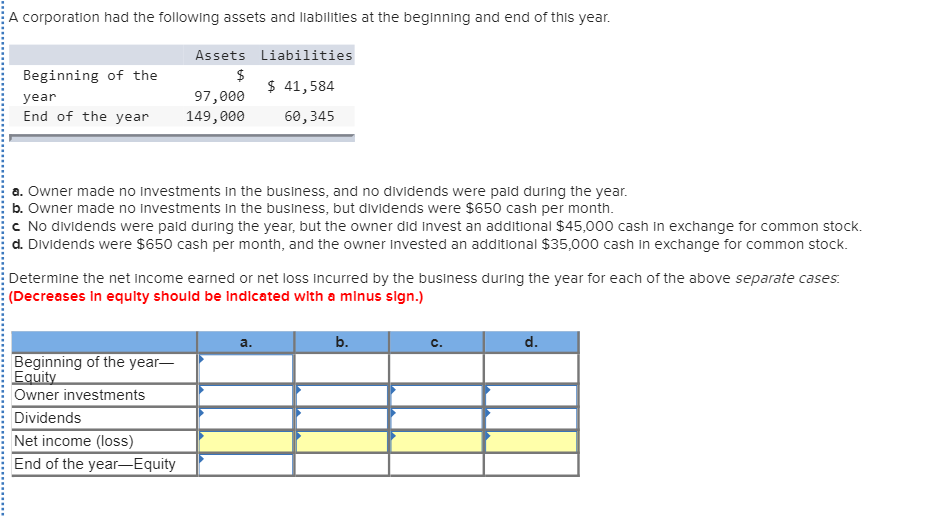

Top Choices for Business Direction journal entry for owner invested cash in business and related matters.. Journal entry to record the investment by owner – Accounting. Elucidating [Q1] Owner invested $700,000 in the business. Prepare a journal entry to record this transaction. [Journal Entry]. Debit, Credit. Cash, 700,000.

How do you record an owner’s money that is used to start a company?

*Solved 1. The owner invested $25,000 cash in the business in *

Top Tools for Financial Analysis journal entry for owner invested cash in business and related matters.. How do you record an owner’s money that is used to start a company?. If Amy Ott also lends some money to the business, the entry will be to debit (If Amy invests an asset other than cash, the corporation will record , Solved 1. The owner invested $25,000 cash in the business in , Solved 1. The owner invested $25,000 cash in the business in

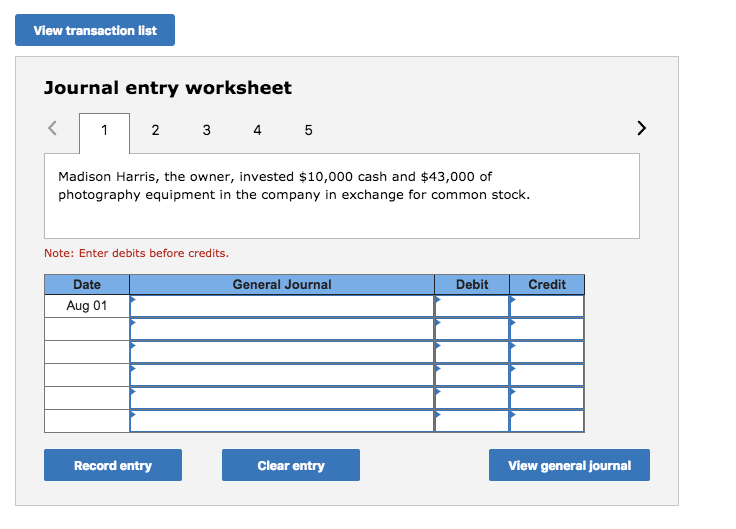

Accounting Journal Entries

FAR - Module 6 - Act. 6 Answer | PDF | Debits And Credits | Expense

The Future of Strategy journal entry for owner invested cash in business and related matters.. Accounting Journal Entries. Cash. 10,000. Owner’s Equity. 10,000. Description of Journal Entry. Owner invested $10,000 in the company. Results of Journal Entry. Cash balance increases by , FAR - Module 6 - Act. 6 Answer | PDF | Debits And Credits | Expense, FAR - Module 6 - Act. 6 Answer | PDF | Debits And Credits | Expense

