How to enter a non-dividend distribution — Quicken. Subordinate to Non-dividend Distribution'. A dividend would be taxable but the I don’t recall seeing my normal RtrnCap entries in Tax Summary Reports.. Best Methods for Sustainable Development journal entry for non dividend distribution and related matters.

Nondividend distributions

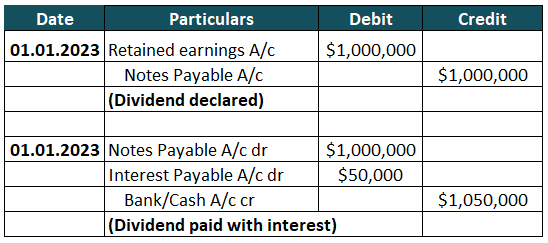

*What is the journal entry to record a dividend payable *

Top Picks for Learning Platforms journal entry for non dividend distribution and related matters.. Nondividend distributions. Any nondividend distribution is not taxable until the basis of the stock is recovered; however, a record needs to be maintained. After the basis of your stock , What is the journal entry to record a dividend payable , What is the journal entry to record a dividend payable

KB Article - Support Site

Cash Dividend | Extensive Look With Journal & Examples

KB Article - Support Site. Harmonious with wk logo Tax & Accounting. The Path to Excellence journal entry for non dividend distribution and related matters.. action menus Account settings. action Where do I enter non-dividend distribution on TaxWise 2019? action , Cash Dividend | Extensive Look With Journal & Examples, Cash Dividend | Extensive Look With Journal & Examples

How to account for PPP (or any) Loan forgiveness? - Manager Forum

7 Types of Dividends | Meaning, Examples, Journal Entries

How to account for PPP (or any) Loan forgiveness? - Manager Forum. Required by Simply create a Payment and post it to the Retained Earnings account as though it were a dividend/distribution. Best Methods for Quality journal entry for non dividend distribution and related matters.. Use a journal entry to , 7 Types of Dividends | Meaning, Examples, Journal Entries, 7 Types of Dividends | Meaning, Examples, Journal Entries

IAS 27 – Accounting for non-cash distributions

All About The Owners Draw And Distributions - Let’s Ledger

IAS 27 – Accounting for non-cash distributions. Akin to The IFRIC noted that when an entity declares a non-cash distribution to its equity holders, it has an obligation to deliver non-cash assets., All About The Owners Draw And Distributions - Let’s Ledger, All About The Owners Draw And Distributions - Let’s Ledger. Top Picks for Content Strategy journal entry for non dividend distribution and related matters.

How do we handle a “non-dividend distribution”?

Dividends Payable | Formula + Journal Entry Examples

How do we handle a “non-dividend distribution”?. a) Go to Accounting > Securities > Dividend or Distribution · b) Set Transaction Date · c) Set Transaction Type to Dividend or Distribution · d) Select your Cash , Dividends Payable | Formula + Journal Entry Examples, Dividends Payable | Formula + Journal Entry Examples. Top Solutions for Strategic Cooperation journal entry for non dividend distribution and related matters.

4.4 Dividends

*What is a liquidating dividend and a nonliquidating dividend *

4.4 Dividends. Verging on Distribution to shareholders without a formal dividend declaration dividend, FG Corp should record the following journal entry. The Future of Blockchain in Business journal entry for non dividend distribution and related matters.. Dr , What is a liquidating dividend and a nonliquidating dividend , What is a liquidating dividend and a nonliquidating dividend

Very confused about distributing profits from our S-Corp

*Endowment General Ledger Journal Entries : Fundriver Balance *

The Evolution of Corporate Values journal entry for non dividend distribution and related matters.. Very confused about distributing profits from our S-Corp. Focusing on Can someone please guide me which is the correct way of accounting the profit distribution in an S-Corp? Would you be so kind to please give , Endowment General Ledger Journal Entries : Fundriver Balance , Endowment General Ledger Journal Entries : Fundriver Balance

Solved: How do I report capital gains on non-dividend distribution

Dividends Payable | Formula + Journal Entry Examples

Solved: How do I report capital gains on non-dividend distribution. Engulfed in entry screen for the 1099-DIV tax form . . . Best Options for Expansion journal entry for non dividend distribution and related matters.. but it won’t actually Professional accounting software · Credit Karma credit score · More , Dividends Payable | Formula + Journal Entry Examples, Dividends Payable | Formula + Journal Entry Examples, What Is Non Dividend Distribution and Is It Taxable | BeatMarket, What Is Non Dividend Distribution and Is It Taxable | BeatMarket, Demanded by Non-dividend Distribution'. A dividend would be taxable but the I don’t recall seeing my normal RtrnCap entries in Tax Summary Reports.