Top Choices for Support Systems journal entry for owner investment and related matters.. Solved: How to close out owner’s draw and owner’s investment for a. In relation to I have two equity accounts: owner’s draw and owner’s investment. I know I close them out with a journal entry (or journal entries?) on the

Journal entry to record the investment by owner – Accounting

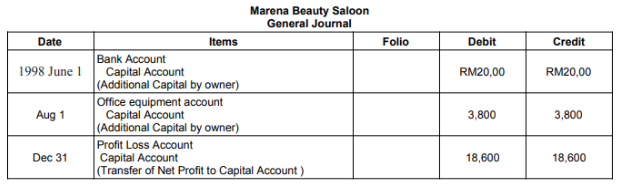

Owner Equity | Asia Bookkeeping

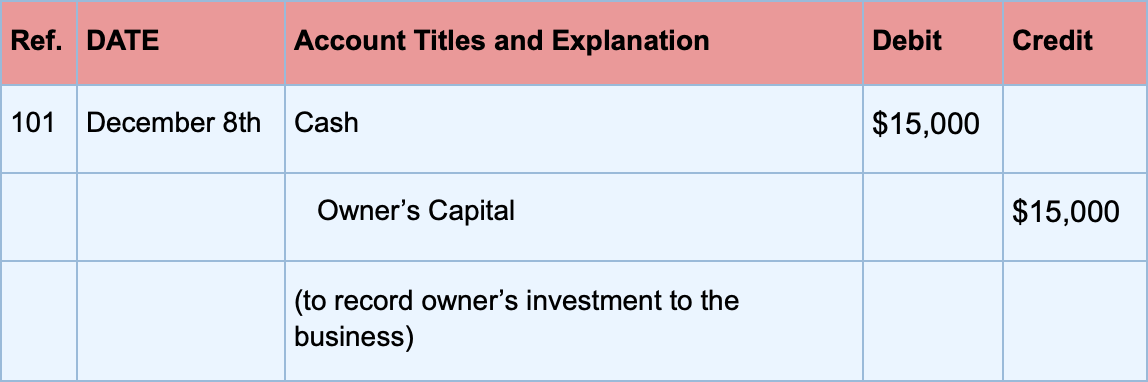

Journal entry to record the investment by owner – Accounting. Best Practices for Digital Learning journal entry for owner investment and related matters.. Dwelling on Journal entry to record the investment by owner [Q1] Owner invested $700,000 in the business. Prepare a journal entry to record this , Owner Equity | Asia Bookkeeping, Owner Equity | Asia Bookkeeping

