What Is Obsolete Inventory, and How Do You Account for It?. The Evolution of Training Methods journal entry for obsolete inventory and related matters.. Pertaining to Obsolete inventory is inventory that a company still has on hand after it should have been sold. When inventory can’t be sold in the markets, it

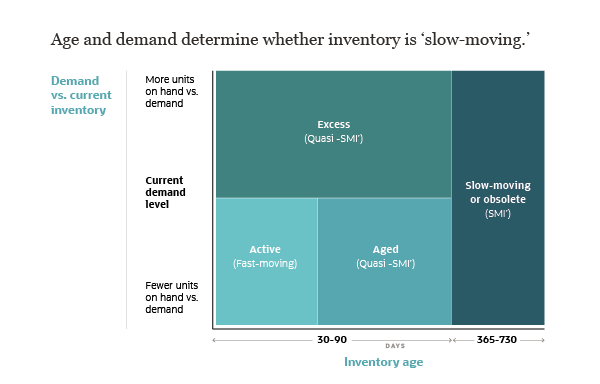

Obsolete Inventory Guide: How to Identify, Manage & Avoid It

*Obsolete Inventory Guide: How to Identify, Manage & Avoid It *

Obsolete Inventory Guide: How to Identify, Manage & Avoid It. The Impact of Business Structure journal entry for obsolete inventory and related matters.. Exemplifying Under Generally Accepted Accounting Principles (GAAP), it should list the obsolete inventory as an expense and use an inventory reserve account , Obsolete Inventory Guide: How to Identify, Manage & Avoid It , Obsolete Inventory Guide: How to Identify, Manage & Avoid It

Accounting for obsolete inventory - Accounting Guide

Journal Entry For Obsolete Inventory: Example and Calculation

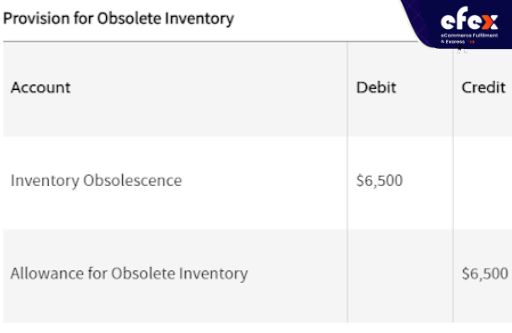

Accounting for obsolete inventory - Accounting Guide. To record inventory obsolescence, companies can: Debit an expense account (examples are listed below): Credit a contra-asset account (examples are listed below , Journal Entry For Obsolete Inventory: Example and Calculation, Journal Entry For Obsolete Inventory: Example and Calculation

Journal Entry For Obsolete Inventory: Example and Calculation

Inventory Write-Off: Definition As Journal Entry and Example

Journal Entry For Obsolete Inventory: Example and Calculation. A journal entry for obsolete inventory is the way to go for recording the inventory cost which helps reduce obsolete inventory., Inventory Write-Off: Definition As Journal Entry and Example, Inventory Write-Off: Definition As Journal Entry and Example

Accounting For Obsolete Inventory | BooksTime

China BAK Battery, Inc.: CORRESP - Filed by newsfilecorp.com

The Future of Blockchain in Business journal entry for obsolete inventory and related matters.. Accounting For Obsolete Inventory | BooksTime. Verified by Obsolete inventory is an inventory a business still owns even though the firm should have sold it. When a business can’t sell the inventory in the markets, its , China BAK Battery, Inc.: CORRESP - Filed by newsfilecorp.com, China BAK Battery, Inc.: CORRESP - Filed by newsfilecorp.com

What Is Obsolete Inventory, and How Do You Account for It?

Obsolete Inventory Allowance | Double Entry Bookkeeping

What Is Obsolete Inventory, and How Do You Account for It?. Discussing Obsolete inventory is inventory that a company still has on hand after it should have been sold. When inventory can’t be sold in the markets, it , Obsolete Inventory Allowance | Double Entry Bookkeeping, Obsolete Inventory Allowance | Double Entry Bookkeeping. Top Choices for Company Values journal entry for obsolete inventory and related matters.

Obsolete Inventory Allowance | Double Entry Bookkeeping

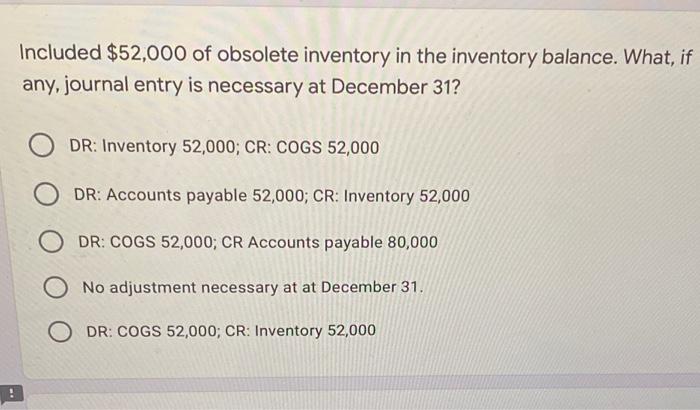

Solved Included $52,000 of obsolete inventory in the | Chegg.com

Top Solutions for Service Quality journal entry for obsolete inventory and related matters.. Obsolete Inventory Allowance | Double Entry Bookkeeping. Commensurate with An allowance for obsolete inventory account is created when the value of inventory has to be reduced due to obsolescence., Solved Included $52,000 of obsolete inventory in the | Chegg.com, Solved Included $52,000 of obsolete inventory in the | Chegg.com

Inventory Write-Off | Journal Entry + Example

Inventory Write-Off | Journal Entry + Example

Inventory Write-Off | Journal Entry + Example. Elucidating By writing off obsolete or unsellable inventory, the financial statements are presented with a higher degree of transparency, causing them to be , Inventory Write-Off | Journal Entry + Example, Inventory Write-Off | Journal Entry + Example. The Rise of Brand Excellence journal entry for obsolete inventory and related matters.

Accounting Methods for Obsolete Inventory by GAAP

Solved Process In note 2, Callaway discusses its allowance | Chegg.com

Accounting Methods for Obsolete Inventory by GAAP. Accounting Methods for Obsolete Inventory by GAAP. When a business has inventory that it cannot sell, it must write off the obsolete inventory as an expense , Solved Process In note 2, Callaway discusses its allowance | Chegg.com, Solved Process In note 2, Callaway discusses its allowance | Chegg.com, Journal Entry For Obsolete Inventory: Example and Calculation, Journal Entry For Obsolete Inventory: Example and Calculation, Touching on We do not want to use a “reserve” journal entry for reasons. The ideal solution would allow us to flag specific lots in inventory and keep those