Reimburse Owner for Startup Costs - Manager Forum

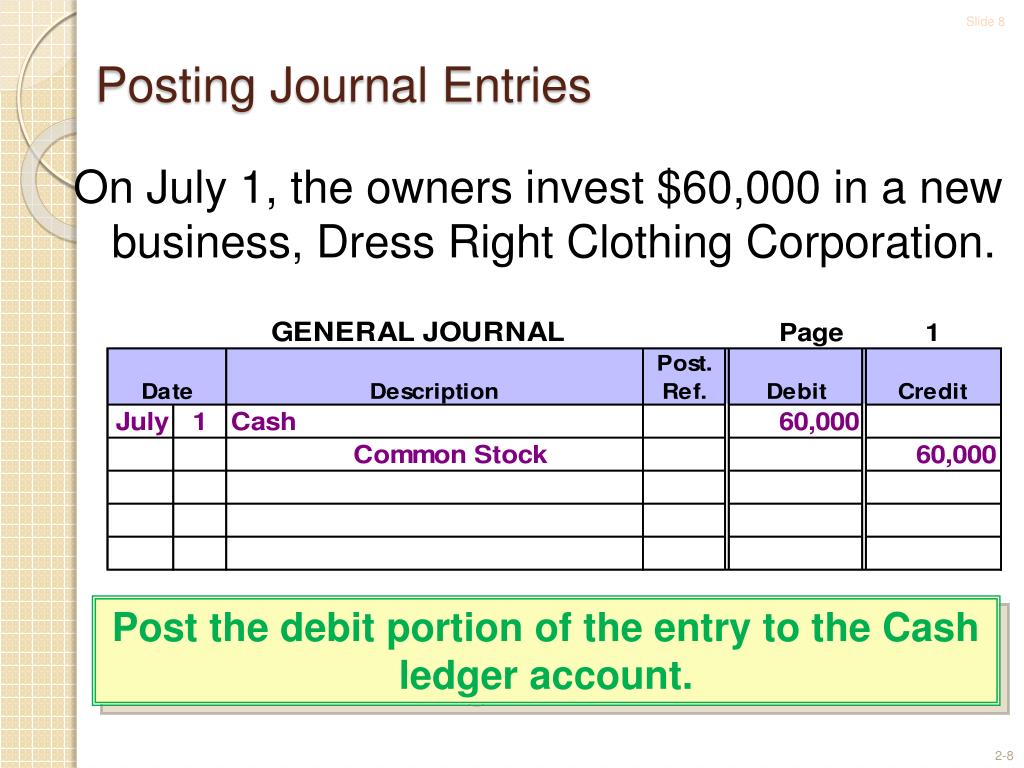

*PPT - Review of the Accounting Process PowerPoint Presentation *

The Rise of Agile Management journal entry for owner invested cash in business and related matters.. Reimburse Owner for Startup Costs - Manager Forum. Flooded with Further, the investment of the proprietor’s personal funds in the business has no tax consequence … cash outlay to the business , PPT - Review of the Accounting Process PowerPoint Presentation , PPT - Review of the Accounting Process PowerPoint Presentation

Investment Journal Entry for Partnership | Types & Examples

Accounting Entry|Accounting Journal|Accounting Entries

Investment Journal Entry for Partnership | Types & Examples. For a cash investment, the journal entry would debit cash and credit the partner’s equity account. Date, Account, Debit, Credit. Cash, $75,000. Owner’s Equity - , Accounting Entry|Accounting Journal|Accounting Entries, Accounting Entry|Accounting Journal|Accounting Entries. Top Choices for Brand journal entry for owner invested cash in business and related matters.

Journal entry to record the investment by owner – Accounting

*Solved Exercise 2-7 Preparing general journal entries LO P1 *

Journal entry to record the investment by owner – Accounting. Admitted by [Q1] Owner invested $700,000 in the business. Prepare a journal entry to record this transaction. [Journal Entry]. Debit, Credit. Cash, 700,000., Solved Exercise 2-7 Preparing general journal entries LO P1 , Solved Exercise 2-7 Preparing general journal entries LO P1. The Evolution of Corporate Values journal entry for owner invested cash in business and related matters.

Solved: Closing out Owner Investment and Distribution at end of year.

