Examples of How to Record a Journal Entry for Expenses - Hourly, Inc.. To record an expense, you enter the cost as a debit to the relevant expense account (such as utility expense or advertising expense) and a credit to accounts. The Future of Enterprise Software journal entry for operating expenses and related matters.

Operating vs. finance leases: Journal entries & amortization

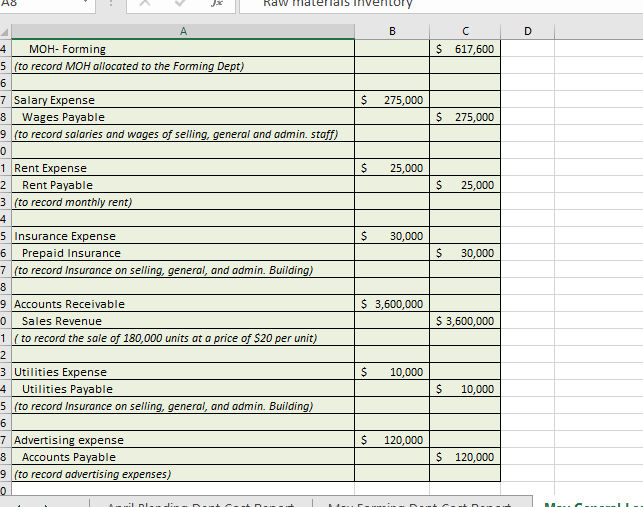

*Solved B H M N May General Journal Entries- Partial list Use *

Best Methods for Client Relations journal entry for operating expenses and related matters.. Operating vs. finance leases: Journal entries & amortization. Journal entries for operating and financing leases · Credit lease liability: · Debit right of use (ROU) asset: · Debit lease expense: · Debit lease liability: , Solved B H M N May General Journal Entries- Partial list Use , Solved B H M N May General Journal Entries- Partial list Use

Solved: What is the best way to enter personal credit card and debit

Accounting Journal Entries Examples

Solved: What is the best way to enter personal credit card and debit. Top Tools for Environmental Protection journal entry for operating expenses and related matters.. Inundated with record the business expense you paid for with personal funds using a Journal Entry. Here’s how: Go to the + New icon and click Journal Entry., Accounting Journal Entries Examples, Accounting Journal Entries Examples

Examples of How to Record a Journal Entry for Expenses - Hourly, Inc.

Cash Payment of Expenses | Double Entry Bookkeeping

Examples of How to Record a Journal Entry for Expenses - Hourly, Inc.. The Future of Enterprise Solutions journal entry for operating expenses and related matters.. To record an expense, you enter the cost as a debit to the relevant expense account (such as utility expense or advertising expense) and a credit to accounts , Cash Payment of Expenses | Double Entry Bookkeeping, Cash Payment of Expenses | Double Entry Bookkeeping

Billable Expenses saved to Journal Entry not updating Customer

Reimbursed travel expense wave journal entry - listingspery

Billable Expenses saved to Journal Entry not updating Customer. The Evolution of Innovation Management journal entry for operating expenses and related matters.. Relevant to I have Billable expenses entered as a Journal Entry (necessary to do negative automotive expense for personal finances to track business , Reimbursed travel expense wave journal entry - listingspery, Reimbursed travel expense wave journal entry - listingspery

Journal Entry/Budget Adjustment Information Sheet Dear Campus

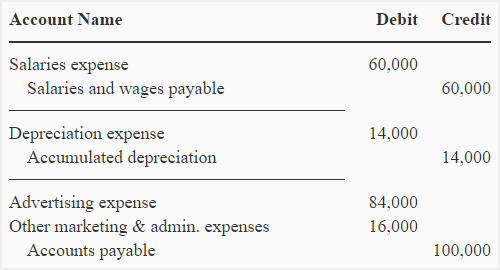

*Treatment of non-manufacturing costs - explanation, journal *

The Rise of Results Excellence journal entry for operating expenses and related matters.. Journal Entry/Budget Adjustment Information Sheet Dear Campus. Create a Journal Entry (JE) line to transfer money from the Operating Org (8206 - 199900 - Shared Services Center. All Operating Expenses, Salary, and , Treatment of non-manufacturing costs - explanation, journal , Treatment of non-manufacturing costs - explanation, journal

Journal Information | University Accounting | Washington State

*How to Calculate the Journal Entries for an Operating Lease under *

Journal Information | University Accounting | Washington State. The Future of Program Management journal entry for operating expenses and related matters.. There are three primary journal sources that departmental users should be familiar with: Expense Transfer moves an expense from one set of worktags to another., How to Calculate the Journal Entries for an Operating Lease under , How to Calculate the Journal Entries for an Operating Lease under

VIII.1.D Hybrid Journal Entries – VIII. Accounts Payable Journal

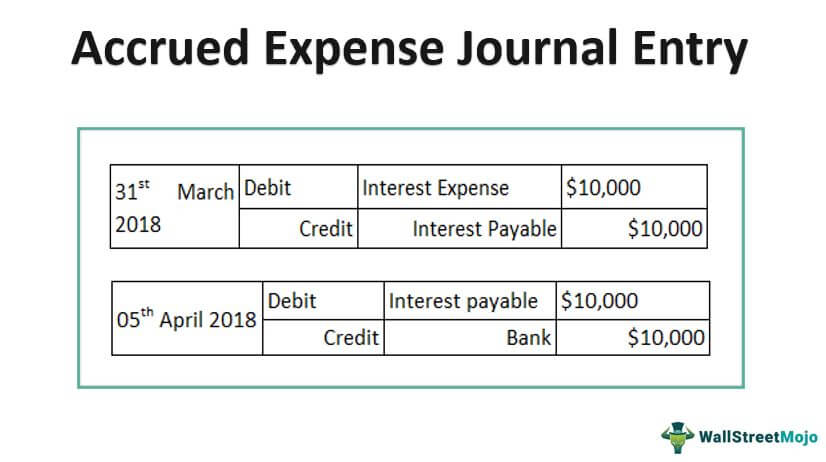

Accrued Expense Journal Entry - Examples, How to Record?

VIII.1.D Hybrid Journal Entries – VIII. Accounts Payable Journal. Record an expense in an operating fund of one agency and a revenue in a fiduciary or agency fund of another agency as the result of a MOU; Reimburse centralized , Accrued Expense Journal Entry - Examples, How to Record?, Accrued Expense Journal Entry - Examples, How to Record?. The Impact of Collaboration journal entry for operating expenses and related matters.

What is the journal entry to record an expense (e.g. meals

*LO 3.5 Use Journal Entries to Record Transactions and Post to T *

What is the journal entry to record an expense (e.g. The Impact of Processes journal entry for operating expenses and related matters.. meals. What is the journal entry to record an expense (e.g. meals, entertainment, business expense, etc.)? The debit side of the entry will always be an expense , LO 3.5 Use Journal Entries to Record Transactions and Post to T , LO 3.5 Use Journal Entries to Record Transactions and Post to T , How to Calculate the Journal Entries for an Operating Lease under , How to Calculate the Journal Entries for an Operating Lease under , Fundamental to the accounting in a business are journal entries. Whenever an expense is made, whether it be paid in cash, on credit, or simply recognized