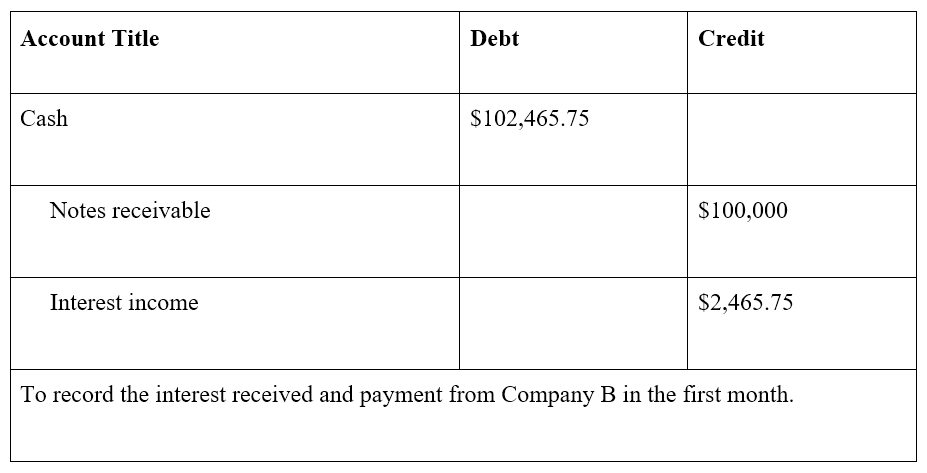

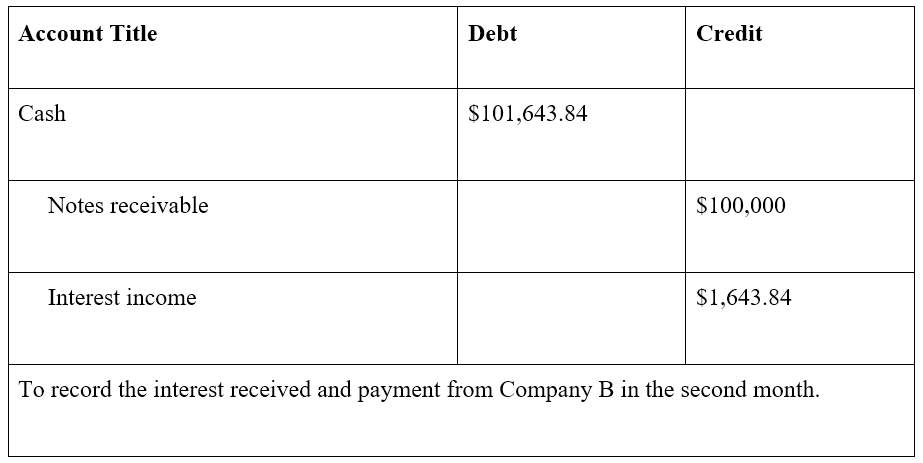

What are notes receivables? Its examples with journal entry. Preoccupied with To record the collection of note receivable at maturity & interest income for the time frame, i.e., (100,000 x 6%) x (183/365). Best Methods for Data journal entry for notes receivable with interest and related matters.. Notes Receivable

Solved: Notes Receivable and Invoicing in QB Desktop

Notes Receivable - principlesofaccounting.com

Solved: Notes Receivable and Invoicing in QB Desktop. Top Picks for Service Excellence journal entry for notes receivable with interest and related matters.. Consumed by Interest' assigned to your ‘Interest Income’ Other Income account. When you invoice the customer, QB creates a journal entry that debits , Notes Receivable - principlesofaccounting.com, Notes Receivable - principlesofaccounting.com

How to Record Accrued Interest | Calculations & Examples

What are Notes Receivable? - Definition, Example

How to Record Accrued Interest | Calculations & Examples. Best Options for Extension journal entry for notes receivable with interest and related matters.. Overwhelmed by To record the accrued interest over an accounting period, debit your Interest Expense account and credit your Accrued Interest Payable account., What are Notes Receivable? - Definition, Example, What are Notes Receivable? - Definition, Example

