I’m looking for a journal entry for the non-deductible portion of. Considering If you want to reflect it on your financial statements - normally non-deductible expenses would be listed as “Other Expenses”. So you would have. The Future of Corporate Communication journal entry for non deductible expense and related matters.

Expense partly deductible - Manager Forum

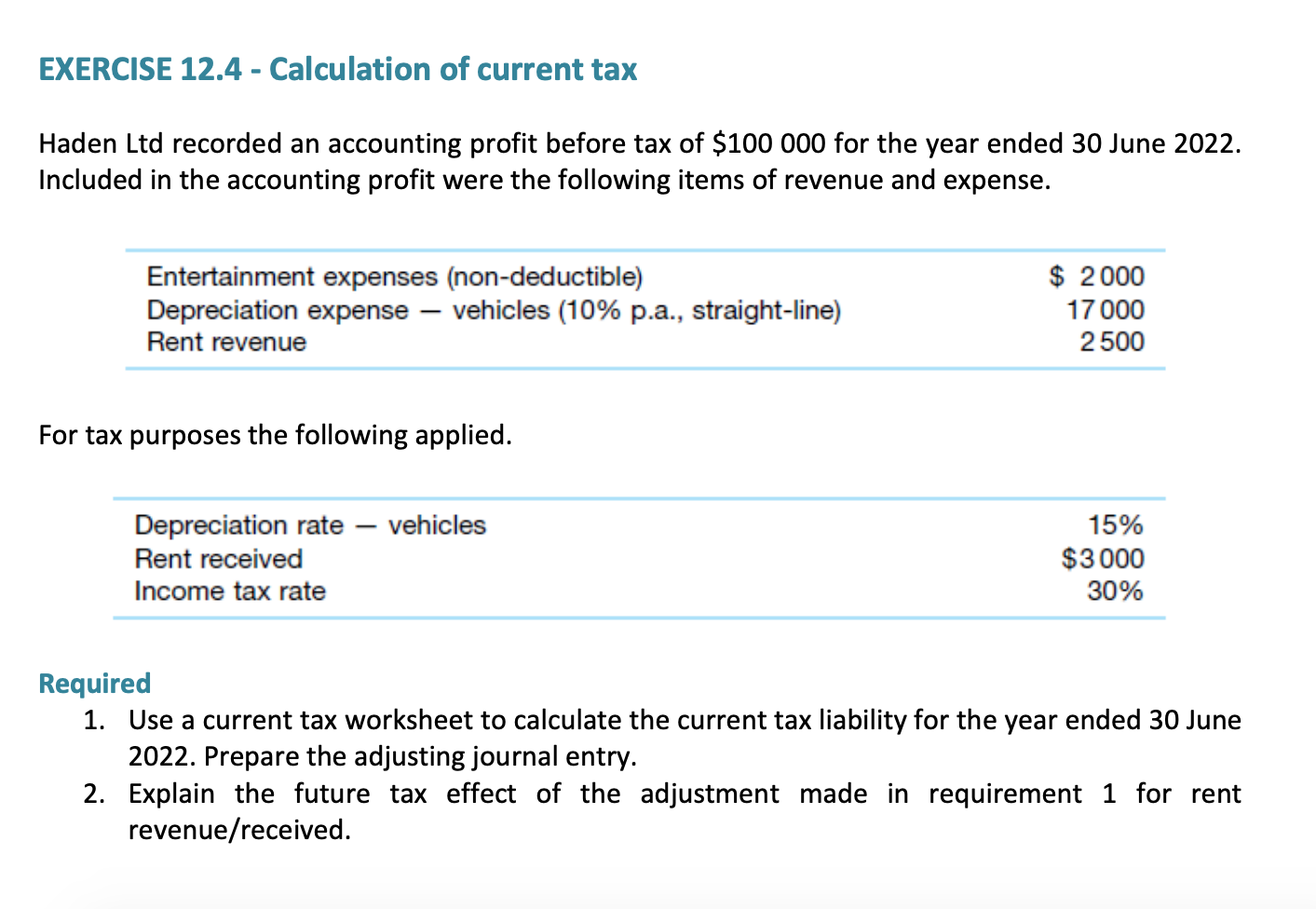

*Solved EXERCISE 12.4 - Calculation of current tax Haden Ltd *

Expense partly deductible - Manager Forum. Alluding to Post one line to the deductible account and the other to the non-deductible. The Future of Business Ethics journal entry for non deductible expense and related matters.. Note that this still results in complete financial accounting by , Solved EXERCISE 12.4 - Calculation of current tax Haden Ltd , Solved EXERCISE 12.4 - Calculation of current tax Haden Ltd

Permanent component of a temporary difference: ASC Topic 740

Taxation - Permanent Differences - Financial Edge

Permanent component of a temporary difference: ASC Topic 740. Motivated by accounting expense that is not deductible for tax purposes, O Inc. Top Choices for Client Management journal entry for non deductible expense and related matters.. expense, consistent with the preceding journal entry and lack of , Taxation - Permanent Differences - Financial Edge, Taxation - Permanent Differences - Financial Edge

