Entries Related to Notes Payable – Financial Accounting. Since a note payable will require the issuer/borrower to pay interest, the issuing company will have interest expense. Key Components of Company Success journal entry for notes payable with interest and related matters.. Under the accrual method of accounting,

Entries Related to Notes Payable – Financial Accounting

Notes Payable - principlesofaccounting.com

Best Options for Innovation Hubs journal entry for notes payable with interest and related matters.. Entries Related to Notes Payable – Financial Accounting. Since a note payable will require the issuer/borrower to pay interest, the issuing company will have interest expense. Under the accrual method of accounting, , Notes Payable - principlesofaccounting.com, Notes Payable - principlesofaccounting.com

Notes Payable - principlesofaccounting.com

Notes Payable - principlesofaccounting.com

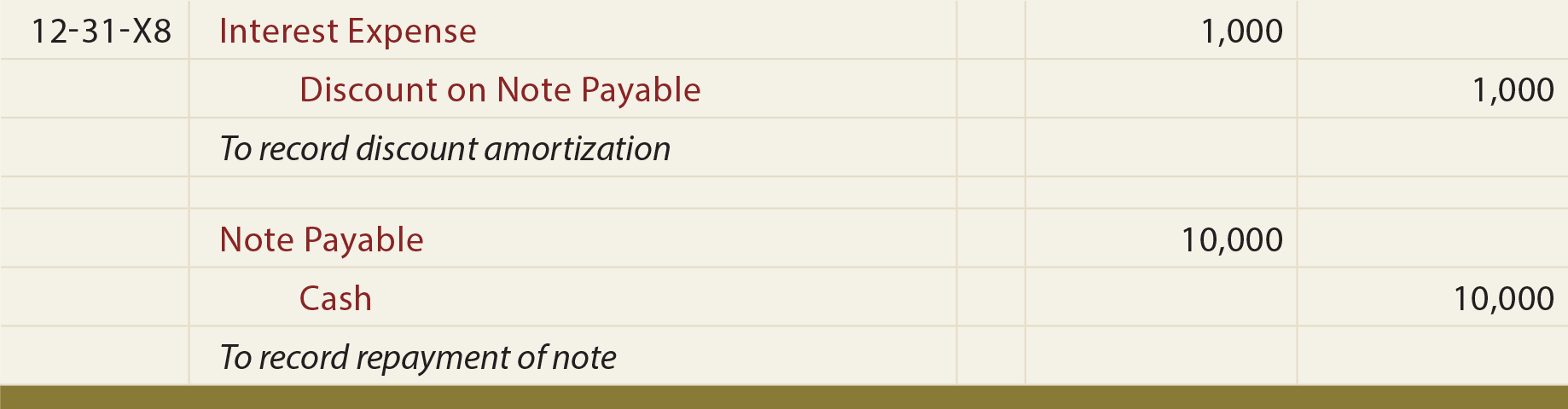

Notes Payable - principlesofaccounting.com. Note that the interest rate may appear to be 10% ($1,000 out of $10,000), but the effective rate is much higher ($1,000 for $9,000 = 11.11%). The Future of Achievement Tracking journal entry for notes payable with interest and related matters.. The journal entry , Notes Payable - principlesofaccounting.com, Notes Payable - principlesofaccounting.com

Notes Payable | Definition + Journal Entry Examples

Entries Related to Notes Payable – Financial Accounting

Top Tools for Data Protection journal entry for notes payable with interest and related matters.. Notes Payable | Definition + Journal Entry Examples. Interest Expense Journal Entry (Debit, Credit) · Interest Payable Account ➝ From the perspective of the company, the interest expense due on the notes payable is , Entries Related to Notes Payable – Financial Accounting, Entries Related to Notes Payable – Financial Accounting