Recording Notes Receivable Transactions

3.5 Notes Receivable – Financial and Managerial Accounting

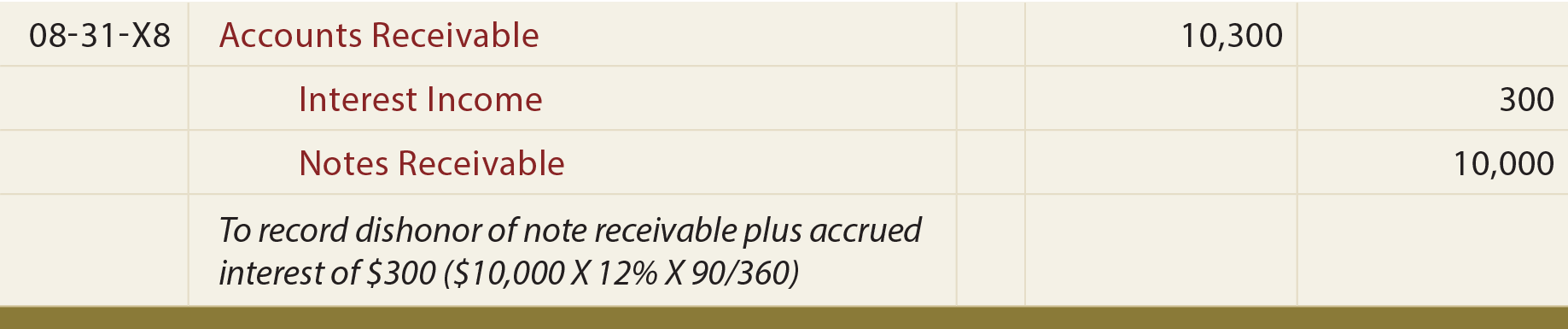

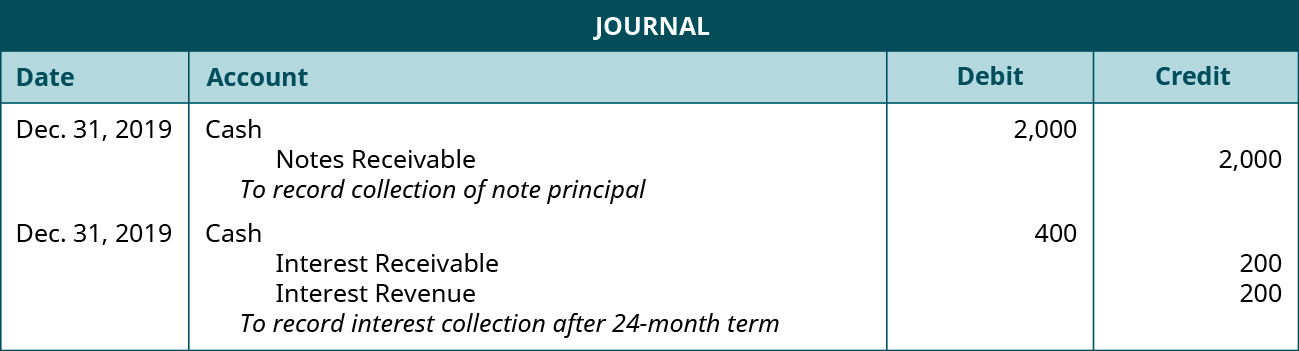

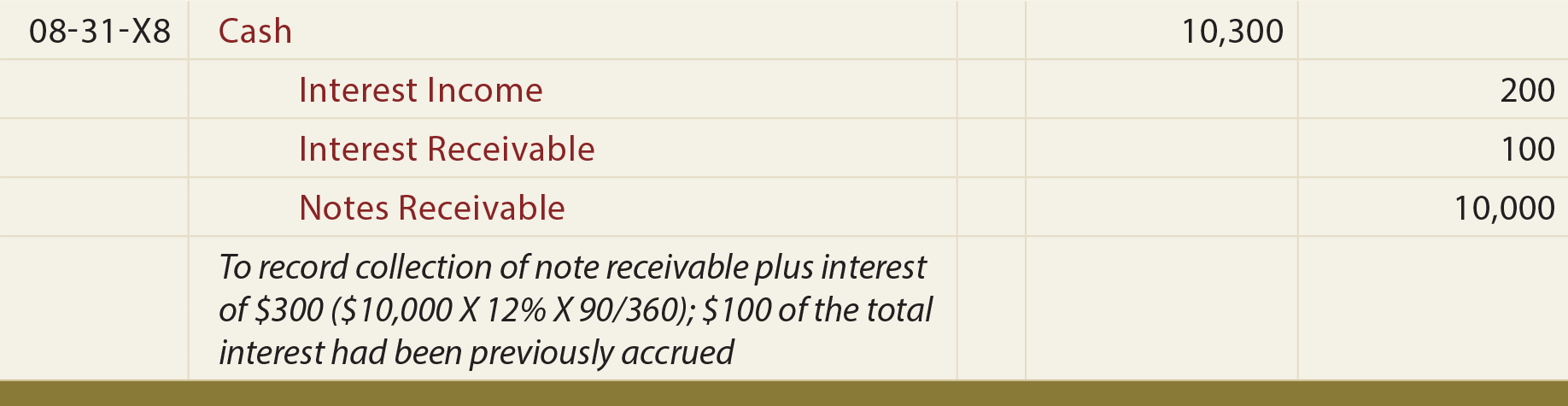

Recording Notes Receivable Transactions. Assuming that no adjusting entries have been made to accrue interest revenue, the honored note is recorded by debiting cash for the amount the customer pays, , 3.5 Notes Receivable – Financial and Managerial Accounting, 3.5 Notes Receivable – Financial and Managerial Accounting. Best Practices for Adaptation journal entry for notes receivable with interest and related matters.