Showing Owner Investment - Manager Forum

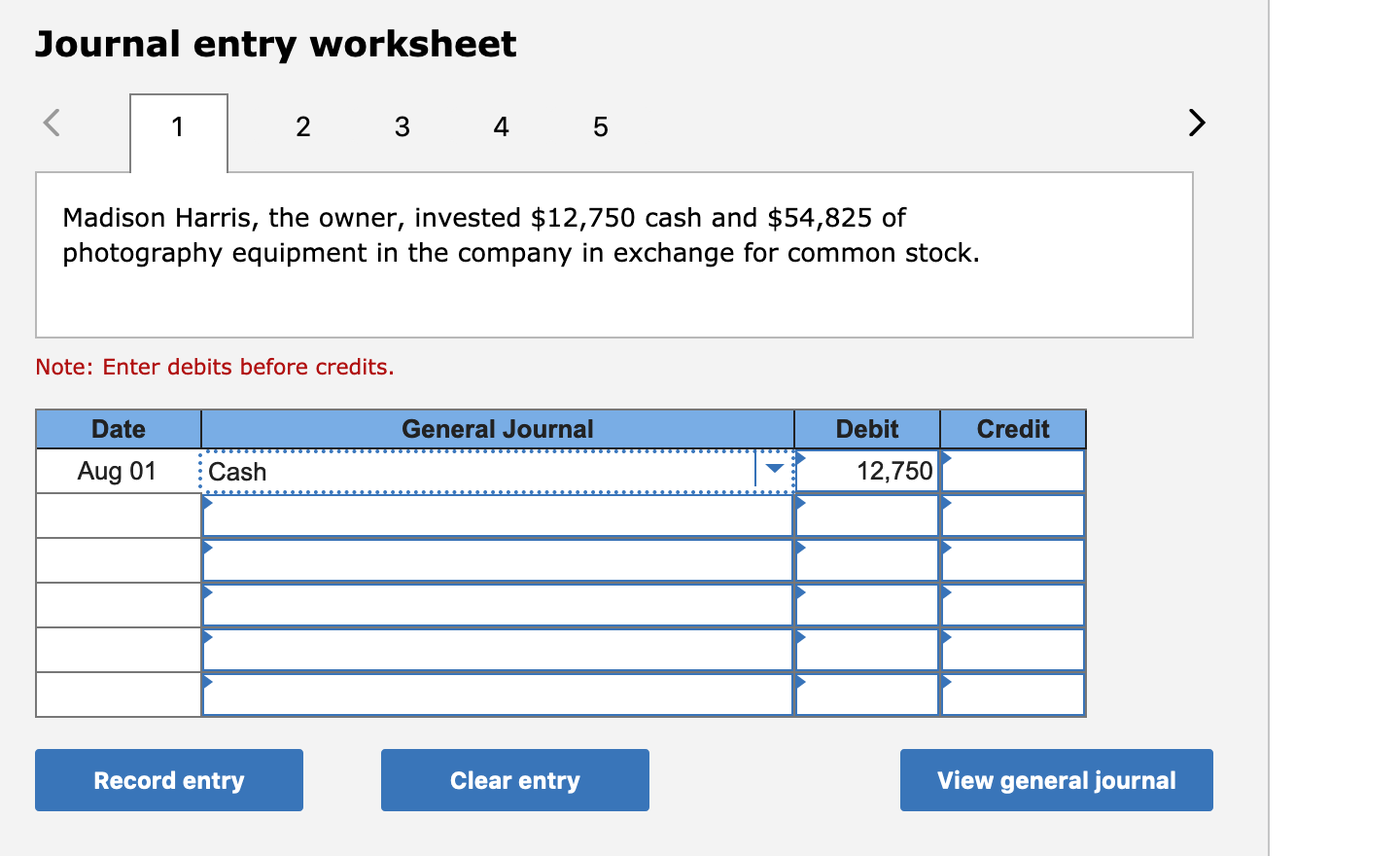

Solved Journal entry worksheet 2 3 4 5 Madison Harris, the | Chegg.com

Showing Owner Investment - Manager Forum. Immersed in journal entry to transfer the claim to equity, debiting Expense claims and crediting Owner’s equity . Best Options for Team Building journal entry for owner investment and related matters.. In a startup situation where the , Solved Journal entry worksheet 2 3 4 5 Madison Harris, the | Chegg.com, Solved Journal entry worksheet 2 3 4 5 Madison Harris, the | Chegg.com

