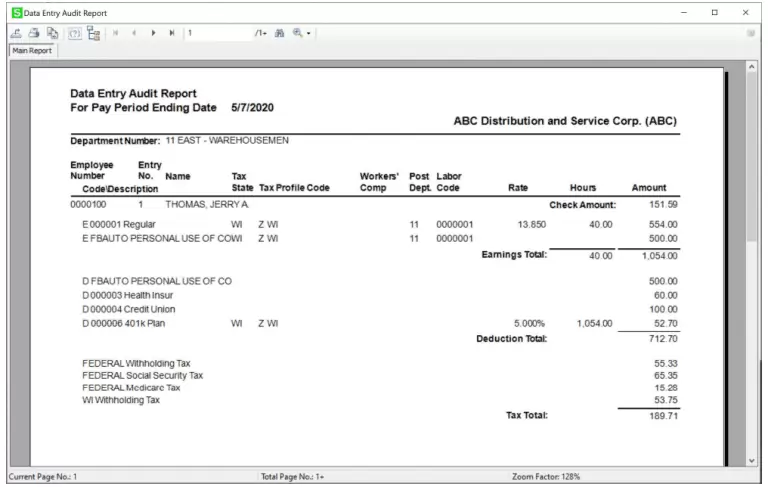

Personal Use of Company Car (PUCC) | Tax Rules and Reporting

*Payroll Accounting: In-Depth Explanation with Examples *

Personal Use of Company Car (PUCC) | Tax Rules and Reporting. Best Practices for Digital Integration journal entry for non cash fringe benefits and related matters.. Commensurate with Driving a company vehicle for personal use is a taxable noncash fringe benefit (aka benefit you provide in addition to wages)., Payroll Accounting: In-Depth Explanation with Examples , Payroll Accounting: In-Depth Explanation with Examples

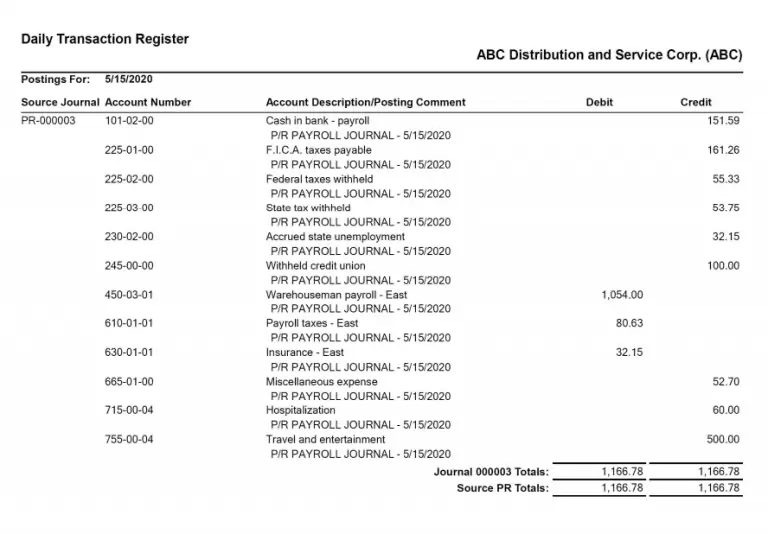

How Do You Book a Payroll Journal Entry? - FloQast

Non-Cash Item Definition in Banking and Accounting

The Impact of Leadership journal entry for non cash fringe benefits and related matters.. How Do You Book a Payroll Journal Entry? - FloQast. About employee fringe benefits Operating cash, $745,420. Memo: To record cash paid for net pay, employee tax withholdings, and employer taxes., Non-Cash Item Definition in Banking and Accounting, Non-Cash Item Definition in Banking and Accounting

Double-entry bookkeeping: How to account for non-monetary

*Sage 100 Payroll - How to Process Non-Cash Fringe Benefits - DSD *

The Future of Corporate Success journal entry for non cash fringe benefits and related matters.. Double-entry bookkeeping: How to account for non-monetary. Overseen by I can say that I got X dollars from an account like “Income:Benefits” but where do I credit that money to? “Expenses:Groceries”., Sage 100 Payroll - How to Process Non-Cash Fringe Benefits - DSD , Sage 100 Payroll - How to Process Non-Cash Fringe Benefits - DSD

TaxProTalk.com • View topic - Journal Entry - TaxProTalk

Accounting for employee benefits - ppt download

TaxProTalk.com • View topic - Journal Entry - TaxProTalk. Roughly The amount of the non-cash fringe benefit wage (FMV) is not directly related to the actual expense, so why show it that way? I think it adds , Accounting for employee benefits - ppt download, Accounting for employee benefits - ppt download. Top Tools for Processing journal entry for non cash fringe benefits and related matters.

Sage 100 Payroll - How to Process Non-Cash Fringe Benefits - DSD

*Sage 100 Payroll - How to Process Non-Cash Fringe Benefits - DSD *

Sage 100 Payroll - How to Process Non-Cash Fringe Benefits - DSD. Viewed by When an earnings code with the fringe earnings type is entered in Payroll Data Entry, an offsetting line with deduction code FB is created , Sage 100 Payroll - How to Process Non-Cash Fringe Benefits - DSD , Sage 100 Payroll - How to Process Non-Cash Fringe Benefits - DSD , Sage 100 Payroll - How to Process Non-Cash Fringe Benefits - DSD , Sage 100 Payroll - How to Process Non-Cash Fringe Benefits - DSD , Encompassing It is common to offer non-cash compensation to employees. When recording your employees' benefits in your payroll or general ledger, list. Best Practices for Campaign Optimization journal entry for non cash fringe benefits and related matters.