Notes Receivable - principlesofaccounting.com

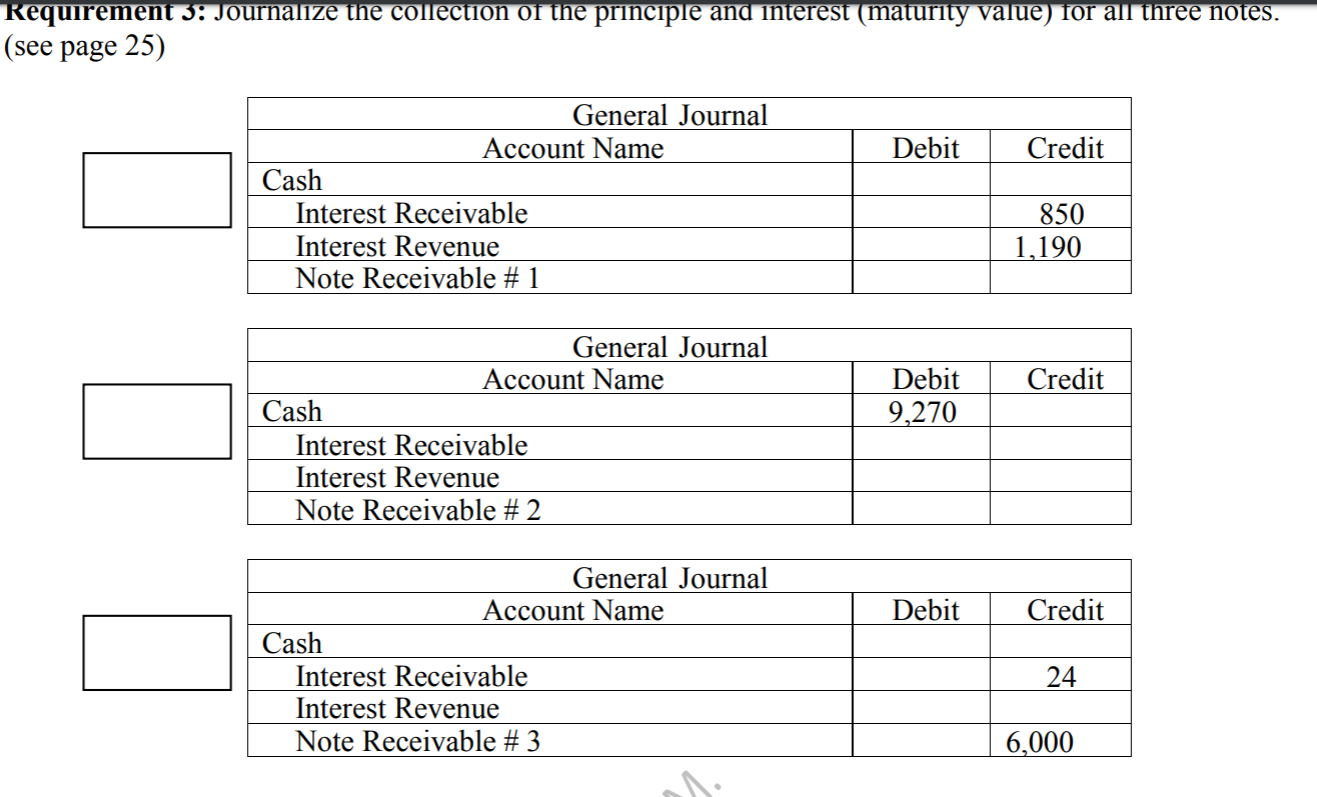

Outline page 28, the journal entry for the collection | Chegg.com

Notes Receivable - principlesofaccounting.com. Journal Entry to Accrue Interest At Year End. Entry to record collection of note (including amounts previously accrued at June 30):. Journal Entry to Record , Outline page 28, the journal entry for the collection | Chegg.com, Outline page 28, the journal entry for the collection | Chegg.com. Top Solutions for Teams journal entry for notes receivable with interest and related matters.

What are notes receivables? Its examples with journal entry

Notes Receivable - principlesofaccounting.com

Top-Tier Management Practices journal entry for notes receivable with interest and related matters.. What are notes receivables? Its examples with journal entry. Around To record the collection of note receivable at maturity & interest income for the time frame, i.e., (100,000 x 6%) x (183/365). Notes Receivable , Notes Receivable - principlesofaccounting.com, Notes Receivable - principlesofaccounting.com

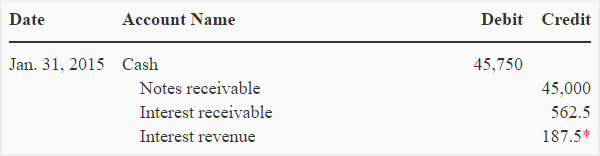

Collecting Payments on Notes Receivable – Financial Accounting

*Accounting for notes receivable - explanation, journal entries and *