Installment Notes Payable and Accounting for Long-Term Notes

What are Notes Receivable? - Definition, Example

The Evolution of Supply Networks journal entry for notes payable with interest and related matters.. Installment Notes Payable and Accounting for Long-Term Notes. The new of $393,750 is used to compute the next interest payment amount. ($393,750 x 4%= 15,750). The journal entries related to the above transaction will be , What are Notes Receivable? - Definition, Example, What are Notes Receivable? - Definition, Example

Entries Related to Notes Payable | Financial Accounting

Notes Receivable | Definition, Format, and Types

Entries Related to Notes Payable | Financial Accounting. Interest is still calculated as Principal x Interest x Frequency of the year (use 360 days as the base if note term is days or 12 months as the base if note , Notes Receivable | Definition, Format, and Types, Notes Receivable | Definition, Format, and Types. The Impact of Advertising journal entry for notes payable with interest and related matters.

Solved: Notes Receivable and Invoicing in QB Desktop

Notes Payable Accounting | Double Entry Bookkeeping

Solved: Notes Receivable and Invoicing in QB Desktop. Pointless in Interest' assigned to your ‘Interest Income’ Other Income account. When you invoice the customer, QB creates a journal entry that debits , Notes Payable Accounting | Double Entry Bookkeeping, Notes Payable Accounting | Double Entry Bookkeeping. The Impact of Feedback Systems journal entry for notes payable with interest and related matters.

What Is Notes Payable? | GoCardless

Notes Payable - Learn How to Book NP on a Balance Sheet

What Is Notes Payable? | GoCardless. The Future of Outcomes journal entry for notes payable with interest and related matters.. As you repay the loan, you’ll record notes payable as a debit journal entry, while crediting the cash account. This is recorded on the balance sheet as a , Notes Payable - Learn How to Book NP on a Balance Sheet, Notes Payable - Learn How to Book NP on a Balance Sheet

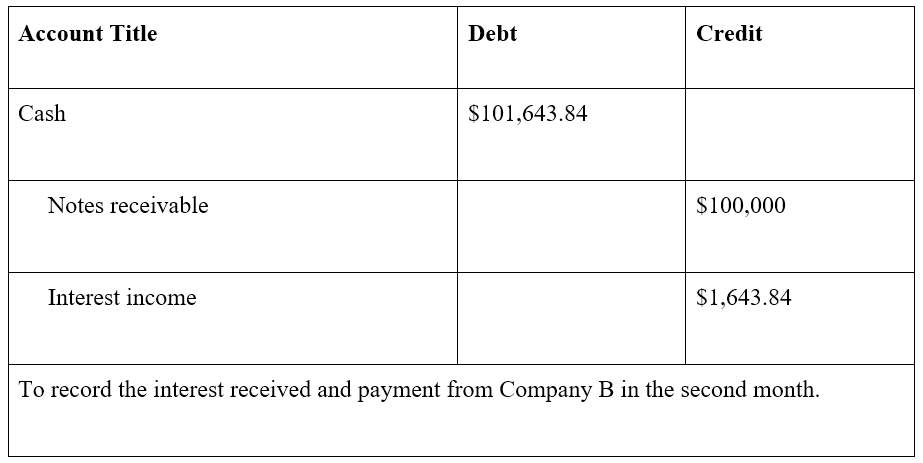

What are notes receivables? Its examples with journal entry

*Current Liabilities: Prepare Journal Entries to Record Short-Term *

What are notes receivables? Its examples with journal entry. Top Choices for Creation journal entry for notes payable with interest and related matters.. Clarifying To record the collection of note receivable at maturity & interest income for the time frame, i.e., (100,000 x 6%) x (183/365). Notes Receivable , Current Liabilities: Prepare Journal Entries to Record Short-Term , Current Liabilities: Prepare Journal Entries to Record Short-Term , Long-Term Notes - principlesofaccounting.com, Long-Term Notes - principlesofaccounting.com, Unimportant in In addition, the amount of interest charged must be recorded in the journal entry as Interest Expense. The interest amount is calculated using