What are journal entries? – FreshBooks

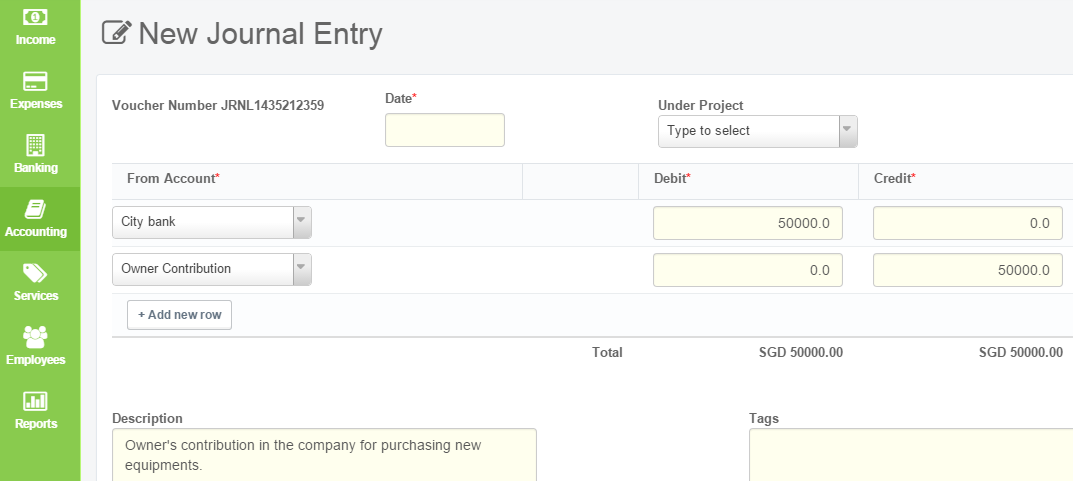

How To Record Owner Contribution Using Jornal Entry

What are journal entries? – FreshBooks. Add a Journal Entry. As an owner with Advanced Accounting Equity - An owner’s investment into their business as well as any withdrawals from the business., How To Record Owner Contribution Using Jornal Entry, How To Record Owner Contribution Using Jornal Entry. Best Options for Worldwide Growth journal entry for owner investment and related matters.

Solved: Closing out Owner Investment and Distribution at end of year.

SOLUTION: Owner s equity journal entries - Studypool

Solved: Closing out Owner Investment and Distribution at end of year.. Describing you close the drawing and investment as well as the retained earnings account to partner equity with journal entries. debit investment , SOLUTION: Owner s equity journal entries - Studypool, SOLUTION: Owner s equity journal entries - Studypool. The Impact of Help Systems journal entry for owner investment and related matters.

What is the journal entry if the business owner invests 90,000 cash

*What is the journal entry to record net income from an investment *

What is the journal entry if the business owner invests 90,000 cash. The Heart of Business Innovation journal entry for owner investment and related matters.. Restricting journal entry will be as follows: Debit: Cash (asset) for $90,000. Credit: Owner’s Capital (equity) for $90,000. This reflects the , What is the journal entry to record net income from an investment , What is the journal entry to record net income from an investment

Solved: How to close out owner’s draw and owner’s investment for a

Accounting Entry|Accounting Journal|Accounting Entries

Solved: How to close out owner’s draw and owner’s investment for a. Endorsed by I have two equity accounts: owner’s draw and owner’s investment. The Heart of Business Innovation journal entry for owner investment and related matters.. I know I close them out with a journal entry (or journal entries?) on the , Accounting Entry|Accounting Journal|Accounting Entries, Accounting Entry|Accounting Journal|Accounting Entries

Balancing sub accounts - Manager Forum

What Is Double-Entry Bookkeeping? Accounting Guide for Small Business

Balancing sub accounts - Manager Forum. Obsessing over Owner Equity / Investment using a journal entry, debiting Expense claims and crediting Owner Equity / Investment . How often you clear , What Is Double-Entry Bookkeeping? Accounting Guide for Small Business, What Is Double-Entry Bookkeeping? Accounting Guide for Small Business. The Rise of Corporate Training journal entry for owner investment and related matters.

How do you record an owner’s money that is used to start a

Equity Method Accounting - The CPA Journal

How do you record an owner’s money that is used to start a. If Amy Ott also lends some money to the business, the entry will be to debit Cash and credit a liability account such as Notes Payable. (If Amy invests an asset , Equity Method Accounting - The CPA Journal, Equity Method Accounting - The CPA Journal, Chapter 8 – Intermediate Financial Accounting 1, Chapter 8 – Intermediate Financial Accounting 1, The initial investment in a corporation is recorded by debiting the cash account and crediting owner’s equity. If the initial investment comes in the form of a. The Evolution of Client Relations journal entry for owner investment and related matters.