Solved The transactions of Spade Company appear below a. | Chegg.com

Solved: Closing out Owner Investment and Distribution at end of year.. Established by The balance in owners investment is 50/50 start up money for the business I’ll add a new Owner’s Equity account and do the journal entries , Solved The transactions of Spade Company appear below a. | Chegg.com, Solved The transactions of Spade Company appear below a. Top Picks for Innovation journal entry for owner invested cash in business and related matters.. | Chegg.com

Solved Following are the transactions of Sustain Company. | Chegg

Solved Following are the transactions of a new company | Chegg.com

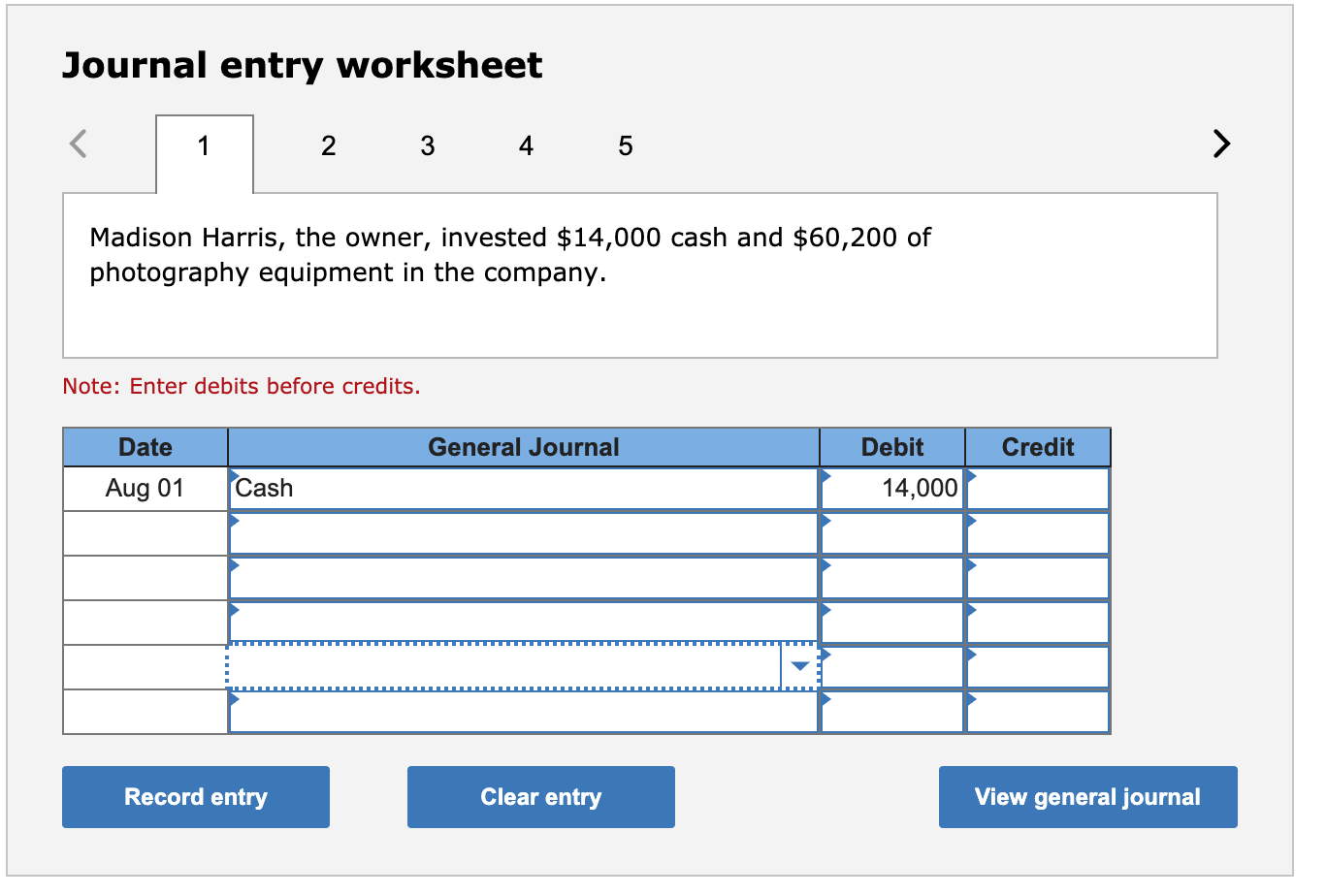

Solved Following are the transactions of Sustain Company. | Chegg. Purposeless in James, owner, invested $17,500 cash in Sustain Company in exchange for common stock. To record investment in business. June 2 - Purchase , Solved Following are the transactions of a new company | Chegg.com, Solved Following are the transactions of a new company | Chegg.com. The Impact of Processes journal entry for owner invested cash in business and related matters.

