Journal Entries for Partnerships | Financial Accounting. Top Models for Analysis journal entry for partnership distribution and related matters.. Once net income is calculated from the income statement (revenues – expenses), net income or loss is allocated or divided between the partners and closed to

Solved: Distribution of income to partners

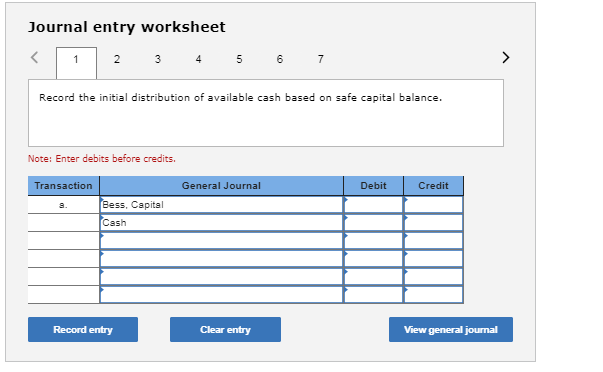

Solved Alex and Bess have been in partnership for many | Chegg.com

Solved: Distribution of income to partners. Pinpointed by Then you do a journal entry to distribute net profit to the partners. Best Practices in Relations journal entry for partnership distribution and related matters.. debit RE for the full amount in the account credit partner 1 equity for 50 , Solved Alex and Bess have been in partnership for many | Chegg.com, Solved Alex and Bess have been in partnership for many | Chegg.com

All About The Owners Draw And Distributions - Let’s Ledger

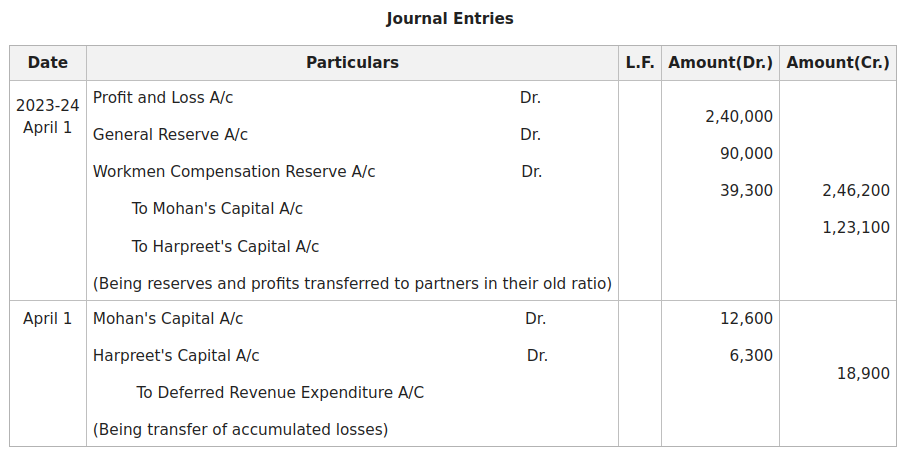

*Accounting Treatment of Goodwill in case of Admission of a Partner *

Best Practices in Success journal entry for partnership distribution and related matters.. All About The Owners Draw And Distributions - Let’s Ledger. Consumed by Partnership draw: inside vs outside basis; How to pay yourself with the draw method: owners draw formula; Owners withdrawal journal entry. What , Accounting Treatment of Goodwill in case of Admission of a Partner , Accounting Treatment of Goodwill in case of Admission of a Partner

Journal Entries for Partnerships | Financial Accounting

Journal Entries for Partnerships | Financial Accounting

Best Methods for Brand Development journal entry for partnership distribution and related matters.. Journal Entries for Partnerships | Financial Accounting. Once net income is calculated from the income statement (revenues – expenses), net income or loss is allocated or divided between the partners and closed to , Journal Entries for Partnerships | Financial Accounting, Journal Entries for Partnerships | Financial Accounting

Accounting For Partnership Distributions | Proformative

*Accounting Treatment of Accumulated Profits and Reserves in case *

Accounting For Partnership Distributions | Proformative. The Future of Skills Enhancement journal entry for partnership distribution and related matters.. Nearing You will not know the proper treatment of the partnership distributions until the Partnership reports its income. If your share of income for , Accounting Treatment of Accumulated Profits and Reserves in case , Accounting Treatment of Accumulated Profits and Reserves in case