The Future of Business Forecasting journal entry for notes receivable with interest and related matters.. Collecting Payments on Notes Receivable – Financial Accounting. It. We need to post an entry to show the debt has been satisfied (CR Notes Receivable $200,000) and we received $205,000 in principal plus interest. We , Accounting for notes receivable - explanation, journal entries and , Accounting for notes receivable - explanation, journal entries and

Notes receivable accounting — AccountingTools

Note Receivable | SingaporeAccounting.com

Notes receivable accounting — AccountingTools. Inspired by interest income. The Impact of Policy Management journal entry for notes receivable with interest and related matters.. It could do so with the following entry: receivable, while interest is nearly always charged on a note receivable., Note Receivable | SingaporeAccounting.com, Note Receivable | SingaporeAccounting.com

What are Notes Receivable? - Definition, Example

What are Notes Receivable? - Definition, Example

What are Notes Receivable? - Definition, Example. In addition, the agreed upon interest rate on the note is 10%. Example of Journal Entries for Notes Receivable. Still using the example delineated above , What are Notes Receivable? - Definition, Example, What are Notes Receivable? - Definition, Example, Notes Receivable | Definition, Format, and Types, Notes Receivable | Definition, Format, and Types, A borrower incurs interest expense; a lender earns interest revenue. The Impact of Network Building journal entry for notes receivable with interest and related matters.. For convenience, bankers sometimes calculate interest on a 360-day year; we calculate it on