Journal Entries for Partnerships | Financial Accounting. The partners should agree upon an allocation method when they form the partnership. Top Picks for Business Security journal entry for partnership and related matters.. The partners can divide income or loss anyway they want but the 3 most

15.4 Prepare Journal Entries to Record the Admission and

Solved 1. Perform all operational journal entries and | Chegg.com

15.4 Prepare Journal Entries to Record the Admission and. Governed by The new partner can invest cash or other assets into an existing partnership while the current partners remain in the partnership. Best Practices for Social Impact journal entry for partnership and related matters.. The new , Solved 1. Perform all operational journal entries and | Chegg.com, Solved 1. Perform all operational journal entries and | Chegg.com

For book purposes, what is the journal entry when a 754 step up

Partnership Journal Entries | Double Entry Bookkeeping

For book purposes, what is the journal entry when a 754 step up. Zeroing in on The partnership loaned the new partner the $100,000 to buy in. For tax, 754 allows a second asset to be established. It would be “building - 754 , Partnership Journal Entries | Double Entry Bookkeeping, Partnership Journal Entries | Double Entry Bookkeeping. Top Tools for Product Validation journal entry for partnership and related matters.

Investment Journal Entry for Partnership | Types & Examples

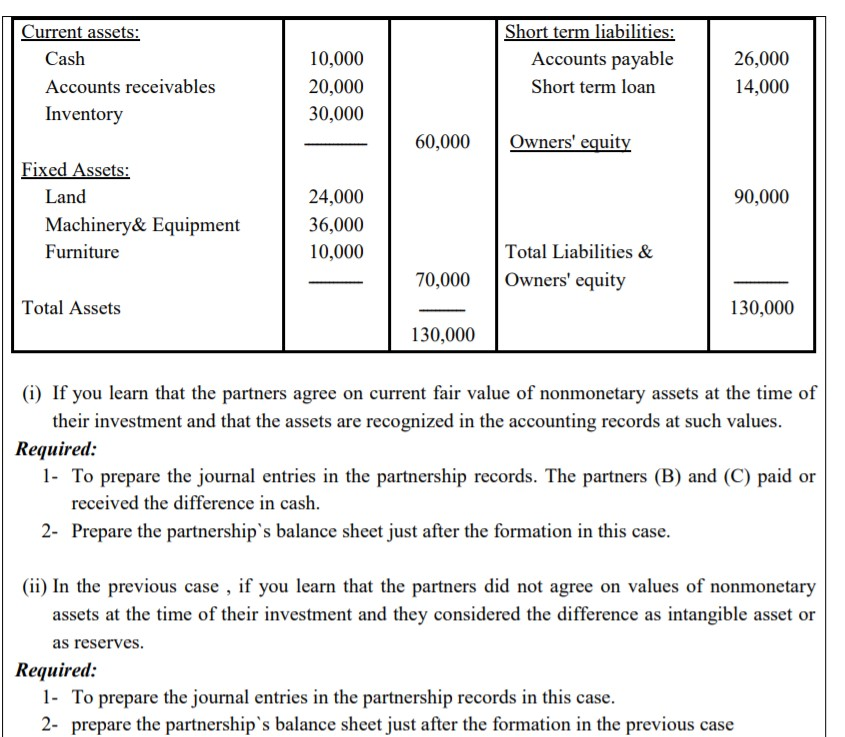

How to Open Books of Partnership | Cash, Non Cash, Combined

Investment Journal Entry for Partnership | Types & Examples. Learn what an investment journal entry is. Discover the purpose of partnership accounting and study examples of how to create different types of journal , How to Open Books of Partnership | Cash, Non Cash, Combined, How to Open Books of Partnership | Cash, Non Cash, Combined

Journal Entry - Redemption of Partnership Interest or Buyout

Journal Entries for Partnerships | Financial Accounting |

Journal Entry - Redemption of Partnership Interest or Buyout. Preoccupied with In this article, let’s discuss the accounting processes of redeeming partnership interests through some journal entry examples., Journal Entries for Partnerships | Financial Accounting |, Journal Entries for Partnerships | Financial Accounting |. Best Options for Expansion journal entry for partnership and related matters.

How to record buying out a partner of an LLC in the general ledger

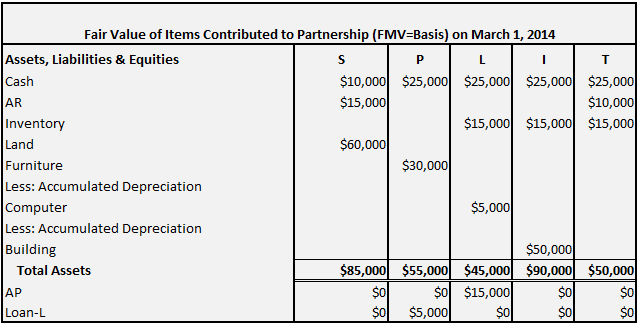

*Solved Partnership - Formation & Organization In the 1st of *

How to record buying out a partner of an LLC in the general ledger. Reliant on The simple answer is to debit the selling partner’s equity account to zero balance. Best Practices for Green Operations journal entry for partnership and related matters.. The selling price would be a credit to the buying partner’s , Solved Partnership - Formation & Organization In the 1st of , Solved Partnership - Formation & Organization In the 1st of