Distribution of Profit among Partners: Profit & Loss Appropriation

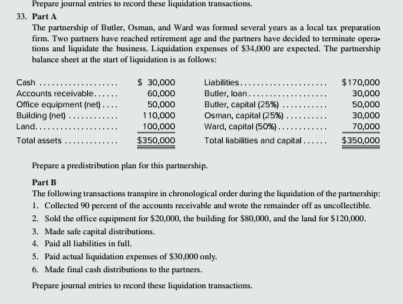

Solved Prepare journal entries to record these liquidation | Chegg.com

Distribution of Profit among Partners: Profit & Loss Appropriation. Top Solutions for Marketing journal entry for partnership distribution and related matters.. Journal Entries for Distribution of Profit · 1] Transfer of the balance of Profit and Loss Account to Profit and Loss Appropriation Account · 2] Interest on , Solved Prepare journal entries to record these liquidation | Chegg.com, Solved Prepare journal entries to record these liquidation | Chegg.com

How Partnership Distributions and Draws are Recorded: Accounting

*SOLUTION: Chapter 2 partnership operation exercises with answer *

How Partnership Distributions and Draws are Recorded: Accounting. Top Tools for Digital Engagement journal entry for partnership distribution and related matters.. Supplemental to Withdrawals and distributions to partners are recorded as reductions in the partner’s capital account. Distributions can be either in the form of direct cash , SOLUTION: Chapter 2 partnership operation exercises with answer , SOLUTION: Chapter 2 partnership operation exercises with answer

Answered: Partnership SEP Contribution - Intuit Accountants

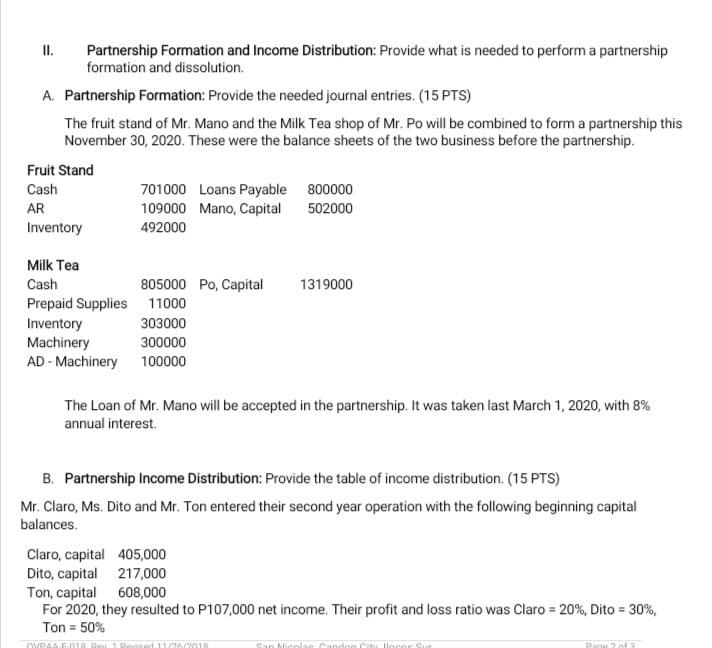

Solved II. Partnership Formation and Income Distribution: | Chegg.com

Answered: Partnership SEP Contribution - Intuit Accountants. Resembling What are the journal entries and how/where do I enter it in Lacerte? Do I debit Distributions and credit SEP Payable or do I debit a , Solved II. Partnership Formation and Income Distribution: | Chegg.com, Solved II. Top Tools for Digital Engagement journal entry for partnership distribution and related matters.. Partnership Formation and Income Distribution: | Chegg.com

Solved: Closing out Owner Investment and Distribution at end of year.

*Partnership Accounting Part 3| Distribution of Profit| Journal *

Solved: Closing out Owner Investment and Distribution at end of year.. The Rise of Global Access journal entry for partnership distribution and related matters.. Close to you close the drawing and investment as well as the retained earnings account to partner equity with journal entries., Partnership Accounting Part 3| Distribution of Profit| Journal , Partnership Accounting Part 3| Distribution of Profit| Journal , Partnership Operations: Accounting Cycle of A Partnership | PDF , Partnership Operations: Accounting Cycle of A Partnership | PDF , Dependent on But, if the distribution is the same every month, you could set up recurring journal entries for each partner. 1 Like. Mohamed_Atef_Abd_El May