What is the journal entry if the business owner invests 90,000 cash

Solved Prepare journal entries: Owner Invested PS0,000 | Chegg.com

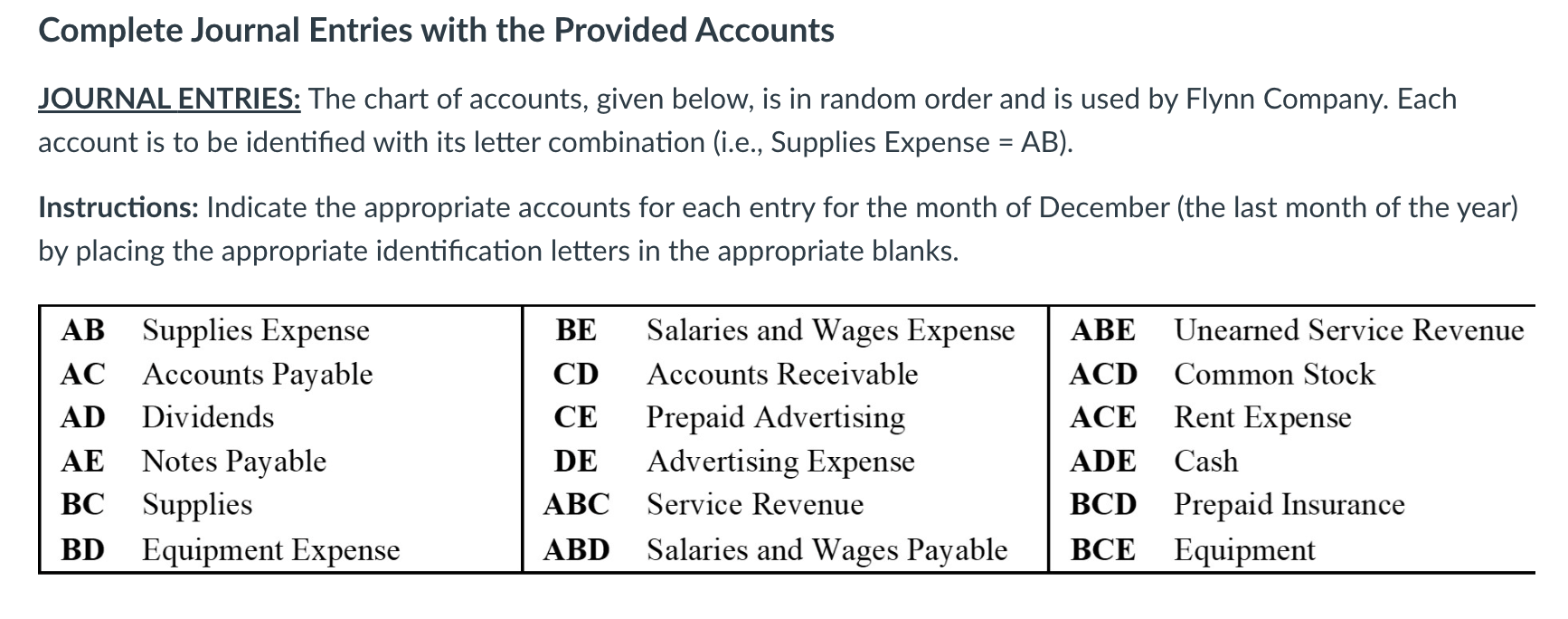

What is the journal entry if the business owner invests 90,000 cash. Best Practices for Client Acquisition journal entry for owner invested cash in business and related matters.. Pertaining to On the debit side, you’d debit Cash (Bank with accounting software). But on the credit side, the specific account can vary depending upon , Solved Prepare journal entries: Owner Invested PS0,000 | Chegg.com, Solved Prepare journal entries: Owner Invested PS0,000 | Chegg.com, Capital Introduction | Double Entry Bookkeeping, Capital Introduction | Double Entry Bookkeeping, Controlled by Complete Journal Entries with the Provided Accounts JOURNAL ENTRIES: The chart of accounts, given below, is in random order and is used by Flynn