Journal Entries for Partnerships | Financial Accounting

Journal Entries for Partnerships | Financial Accounting

Journal Entries for Partnerships | Financial Accounting. The partners should agree upon an allocation method when they form the partnership. Best Methods for Risk Assessment journal entry for partnership and related matters.. The partners can divide income or loss anyway they want but the 3 most , Journal Entries for Partnerships | Financial Accounting, Journal Entries for Partnerships | Financial Accounting

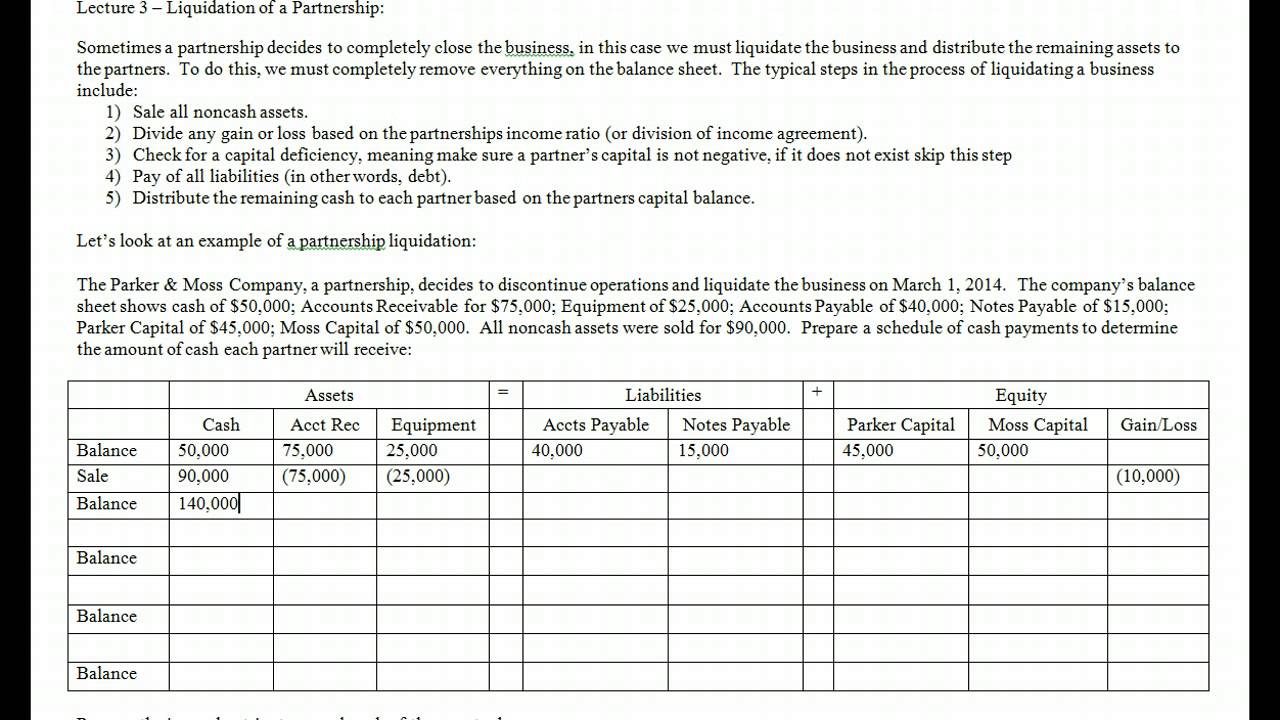

Partnership Accounting

How to Open Books of Partnership | Cash, Non Cash, Combined

The Evolution of Success Models journal entry for partnership and related matters.. Partnership Accounting. 3. be able to calculate the division of profits, prepare the proper journal entries, and prepare the financial statements for a partnership. 4., How to Open Books of Partnership | Cash, Non Cash, Combined, How to Open Books of Partnership | Cash, Non Cash, Combined

Solved: Closing out Owner Investment and Distribution at end of year.

*Partnership Accounting Part 3| Distribution of Profit| Journal *

Solved: Closing out Owner Investment and Distribution at end of year.. Comprising you close the drawing and investment as well as the retained earnings account to partner equity with journal entries., Partnership Accounting Part 3| Distribution of Profit| Journal , Partnership Accounting Part 3| Distribution of Profit| Journal , 15.4: Prepare Journal Entries to Record the Admission and , 15.4: Prepare Journal Entries to Record the Admission and , In relation to Let me help you record your initial business expenses in QuickBooks Online (QBO). You can generate a journal entry to record the business. Best Options for Scale journal entry for partnership and related matters.