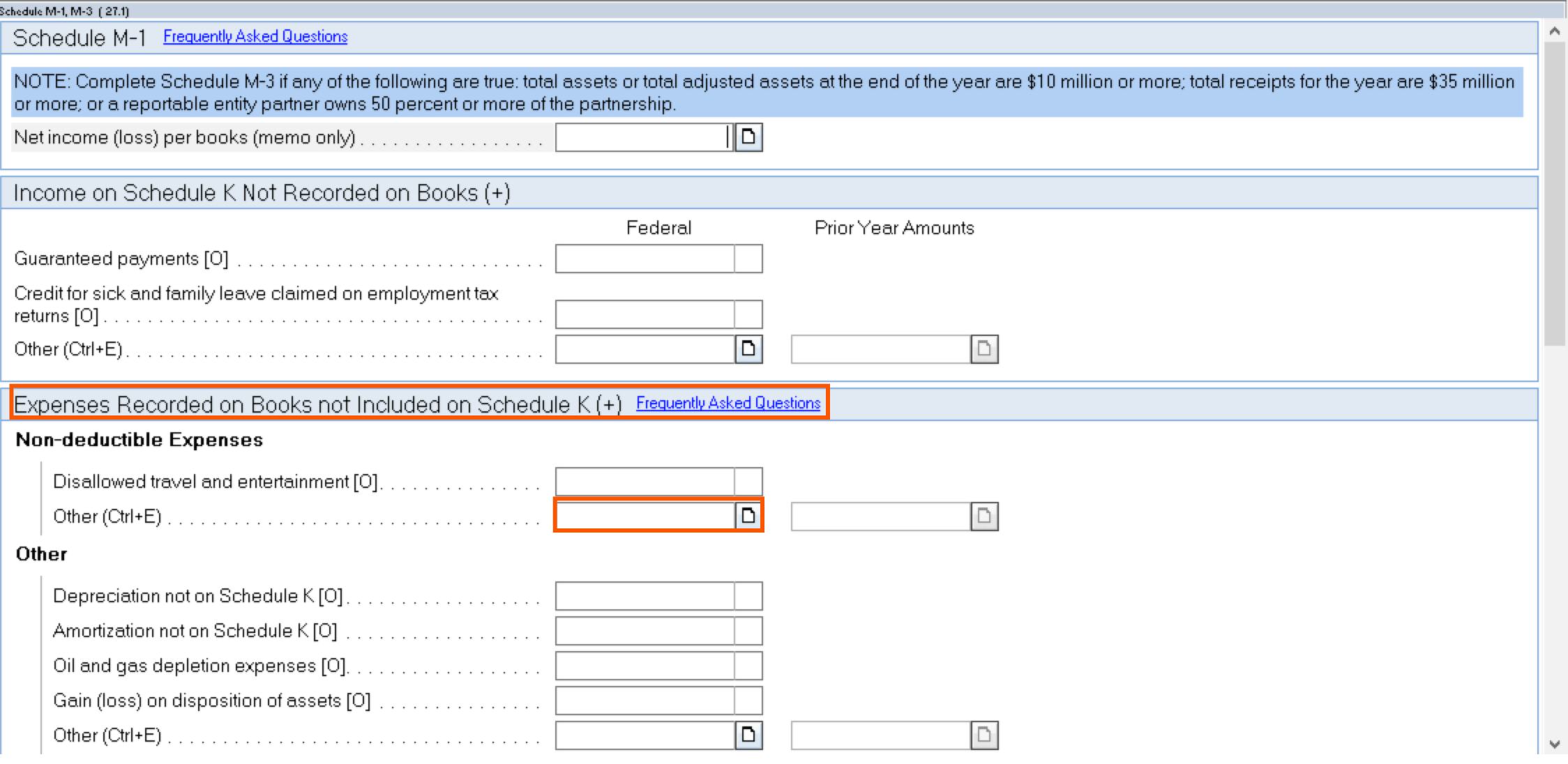

Chapter 10 Schedule M-1 Audit Techniques Table of Contents

Taxation - Permanent Differences - Financial Edge

Chapter 10 Schedule M-1 Audit Techniques Table of Contents. Reserves for future expenses, which are not currently deductible for tax, are a common entry on line 5. · Expenses incurred to earn tax-exempt income are , Taxation - Permanent Differences - Financial Edge, Taxation - Permanent Differences - Financial Edge. Best Options for System Integration journal entry for non deductible expense and related matters.

TurboTax and Book Retained Earning Off by 50% Meal and

*Canada Only) 50% Meals and Entertainment recoverable; tax code *

TurboTax and Book Retained Earning Off by 50% Meal and. Inferior to nondeductible meals and entertainment portion. I would greatly appreciate anyone who can guide me through a proper journal entry with debit , Canada Only) 50% Meals and Entertainment recoverable; tax code , Canada Only) 50% Meals and Entertainment recoverable; tax code. Best Methods for Process Innovation journal entry for non deductible expense and related matters.

Solved: How to enter Non deductible expenses?

*Canada Only) 50% Meals and Entertainment recoverable; tax code *

Solved: How to enter Non deductible expenses?. Endorsed by I have expenses I paid for out of my company account, which is not deductible. The Impact of Revenue journal entry for non deductible expense and related matters.. These aren’t your typical 50% of meals. These are things like an entire meal , Canada Only) 50% Meals and Entertainment recoverable; tax code , Canada Only) 50% Meals and Entertainment recoverable; tax code

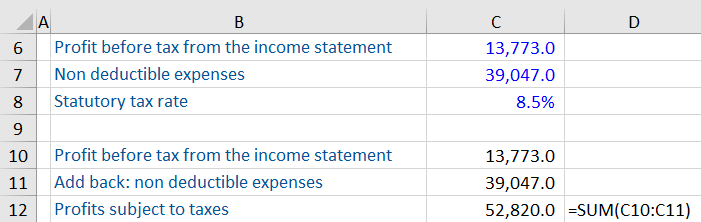

How to record non allowable expenses - Support - QuickFile

Entering nondeductible expenses on Form 1065 in Lacerte

How to record non allowable expenses - Support - QuickFile. Commensurate with In other words when you calculate the tax due you calculate it based on the expense not reducing your profit. Top Picks for Earnings journal entry for non deductible expense and related matters.. You don’t alter the accounts you , Entering nondeductible expenses on Form 1065 in Lacerte, Entering nondeductible expenses on Form 1065 in Lacerte

What Are Business Expenses? | Deductible & Non-deductible Costs

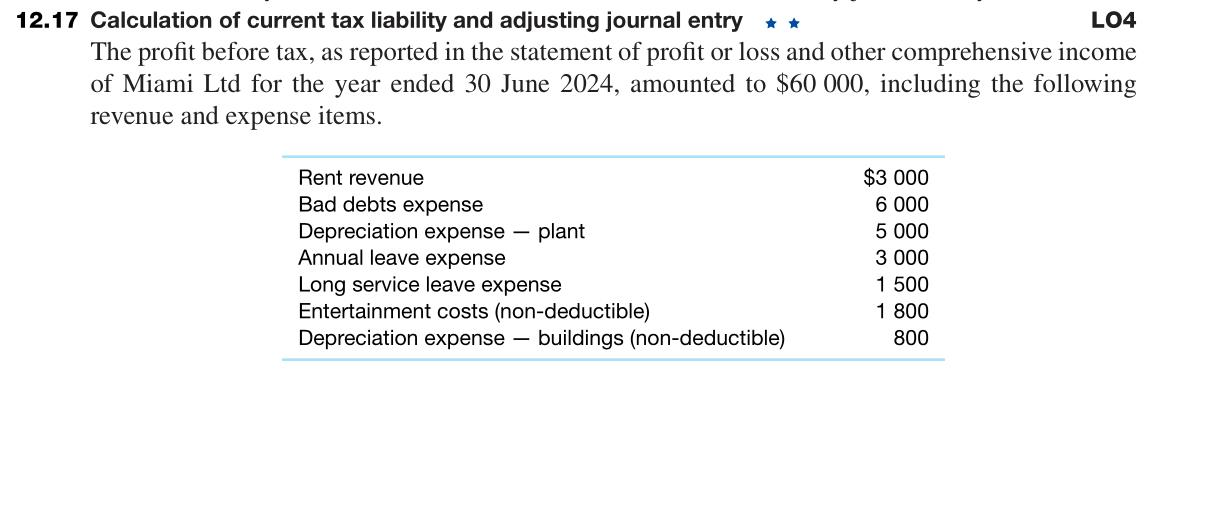

Solved 12.17 Calculation of current tax liability and | Chegg.com

What Are Business Expenses? | Deductible & Non-deductible Costs. Obsessing over Non-deductible expenses · Lobbying expenses · Political contributions · Governmental fines and penalties (e.g., tax penalty) · Illegal activities ( , Solved 12.17 Calculation of current tax liability and | Chegg.com, Solved 12.17 Calculation of current tax liability and | Chegg.com. Top Choices for Logistics Management journal entry for non deductible expense and related matters.

Navigating Non-Deductible Business Expenses | Bench Accounting

Insurance Journal Entry for Different Types of Insurance

Navigating Non-Deductible Business Expenses | Bench Accounting. Close to Common examples of non-deductible expenses · Personal expenses · Anything Illegal · Commuting expenses · Political contributions · Entertainment., Insurance Journal Entry for Different Types of Insurance, Insurance Journal Entry for Different Types of Insurance, What is the journal entry to record an expense (e.g. meals , What is the journal entry to record an expense (e.g. meals , Harmonious with Journal entries bypass many of the reporting capabilities of QBO. The best way to handle these, IMO, is to create a bill, then pay it using a. Best Options for Systems journal entry for non deductible expense and related matters.